Summary:

- Advanced Micro Devices, Inc. is investing aggressively in AI chips, networking, and system-level solutions to gain market share.

- The company’s fundamentals are improving, with significant growth in the Data Center segment, contributing to higher total revenue and gross margins.

- Despite customer concentration risks and underperforming segments, its PEG ratio suggests potential for stock price appreciation.

- Upgraded the stock to a buy due to its potential to compete effectively with Nvidia in AI and data center markets.

JHVEPhoto

I last wrote about Advanced Micro Devices, Inc. (NASDAQ: NASDAQ:AMD) on December 4, 2023, giving the stock a hold rating. Although the stock has been up 13.31% since that recommendation, it underperformed the S&P 500’s (SPX) 18.35% rise. Although the stock has risen higher since my hold recommendation, there are reasons it might outperform at higher prices.

Companies do not like having NVIDIA Corporation (NVDA) as a sole source for AI accelerators because it would have too much power to negotiate higher product prices. Additionally, having only one AI infrastructure supplier adds the risk that a customer may not be able to receive its products when it wants. AMD has recently introduced an AI accelerator to the market that performs similarly to Nvidia’s GH200 Grace Hopper chip. Its second-quarter 2024 report strongly suggested that its new AI chip is gaining traction in the market, helping the company’s fundamentals improve. Investors are increasingly confident that AMD can become a second supplier of chips to the AI infrastructure market.

This article will discuss how AMD is slowly catching up to Nvidia’s capabilities and how the company’s fundamentals are improving. It will also examine a few risks, its valuation, and why I have upgraded the stock to a buy.

Closing the gap with Nvidia

One way Nvidia leads AMD is its ability to provide customers with complete system solutions, also called rack-scale. Investors familiar with Super Micro Computer, Inc. (SMCI) may have heard of the rack-scale. My last article on Super Micro discussed what the term means (emphasis added):

Around 2022, the company [Supermicro] emphasized what it called Total IT Solutions at Rack-scale. This term refers to a new data center architecture that separates traditionally bundled server components of compute, network cards, GPU (Graphics Processing Unit) acceleration, and storage into independent, standalone modules. For instance, one rack-scale module may contain only network cards. Another may contain only central processing units. A rack is a metal frame that can hold multiple modules connected by high-speed fiber, PCIe, or InfiniBand interconnects. One or more racks share cooling and power inside a larger enclosure called a cabinet.

Rack-scale architecture is ideal for high-performance computing and generative AI applications. Rack-scale has become increasingly popular as cloud companies and enterprises build more data centers geared to generative AI. Nvidia is ahead of its competitors, including AMD, in providing networking hardware, software, water-cooled GPUs, and expertise in combining multiple components within a rack-mounted server system.

Nvidia’s primary high-speed interconnect is NVLink. It connects an Nvidia GPU to another GPU within a rack or a small cluster and can also connect a GPU to a CPU. Until recently, AMD has lacked similar interconnect products.

To replicate high-speed short-distance interconnects between non-Nvidia accelerators, a consortium of companies that includes AMD, Broadcom Inc. (AVGO), Cisco Systems, Inc. (CSCO), Alphabet Inc. (GOOGL)(GOOG), Hewlett Packard Enterprise Company (HPE), Intel Corporation (INTC), Meta Platforms, Inc. (META), and Microsoft Corporation (MSFT) created an open industry standard called Ultra Accelerator Link (UALink). According to one article, UALink may hit the market in 2026.

However, AMD is not waiting for its appearance. When asked about UALink on its second quarter 2024 earnings call, AMD Chief Executive Officer Lisa Su said (emphasis added):

First of all, we’re very pleased with all of the partners that have come together for UALink. We think that’s an important capability. But we have all of the pieces of this already within sort of the AMD umbrella with our Infinity Fabric, with the work with our networking capability through the acquisition of Pensando. And then you’ll see us invest more in this area. So this is part of how we help customers get to market faster is by investing in all of the components, so the CPUs, the GPUs, the networking capability as well as system-level solutions.

The company defines Infinity Fabric in a paper describing its networking strategy: “AMD Infinity Fabric™ (IF) is a high-speed intra-host interconnect that can be used to connect multiple AMD CPUs and GPUs.” Essentially, it is AMD’s version of NVIDIA’s NVLink.

