Summary:

- Lowe’s stock has returned 24% since my last coverage, slightly ahead of the S&P 500, which raises the question of whether LOW is a sell now, ahead of Q2 earnings.

- The home improvement giant will release its results for the second quarter of fiscal 2025 on Tuesday, August 20, 2024 at 9 a.m. Eastern Time.

- In this update, I share what is currently expected from LOW’s Q2 FY2025 earnings and take a look at the company’s longer-term track record.

- I provide a detailed valuation update based on backward and forward-looking metrics and discuss whether LOW stock is a buy, sell, or hold ahead of Q2 FY2025 earnings.

Klaus Vedfelt

Introduction

It’s been quite a while since I last covered Lowe’s Companies, Inc. (NYSE:LOW), the second-largest home improvement retailer in the U.S. (and globally), behind The Home Depot, Inc. (HD). I compared the two retailers for the first time in early 2023 and highlighted four key implications of interest rates on the U.S. home improvement industry in May 2023. My last article on Lowe’s was published last November, when I still rated LOW stock a solid buy.

Since then, the stock has returned 24%, slightly ahead of the mighty S&P 500 Index (SPY). The SPY’s rather high valuation is no secret, so it’s easy to conclude that LOW stock – with a similar return – must be very expensive, especially considering a still difficult macroeconomic environment and comparatively high interest rates. But is that really the case, or could LOW stock at $240 still be a compelling investment for long-term investors?

In this update, I provide a detailed valuation update – based on backward- and forward-looking metrics – and discuss whether I think Lowe’s stock is a buy, sell, or hold ahead of its fiscal 2025 second-quarter earnings. Speaking of which, the company will report on Tuesday, August 20, at 9 a.m. Eastern Time, so I’ll also share what we can expect from Lowe’s upcoming quarterly report.

How Were Lowe’s Previous Earnings And What To Expect From Q2 Earnings?

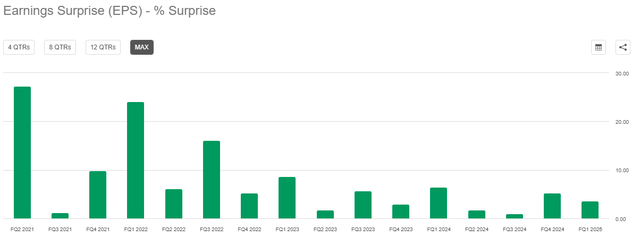

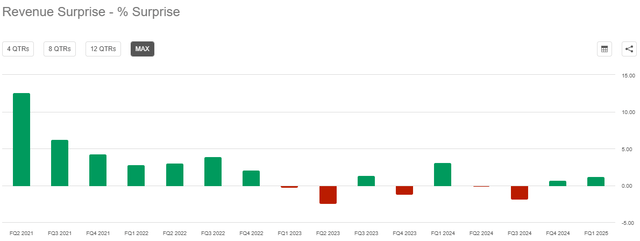

Over the past 16 quarters, Lowe’s track record for earnings per share (EPS) surprises has been absolutely spotless. The company has beaten estimates in every single quarter, with an average positive surprise of 7.9%. However, as we know, Lowe’s – as well as The Home Depot – benefited greatly from the pandemic-related special economic cycle. The gradual decline in adjusted EPS surprises (Figure 1) can be seen as confirmation that this trend is abating and is partly also due to the rather difficult macroeconomic environment (see my previous articles on LOW stock and the home improvement industry). Net sales, which are much more difficult to manage than EPS, or more precisely the decline in the percentage of surprises also confirms this (Figure 2). With this in mind, I would not hold my breath for a significant positive (or negative) surprise in adjusted EPS or net sales next week.

Figure 1: Lowe’s Companies, Inc. (LOW): Adjusted earnings per share surprise on a quarterly basis, past 16 quarters (Seeking Alpha) Figure 2: Lowe’s Companies, Inc. (LOW): Net sales surprise on a quarterly basis, past 16 quarters (Seeking Alpha)

