Summary:

- Apple Inc.’s Glowtime event showcased new Watches, AirPods, and iPhones, but lacked major surprises, leading to a slight stock decline.

- Despite AI enhancements, iPhone pricing remained stable, potentially impacting margins due to higher production costs.

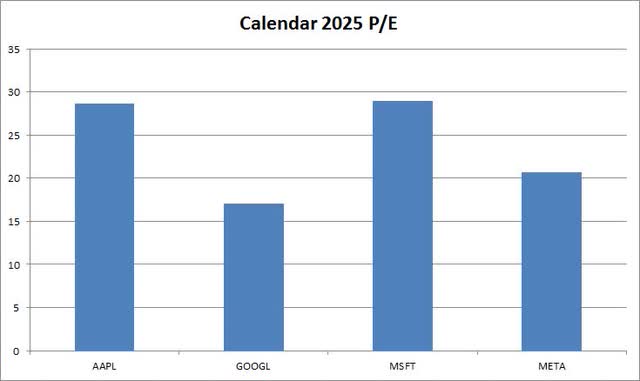

- Apple’s calendar 2025 valuation is high compared to its large-cap tech peers, with lower top and bottom-line growth expectations.

Justin Sullivan/Getty Images News

On Monday, technology giant Apple Inc. (NASDAQ:AAPL) held its Glowtime event. While the company showed off new versions of the Watch and AirPods, the main attraction for the show was this year’s iPhone launch. Unfortunately, given all the rumors we’ve heard about for months, as well as the nearly 30% jump in shares over the past six months, the event didn’t do much to excite.

Previous coverage of the name:

It’s been about two months since I last looked at Apple shares. In early July, I detailed how I believed that the upcoming earnings report could be irrelevant. My thesis was that all eyes would be on this year’s iPhone launch, as both consumers and investors were waiting to see Apple’s first major foray into artificial intelligence with its smartphones.

At that time, I had a neutral rating on Apple shares because the valuation had been stretched and shares were running quite a bit ahead of the average street target price. I believed the near-term upside was rather limited, and I turned out to be right. Since my previous article, Apple shares have returned a negative 4.1%, which is almost double the loss of the S&P 500 over that time.

Apple launches iPhone 16:

I won’t get overly technical here, since most of the new hardware details and features have been rumored or leaked for some time now. You can read a run-down of everything announced right here. When it comes to the Apple Watch and AirPods, the company made its usual set of improvements, but it also made a point of adding some artificial intelligence features. For the Watch, a new design was shown off along with a faster charging experience, while a focus was made on health issues surrounding AirPods.

When it comes to the iPhone, there weren’t too many surprises. The Pro versions got larger displays, while also getting the expected Pro version of the new A18 chip. This allowed Apple to bring the A18 chip to the base two versions of the iPhone 16, meaning a two-generation leap. The lower-level iPhones had previously had an older generation chip than their current year counterparts, part of which was due to the chip shortage problem we saw a few years ago. In the graphic below, you can see the available iPhone models over the past four years, with each year’s respectively launched models (excluding the SE) in yellow.

iPhone Launch Pricing (Apple Website)

There are two key takeaways here, in my opinion. First, Apple kept the 14 Plus variant around, an extra version that’s now two years old. I’m not sure if that’s due to device popularity, some excess inventory, or an effort to keep overall iPhone pricing down. Last year, there were 25 different iPhones available (in terms of model/storage configurations) with an average price of $958.60. By keeping the 14 Plus here, this year has 28 available with an average price of $945.00, or about a 1.42% decrease.

My second takeaway here is on the margin side. It would not surprise me if we see gross margins for the phones come down a little this year. Jumping two years forward with the chips for the two base versions will add a little cost pressure, and the larger screens on the Pro models will also cost a bit more. With Apple bolstering the iPhone’s brain as it looks to make a jump in artificial intelligence, we could see gross margin percentages decrease slightly.

However, if Apple sells more phones as many analysts expect, it could still see an increase in total gross margin dollars. Currently, the Street is looking for 7.65% revenue growth in Apple’s fiscal 2025 (ending September 2025) period, up from less than 1.9% in the current fiscal year that ends in a few weeks. While the services segment will likely continue as the overall revenue growth leader, analysts expect iPhone revenue growth to accelerate.

A look at valuation:

There are a couple of things to look at here. The first thing I like to look at is the price-to-earnings ratio. As the chart below shows, Apple trades at almost 29 times its calendar 2025 street expected earnings (fiscal year does end in September). That number is about the same as peer Microsoft (MSFT), but Apple is only expected to show about half of the revenue and earnings growth, in percentage terms. Furthermore, Alphabet (GOOG, GOOGL) and Meta Platforms (META), which are growing about the same as Microsoft, are trading at much more reasonable valuations.

Calendar 2025 P/E (Seeking Alpha)

In terms of the analyst community, things have flipped quite a bit. On the hopes of artificial intelligence, Apple shares are now about $20 below the average price target on the street. That’s mostly a reflection of the street hiking its targets quite a bit in the last couple of months. When I last looked at the name, Apple traded $15 over the average street target.

Final thoughts and recommendation:

In the end, Apple’s product launch event on Monday was about as expected. The company showed off its new Watches, iPhones, and AirPods, all with a focus on artificial intelligence. Apple AI will start to roll out next month for its smartphones, but only in the US for the English language, with expansion coming in December and further in 2025. The iPhone’s pricing was kept the same, except for keeping around an extra version of an older generation, so there could be some slight hits to margins here.

In terms of Apple shares, I’m going to keep my hold rating on the stock here. As usual, there were enough leaks ahead of time so that there weren’t any major surprises on Monday, so the stock declined a little as another example of a “buy the rumor, sell the news” event. The valuation remains a bit high as compared to its large-cap tech peers, despite the lowest growth profile of the bunch.

There are some lofty expectations here baked into shares right now that artificial intelligence can power a supercycle in phone sales. This leads me to believe there’s slightly more room for disappointment than an upside surprise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.