Summary:

- Amazon’s recent stock dip presents a buying opportunity – I still believe it’ll surpass its peak $2 trillion market cap in the medium term.

- AWS’s expanding cloud market presence and strategic AI investments are key growth drivers, despite a slight revenue miss in Q2 2024.

- Amazon Prime’s strong membership base and the ongoing shift towards e-commerce will continue to drive high-margin recurring revenue and market share growth.

- Amazon stock has gotten much cheaper over the last three months, with consensus forecasts suggesting even greater growth in EPS than last quarter.

- As I don’t see any clearly expressed red flags, I have decided to update my coverage with a ‘Buy’ rating again.

Jonathan Kitchen

My Thesis Update

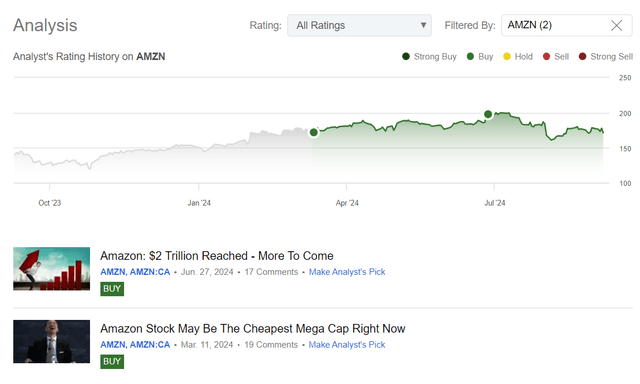

I initiated coverage of Amazon, Inc. (NASDAQ:AMZN) stock in March of this year, and reaffirmed my bullish rating at the end of June. Unfortunately, this coincided almost precisely with the stock’s peak, after which it fell by more than 13% amid broader market weakness.

SA, Oakoff’s coverage of AMZN stock

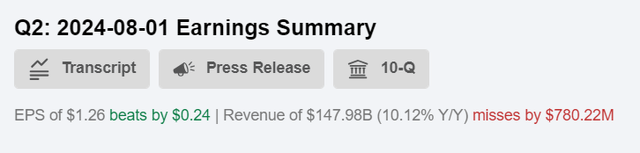

This downward movement accelerated particularly following the company’s Q2 2024 report: On the day of the release, the stock fell by almost 9%, although the bottom line figure actually exceeded the consensus estimates (the revenue missed slightly though).

Seeking Alpha, AMZN

In my opinion, the current dip, although not massive, already presents a rather attractive opportunity to buy a good company at a great discount. I believe that over the next 3-5 years, Amazon, as I previously expected, will surpass its previous market cap peak of $2 trillion and continue to rise above that.

My Reasoning

Amazon reported Q2 revenue of $147.98 billion (+10.1% YoY), which, as I noted above, couldn’t exceed the consensus estimate and missed by ~$780.2 million. The EPS figure of $1.28, on the other hand, beat the Street’s expectations by $0.24 (that’s ~24%), driven primarily by the strength in AWS.

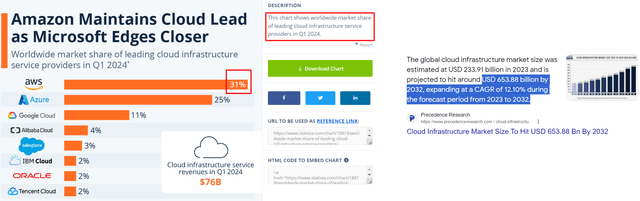

Noteworthy, Amazon’s North America segment operating income amounted to $5.1 billion, the International segment reported a $0.3 billion EBIT and AWS segment operating income was $9.3 billion. Although AWS’s operating margin in Q2 2024 was 210 b.p. lower than in Q1 2024, on a YoY basis we saw an expansion of 11.3% (from 24.2%), which looks significant to me. In my view, AWS’s expanding presence in the cloud infrastructure market and its strategic investments in AI will be the main growth driver for Amazon going forward – as the end market expands and Amazon’s market share there doesn’t get lower, as was the case for the past few years, the monetization opportunity in 3-5 years looks massive to me.