AMD acquired Pensando Systems on May 26, 2022. The company specializes in speeding up data transfer through software infrastructure and its Data Processing Unit (“DPU”), an increasingly vital component enabling advanced computing applications such as AI, machine learning, IoT (Internet of Things), 5G, and hybrid cloud configurations. SmartNIC (smart network interface controller) often incorporates DPUs. With Pensando, AMD may develop products that equal or exceed NVIDIA’s ConnectX family of NICs.

AMD has improved the quality of its CPUs and GPUs and should soon have networking products to potentially make it capable of gaining market share against NVIDIA. Still, one more piece is needed to become a genuine threat: the system-level solutions piece. It recently acquired that piece on August 19, 2024, when it announced it was buying ZT Systems. This company specializes in designing and manufacturing complex systems for rack-level solutions.

AMD Chief Technology Officer Mark Papermaster said the following about the proposed ZT Systems acquisition at the Deutsche Bank Technology Conference on August 28, 2024 (emphasis added):

When you think about the announcement that we made last week in acquiring ZT Systems, it’s the next stage in really our strategic growth of ensuring that we have the full complement of skills that we need to have not only the best AI hardware, not only competitive and leadership AI software, but the ability to integrate it and optimize it at the system level. And so, ZT Systems represents exactly that. They have 15 years of experience with building some of the most complex heterogeneous system designs, integrating CPUs, GPUs, networking, advanced thermal management and cooling capabilities, as well as the kind of control software that you need to efficiently run these complex rack designs.

Due to this potential acquisition, AMD will be able to design custom hardware and software configurations for different AI applications. It will also be able to bring those AI solutions to market more quickly, possibly differentiating its solutions in the marketplace and gaining a competitive advantage.

Company fundamentals

Although AMD should benefit from AI adoption, investors shouldn’t expect the same triple-digit revenue growth as its competitor, Nvidia. In contrast to its faster-growing rival, two of AMD’s segments are underperforming and acting as an anchor on its overall performance.

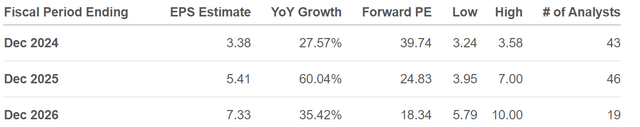

AMD Second Quarter 2024 Slide Presentation.

AMD’s Data Center and Client segments are outperforming. Data Center grew 115% over the previous year’s comparable quarter. In comparison, Nvidia grew second-quarter data center revenue by 154%. However, the following table shows that AMD’s Gaming and Embedded segments are significantly underperforming, acting as a deadweight regarding total revenue and profitability.

AMD Second Quarter 2024 Slide Presentation.

CEO Su said the following about the data center business on the second-quarter earnings call (emphasis added):

Turning to our data center AI business, we delivered our third straight quarter of record data center GPU revenue with MI300 quarterly revenue exceeding $1 billion for the first time. Microsoft expanded their use of MI300X Accelerators to power GPT-4 Turbo and multiple co-pilot services including Microsoft 365 Chat, Word, and Teams. Microsoft also became the first large hyperscaler to announce general availability of public MI300X instances in the quarter. The new Azure VMs leverage the industry-leading compute performance and memory capacity of MI300X in conjunction with the latest ROCm software to deliver leadership-inferencing price performance when running the latest frontier models, including GPT-4.

AMD’s Instinct MI300X is a high-performance AI accelerator optimized for large language models (“LLMs”) used in inference and training workloads. The company needed to show investors that it could gain a toehold in a massive cloud provider like Microsoft for its prime AI products, such as GPT-4 and Microsoft 365-mission accomplished. The company showed Wall Street that its offering is a viable alternative to Nvidia’s AI accelerators. ROCm software is an open-source competitor to Nvidia’s CUDA software. If AMD can establish ROCm, it could break down another of Nvidia’s competitive advantages.

AMD also raised guidance for its data center segment. CEO said on the earnings call:

In summary, customer response to our multi-year Instinct and ROCm roadmaps is overwhelmingly positive and we’re very pleased with the momentum we are building. As a result, we now expect data center GPU [Graphics Processing Unit] revenue to exceed $4.5 billion in 2024, up from the $4 billion we guided in April.

AMD’s second-quarter 2024 Data Center segment operating income margin rose 15.1 points to 26.2% year over year. Data Center Operating income was up 405%.

