Summary:

- Microsoft is a highly profitable, cash-generating giant with a strong history of innovation and rewarding shareholders, making it a top long-term holding.

- Key growth drivers include the Intelligent Cloud segment and AI adoption, with significant contributions from Azure and strategic partnerships like OpenAI.

- Microsoft’s robust cash flow generation supports substantial dividends and stock repurchases, enhancing shareholder value over time.

- Despite potential risks, I consider Microsoft a ‘strong buy’ due to its leadership position in an AI-driven revolution that still has a long way to go before it fully unravels.

- Ongoing revenue growth, improving margins despite substantial investments, adopting AI into existing solution environment, and innovative approach make a strong case for MSFT as the best business ever.

Jean-Luc Ichard

I am a buy-and-hold investor interested in highly profitable, cash-generating giants with a rich history of upholding and enhancing their competitive advantages and rewarding shareholders.

I couldn’t think of a company better fitting that description than Microsoft (NASDAQ:MSFT). It’s one of my longest holdings and the most important technological player in my portfolio. I’ve added to the Company multiple times and decided to add again this week. Microsoft has greatly benefited my portfolio and brought me much satisfaction not only from a financial perspective but also through following its outstanding pioneer path. Microsoft is a true reflection of the popular saying: change is the only constant.

Not every business I hold is of MSFT’s quality, and I consider it one of my best holdings, especially from a long-term perspective. Let me explain why I’m holding on to MSFT and adding regularly to enhance its well-deserved spot in my portfolio.

Microsoft: The Best Business Ever Created?

Key segments overview – increasing adoption of AI

Microsoft distinguishes three main reportable segments:

- Productivity and Business Processes

- Intelligent Cloud

- More Personal Computing

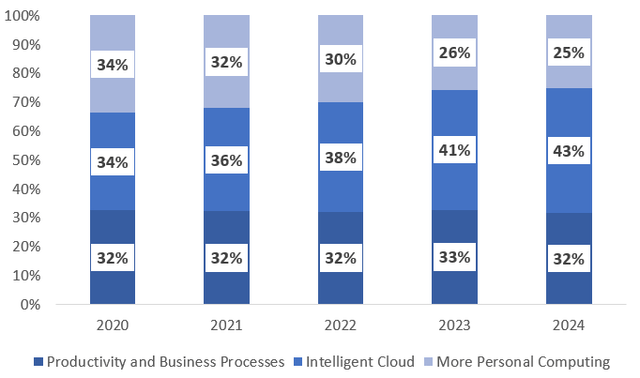

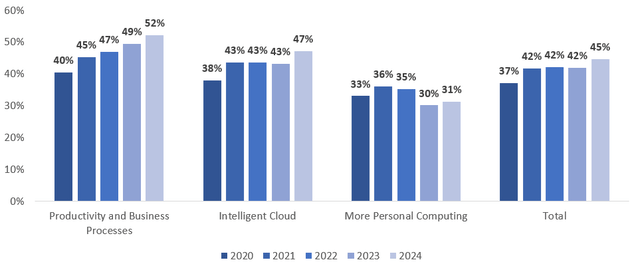

Its revenue structure is well-diversified across these segments, with an increasing significance of the Intelligent Cloud, upholding share of Productivity and Business Processes, and decreasing share of More Personal Computing. Please review the chart below for details regarding MSFT’s revenue structure.

The Intelligent Cloud segment was MSFT’s main growth driver, recording a revenue CAGR of 21.5% during 2021–2024 (with FY 2020 as a base year). The Productivity and Business Processes segment recorded growth almost in line with overall MSFT’s revenue growth, amounting to 13.8% CAGR over the same period. The More Personal Computing segment was the weakest growth driver, recording a CAGR of 6.5%.

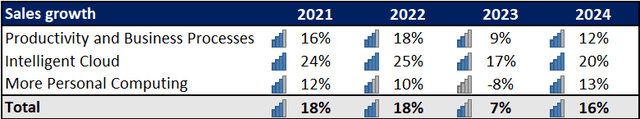

Overall, the Company grew its revenue at a high double-digit rate each year (except for 2023) of the indicated period, delivering a CAGR of 14.4%. Please review the table below for details.

