Summary:

- T’s robust dividend investment thesis is supported by stable profitability, rich yields, and strong FY2024 FCF guidance, making it a solid telecom/dividend stock.

- The stock’s impressive YTD returns are driven by the Fed’s impending rate cuts and market rotation towards high-yield dividend stocks.

- T’s improved balance sheet and increased cross-selling efforts enhance its dividend safety and growth potential, justifying our reiterated Buy rating.

- Despite the upcoming seasonality in handset sales in Q3, we expect the telecom to outperform in Q4 as how it has over the past few years.

- There is a promising potential for additional shareholder returns through share repurchases and/ or dividend raises as well, once the management achieves its leverage target by H1’25.

Klaus Vedfelt

T’s Dividend Investment Thesis Remains Rich As The Fed Likely Commences Its Rate Cut

We previously covered AT&T (NYSE:T) in May 2024, discussing why we had maintained our Buy rating, thanks to its robust dividend investment thesis attributed to the stable profitability, rich yields, and reiterated FY2024 FCF guidance.

Combined with the improving balance sheet, the management’s guidance of lower vendor financing payments, and the intensified fiber expansion/ wireless network transformation in 2024, we believed that the stock was likely to continue performing well as a telecom/ dividend stock.

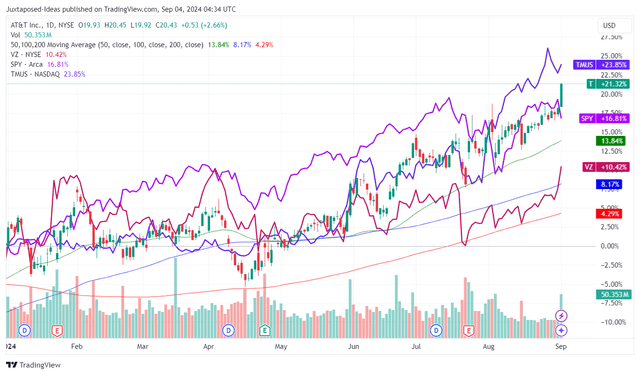

T YTD Stock Price

Since then, T has already recorded an impressive total returns of +20.7% (including dividends), as the impending Fed pivot in the September 2024 FOMC meeting triggers the expected flight to rich dividend yielding stocks during the recent market rotation in July 2024.

With the market already pricing in a 25 basis point rate cut, it is unsurprising that the US Treasury Yields has moderated to between 3.63% and 5.08% by the time of writing, compared to the peak of 4.95% and 5.51% observed in October 2023.

The same rally has been observed in other dividend paying sectors as well, such as REITs, commodities, and tobacco stocks, significantly aided by their inherent undervaluation after the challenging past four years.

The stock’s ongoing uptrend is significantly aided by T’s stable FQ2’24 performance and reiterated FY2024 guidance, with the most important metric, Free Cash Flow generation (before dividends) hitting $7.71B by H1’24 (+47.9% YoY) and FCF generation (after dividends) hitting $3.58B (+222.5% YoY).

This allows the telecom to report a lower net debt balance of $126.86B (-1.4% QoQ/ -3.8 YoY) and moderating net-debt-to-EBITDA ratio of 2.87x (compared to 2.94x in FQ1’24 and 3.10x in FQ2’23), thanks to the higher adj EBITDA generation at $44.14B (+0.6% QoQ/ +3.6% YoY) over the LTM.

Given that the sector is typically highly leveraged, T’s ability to deliver on the deleveraging promises has been very encouraging indeed, with the telecom highly likely to achieve its net-debt-to-EBITDA-ratio target of 2.5x by H1’25.

This is also why its dividend coverage ratio has improved to 1.96x, compared to the 5Y mean of 1.87x, with it implying the safety of its dividend investment thesis.

Much of T’s tailwinds are attributed to the management’s increased cross selling across its vertically integrated offerings, allowing the telecom to report an impressive ratio of “nearly four out of every 10 AT&T Fiber households also choose AT&T as their wireless provider,” well higher than the national average by +500 basis points.

It is apparent that they have been able to drive growth in both fiber and mobility business, as “consumers increasingly prefer to purchase mobility and broadband together as a converged service.”

These developments have already triggered the robust postpaid phone net adds at 419K (+20% QoQ/ +28.5% YoY) with low churn rates of 0.7% and Fiber net adds at 239K (-5.1% QoQ/ -4.7% YoY) – triggering the higher postpaid phone ARPUs of $56.42 (+1.5% QoQ/ +1.4% YoY) and fiber ARPUs of $69 (+0.5% QoQ/ +3.4% YoY).