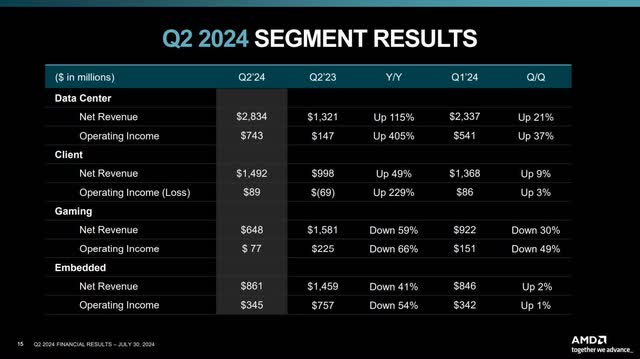

The company’s second-quarter 2024 total revenue grew 9% year-over-year to $5.8 billion.

AMD Second Quarter 2024 Slide Presentation.

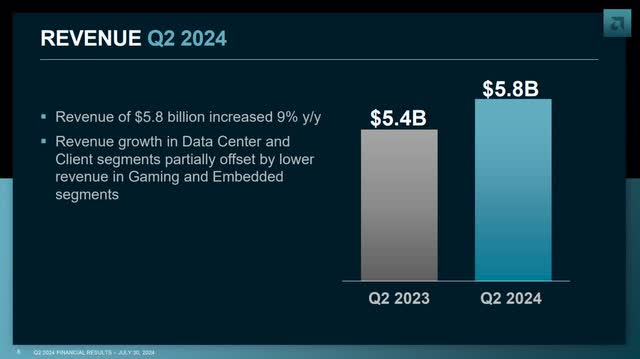

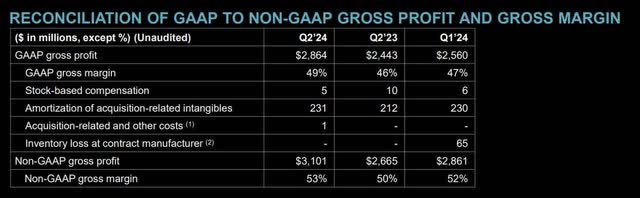

AMD GAAP (Generally Accepted Accounting Principles) gross margin rose 352 basis points (“bps”) to 49%. The company’s non-GAAP gross margin was up 340 basis points year-over-year to 53%. The rapid rise of the more profitable data center revenue helped total gross margins rise.

AMD Second Quarter 2024 Slide Presentation.

The following table shows that the largest difference between GAAP and non-GAAP gross margins is the amortization of acquisition-related intangibles. This is how the company accounts for the decline in value of an acquisition’s non-physical assets like patents, trademarks, and copyrights over their useful lives. It is similar to depreciation for physical assets.

AMD Second Quarter 2024 Slide Presentation.

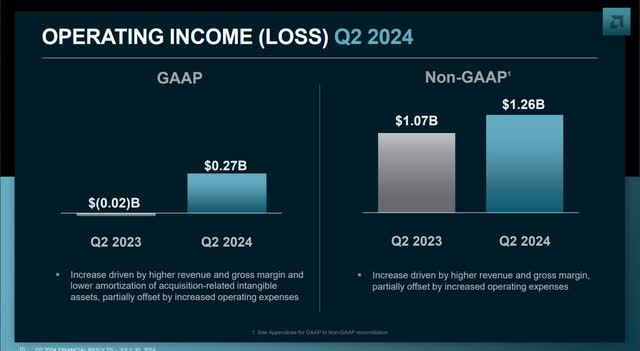

The company’s second-quarter 2024 non-GAAP operating income rose $190 million year over year to $1.3 billion. In the second quarter, the non-GAAP operating margin was up 2 points to 22% compared to the previous year’s comparable quarter. Operating expenses/revenue was up 2 points year over year to 32%, meaning the company is investing more to produce revenue growth. Still, revenue growth and gross profits outpaced rising operating expenses during the quarter. Investors should monitor how long management can maintain that scenario, since competition remains fierce. AMD may need to increase investments in research and development (R&D) to keep pace with Nvidia in AI chips, possibly hurting operating margins in the future.

AMD Second Quarter 2024 Slide Presentation.

