Summary:

- Tesla, Inc.’s share price grew by 24% post-recommendation, outperforming the S&P 500, driven by expected Fed monetary easing and strong fundamentals.

- Tesla’s management excelled in cost control and capital allocation, maintaining high operating margins and a strong financial position despite revenue headwinds.

- The Dojo supercomputer and enhanced full self-driving capabilities will unlock new revenue streams, reducing dependence on monetary cycles and opening the Robotaxi market.

- Valuation analysis suggests a 40% upside potential with a target price above $300, supported by strong near-term catalysts.

Beatriz Montes Duran /iStock Editorial via Getty Images

Introduction

I am pleased to share that Tesla, Inc.’s (NASDAQ:TSLA) share price grew by around 24% after I recommended it as a “Strong buy” in early June. The stock has been outperforming the S&P 500 (SP500) since then. TSLA’s momentum has improved significantly over the last six months as well.

The expected monetary easing from the Fed is a strong positive catalyst, and my discounted cash flow model suggests that the stock is still very attractively valued. Tesla’s fundamentals continue to improve, and it is highly likely that the most severe challenges are behind. A potential recession in the U.S. is still not off the table, but I remain bullish from the secular perspective. I believe that adding more TSLA shares to my portfolio at the current share price is a sound decision. Therefore, I reiterate TSLA’s “Strong buy” rating.

Fundamental analysis

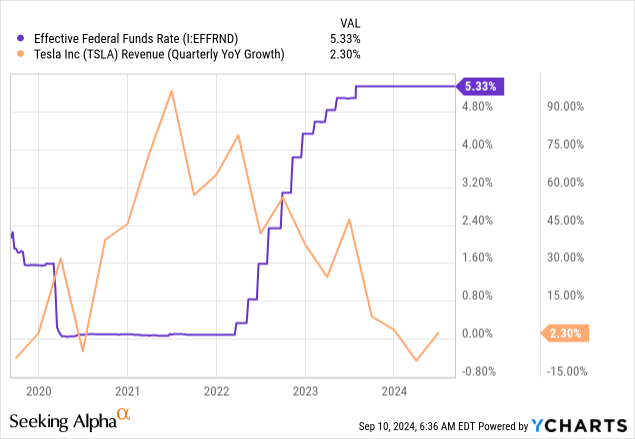

According to Statista, almost 80% of new cars sold in the U.S. are financed with loans or leasing. As a result, the Fed’s tight monetary policy of the last few years was a big headwind for Tesla. Therefore, the information that the Fed is highly likely ready to start cutting interest rates is a big positive catalyst for Tesla. According to the below chart, there is a strong inverse relationship between Tesla’s revenue growth and the federal funds rate.

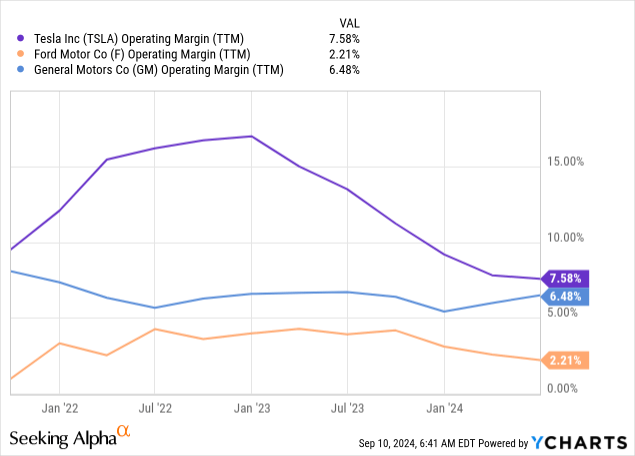

While positive developments around interest rates are a strong catalyst for the company’s future revenues, it is also crucial to acknowledge that the management did well in navigating the challenging environment of the last two years. Despite massive revenue headwinds, I think that cost control at Tesla was top-level, as the company’s operating margin remained higher compared to giants like Ford (F) and General Motors (GM). Moreover, it is important to emphasize that Tesla still invested around a billion per quarter in R&D.

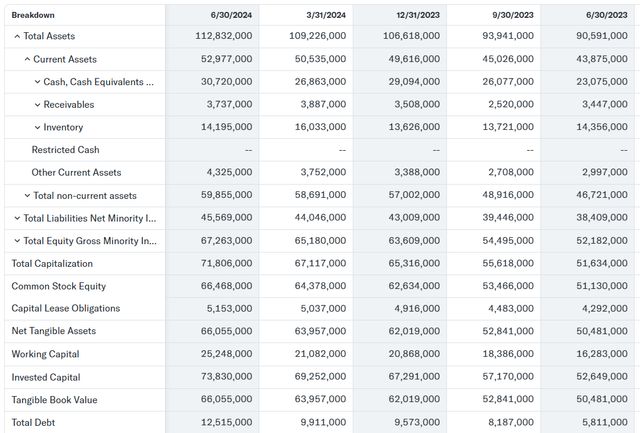

The management’s flexibility to manage costs while there was a deep plunge in revenue growth speaks volumes about its quality level. The management’s capital allocation approach was also well-balanced as the company’s financial position remained strong even despite all the macro headwinds. TSLA ended Q2 with $31 billion in cash and quite low total debt.