FY 2024 brought much more positive developments than FY 2023, which we will review in detail in the following sections.

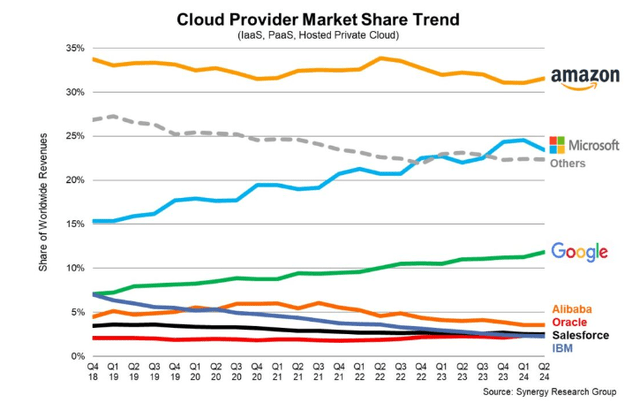

Productivity and Business Processes – AI becomes a daily habit

This segment encompasses (in short) Office / Microsoft 365 licenses and subscriptions, including Copilot for Microsoft 365 in Commercial and Consumer packages; LinkedIn-related subscriptions and services; and Dynamics 365 solutions (ERP, CRM, Power Apps, etc.). This segment’s revenue is driven primarily by the Office Commercial subsegment and the Dynamics environment, especially Dynamics 365. Please review the table below for a more detailed revenue breakdown.

Thanks to its strategic partnership with OpenAI (which reached its third phase in January 2023), Microsoft adopts the AI models of a leading AI R&D company in its solutions and its whole environment. However, OpenAI is not Microsoft’s only crucial AI partner. We can also mention Nuance Communications, a leading conversational AI business that the Company acquired in March 2022. Nuance is another example of MSFT’s robust M&A activity and competence in choosing the right targets to enhance its leading solutions’ environment.

MSFT’s AI investments facilitate customer endorsement and retention, encouraging them to rely even more on its solution environment. For instance, Microsoft 365 is the first platform to combine long-known products such as Office or Windows with the AI platform Copilot. During the last Earnings Call, the management provided impressive data and an optimistic outlook for the future regarding the Copilot adoption:

Now, on to future of work. Copilot for Microsoft 365 is becoming a daily habit for knowledge workers, as it transforms work, workflow, and work artifacts. The number of people who use Copilot daily at work nearly doubled quarter-over-quarter, as they use it to complete tasks faster, hold more effective meetings, and automate business workflows and processes.

Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees.

The Company’s core products in this segment, such as ERP, CRM, or Microsoft Teams, continue to innovate, entailing increasingly advanced, efficiency-boosting solutions that drive customers’ interest and encourage them to adopt the Dynamics 365 environment. A great example is MSFT’s first AI-assisted contact centre solution:

Copilot is also transforming ERP and CRM business applications. We again took share this quarter, as customers like ThermoFisher Scientific switched to Dynamics. Our new Dynamics 365 Contact Center is a Copilot-first solution that infuses generative AI throughout the contact center workflow.

Companies like 1-800 Flowers, Mediterranean Shipping, Synoptek will rely on it to deliver better customer support. And Dynamics 365 Business Central is now trusted by over 40,000 organizations for core ERP.

Intelligent Cloud – Microsoft’s path to leadership position

As you probably know, this segment is driven primarily by the Microsoft Azure cloud platform/set of cloud services, generating revenue in IaaS and PaaS models. Leading cloud providers allow IT professionals and IT businesses to really focus on the development part instead of managing on-premise devices/software. Azure is another place that Microsoft continues to introduce its AI features, as we can read in its FY 2024 10-K:

Azure AI offerings provide a competitive advantage as companies seek ways to optimize and scale their business with machine learning. With Azure’s purpose-built, AI-optimized infrastructure, customers can use a variety of large language models and developer tools to create the next generation of AI apps and services.