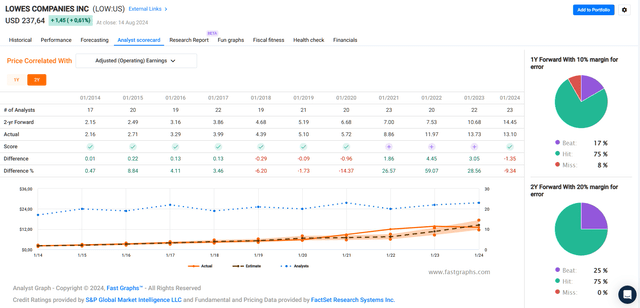

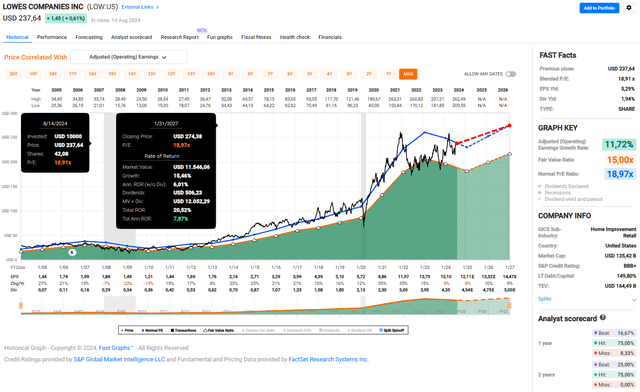

That said, I think Lowe’s management does a very good job of keeping the investment community informed of near- and longer-term expectations. Lowe’s is a company that delivers very consistently, as evidenced by FAST Graphs’ two-year forward analyst scorecard (Figure 3). With a 20% margin for error, management has met and beaten analysts’ estimates 75% and 25% of the time, respectively.

Figure 3: Lowe’s Companies, Inc. (LOW): Two-year forward analyst scorecard (FAST Graphs)

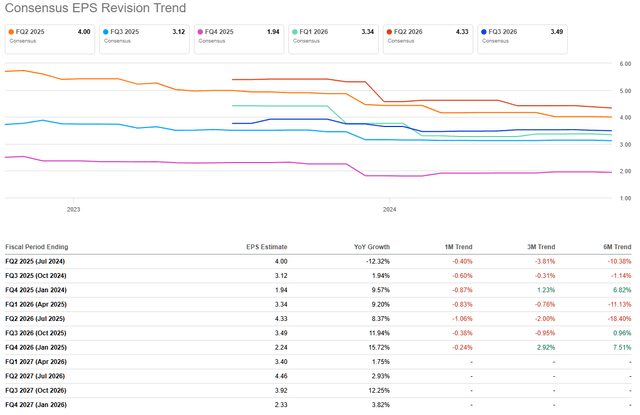

Analysts’ expectations for Q2 FY2025 adjusted EPS were revised downwards quite sharply at the end of last year, but have barely changed in recent months, as have longer-term expectations (Figure 4). This suggests that the analysts covering Lowe’s do not expect a serious deterioration in fundamentals in the coming quarters and through 2026. But of course, no one can predict the future, so I think it is more or less pointless to bet on such short-term developments. Knowing how solid the fundamentals of Lowe’s are, I feel very comfortable owning a position in this leading home improvement retailer for the long haul.

Figure 4: Lowe’s Companies, Inc. (LOW): Consensus quarterly earnings per share revision trend (Seeking Alpha)

Let’s now take a look at the current expectations for the recently ended quarter and the full-year fiscal 2025, also because of the impact this data has on the valuation of LOW stock.

Analysts currently expect Lowe’s to report adjusted EPS of $4.00, down 12% from the second quarter of fiscal 2024. Quarterly net sales are expected to decline 4% year-over-year, to $24.0 billion. For the full year, analysts expect adjusted EPS to fall by almost 8% to $12.17, based on net sales of $84.26 billion, a decline of 2.5% compared to the previous year. This is broadly in line with management’s guidance issued in the full-year fiscal 2024 press release, which was reiterated in May following the presentation of results for the first quarter of fiscal 2025. The decline in sales and adjusted EPS is largely due to weakness in more expensive discretionary products, reflecting the challenging macroeconomic environment, but also due to a still difficult comparison. However, the company’s Pro segment remained solid and even grew slightly in the first quarter.

Lowe’s Stock At $240: Caution Advised, A Solid Hold, Or Maybe Even A Buy?

Let’s start with the valuation of LOW stock from an adjusted EPS perspective. According to FAST Graphs, the stock currently trades at a blended price-to-earnings (P/E) ratio of 19, which is definitely not cheap for a retailer – despite its dominant footprint, trusted brand, and strong economies of scale.

A P/E ratio of 19 may sound expensive, but that’s exactly what the stock has changed hands for on average over the past 20 years (Figure 5). Prior to the Great Recession, LOW stock typically traded at 16 to 20 times adjusted earnings, with brief periods where it traded at 15 times earnings. I would argue that LOW is a completely different and much better-positioned company today, so I think it would be inaccurate to conclude that the stock has benefited from significant multiple expansion.

