Summary:

- Nvidia Corporation stock declined by 17% post-Q2 earnings due to Blackwell chip delays, peaking AI chip demand, and broader market recession fears.

- If everything goes according to plan, this could be a buying opportunity and the stock could deliver double-digit returns over the coming years.

- But risks are elevated, and history suggests that investors often overestimate how fast a new technology will translate into increased earnings.

- Following a round of disappointing Q2 big tech earnings calls with increased AI investment, but little to show for it, I remain cautious about buying into the Nvidia hype.

luza studios

Dear readers,

I have been covering Nvidia Corporation (NASDAQ:NVDA) for a while and have been warning against chasing the stock higher. Recently, in June, I published an article called Nvidia: Likely To Lose Its Dominant Position Over Time. In that article, I argued that, despite an indisputable competitive advantage, from a historical perspective it’s extremely unlikely that Nvidia would be able to maintain the high growth and high margin trajectory it has been on. In fact, I showed that since 1985 there has only been one company which has managed to maintain 50%+ EBIT margin for 10 consecutive years. And since NVDA’s expensive valuation required its high growth and margin trajectory to continue, I proceeded to rate the stock a SELL at $123 per share.

Since June, Nvidia stock has fallen by almost 17% while the broader market, characterized by the S&P 500 (SPX), has been roughly flat. The majority of the downside came after the company reported its Q2 2024 results, which, although they beat expectations, resulted in a price drop from $125 to just above $100 per share.

Today, I publish an update for the stock to decipher what happened and guide for a way forward.

What caused the post earnings sell-off?

I suspect that the sell-off may have been caused by a combination of three factors, some short-term and some which will very much affect where the stock goes in the future.

First, Blackwell chips, which are critical to Nvidia’s future performance as they form the basis for the competing MI 300x chips from Advanced Micro Devices (AMD), have experienced significant production delays recently. The delays are a result of the chip redesign and have been expected before the release of Q2 earnings. But the most recent earnings release, and especially management’s commentary which followed, have likely disappointed investors as management was unable to specify the expected length of these delays and the corresponding expected drag on earnings.

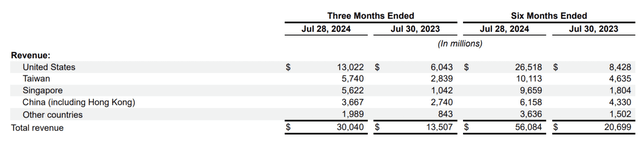

Second, despite record booked quarterly revenue driven by strong buying from hyper-scalers, demand for AI chips in the U.S. seems to have peaked as revenue came in at just $13 Billion, down quarter-over-quarter from $13.5 Billion last quarter. Lower revenue in the U.S. could, of course, be a temporary phenomenon. Management did indeed try to justify it by saying that the location where the product is bought is not necessarily the location where the product ends up with the end-customer. This implied that they don’t see looking at revenue on a per country basis as relevant. But I do find it worrying because the U.S. has by far the most data centers in the world and should therefore be the main driver of AI-related chip sales.

Moreover, I think that investors were slightly disappointed by a relatively small size of the earnings beat, which was the smallest since January 2022.

Third, the last two weeks have been tough for the whole market, as the Nasdaq 100 (NDX) declined by 6% on recession fears. A market wide sell-off was, understandably, felt more by higher beta stocks that were, arguably, already trading at rich valuation.

Where could Nvidia go from here?

The recent dip could very well be a buying opportunity, and that is precisely what I want to examine today.

The AI market is expected to grow with a CAGR of 28%, primarily thanks to machine learning, from under $200 Billion this year to over $800 Billion by the end of the decade.

That’s significant industry growth, but I see one risk factor that could jeopardize this.

Currently, the expectation is that AI will translate into significant productivity and earnings growth. Specifically, McKinsey predicts that AI has the potential to generate incremental global earnings of $2.6 to $4.4 annually, realized predominantly in banking, high-tech, and life sciences, as about half of today’s work activities could get replaced by AI between 2030 and 2060.

But here’s the thing.

While the AI opportunity is huge, it’s unlikely that it will translate into significant earnings overnight.

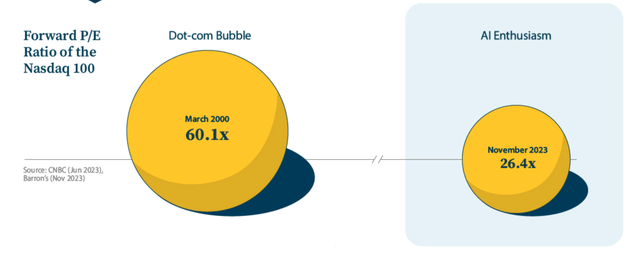

Specifically, I worry that investors may have got ahead of themselves (again), similarly to the early 2000s and the dot-com bubble. Back then, companies were also very heavily investing in new Internet infrastructure and investors drove valuations to very high levels ahead of rapid earnings growth. But as that growth took significantly longer to materialize than expected, and stocks of these companies suffered considerable losses.

Take Amazon (AMZN), for example. It turned out to be a massive winner eventually, but the stock still declined by 95% from over $5 per share in late-1999 to just $0.35 per share in 2001.

Today, Amazon and other big tech firms are spending billions of dollars on AI, without much to show for it. This has led to a series of disappointing earnings calls, with Wall Street questioning whether AI will live up to its hype after all.

It is true that valuations were much higher during the dot-com bubble, and many of the companies, including Amazon at the time, were much less established than Nvidia today.

Still, I do worry that optimism is currently running too high and that it will take significantly longer than expected to see any sort of AI-related earnings growth. This may result in significant downside once investors lose their patience.

The question then becomes, whether we’re getting compensated enough for this potential downside.

Nvidia has around a 90% share of the AI-chip market, which means that it is unlikely to capture further share of the market and is therefore unlikely to grow by more than the market itself. At the same time, it’s likely that competition — mainly AMD and Intel (INTC) — will eventually start to catch up and capture more market share. Therefore, I expect that revenue growth will likely be capped at around 20% annually going forward.

Now, 20% is still pretty high, especially if Nvidia can maintain its industry-leading margin which currently stands at an impressive 76% (much above AMD’s 47% and Intel’s 41%).

Even from a currently somewhat stretched forward P/E of 36x, the company can deliver solid double-digit returns over the next 5 years or so if the growth forecast materializes and if we assume an exit multiple of 25x.

Bottom line

To sum up, the market’s overreaction to Q2 earnings and delay of Blackwell chips may have created a buying opportunity. This is especially true if Nvidia manages to deliver on the revenue growth forecast and maintains its incredibly high margin. Then, it will likely turn out to be a good investment over time.

This will, however, depend entirely on whether (and when) the recent AI investments, which have fuelled Nvidia’s earnings, will translate into actual corporate profit growth. Only the future will tell. However, knowing (1) what happened in the early 2000s, and (2) following a round of fairly disappointing big tech earnings calls, which are upping their AI spend without clear ways to monetize the technology, I’m worried that the downside may be significant.

For this reason, I rate Nvidia Corporation stock a SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.