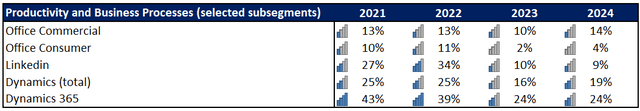

Although Microsoft’s Azure is not the global leader in cloud services, it can certainly be considered a strong challenger with the potential to overthrow Amazon’s (AMZN) AWS, as MS Azure has regularly gained market share since ~15% in Q4 2018 to close to ~24-25% in 2024 YTD.

This segment’s revenue growth picked up in 2024 after a slower 2023, recording 20% annual growth, driven primarily by Azure development of 30% year over year.

MSFT’s AI adoption constitutes a solid growth, long-term growth driver for this segment, as the management commented:

Our share gains accelerated this year, driven by AI.

(…) We added new AI accelerators from AMD and NVIDIA, as well as our own first party silicon Azure Maia.

(…) All-up, we now have over 60,000 Azure AI customers, up nearly 60% year-over-year, and average spend per customer continues to grow. Azure OpenAI Service provides access to best-in-class frontier models, including as of this quarter GPT-4o and GPT-4o mini.

It is being used by leading companies in every industry (…)

Last, revenue-wise, not least insight-wise: More Personal Computing

- Gaming revenue recorded robust 39% growth, driven primarily by Xbox content and services, which grew 50% (44 percentage points generated through the Activision Blizzard Acquisition). That once again showcases Microsoft’s strong competence in picking M&A targets and facilitating its existing solutions and products.

- Microsoft gaming platforms exceeded 500m active users and kept a strong content pipeline with 30 titles previewed.

- Windows revenue recorded 8% growth, with an 11% increase in Windows Commercial and cloud services sales and a 7% increase in Windows OEM.

Moreover, Microsoft keeps on adopting its AI solutions and further innovations to drive the performance and engagement of Bing, Edge, and Copilot:

Just last week, we announced we are testing a new generative search experience, which creates a dynamic response to a user’s query, while maintaining click share to publishers. And we continue to drive record engagement with Copilot for the web. Consumers have used Copilot to create over 12 billion images and conduct 13 billion chats to date, up 150% since the start of the calendar year.

For many more testimonies and use cases of MSFT’s AI adoptions into its core solutions’ infrastructure, please refer to the link below, as the endorsement keeps on accelerating and finding new niches to facilitate:

Top-Tier Profitability Equals Cash Flow Beast

Microsoft achieves dream-like margins

Each of the Company’s segments is highly profitable, with Productivity and Business Processes leading the way with its 52% operating income margin recorded in FY 2024. MSFT’s overall operating income derived from business segments amounted to 45%, a significant improvement over recent years. Please review the chart below for details on operating margin by business segment.

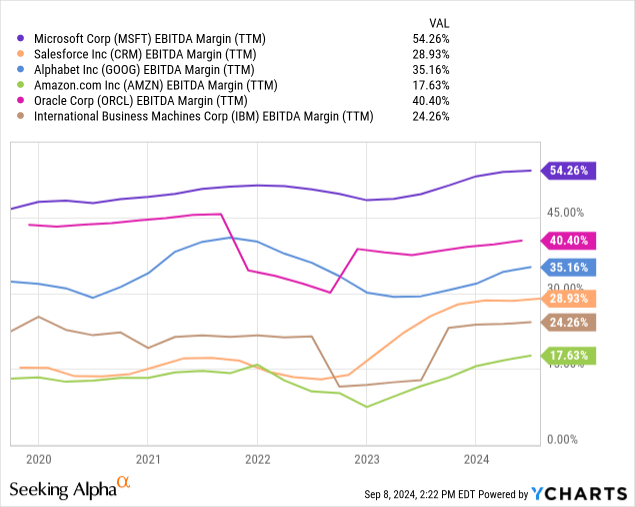

Microsoft’s EBITDA margin has been unmatched during the last couple of years, exceeding 45% and often recording over 50% levels.