If Lowe’s returns to growth after fiscal 2025 – analysts currently expect a 10% and 9% recovery in fiscal 2026 and 2027, respectively – the expected total return is still around 8%. That’s certainly not overly significant, but from that perspective, I’d have a hard time calling Lowe’s stock grossly overvalued at $240.

Figure 5: Lowe’s Companies, Inc. (LOW): FAST Graphs chart, based on adjusted (operating) earnings per share (FAST Graphs)

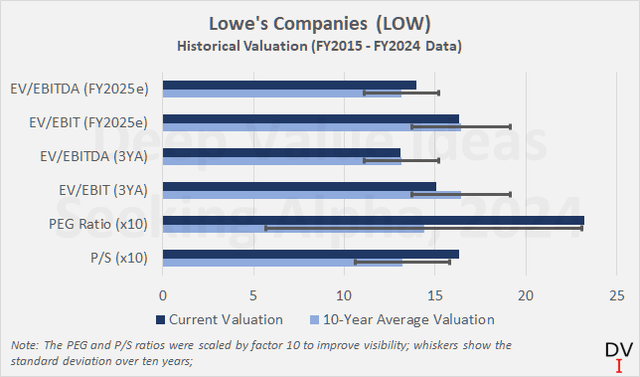

Figure 6 shows the results of a historical valuation of Lowe’s stock based on data for FY2015 through FY2024. I calculated Lowe’s enterprise value (EV) based on net debt at the end of the first quarter of FY2025 ($32.4 billion) and used the weighted average number of shares outstanding in the quarter (572 million).

Figure 6: Lowe’s Companies, Inc. (LOW): Historical valuation, based on earnings data for the period FY2015 – FY2024 (own work)

Based on most of the metrics, we can see that LOW is fairly valued, with a slight tendency towards overvaluation. What leads me to conclude that Lowe’s is not heavily overvalued is the fact that the company is trading in line with the long-term average of the EV/EBIT and EV/EBITDA ratios, regardless of whether we use the average EBIT and EBITDA figures for FY2022 to FY2024 or my current estimate for FY2025.

The only outlier is the price-to-earnings-growth (PEG) ratio, which screams overvaluation.

I attribute this to the fact that I used Lowe’s average adjusted EPS growth rate for the period FY2021-FY2027e for the calculation but think this growth expectation is justified. Over this period, Lowe’s adjusted EPS growth averaged 8.5%, compared to the long-term average of 11.7% (recall Figure 5). Frankly, I doubt Lowe’s can return to and sustain double-digit growth – primarily due to limited domestic growth prospects and an already fairly consolidated footprint. Growth through acquisitions comes with its own set of challenges, and international expansion is no walk in the park either, especially overseas. Remember that LOW sold its Canadian business to retail-focused private equity firm Sycamore Partners in the fourth quarter of 2022.

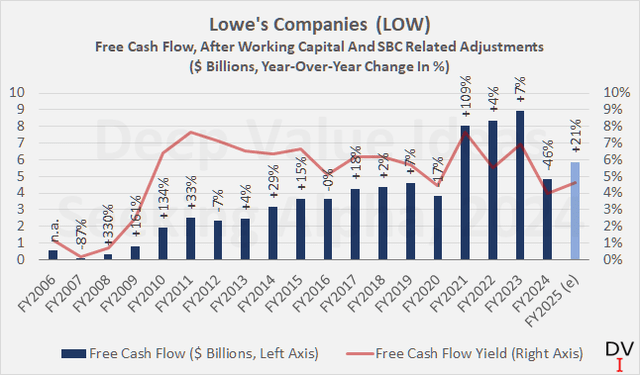

Finally, let’s look at the valuation of LOW shares from a free cash flow perspective. As always, I have adjusted free cash flow for working capital movements and treated stock-based compensation as a cash expense. Over the last 20 years (Figure 7), LOW stock has traded at an average free cash flow yield of 4.9%. Today, it trades at a yield of 5.4% if we take the average free cash flow for FY2022 to FY2024, i.e. even at a slight discount to the long-term average. Bear in mind, however, that the three-year average is still somewhat distorted by the pandemic-related tailwind. Comparing LOW’s current market capitalization ($137 billion) with the free cash flow expected for FY2025, the free cash flow yield is 4.3%, indicating a slight overvaluation.

Figure 7: Lowe’s Companies, Inc. (LOW): Free cash flow, after working capital- and stock-based compensation-related adjustments and free cash flow yield (own work)

A quite illustrative way of valuing a stock is through a discounted cash flow sensitivity analysis. This allows specific conclusions to be drawn regarding valuation under certain growth and return-related assumptions. From Figure 7 (and in conjunction with the modest cyclicality), I believe it can be concluded that Lowe’s is currently capable of generating nearly $6 billion in annual free cash flow, barring of course a significant economic downturn.