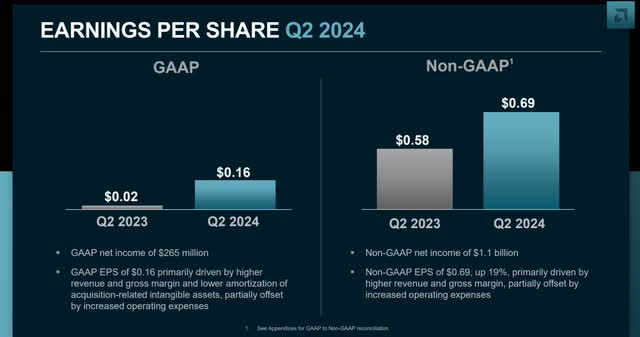

The company’s second-quarter 2024 GAAP diluted earnings per share (“EPS”) grew by 700% year over year to $0.16. Its non-GAAP diluted earnings per share were $0.69, an increase of 19% year over year.

AMD Second Quarter 2024 Slide Presentation.

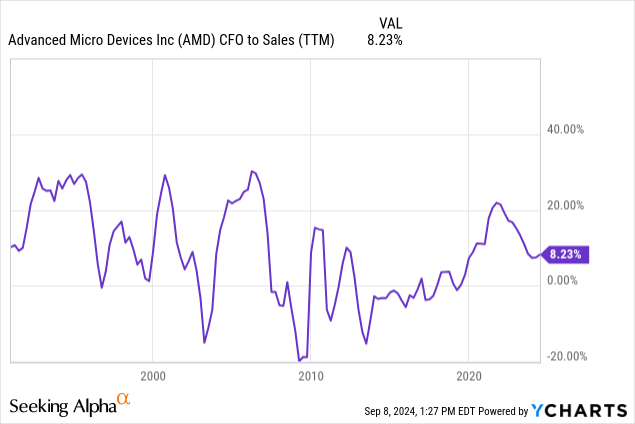

AMD’s cash from operations (“CFO”) to sales ratio was 8.23%. The following chart shows that the company’s CFO-to-sales ratio is cyclical and will often rise above 20% at the cycle’s peak. The company is potentially going into an upcycle in its server and PC markets, boosted by AI growth. If that assessment is accurate, look for CFO-to-sales to rise above 20% over the next one to two years, which would bode well for free cash flow (“FCF”) growth.

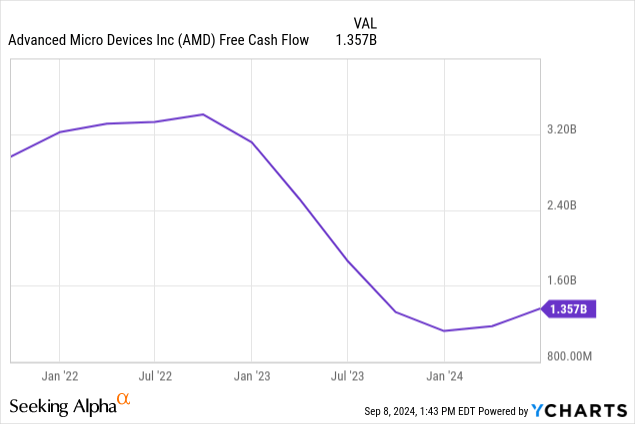

AMD’s second-quarter 2024 trailing 12-month (“TTM”) free cash flow (“FCF”) was $1.357 billion. The following chart shows that before the traditional server and PC market decreased in 2023, the company’s TTM FCF was above $3.2 billion. Suppose AMD’s main end markets emerge from its downturn in the second half of 2024, as some analysts expect; investors may see FCF rise much higher in 2025.

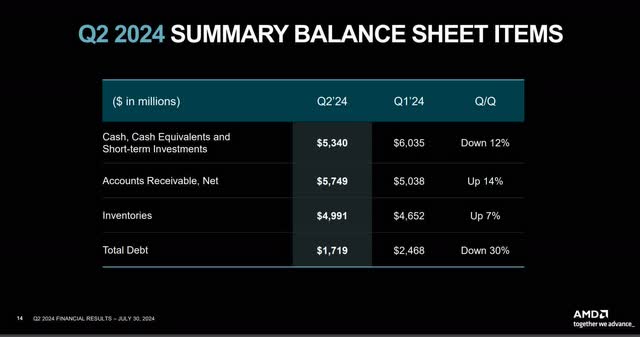

The company ended its June quarter with $5.34 billion in cash and marketable investments against $1.719 billion in long-term debt.

AMD Second Quarter 2024 Slide Presentation.

AMD has $2.245 billion in total debt and $4.046 billion in TTM EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Its debt-to-EBITDA ratio is 0.55, meaning the company can pay its debt down with its profits. Its debt-to-equity ratio is 0.04, which means the company has a low risk of defaulting on its debt.

