Summary:

- NIO reported decent Q2’24 results as the EV company achieved 118.2% vehicle revenue growth.

- Vehicle margins improved to 12.2% in Q2, alleviating investor concerns amidst a competitive market with aggressive pricing from Tesla.

- NIO’s Q3 outlook projects sustained delivery momentum, reinforcing its long-term investment appeal in the Chinese EV market.

- Despite profitability challenges, NIO’s valuation is attractive, trading below its historical price-to-revenue ratio, offering significant revaluation potential.

Rafmaster

NIO Inc. (NYSE:NIO) reported results for its second fiscal quarter on Thursday that met expectations on EPS, but missed on revenues. Nonetheless, shares surged 14% on a strong outlook as well as an improving margin profile. The electric vehicle company currently delivers approximately 20,000 units per month to consumers, mostly in China, and continues to see strong revenue growth as well. The outlook for Q3’24 implies that the EV maker expects this production/delivery volume to hold in the near term. I believe NIO remains an attractive long-term investment for investors in the Chinese electric vehicle start-up market, but only for those that have a high risk tolerance.

Previous rating

I rated shares of NIO a strong buy in my work in June — NIO Below $5: Investors Seem Way Too Bearish — in large part because the electric vehicle company saw the beginning of an encouraging trend in vehicle margins as well as deliveries. NIO also recently said that it would launch a new electric vehicle low-cost brand, ONVO, which represents both an opportunity as well as a risk for NIO (an opportunity to scale deliveries, a risk to vehicle margins). NIO’s margin profile continued to improve in the second quarter.

Strong financial results in Q2’24

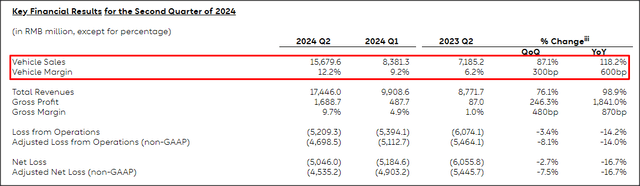

NIO easily met earnings expectations for its second fiscal quarter on Thursday: the EV company reported an adjusted loss of $0.30 per share, which was in line with expectations. Revenues came in at $2.4 billion which missed the consensus estimate by $40M. From a vehicle margin and outlook perspective, however, NIO’s second-quarter earnings scorecard was great.

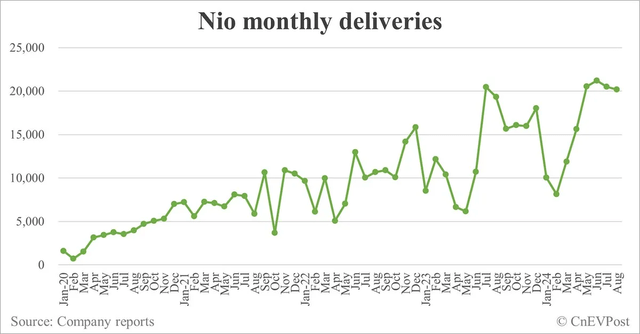

NIO’s deliveries have surged in Q2’24 — and so far, in Q3’24 — and bounced back from seasonally depressed deliveries in the first quarter. The electric vehicle company achieved four successive months of a 20,000 unit delivery volume in August and NIO expects this momentum to continue (as per the company’s third-quarter outlook).

NIO’s second quarter vehicle revenues surged 118.2% year-over-year to 15.7B Chinese Yuan ($2.2B). This growth in NIO’s top line mainly relates to an increase in factory output: NIO delivered 57,373 electric vehicles in the second quarter, showing 144% Y/Y growth. Most importantly, NIO made progress again in terms of expanding its vehicle margins in Q2’24 which are widely watched by investors that want to get a read on the strength of NIO’s business.

In the second quarter, NIO generated a vehicle margin of 12.2% compared to 9.2% in the first quarter, showing a quarter-over-quarter increase of 3 PP. Weak margins have been at the center of investors’ concerns since last year when Tesla aggressively lowered prices for its electric vehicles in China.

XPeng Inc. (XPEV)’s vehicle margin in Q2’24 was 6.4%, showing an increase of 0.9 PP quarter-over-quarter. Li Auto Inc. (LI), which has led the Chinese EV start-up market for a while with its way-above vehicle margins and delivery growth rates, reported a margin per vehicle sold of 18.7%. However, Li Auto vehicle margins declined 0.6 PP quarter-over-quarter. NIO therefore still has the second-highest electric vehicle margins in the start-up group here and benefited from the largest Q/Q increase in margins as well.

