Summary:

- Lowe’s long-term investment thesis is supported by history of shareholder returns and free cash flow growth, but short-term weakness in sales and economy pose risks.

- Aging housing stock in the US presents a long-term opportunity for Lowe’s, but near-term challenges in consumer spending and debt repayment need to be addressed.

- Despite the potential for future growth, a cautious approach is advised with Lowe’s due to weakening financial outlook and uncertain economic conditions.

- LOW stock is downgraded to hold rating.

carterdayne

Investment Thesis

In my previous article, titled Lowe’s Companies Is Still A Buy For The Long Run, I laid out my long-term investment thesis for the stock. My reasoning is that Lowe’s (NYSE:LOW) will benefit from the number of aging homes in the US that will require significant repairs or replacement. I supported this with Lowe’s history of excellent shareholder returns and generation of free cash flow, which I believe will continue thanks to the company’s growing efficiency and positioning as one of only two major home improvement retailers in the market. Despite recognizing that there could be harder times faced by Lowe’s in 2024 and even 2025, I looked past the short term and focused on the bigger opportunity for a buy-and-hold position or DCA strategy.

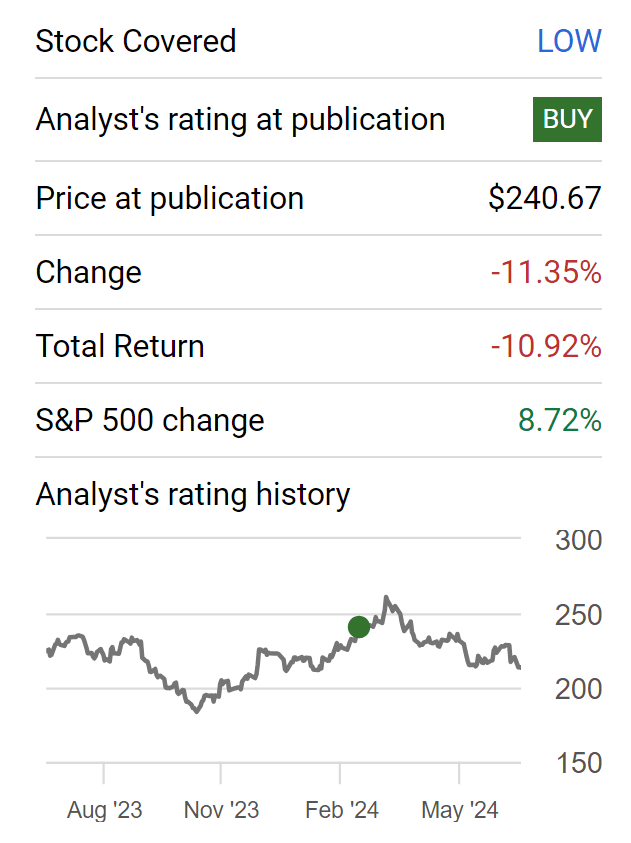

Since then, the stock has significantly underperformed the market, and evidence of a weakening of the economy has only grown.

Author’s previous article – Seeking Alpha

My personal investing mindset has changed since I wrote that article, and I am leaning more heavily towards holding off on investments in companies I believe will experience near-term weakness and downside recession risk. I have re-examined my model for free cash flow, making adjustments for debt repayments to offset the significant long-term debt on the company’s balance sheet, and have come away with a different opinion on investing in LOW for the time being. Though I am still bullish on the long-term investment thesis, I believe it is prudent to downgrade LOW to a hold for now. I believe there is potential downside in LOW stock for now, but not so much that I would sell it.

The Long-Term Bullish Thesis

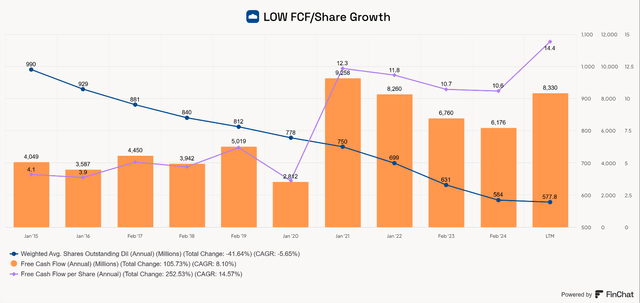

From FY 2015 until the last twelve months, Lowe’s has reduced its weighted average diluted shares outstanding by 41.6% and grown its free cash flow at a CAGR of 8.1% and FCF per share at a CAGR of 14.6%.

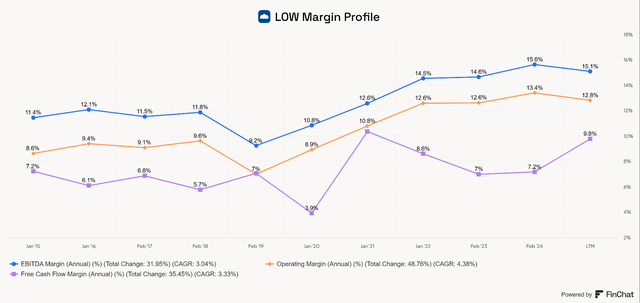

Margins have significantly expanded during this time period, with EBITDA margin expanding from 11.4% to 15.1%, operating margin improving from 8.6% to 12.8%, and FCF margin growing from 7.1% to 9.8%.