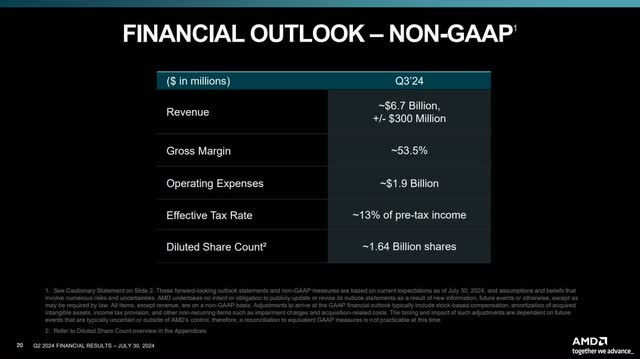

The chart below shows the company’s guidance for the third quarter of 2024. If the company hits its revenue guidance of $6.7 billion, it will produce revenue growth of 15.51% year over year, slightly above analysts’ estimates.

AMD Second Quarter 2024 Slide Presentation.

If the company hits its gross margin guidance of 53.5%, the gross margin will rise 2.5 points over the previous year’s comparable quarter. Suppose AMD hits its third-quarter operating expense guidance of $1.9 billion. In that case, operating expenses will grow around 12% over last year’s second quarter, around 3.5% lower than forecasted revenue growth. Investors want to see revenue growth continue to outpace operating expense growth.

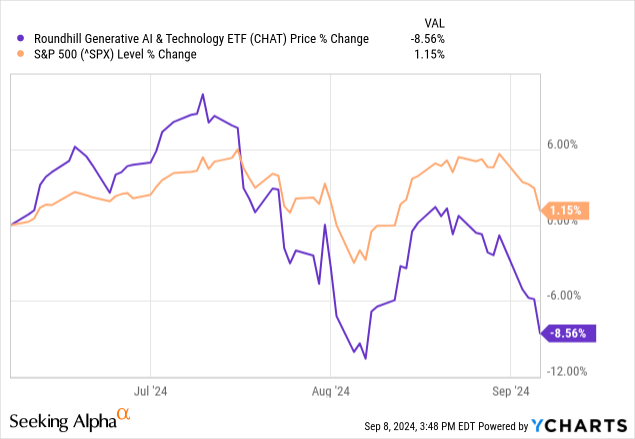

Risks

AMD has several risks that investors need to monitor. Over the last several months, many of the stocks that people associate with being AI beneficiaries have underperformed in the market. The Roundhill Generative AI & Technology ETF (CHAT) underperformance compared to the S&P 500 is evidence of investors’ sentiment cooling to generative AI. One of the things investors fear is that cloud companies like Microsoft’s Azure and Meta Platforms are overbuilding AI infrastructure and may not quickly see returns from their investments. There is a potential that some of these companies may pull back on some of their AI investments at some point, which is why some feel that generative AI infrastructure stocks are in a bubble.

The only significant customers of AMD’s Instinct MI300X AI chips that the company announced are Microsoft, OpenAI, and Meta Platforms. AMD could have revenue growth or profitability issues if those customers stop buying its AI chips since they are the company’s most significant growth driver.

Another issue the company has is that it has always been a laggard in the CPU (Central Processing Unit) and GPU (Graphics Processing Unit) markets against Intel and Nvidia. Both markets are intensely competitive, and there is no guarantee that AMD can maintain or gain market share without engaging in price wars, which could hurt profitability in the long term. Additionally, the company will likely need to spend significant sums to keep up in the AI chip market, especially since Nvidia recently decided to release a new AI chip annually instead of every two years.

In response, AMD has committed to releasing new AI chip architecture at the same pace. On AMD’s second-quarter 2024 earnings call, the CEO said (emphasis added),

“Looking ahead from a roadmap perspective, we are accelerating and expanding our Instinct roadmap to deliver an annual cadence of AI accelerators, starting with the launch of MI325X later this year.“

The company will likely have to up spending on R&D to keep pace with NVIDIA, which could hurt operating margins in the long term.