Oakoff’s compilation, different sources

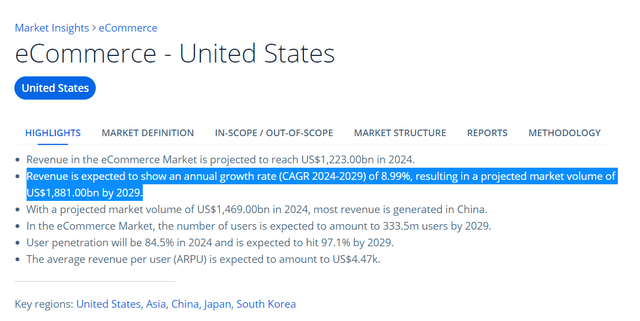

Regarding the non-AWS part of the issue (e-commerce), in Q2 Amazon’s online stores and third-party seller services drove most of the revenue miss. However, I think the most important thing here is how the company protects its wide moat – judging by the marginality in Q2, Amazon is making everything right as the margins have been consistently stronger than anticipated over the past year.

From what I can see today, Amazon’s opportunity in e-commerce going forward is also significant as the shift towards online shopping, known as the “secular drift toward e-commerce,” continues to grow, and Amazon is well-positioned to capture more market share despite its already large size. In case you thought it was an already well-saturated market, I’d want you to think again because according to third-party sources, US e-commerce revenue is projected to grow by a CAGR of ~9% over the next 5 years at least.

Statista

The key to the company’s growth in e-commerce is Amazon Prime, a membership program that offers customers fast shipping, exclusive content, and other benefits. As noted in different research reports, Prime members tend to shop more frequently on Amazon, generating high-margin recurring revenue for the company and creating a powerful cycle where more customers attract more sellers, and more sellers attract more customers, making Amazon’s platform increasingly attractive to both parties. So this approach, assuming no extraordinary or unexpectedly bad events occur, should lead to retention and potentially even an expansion of Amazon’s footing in this market.

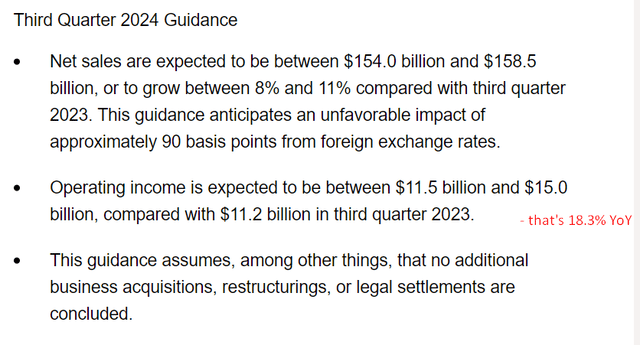

Amazon’s guidance for Q3 2024 was slightly below market expectations, which likely became the main reason for such an ugly price action post-earnings. On the other hand, the firm’s revenue outlook wasn’t significantly off from what analysts had anticipated. The company is still expected to deliver impressive profit growth, with operating profit projected to increase by 3-34% (about 18% in the middle) compared to the same period last year.

Amazon’s press release, Oakoff’s notes added

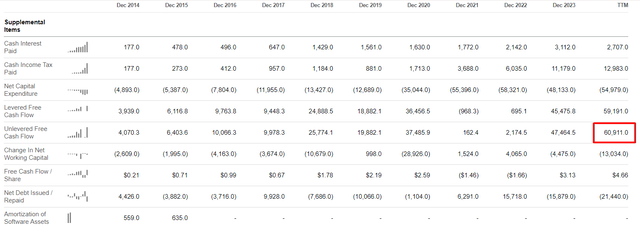

Regarding the balance sheet, I should note that Amazon held $89.1 billion in cash and marketable securities by the end of Q2, with total debt standing at $54.9 billion, resulting in a net cash position of $34.2 billion. At the same time, the company’s cash flow from operations reached an all-time record of $107.9 billion this year on a TTM basis, according to Seeking Alpha, and its free cash flow was almost $61 billion (also on a TTM basis). In my opinion, this underscores the company’s ability not only to rapidly increase its revenue and operating profit growth on paper but also to convert this growth into tangible cash, thereby enhancing both a) shareholders’ return prospects and b) its capacity to invest in and support future development.