High profitability translates into robust cash flow generation

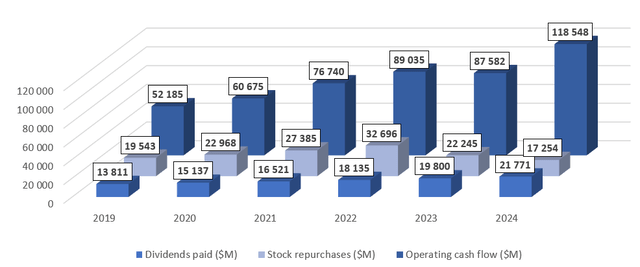

Outstanding profitability and a strong negotiating position (regarding procurement) translate into robust operating cash flow generation that supports MSFT’s rewards for shareholders. During the 2019–2024 period, the Company generated an unimaginable $484.8B of operating cash flow and rewarded its shareholders with:

- $105.2B of dividend payments (growing dynamically)

- $142.1B of stock repurchases

Please review the chart below for details.

While MSFT’s forward-looking dividend yield may not be tempting for many investors, it’s worth remembering that with solid DPS increases, substantial growth, and significant share repurchases, MSFT keeps on rewarding its shareholders. With time, the yield-on-cost improves drastically, leading to a great total return outlook.

That’s what got me involved in MSFT, and that’s what keeps me involved. Cash flow generation potential is the ultimate goal that investors look for in their long-term holdings, and MSFT does its homework.

Valuation Outlook

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

Why do I use such a method? Many investors stop exploring a business’s valuation after reviewing its stock price, enterprise value, or market capitalization (which is a better but still inferior approach). Relying solely on the stock price leaves two significant holes in the quality of an analysis:

- Such an approach doesn’t take into account any changes in the number of shares outstanding due to the share repurchases or issues, which impact the stock price

- One has to factor in the changes in the scale of the business, which the stock price or enterprise value doesn’t ensure

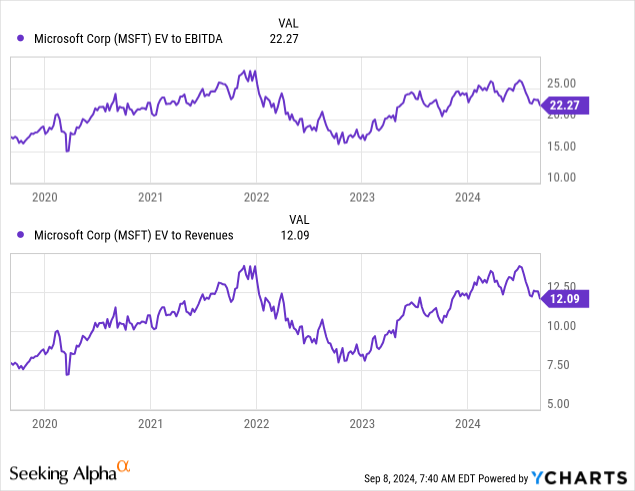

The multiple valuation method comes to our safety with a clear structure of referring a given ‘value’ metric (usually enterprise value) to a given ‘financial metric’ (usually EBITDA). Using an EV/EBITDA multiple is generally a rule of thumb for most sectors, but I’ll provide an EV/Revenue multiple for further reference.