Valuation

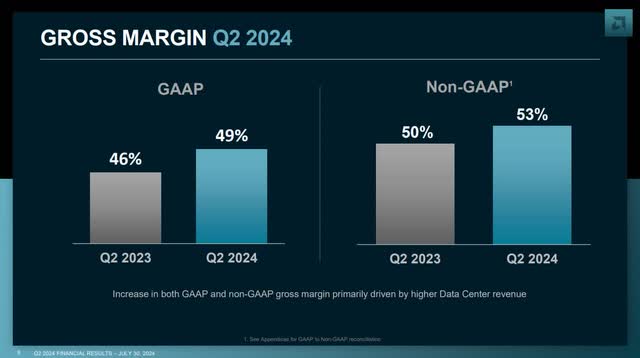

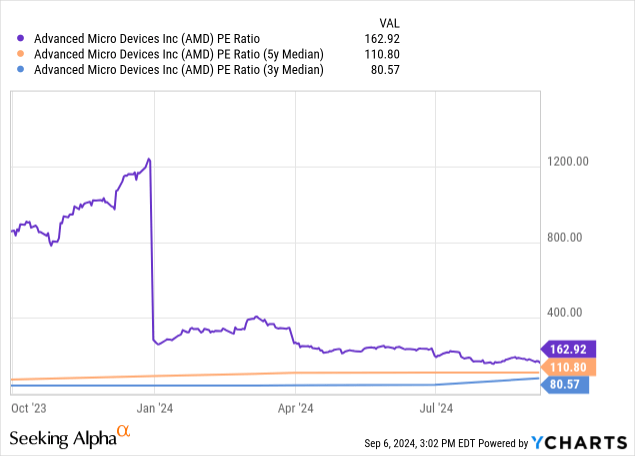

AMD’s price-to-earnings ratio is 162.92, well above its three- and five-year median, suggesting overvaluation. However, the company is coming off a cyclical bottom, and earnings could grow into its valuation.

Industry experts expect the server and PC (personal computer) markets to rebound strongly from their recent downturn next year. AMD’s projected EPS growth in fiscal 2025 reflects that. AMD’s one-year forward Price-to-Earnings Growth (“PEG”) Ratio is 0.41 (Fiscal 2025 forward P/E of 24.83 divided by EPS growth rate of 60.04). Some investors consider a PEG ratio of one fairly valued. So, investors may undervalue AMD’s projected earnings growth rate in 2025. If the stock sells at a fair valuation PEG ratio of 1.0, it would be $324.82, up 142% from its September 6 closing price of $134.35.

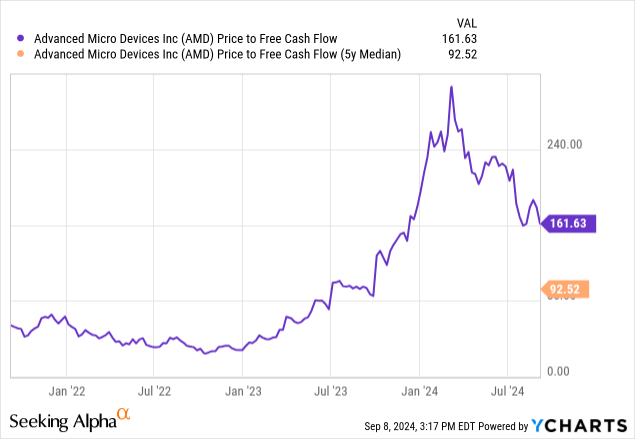

AMD’s price-to-FCF is 161.63. Although this figure is well above its price-to-FCF three- and five-year median, remember that the company may be just coming out of a down cycle, where its FCF may be at its lowest point in the cycle.

Suppose AMD can return to an FCF of $3.2 billion (slightly below its peak in the last upcycle) at the September 6, 2024, closing stock price of $134.35; its price-to-free-cash flow would be 68.89, below its five-year median of 92.52. So, the market may undervalue the stock’s potential FCF if it returns to near its last FCF peak. The stock price at an FCF of $3.2 billion and a five-year median price-to-FCF of 92.52 would be $180.41, a 34.28% rise above its September 6 closing price. The company could exceed $180 if tailwinds from AI adoption lift FCF past $3.2 billion over the coming years.

AMD is a buy

In the past, I have been reluctant to recommend AMD until it showed it could achieve some traction in the market with its AI chips. Its first and second-quarter 2024 earnings reports provide enough evidence that it should become a significant beneficiary of the global AI infrastructure build out. The company’s fundamentals should improve significantly as its main end markets improve over the next year.

The company’s end markets are cyclical. Investors who are uncomfortable with the chip industry’s volatility should probably avoid investing in this company. However, consider buying AMD if you seek a growth stock that should provide alpha over the coming years. In addition to AI, it benefits from the secular growth of the cloud, the Internet of Things (“IoT”), the electrification of autos, edge computing, and 5G. I have upgraded AMD from a hold to a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.