Summary:

- Verizon just announced a huge acquisition of Frontier Communications.

- While the deal offers some exciting market growth opportunities for Verizon, it also comes with some risks.

- We look at what factors are likely going to increase the risk profile for Verizon’s dividend and share our updated outlook for the stock.

Dilok Klaisataporn

I last covered Verizon (NYSE:VZ) back in April and assigned it a hold rating as I was neutral on the stock. While the dividend remained attractive and management’s commitment to it seemed strong, the valuation did not seem particularly compelling, and the growth was quite anemic as well. Since then, the stock’s total returns have been roughly in line with the S&P 500, thereby validating my neutral take on it.

However, the company just announced that it plans to acquire Frontier (FYBR), which is a major acquisition for VZ, as it is a $20 billion all-cash deal. In this article, I will discuss the impact that this deal may have on the company’s dividend and share my updated outlook on the stock.

How Verizon’s Acquisition Of Frontier Will Impact Its Dividend

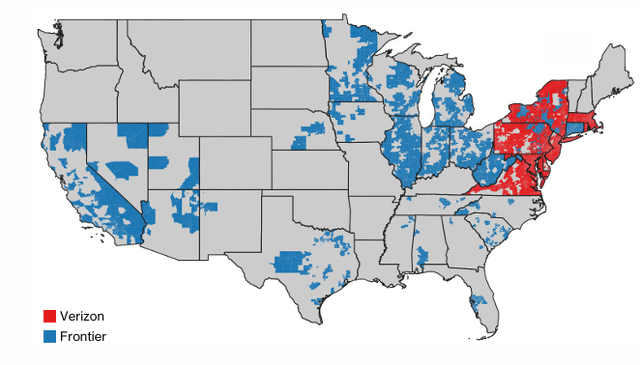

First, the main positive of this deal: it significantly expands Verizon’s presence as previously, its internet business was confined to the Northeast, but it will now be active in 22 new states, spanning the Midwest, Southwest, and parts of the Southeast.

Verizon + Frontier Fiber Network (Investor Presentation)

This expansion gives Verizon numerous additional opportunities to market its cell phone and other services as a bundle with Frontier’s internet offerings, which could help the company achieve some growth via its significant customer acquisition (Frontier has 2.2 million fiber customers in over 25 states). Another positive for Verizon is that the deal is not expected to close for 18 months, which will give the company time to set up its balance sheet for the acquisition. Given that Verizon generates significant free cash flow, it should be able to position itself well for executing this large all-cash deal.

That said, this deal also significantly raises VZ’s risk profile. The biggest concern I have with this deal is the effect it will have on Verizon’s balance sheet. In addition to the fact that it is an all-cash transaction valued at $20 billion, Frontier itself is a cash-burning business right now, as it is investing aggressively in capital expenditures to accelerate its transition from copper to fiber. While Verizon has plenty of free cash flow to make up for this and continue to fund Frontier’s growth investments, while still supporting its current dividend, this deal will likely set Verizon back in terms of its debt reduction and free cash flow generation goals.

Another reason for concern is that management is forecasting $500 million in synergies to be captured within three years. Given that this is just 2.5% of the transaction’s value, it is not a particularly compelling number, which implies that the deal is not particularly synergistic. This calls into question the fact that Verizon is paying a huge premium for the acquisition—43.7% over the 90-day volume-weighted average share price for Frontier—indicating that they believe this deal will unlock a lot more value in Frontier than the market saw in it as a standalone company. While that’s certainly possible, it places a pretty high hurdle for Verizon to meet, especially given that they are not generating much in the way of synergies from the deal, and even those synergies are expected to take quite a while to be realized.

Additionally, there is uncertainty regarding what sort of churn will take place with this deal. While Verizon is optimistic that this acquisition will reduce their own churn, given that pairing fiber with wireless telephone services tends to reduce churn in existing customers of one or the other service, it is hard to know exactly how that will play out in this case as there is a risk that a decent number of Frontier’s customers will leave once the transaction is completed as they may not want to be part of Verizon, or maybe they want to keep their existing cell phone service and may find a better internet offer elsewhere. If this happens, it could offset some of the reduced churn among Verizon wireless subscribers if Verizon is able to offer them internet alongside their cell phone service in Frontier’s current markets.

