Summary:

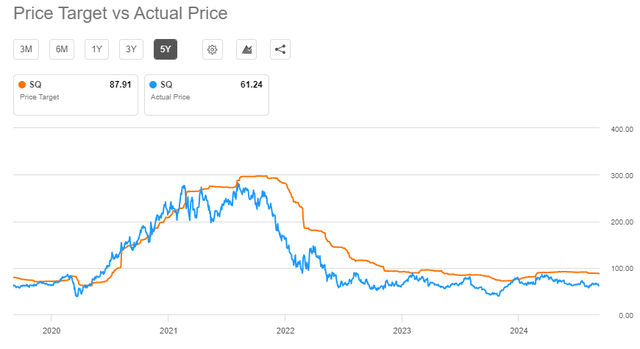

- Block, Inc.’s share price has been a major disappointment for investors, even as sell-side analysts have been recommending the stock for years.

- The last two quarters offered investors some respite as certain areas of the business are improving.

- The stock, however, is not a buy yet as certain problems persist and the macroeconomic environment is unlikely to remain supportive.

hapabapa

The past few years have been very rewarding for investors chasing momentum and high-growth companies in the technology sector. Due to excessive liquidity within the markets, this segment of the equity market has experienced unprecedented tailwinds that are now subsiding.

But even as valuations of growth stocks soared across the board, there are some names that became a bitter pill to swallow for investors. Block, Inc. (NYSE:SQ) is one of them, as the narrative around the company has created the illusion that downside risk is non-existent.

As it usually happens, sell-side analysts’ consensus price target was simply following the market with little to no insight into what future returns would look like.

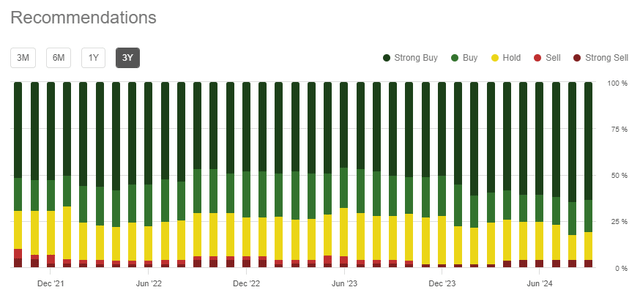

Despite the poor share price performance and the elusive GAAP profitability, Wall Street analysts remain extremely bullish on the stock, with “sell” ratings almost non-existent.

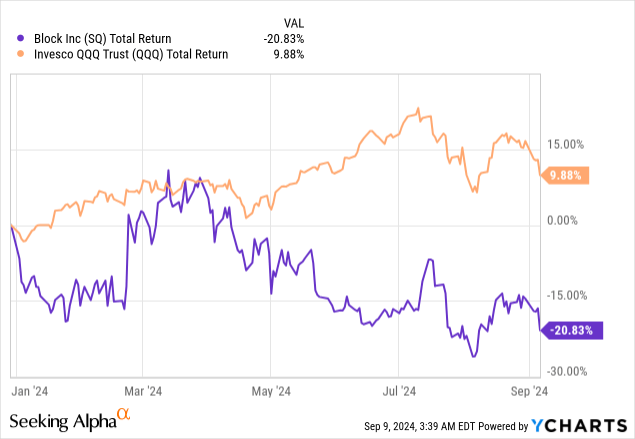

But as we have often heard – even a broken clock is right twice a day, and from current levels, Block’s stock might finally be offering some value for long-term investors. This, however, is far from certain and the stock is already down 21% year-to-date, while growth stocks made new highs during the summer.

I have been having a “sell” rating on the stock for nearly 2 years now, and the performance gap between SQ and the S&P 500 over that period is simply astounding. Since I highlighted all the major problems with Square’s profitability plan in December 2022, the stock is down by 7% while the S&P 500 appreciated by almost 40% during the same period.

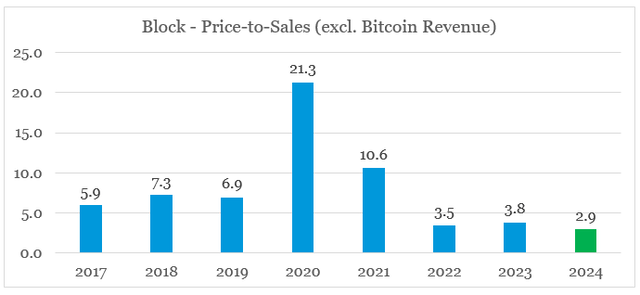

After this disastrous performance at a time when the equity market flourished, SQ could be finally worth keeping an eye on as the stock’s price-to-sales ratio adjusted for bitcoin operations (due to reporting being done on a gross basis) is now at multi-year lows and well-below its 2023 values.

prepared by the author, using data from SEC Filings

Not only that, but certain business fundamentals have been improving in recent quarters and this is now working in favor of SQ shareholders.