Seeking Alpha, Oakoff’s notes

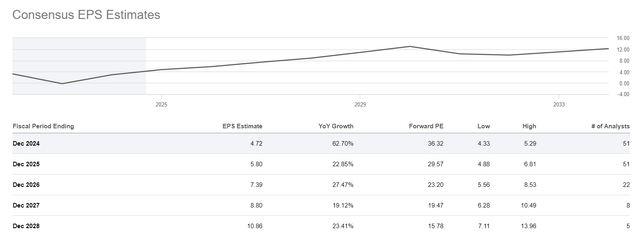

Last time I noted that AMZN was trading at 43x for 2024 earnings, looking quite expensive on an absolute basis, but fully justified when the business growth rates were taken into account. Now we see another picture: the stock is priced at just 36x forward earnings (2024), while its EPS growth rate for 2024 is projected to reach 62.7% YoY – that’s way more compared to the rate I noted last time.

Seeking Alpha, AMZN

Also, Amazon should keep recording significant EPS expansion in 2025 and beyond, according to the consensus figures you may see above. So based on all that, I don’t believe AMZN can be called as overvalued today. As Argus Research’s analysts noted in their recent report (proprietary source, August 2024), their historical COMPs valuation is in the $270s given today’s deviation of Amazon’s forward multiples – that’s way more than today’s stock price.

The two-year forward P/E of 32.7 is below the trailing five-year multiple (2019-2023) of 67.9. The relative P/E of 1.54 on our two-year average EPS forecast is below the historical relative P/E of 3.43. Our historical comparables valuation is in the $270s, in a sharply rising trend and above current levels.

Given Amazon stock’s underperformance over the past few years, the combination of still-solid financials, promising investments in AI, and the stock’s undervaluation, presents an attractive opportunity for investors to either establish a new position or dollar-cost average into the stock of this undisputed category leader, in my opinion. I therefore reaffirm my previous “Buy” rating today.

Risks To Consider

As one of the main concerns, I think investors should always keep in mind that Amazon may encounter intense competition in the coming years as more companies ramp up their online sales efforts and match Amazon’s prices in physical stores. So despite its currently still-leading position in different business areas, thanks to innovations like Prime and the growth of third-party sales, Amazon could face significant challenges.

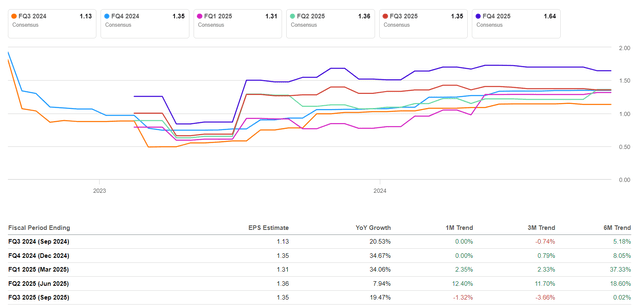

I’d also like to draw your attention to the fact that, no matter how hard I try to justify its valuation, AMZN stock still can’t be described as cheap. Holding a stock that is trading above 30x of forward earnings, investors are taking a big risk if Amazon fails to meet expectations, which have risen sharply in recent quarters. It looks like it’s going to be increasingly difficult to beat EPS and sales figures in the future.

Seeking Alpha, AMZN

Your Takeaway

Despite the existing risks, I believe that the recent drop in Amazon’s stock price, which has been ongoing for a few weeks, offers a great opportunity to buy a great company at a good discount. As my analysis has shown, the stock has gotten much cheaper over the last three months, and consensus forecasts today point to even more significant growth in EPS than was the case last quarter. Yes, the number of analysts who have lowered their forecasts for the third quarter has increased as management’s guidance has been slightly worse than originally expected. Nevertheless, the company’s growth is unlikely to stop even in light of the update. I think that the existing market leadership (aka moat), both in cloud and e-commerce, as well as the ongoing cost optimization should ultimately lead to “valuation justification” so to speak. For this reason, as I do not see any clearly expressed red flags, I have decided to update my coverage with a ‘Buy’ rating again.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.