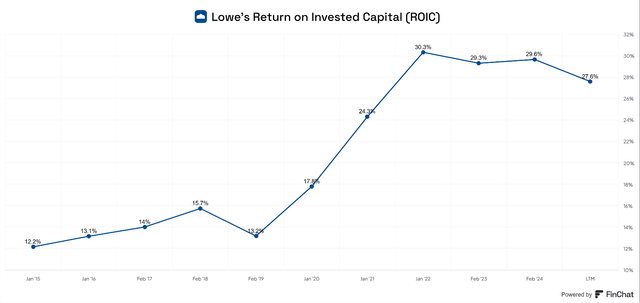

Lowe’s return on invested capital (ROIC) explains this success. Lowe’s efficiency has improved significantly, with ROIC expanding from 12.2% in 2015 to 27.6% over the TTM period. However, this number has dipped slightly since FY 2022.

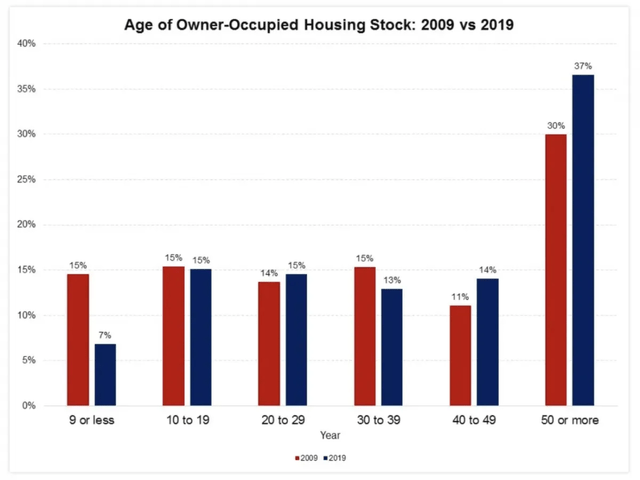

In my previous article, I explained how the aging housing stock in the US presents a long-term tailwind to LOW’s finances. I used these two figures to show that housing repairs and replacement homes will be needed to offset this aging stock.

The age of owner-occupied housing stock has dramatically shifted to being over 50 years old, according to the National Association of Home Builders.

Age of Owner-Occupied Housing Stock (www.nar.realtor.com)

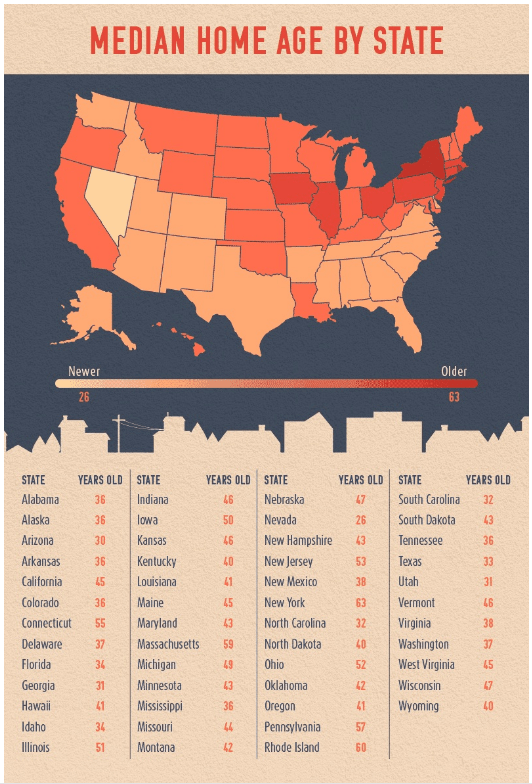

The median home age in the USA is roughly 43.0 years old.

Median Home Age by State (www.todayshomeowner.com) FinChat

All of this supports the idea that Lowe’s can continue to reward shareholders. Without growing its store count, the high ROIC supports free cash flow growth which should lead to further share repurchases, a growing dividend, and share price appreciation.

However, I see reason to be cautious with Lowe’s, as the economy has shown further signs of weakness which are beginning to be reflected in Lowe’s results.

The Short-Term Bearish Thesis

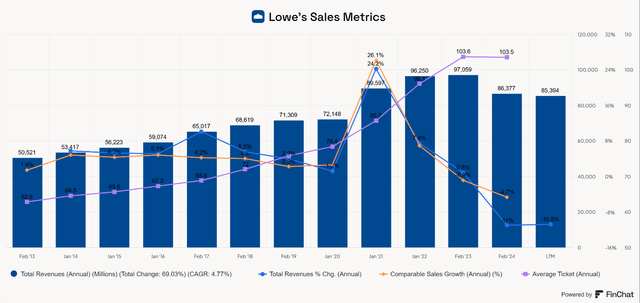

LOW’s sales have fallen roughly 11% YoY since FY23, while comp sales fell 4.7% for FY 2024 and 4.1% during Q1. The average ticket price increased to a high of $103.60 in FY22, and held steady through FY2023; however, it looks like this figure will be under pressure in FY24. During the Q1 call, management stated that big-ticket spending was down, which it attributed to discretionary consumer spending being under pressure.