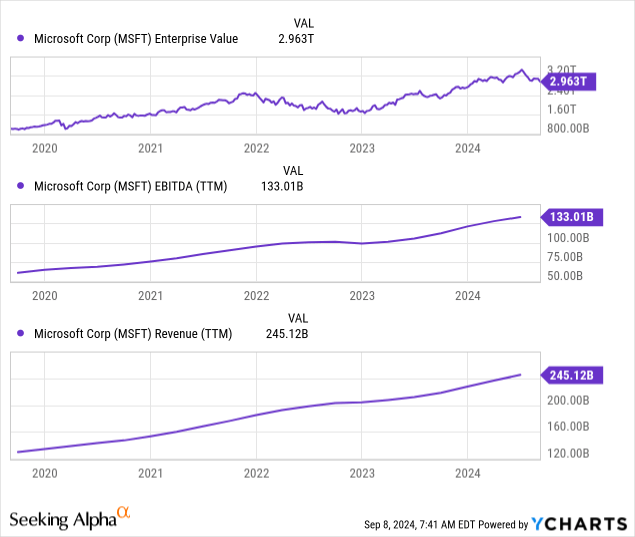

Please review the development of MSFT’s EV, EBITDA, and Revenue in recent years. As we established that a stock price alone is not a good indicator of business value, we can clearly see that the dynamic increase in its enterprise value was not detached from the growth of its business scale.

Combining the above metrics leads us to the earlier mentioned multiples: EV/EBITDA and EV/Revenue (EV/S).

At an early stage of the development, private, and significantly smaller entities (e.g. small, family-run SaaS businesses), there’s a tendency to use EV/ARR (often close to EV/S) multiple to value them in M&A processes. However, when dealing with such a mature business as MSFT, let’s stick with EV/EBITDA, which also reflects its profitability, being a main driver of cash flow generation.

Let’s take the changes between 2023 and 2024 as an example to better grasp the associations between the abovementioned metrics. As we can see, MSFT’s valuation multiple has increased, meaning that its enterprise value has increased more than proportionally to its EBITDA growth. However, recent weeks brought a noticeable correction to its valuation multiples.

Investment Thesis

There are a few things to keep in mind about Microsoft. While some may be concerned about its valuation, I am not a part of that group due to MSFT’s:

- Leadership position of the technological, AI-driven revolution, which still has a long way to go to fully unravel

- Innovation-driven business model with mission-critical services and products that keep the world turning

- Outstanding profitability driving the cash flow generation

- Still robust business scale growth

- Time-tested track record of keeping up (often leading) the technological advancements

- Successful history of M&A transactions

With that said, I regularly increase my position in MSFT, but this time, I added more than usual, as I’ve decided to try capitalizing on the temporary ‘discounts’, even though the multiple itself may still seem high. I believe that MSFT bears underestimate the game-changing effect the Company has always had on the world around us – and will certainly have even more of that, facilitating the ongoing digitization processes and adoption of new solutions enhancing global productivity.

I recognize that MSFT is not a bargain it was in early 2023 (I also added back then, but from the perspective of time, naturally – I wish I had added more 🙂 ). Furthermore, I’ll be happy to keep adding if MSFT upholds or falls below its current forward-looking EV/EBITDA of 20.4x.

My bottom line with Microsoft is simple. While I generally take a very cautious approach to margin of safety, I have a slightly less strict approach to valuation aspects. It’s very difficult to utilize any valuation methods or provide any accurate forecasts for a business that doesn’t really have comparable peers and is a trendsetter within an industry that is the definition of ‘change is the only constant’.

Call me ignorant or refer to my other articles for a more strict valuation approach to investments, but Microsoft has never failed to surprise me with positive business developments. I believe it’s a long-term champion, and with that thought in mind, Microsoft is a ‘strong buy’ for me at its current multiple. I’ve added many times and will continue to do so. Thank you!

What may go wrong?

Each stock market investment is accompanied by market and company-specific risk factors, which in the case of MSFT include:

- Failure to sufficiently capitalize on its ongoing investments in the AI environment

- Lower than expected synergistic effects from its M&A activities

- Failure to uphold a competitive edge in the cloud providers’ race

- Any technological breakdowns could hurt its brand and reputation

- Stock price volatility should be expected with MSFT

Nevertheless, I consider MSFT one of the most reliable technological players, which proves its long-term ability to adapt to the ever-changing market environment. That’s the best competence that a technological business can have: flexibility supported by an innovative approach.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.