Finally, Some Good News

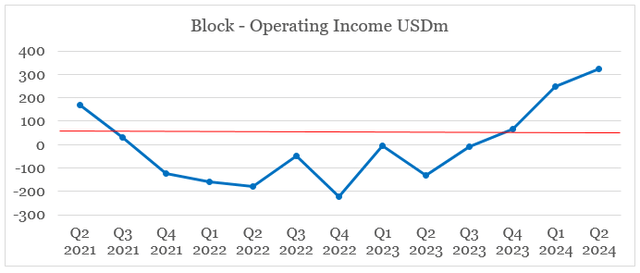

One of my main criticisms of Block has been the company’s struggle to achieve GAAP profitability and although high and sustainable GAAP margins are still a long way to go, notable progress is being made in recent quarters.

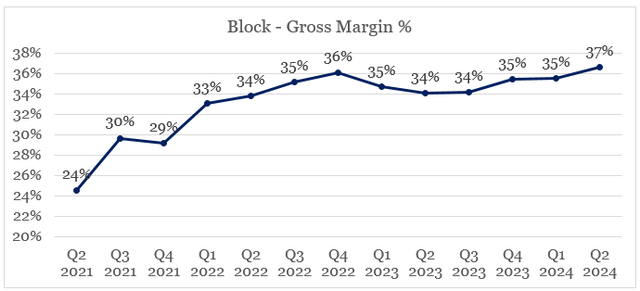

As a starting point, Block’s gross margin reached 37% during the last reported quarter, which surpassed the previous high from Q4 2022.

prepared by the author, using data from Seeking Alpha

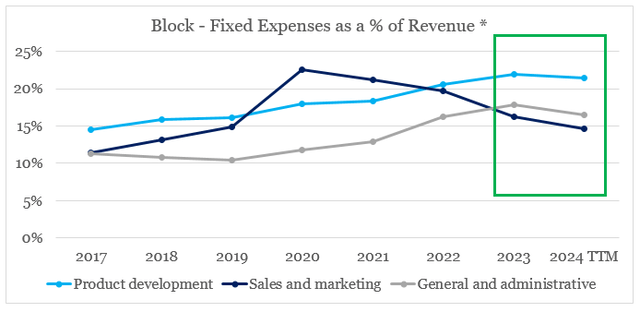

In addition to the improving gross margin, Block’s management has made significant progress in reducing fixed costs as a share of revenue. As we can see on the graph below, all three cost items – product development, sales & marketing, and general & administrative declined as a proportion of revenue (adjusted for bitcoin operations).

prepared by the author, using data from SEC Filings

* excluding Bitcoin operations.

The current decline in sales & marketing expenses relative to sales was to be expected, given the trend we see on the graph above and the recently announced layoffs. The drop in product development and general & administrative expenses, however, came as a surprise, and it appears that SQ might achieve high GAAP profitability earlier than expected.

prepared by the author, using data from Seeking Alpha

For now, it appears that SQ could continue to build upon these improvements through the rest of fiscal year 2024 as management now expects gross profit to improve by 18% on a year-on-year basis.

We are raising our full year 2024 guidance for both gross profit and profitability, reflecting not only outperformance in the second quarter, but also increased expectations for the remainder of the year. For the full year 2024, we are now expecting gross profit of at least $8.89 billion or 18% growth year-over-year.

Source: Block Q2 2024 Earnings Transcript.

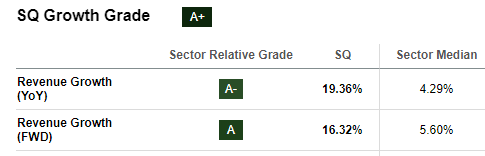

Expected revenue growth is now 16% which means that further gross margin improvement is to be expected through the second half of the year.

Seeking Alpha

It should be noted, however, that the revenue growth numbers above include bitcoin operations, which are reported on a gross basis. What that means is that the gross margin should improve significantly in the coming quarters. In combination with fixed cost efficiencies, this could mean that SQ is on track to deliver strong profitability numbers for FY 2024.

So What’s Holding It?

Unfortunately, it’s not all good news for Block shareholders and although the stock now appears more attractive than it was back in 2022, it is by no means a long-term buy.