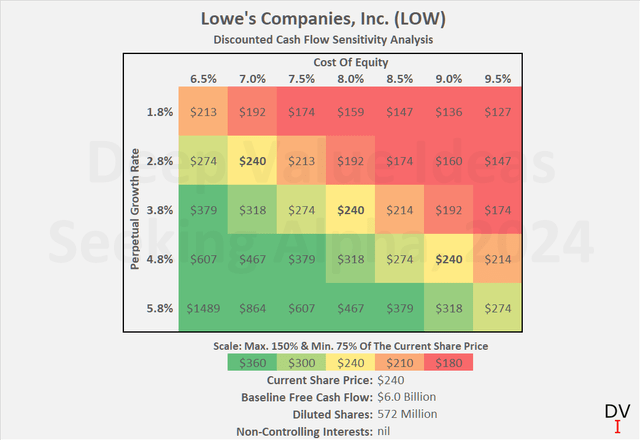

Personally, I do not consider a cost of equity of less than 8% to be worth my while for a moderately cyclical, but undoubtedly high-quality and well-managed company, especially against the backdrop of the current long-term risk-free rate of 4.2%.

Under these expectations, Lowe’s would have to grow its free cash flow at 3.8% in perpetuity to be worth $240 today. Various valuation scenarios are shown in Figure 8. This may not sound like difficult to achieve growth, but keep in mind the limited growth prospects domestically and the risks associated with expanding overseas. At the same time, it should also be borne in mind that Lowe’s has grown its free cash flow by a very solid 15% per year over the past two decades, so sustained growth of 4% seems quite achievable based on past performance. As mentioned above, I think it would be incorrect to conclude that LOW stock is so expensive that a sell would be warranted.

Figure 8: Lowe’s Companies, Inc. (LOW): Discounted cash flow sensitivity analysis (own work)

Conclusion

Like its larger competitor, The Home Depot, Lowe’s has benefited greatly during and after the pandemic. In my view, the company’s focus on strong (and improving) profitability, as well as its significant scale and trusted brand status, are the main reasons for what I consider solid performance, especially after the significant sales boost in FY2021, and taking into account the supply chain challenges and high input cost inflation thereafter. The decline in sales and earnings per share reported for FY2024 and expected for FY2025 should definitely be seen in the context of a very difficult comparison and a challenging environment.

Lowe’s will report its fiscal 2025 second-quarter results on Tuesday, August 20, at 9 a.m. Eastern Time. Revisions to adjusted EPS estimates were insignificant in recent months, and Lowe’s has a strong tendency to beat estimates. Given the aforementioned pandemic-related tailwind and related aftermath, I would not over-interpret the continued decline in the adjusted EPS surprise rate. For the recently concluded second quarter, analysts currently expect Lowe’s to report adjusted EPS of $4.00, down 12% from the second quarter of fiscal 2024. Quarterly sales are expected to decline by 4% to $24.0 billion. The decline is largely due to weakness in higher-priced discretionary goods, reflecting the still challenging macroeconomic environment.

In terms of valuation, LOW stock has performed in line with the tech-heavy S&P 500 index, suggesting it is similarly overvalued and due for a significant correction. On closer inspection, however, it seems inappropriate to declare Lowe’s stock a sell ahead of Q2 earnings. With a price-to-earnings ratio of 19, a free cash flow yield of 4% to 5% (depending on the base estimate), and a price-to-sales ratio of 1.6, Lowe’s is definitely fully valued today. The latter is about 20% above the long-term average, which suggests a significant overvaluation, but which, I believe, is due to the steady improvement in operating profitability over the years and decades (see my previous articles).

Largely thanks to its strong fundamentals, I consider Lowe’s a solid long-term hold and would only consider selling it if there are serious valuation concerns. At $240, I think this is not the case.

I initiated a position in Lowe’s in early 2023, which I added to on dips. At the time, Lowe’s was trading at or below $200, and I didn’t feel like I was buying a bargain, but a quality company at a good price. Therefore, and especially given the difficult macroeconomic environment, I do not feel compelled to add to my position at $240. Furthermore, I do not believe that the – now widely expected – interest rate cuts will have a significant positive impact on the U.S. economy and housing market, mainly because of the high proportion of still quite cheap fixed-rate debt, as explained in this article and in my coverage of banks in general and U.S. Bancorp (USB) and Truist Financial Corp. (TFC) in particular.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW, HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.