Another major concern is the impact that this deal will have on the company’s per-share intrinsic value. While management claims that the deal is expected to be accretive to Verizon’s revenue and adjusted EBITDA growth rates—given that Frontier’s fiber business is generally higher-growth—the deal is not expected to be accretive to earnings per share until 2027. This means shareholders will have to wait quite some time to actually see their shares’ intrinsic value improve from this deal in a tangible manner. Once again, this is predicated on Verizon achieving the operating cost synergies and churn reduction improvements they expect.

Finally, there is the risk that this deal could become a regulatory quagmire for Verizon, though management is confident that the deal will go through. However, they have conceded that the process will be thorough and could take quite a while.

Investor Takeaway

In summary, what does this deal do for VZ? It certainly expands the company’s growth profile and opens the door for some exciting cross-selling opportunities and synergy capture. However, it dramatically increases the company’s debt burden, and VZ has paid a very steep price for this deal, which means they have a high hurdle to clear to make it truly accretive for shareholders in the long term. It is not expected to be accretive for several years on an earnings-per-share basis, and it is expected to be a hit to free cash flow in the near term due to the capital intensity of Frontier’s business, which is transitioning from copper to fiber.

When you combine that with the fact that VZ’s dividend is already growing at a slow crawl—expected to grow at a 1% CAGR moving forward—this deal makes it even less likely that dividend growth will accelerate in the near term, due to the cash demands of both the acquisition itself as well as servicing the additional debt and funding CapEx at Frontier.

However, over the long term, this acquisition could increase Verizon’s growth potential and runway, assuming the company can successfully turn the deal into an accretive one for shareholders. This would give Verizon significant new markets to expand into and more customers to sell their wireless services to, which could ultimately be accretive to earnings per share as well.

That said, the deal also greatly increases the risk to the stock, both in terms of its intrinsic value and the safety of the dividend. If the deal fails to be as accretive as expected, the huge debt burden and capital expenditure obligations could become a drag on Verizon, similar to what some of AT&T’s (T) past acquisitions have been for it—draining shareholder value and potentially forcing the company to cut its dividend to pay down debt.

That said, this deal is different from some of T’s misadventures into entirely different businesses, such as cable television or media assets, as Frontier’s fiber business is complementary to Verizon’s existing fiber business, and fiber internet and wireless services are more naturally paired with each other as essential communications utilities, as opposed to optional entertainment or media offerings.

Overall, I am not changing my view of VZ’s intrinsic value, nor am I changing my hold rating on the stock. However, I do think the company’s risk profile – especially for its dividend – has increased, and I have no desire to buy shares at this point. I see much more attractive opportunities in the market today that offer similar or better dividend yields and better dividend safety and growth potential than what VZ offers right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

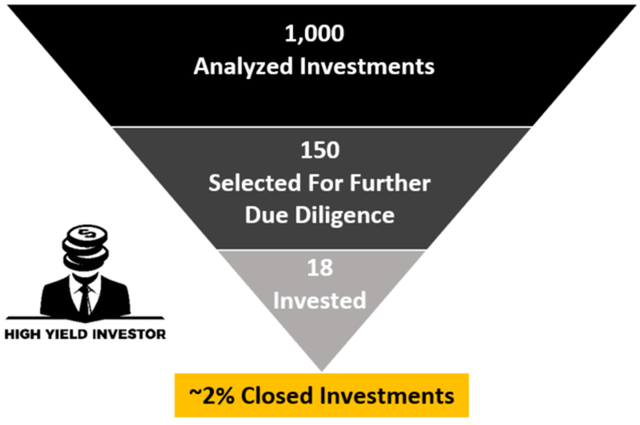

Join Now to Receive our Top Picks for H2/2024

Your timing couldn’t be more perfect! We have just unveiled our top picks for the second half of the year, and by joining us now, you can take advantage of these exciting investment opportunities.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Our high-yield strategies have garnered 150+ five-star reviews from delighted members who are already reaping the rewards.

Click here to get started!