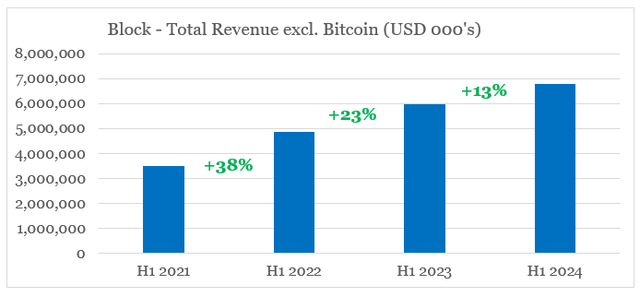

As a starting point, the revenue growth is now slowing down meaningfully. From 38% growth in the first half of 2022 to 23% and now 13% in the first half of 2023 and 2024 respectively.

prepared by the author, using data from SEC Filings

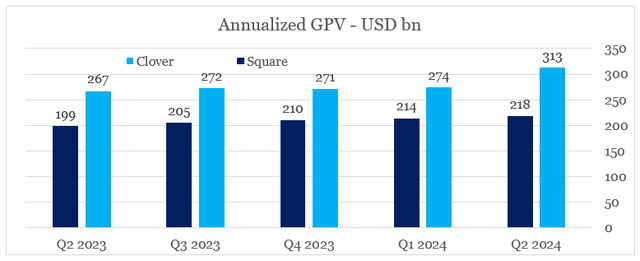

When it comes to Square’s gross payment volume (GPV) growth, things are not looking well either. In the graph below, we can see a comparison between Square and its major peer – Fiserv, Inc.’s (FI) Clover. We could see that despite Square’s notable growth in recent quarters, the gap in terms of annualized GPV between the two has widened significantly.

prepared by the author, using data from shareholder letters and investor presentations

Fiserv’s growth strategy in Merchants Acceptance seems to be working far better than the one utilized by Block. That is why, I have been bullish on the former for several years and the stock has also been among my high-conviction ideas within the sector.

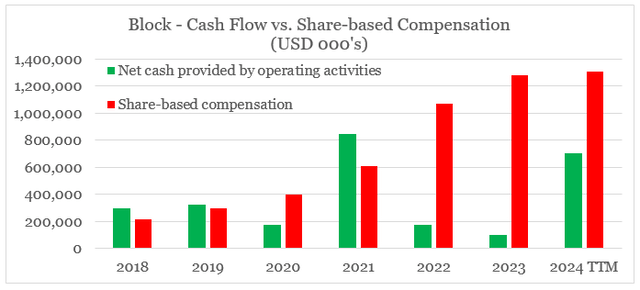

In addition to the slowing topline growth, SQ is still relying heavily on stock-based compensation (“SBC”), while at the same time spending significant amounts on share repurchases just to offset shareholder dilution. So far, the company’s share-based compensation expense remains nearly twice as high as the cash flow from operations, which is a major red flag.

prepared by the author, using data from SEC Filings

Now, as profitability improves and Block’s management finds themselves with higher amounts of cash, a decision was made to significantly increase the share repurchase program.

We very recently completed our inaugural $1 billion share repurchase authorization. And today, we’re excited to announce an incremental $3 billion share repurchase program.

Source: Block Q2 2024 Earnings Transcript.

Usually, this should be considered good news, but as long as the share-based compensation expense continues to increase, the share buyback program will not deliver the desired outcome for shareholders. This dynamic also highlights the capital allocation issues within the company – something that I have talked about before.

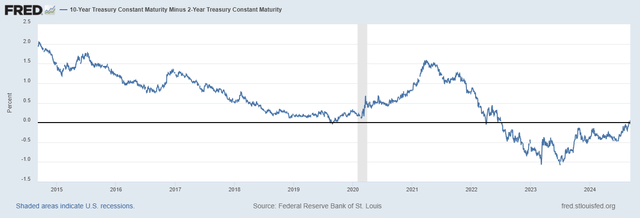

Lastly, the market is also becoming wary of the risks of a recession in the coming months as the yield curve un-inverts and leading economic indicators continue to deteriorate.

This will put significant pressure on SQ stock over the coming months, even if GAAP profitability continues to improve.

Conclusion

Block’s now appears more attractive than it was a couple of years ago when I first rated the stock as a sell. Margins will likely continue to improve through the rest of 2024, provided that a recession is avoided. As optimistic as this might sound, growth is slowing down and issues related to capital allocation remain. The favorable macroeconomic environment that has supported the stock recently is also no longer something that investors should take for granted. With all that in mind, I have upgraded Block, Inc. stock to a Hold, but a Buy rating is not in sight yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.