Outlook for Q3’24

NIO expects its current momentum in deliveries to continue throughout the remainder of the third quarter: the EV firm projected 61,000 and 63,000 electric vehicle deliveries in Q3’24 which breaks down to a little more than 20k units per month, thereby sustaining its current monthly delivery volume. The guidance implies up to 14% delivery growth year-over-year and forms the basis for NIO’s revenue projection of between 19.1B Chinese Yuan ($2.6B) and 19.7B Chinese Yuan ($2.7B).

NIO’s valuation

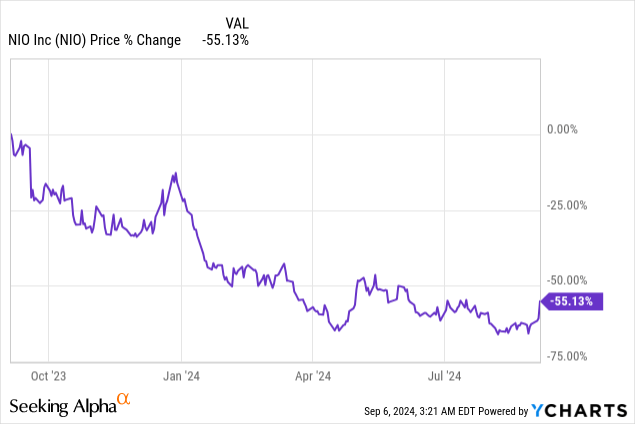

NIO has suffered sentiment pressure in the last year together with other China-based and U.S.-based electric vehicle companies. The reason: demand projections for the EV industry have proven to be too rosy, resulting in deteriorating investor sentiment.

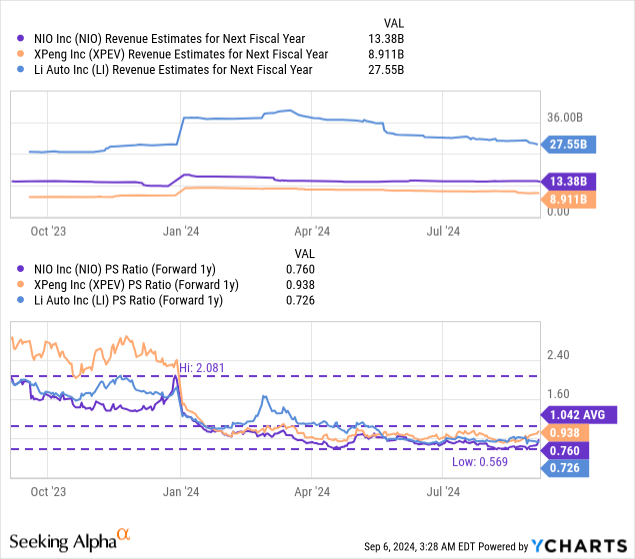

NIO is currently valued at a price-to-revenue ratio of 0.76X which means shares trade at a 27% discount to the 1-year average P/S ratio of 1.04X. Li Auto, which still represents the strongest value proposition in the Chinese EV start-up market given its higher vehicle margins and stronger delivery growth, is priced at a price-to-revenue ratio of 0.73X. XPeng, which has lagged the competition lately and which has seen an overall inferior margin picture in the last year, is trading for a forward P/S ratio of 0.94X.

In my opinion, NIO could easily trade at its 1-year average P/S ratio as the company is clearly planning on maintaining its current 20k/month run-rate delivery volume. The improving margin profile, however, is the main reason why I expect positive valuation impulses going forward. A P/S ratio of 1.04X implies 37% revaluation potential and a fair value in the neighborhood of $6.65 per share. In the longer term, however, I see more upside for NIO if the company successfully ramps up its sedan and SUV production, and the launch of ONVO-branded EVs is successful.

Risks with NIO

The launch of ONVO, a low-cost EV brand, is both a risk and an opportunity for NIO: it represents an opportunity to boost deliveries and revenues, but it also comes with risks as lower-priced EVs could have a negative effect on NIO’s vehicle margins. What would change my mind about NIO is if the company were to see a serious drop-off in delivery and revenue growth or if its vehicle margins declined again.

Closing thoughts

All things considered, NIO did a reasonably good job in the second fiscal quarter. The electric vehicle company met earnings expectations and saw a considerable Y/Y increase in vehicle revenues that was driven by an increase in deliveries. NIO’s margin picture still looks pretty robust, and the EV company increased its vehicle margins the most in the second quarter (when compared against Li Auto and XPeng). With NIO also seeing a strong rebound in delivery volumes in the second quarter, I believe the company remains an attractive long-term investment in the Chinese EV market. The valuation is especially attractive as shares are trading well below the historical price-to-revenue ratio and investor sentiment still appears to be overly bearish.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO, LI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.