Due to this pressure, Lowe’s issued FY 2024 guidance for sales to range from $84 billion to $85 billion, and a comp sales decline of 2% to 3%. With an EPS guidance of $12.15 at the midpoint, and a stock price of $213.31, LOW trades at a Forward FY24 P/E of 17.55.

If big ticket spending is challenged, I assume that Lowe’s will have a difficult time hitting positive comps until we either get through a recession or we avert one.

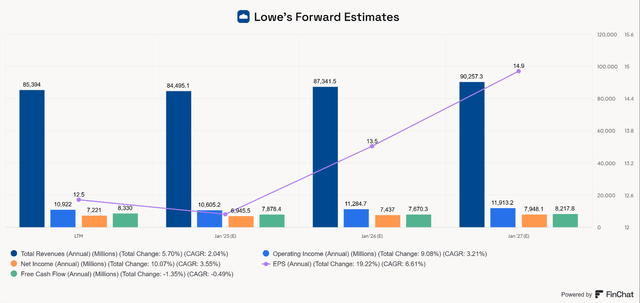

I believe that the pull forward and subsequent pullback in home improvement spending is what impacted Lowe’s finances first; now, I think we are seeing weakening consumer spending on top of this. Analyst’s consensus estimates do not support strong FCF growth over the next few years. Take the FCF metrics with a grain of salt, but these appear to be reasonable revenue and operating income estimates.

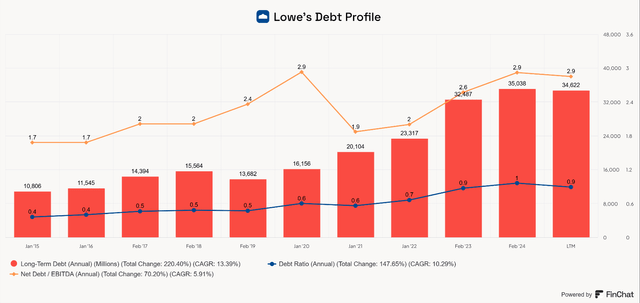

Lowe’s Balance sheet is relatively safe, despite holding $34.6 billion in long-term debt, the company has adequate leverage ratios. Its 2.9x Net Debt / EBITDA ratio and 0.9x Debt Ratio are within a good range, but are a bit stretched at this point. I like to see the debt ratio stay at 1.0x or below and Net Debt / EBITDA remain below 3x. The company’s interest expense has grown to almost $1.5 billion.

Lowe’s will need to focus on paying down its debt in order to minimize interest expense and strengthen future shareholder returns. To account for this, I have adjusted my DCF model to include debt repayments that reduce free cash flow.

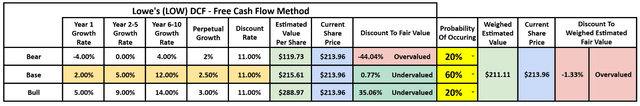

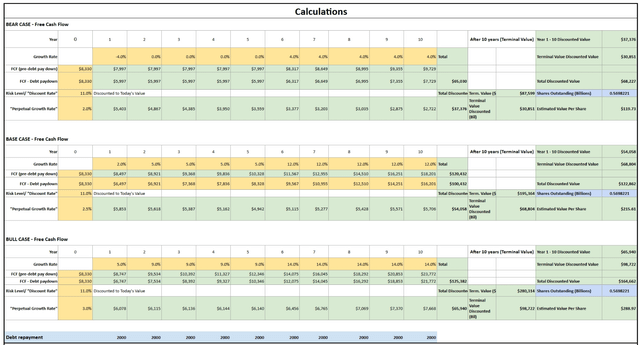

I’m assuming that LOW grows FCF at 2.0% in 2024, then at a 5% CAGR during years 2-5 of the model, and 12.0% during years 6-10. My terminal rate for my base case is 2.5%, as I think LOW can grow above GDP due to its positioning in the market. My bear case is reduced to FCF growth rates of -4%, 0.0%, and 4.0% with a 2% terminal rate. My bull case models, FCF growth of 5.0%, 9.0%, and 14.0% with a 3.0% terminal rate. My discount rate is 11.0%, which is more conservative in my previous model, as I want to achieve a higher return than the market might provide.

Author-generated DCF (Lowe’s) Author-generated DCF Calculations

Given my more conservative assumptions than in my previous article, Lowe’s could be overvalued slightly. This causes me to lower my rating to a hold.

Risks

I’ve already discussed my bearish take, and the risks to Lowe’s business. The balance sheet has been stretched a bit, and the economy poses the biggest risk for Lowe’s. Cracks are forming in its customers’ consumer spending habits, and I don’t think the pain is over yet.

Conclusion

After reevaluating Lowe’s business and investment case, I have lowered my rating from a buy to a hold. As bullish as I am for the long run, I am not willing to add to my position until I see signs of a bottom in Lowe’s financial outlook or signs that a turnaround to growth is imminent. That just doesn’t appear to be the case right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.