Summary:

- Snap has fallen to multi-year lows despite strong sales growth and a promising subscription service, making it an undervalued investment below $9.

- The social messaging company reported 850 million MAUs and 432 million DAUs, with Snapchat+ boosting subscriptions to 11 million.

- The market is overly focused on volatile advertising revenue, ignoring Snap’s potential $700 million in recurring subscription fees by the end of 2024.

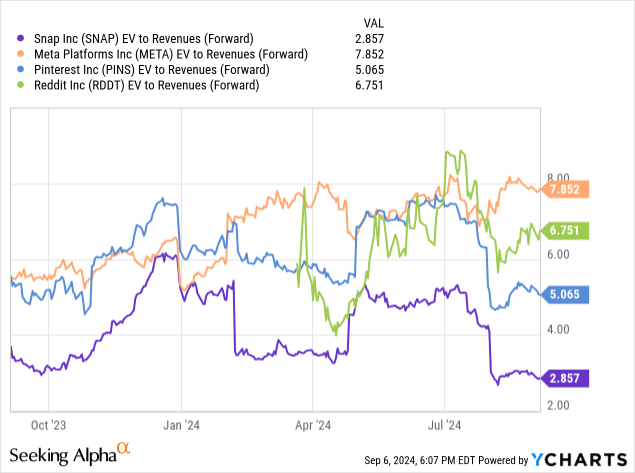

- SNAP stock trades at only 3x forward EV/S targets, significantly lower than peers like Meta and Pinterest, highlighting a substantial market disconnect.

Marina Gorevaya/iStock via Getty Images

In an odd move, Snap, Inc. (NYSE:SNAP) has fallen back to multi-year lows despite reporting strong sales growth in the last quarter. The social messaging company clearly isn’t firing on all cylinders, but the market has completely ignored the progress of the business and the promise of a booming subscription service. My investment thesis remains ultra Bullish on the stock below $9.

850 Million Reasons

Snap announced 850 million platform users on a monthly basis when reporting Q2’24 results. The social messaging platform has the scale of nearly 1 billion users, yet the stock has gone nowhere since going public back in early 2017 with Snap only trading this low during a period in 2018.

The company reported key DAUs were up 9% YoY to 432 million for a 36 million increase YoY. Snapchat+ even has boosted the subscription service to 11 million subs for gross revenue of $44 million per month.

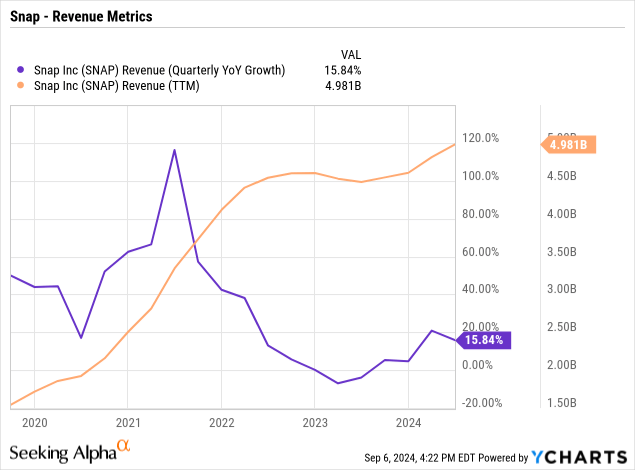

As discussed in prior research, the market appears more obsessed with the volatile quarterly revenue growth. During the last 5 years, Snap has reported both quarters with 100% YoY growth and negative growth, yet revenues have soared from $1.5 to nearly $5 billion now.

The figure that drives value is total revenues, whether TTM or forward projections. Snap has generated fantastic growth over time, questioning why the market is so pessimistic.

CEO Evan Spiegel blamed the stock weakness related to advertising revenue growth not matching other social media players, but this doesn’t justify the weak stock price. Back in early August, Snap reported that Q2 revenues grew nearly 16% while guiding to 14% growth at the midpoint in Q3 with upside potential to 16% growth.

Whether or not the numbers match the other social media players, Snap is still reporting strong growth, with subscription levels providing a strong lever for long-term growth. In the meantime, though, the market is obsessed with the social messaging company struggling to generate ARPU growth.