The Consensus Forward Estimates

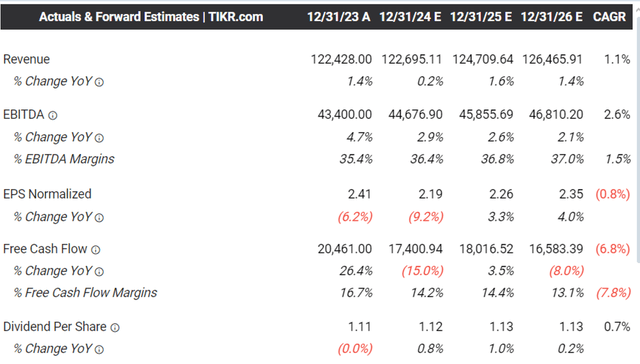

With these efforts already accretive to T’s top/ bottom-lines in FQ2’24, we believe that the telecom remains well positioned to report robust bottom-line growth at low to mid single digits, as how it has at +3.4% in H1’24 while improved compared to its 10Y CAGR of +0.4%.

The same quiet optimism has also been observed in the consensus forward estimates, with the telecom expected to generate a decent top/ bottom-line growth at a CAGR of +1.1%/ +2.6% through FY2026, with a bottom-line upgrade to over +3% entirely possible assuming a similar long-term execution as its H1’24 performance.

So, Is T Stock A Buy, Sell, or Hold?

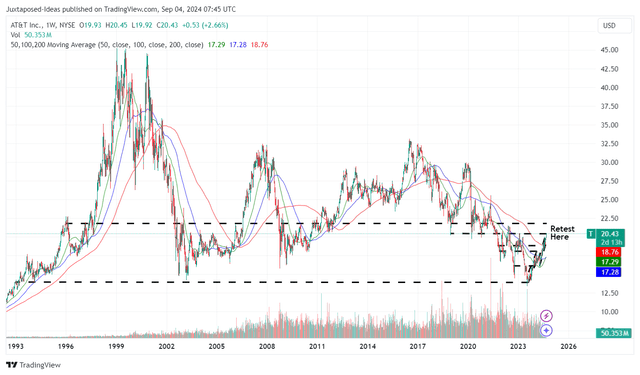

T 30Y Stock Price

For now, T has charted an impressive recovery by +44.6% since the August 2023 bottom, after the news release of the lead-sheathed cable issues in July 2024 and the potentially costly rectification costs of up to $60B.

This recovery has naturally triggered the moderation in its forward dividend yields from 8.20% to 5.58%, though still near to its 5Y average yields of 6.71%.

Even so, we believe that T’s investment thesis remains excellent for dividend oriented investors seeking stable quarterly incomes, especially since the telecom has been generating increasingly rich Free Cash Flow margins of 17.2% over the LTM (+2.2% sequentially/ +1.2 from FY2019 levels of 16%).

With the management on track to achieving its leverage ratio, we believe that long-term investors may look forward to additional shareholder return prospects through a mix of share repurchases and/ or dividend raises, as the telecom also increases its strategic investments in 5G/ fiber networks and wireless network modernization.

As a result, we are reiterating our Buy rating for the T stock, while long-term shareholders may continue to subscribe to their DRIP program in order to regularly accumulate additional shares on a regular basis.

Risk Warning

While T has had great success in phone adds in H1’24, readers must note the seasonality of its handset sales with it typically being slower in Q3s, as Apple (AAPL) usually releases its new iPhone models in September and the phenomenon likely to trigger a sequential weakness in its FQ3’24 sales.

Even so, we maintain our belief in the telecom’s ability to outperform in Q4s as it usually has over the past few years, as observed in the heavier Free Cash Flow weightage at $6.4B in FQ4’23, compared to the first three quarters of 2023 at $10.4B.

Therefore, while T is expected to report its FQ3’24 earnings call on October 23, 2024, readers may want to temper their near-term Free Cash Flow expectations indeed.

Lastly, it goes without saying that T is not a high growth stock, with the recent rally triggering its nearly fully valued position at our estimated price target of $22.10, based on the 10Y P/E mean of 10.12x (compared to the current FWD P/E valuations of 9.09x and the October 2023 bottom of 5.53x) and the consensus FY2024 adj EPS estimates of $2.19.

Therefore, we believe that the stock is likely to trade sideways from current levels, with minimal upside potential ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.