Summary:

- Verizon Communications Inc.’s focus on annual dividend hikes strains its balance sheet, adding $420 million in payouts over the lat two years.

- The $20 billion Frontier Communications acquisition increases Verizon’s debt to $167 billion, with uncertain benefits and regulatory approval not expected until 2026.

- The market has signaled that blind dividend hikes are ineffective without growth or debt reduction, making Verizon a risky investment despite potential yield appeal.

J Studios/DigitalVision via Getty Images

The biggest complaint about Verizon Communications Inc. (NYSE:VZ) for years now has been the weak balance sheet. The wireless giant constantly places too much emphasizes into hiking the dividend annually and the BoD didn’t fail to disappoint last week with a dividend hike and a large cash acquisition thrown on top. My investment thesis remains Neutral on the stock, with the balance sheet again stressed by these moves.

Dividend

Just when Verizon was entering the conversation for returning to being a cash flow machine that was responsible by repaying debt, the company reversed to prior bad decisions. The company just hiked the quarterly dividend by 1.9% to $0.6775 as follows:

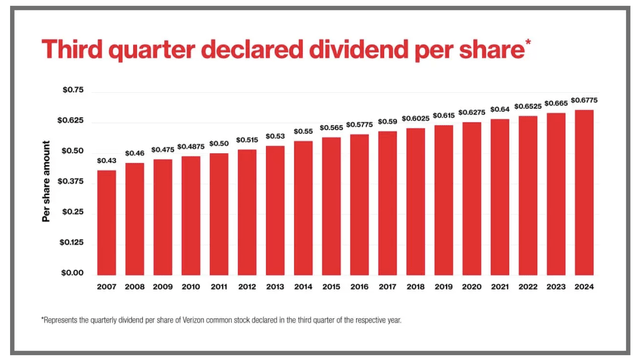

The move definitely isn’t a shock due to the recent history of annual hikes in September by $0.0125 per quarter. The company falls into the dividend aristocrat concept, almost forcing these annual dividend hikes to maintain this status that harms the balance sheet.

Source: Verizon dividend press release

As my previous research highlighted, Verizon is now stuck in an annual escalation of the dividend payouts. The company now has 4.2 billion shares outstanding, leading to ~$210 million in additional cash payouts for the $0.05 annual payout boost.

The problem here is that Verizon is paying an additional $210 million on top of the $210 million from last year. Over just the last 2 years, the annual payout has increased by $0.10, or the equivalent of $420 million in additional dividend payouts.

Verizon now spends $11.4 billion on dividend payouts, while the annualized interest expenses are now approaching $7 billion. In essence, the company payouts out over $18 billion in cash to just appease shareholders and run a high debt balance versus investing in the future.

The company hasn’t guided towards free cash flow for 2024 outside of something similar to the $18+ billion level from 2023 while spending at least $17 billion on capital spending, roughly $1.5 billion less than last year. The positives were the ability to finally repay debt after spending the prior few years ramping up spending on the 5G rollout.

The payout ratio was down to the 60% range, leaving Verizon with $7 billion in cash flow after paying the dividend. Not actually a lot of money considering the revenue base of $135 billion.

Over time, the annual dividend hikes have lost the benefit to shareholders. The whole dividend aristocrat label might attract investors, but the rewards aren’t always clear, especially when the dividend hikes aren’t earned or appreciated with the yield already up at 6.6%.

Since Verizon started hiking the dividend for the last 18 years back in 2007, the S&P 500 Index (SP500) has vastly outperformed the stock. Notably, Verizon outperformed the market through 2020 before massively trailing the market returns. Ironically, the wireless giant first moved to the limited $0.0125 quarterly hikes each year at the end of 2016 and the underperformance took hold when the market figured out the gimmick.

Verizon is at the point where the company can’t just report a Q2 where earnings dipped, yet hike the dividend and boost the annual payout. The company has to boost profits and repay debt before any dividend hikes have any benefit.

Troubling Frontier Deal

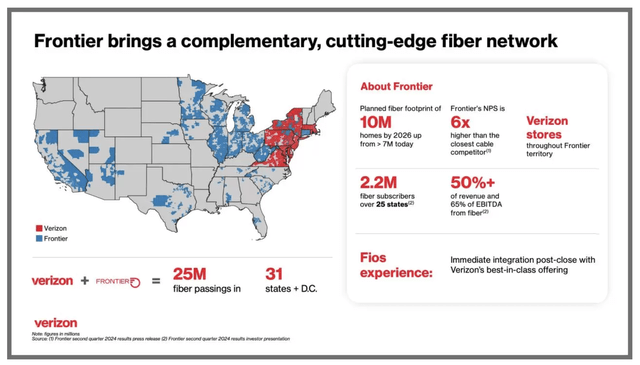

Last week, Verizon announced a big and surprising deal to acquire Frontier Communications (FYBR). The deal to acquire the cutting-edge fiber network will cost Verizon $20 billion in cash, the company will have to borrow or assume existing debt.

Verizon oddly lists the focus of the merger is to acquire the largest pure-play fiber internet provider. Maybe the wireless giant hopes to turn the fiber network into an AI play. However, Frontier generates just shy of $6 billion in sales with limited growth forecasted due to the focus on wireline operations, with limited growth causing the prior bankruptcy back in 2020.

The prime focus of the deal appears to be the 2.2 million current fiber subscribers. Verizon will have a combined 10 million broadband subs while covering 25 million premises.

The big frustration with the financial position of Verizon is that the net debt only rises over time. The company makes promises to reduce debt levels, but just as debt loads start turning down, management decides to hike the dividend again and makes another large acquisition.

As the chart highlights, Verizon had a net debt level below $40 billion back in 2007, when the company started hiking dividends annually. The wireless giant ended the last quarter with a net debt balance of $147 billion, and the debt load is now effectively $167 billion if the Frontier deal closes.

Even worse, the company will now have to spend the next 18 months working with regulators to obtain approval. A lot happens in the market and economy over such a long period. Any opportunity with AI could’ve already passed by the time this deal possibly closes in early 2026.

The financials of the Frontier deal are perplexing as well. While Verizon points to the deal being EBITDA accretive, one has to understand that EBITDA excludes the interest expense piled up by $20 billion in additional debt where an average 5% dividend rate amounts to $1 billion in expenses not included in EBITDA.

Any deal can be accretive when using debt and ignoring the related costs of the acquisition. Please remember, Verizon ultimately has to repay this debt at some point.

Takeaway

The key investor takeaway is that Verizon Communications Inc. has again prioritized raking up debt versus improving shareholder returns. The market has clearly spoken over the last decade that dividend hikes aren’t beneficial when Verizon isn’t growing or paying down debt. A deal to acquire a fiber network would only make sense with an AI boost, but that doesn’t appear to be a logical part of a deal that won’t close until early 2026, if at all.

Verizon offers a 6.6% dividend yield with interest rates likely to fall, making the stock more appealing from a yield standpoint. Otherwise, Verizon would be a clear sell on another move to pile on debt.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Septbemer, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.