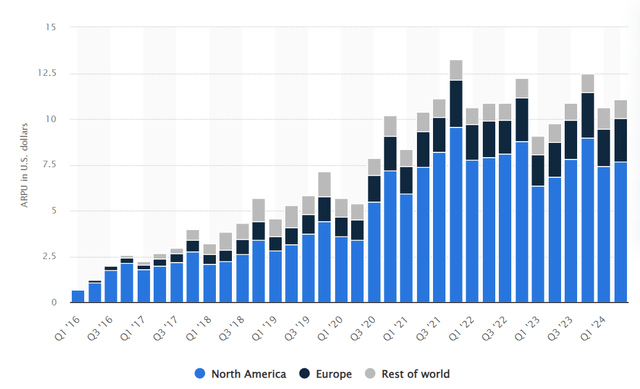

As the below chart highlights, ARPU peaked back at the end of 2021 when the Covid boost peaked and Apple (AAPL) changed the accessibility of device IDs for advertisers. Snap has been slow to rebuild the advertising platform after losing key user information for ad targeting.

Snap only produced $2.86 in ARPU during Q2’24 per DAU. The RoW ARPU of $1.02 pulls down the total ARPU with a huge concentration of users in India.

As with the other social media players, Snap appears to have reached bottom back in 2023 and is making progress now in growing ARPU by region. The key chart focus is North America where the trough in this cycle was Q1’23 right around when Snapchat+ was launched and the company started collecting about $12 per sub each quarter.

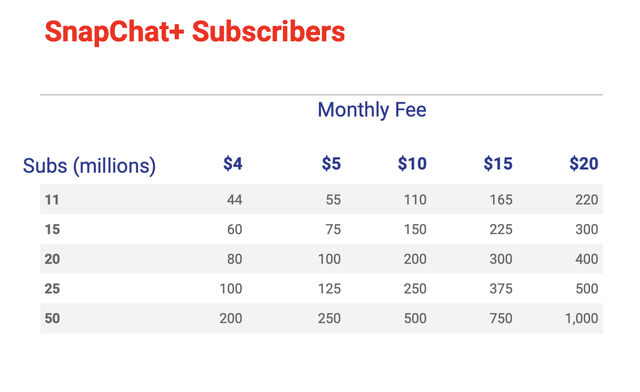

As Q3 heads towards an end, investors need to realize that Snapchat+ likely has up to 13 million subscribers now. The company announced 11 million at the end of Q2, generating $44 million in gross monthly fees and over $500 million in annual fees.

Source: Stone Fox Capital calculations

The company officially reported non-advertising revenue grew 151% YoY to reach $105 million. The majority of this revenue is due to Snapchat+ subscriptions.

Snap forecast ending 2024 with 14 million subs, producing nearly $700 million in recurring subscription fees. Investors seem to be missing the upside potential here. If Snap were to hike the monthly fee to $5 and reach 25 million subs by the end of 2025, the monthly subscription fees would reach $125 million for $1.5 billion in annual revenues.

In essence, the stock has a market cap just below $15 billion now and trades at only 10x a reasonable subscription revenue target for exiting 2025. The market disconnect is already wild, considering Snap already has an advertising business set to generate nearly $5 billion in revenues this year.

Market Disconnect

Snap hasn’t produced the most impressive results, but the market has completely lost connection with reality. Meta Platforms (META) and Pinterest (PINS) both grew Q2 sales just over 20% in the last quarter in comparison to the 16% growth for Snap.

The above charts would seem to suggest a massive difference in the growth prospects for the different social media companies. Meta trades at nearly 9x forward EV/S targets, while Snap trades at only 3x targets despite the small delta in the growth rates. Snap needs to double the price multiple to just trade up to the same multiples of Pinterest and Reddit (RDDT).

Snap continues struggling with the advertising business, but the investment story is all about the subscription business. The company entered 2024 trading at a similar multiple to the other social media peers, and the business hasn’t altered so much for this huge disconnect.

Takeaway

The key investor takeaway is that Snap investors need to focus on the promises of the subscription business, while not getting distracted just due to volatile advertising revenue. The stock is too cheap at only 3x forward EV/S targets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.