I think that Tesla has successfully navigated a very challenging monetary environment and enters the new monetary easing cycle with strong financial basis and valuable lessons learned log.

Despite the temporary pullback in revenue growth and profitability, Tesla continued investing heavily in differentiating itself from the technology perspective. There was some news that Elon Musk was ordering thousands of Nvidia (NVDA) accelerators to build a Dojo supercomputer. The company’s CEO recently revealed that the Dojo 2 supercomputer should be in volume production by the end of 2025.

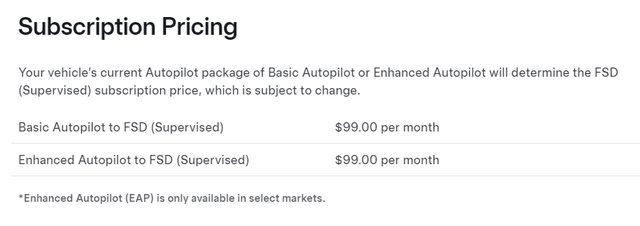

This information is extremely positive for Tesla’s investors, as Dojo is designed to train Tesla’s Full Self-Driving (“FSD”) functionality. The company plans to launch FSD in China and Europe in 2025, which will unlock the new SaaS-based revenue stream for the company. Adding a subscription-based revenue stream to the company’s mix will be a strong positive fundamental factor that will help to decrease the business’s dependence on cycles in monetary policy.

Enhanced FSD capabilities also will help Tesla to move closer to unlocking a new vast market opportunity, which is Robotaxi. According to imarc, the global taxi market is expected to worth almost $360 billion by 2032. Therefore, Tesla’s upcoming Robotaxi event is another potential robust positive catalyst for the stock.

Valuation analysis

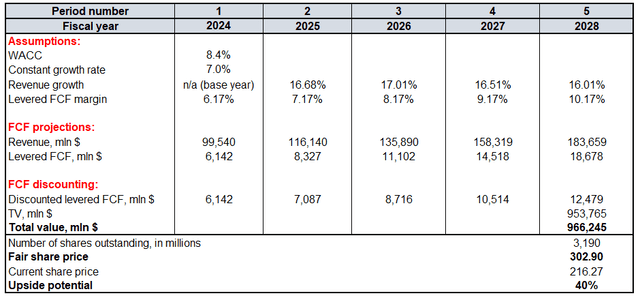

The discounted cash flow (“DCF”) approach is the one that I used in my previous analysis, and that aged well. Therefore, I am not switching to another valuation approach for Tesla. This time I use a lower WACC since the Fed is expected to start easing monetary policy soon. For the updated DCF model, I incorporated an 8.4% discount rate.

FY 2024–2026 revenues are projected by more than 30 Wall Street analysts, which I consider a strong and diverse sample. For the years after 2026, I incorporate a slight 50 basis points per year revenue growth deceleration.

The base year FCF margin is Tesla’s last five years’ average, which is 6.17%. Considering all the positive near-term catalysts together with Tesla’s strong profitability record, I incorporate a 100 basis points yearly expansion for the FCF margin. According to Seeking Alpha, there are currently around 3.2 billion outstanding TSLA shares.

Estimating constant growth rate to calculate a company’s terminal value (“TV”) is always challenging. This is an extremely controversial topic, as plenty of experts and readers claim that it is not fair to incorporate a constant growth rate that is above GDP growth averages.

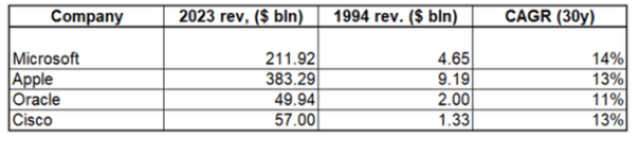

This is sound, but such an approach looks too simplistic, in my opinion. Incorporating a 2-3% for all companies and ignoring qualitative factors is unfair. Tesla is an apparent disruptor that dominates in the thriving EV industry, and the company’s engineers are working hard to roll out new disruptive technologies.

There were several disruptors in the history of the U.S., and these companies were able to deliver far above 2-3% revenue CAGR over the last three decades. Not only superstars like Microsoft and Apple were able to deliver double-digit revenue CAGR over the last thirty years, but also smaller players like Oracle (ORCL) and Cisco (CSCO) were able to do it. Therefore, I think that incorporating a 7% constant growth rate for a company like Tesla is conservative enough.

The company’s total fair value is close to $1 trillion. This indicates a 40% upside potential and means that my target price for TSLA is slightly above $300.

Mitigating factors

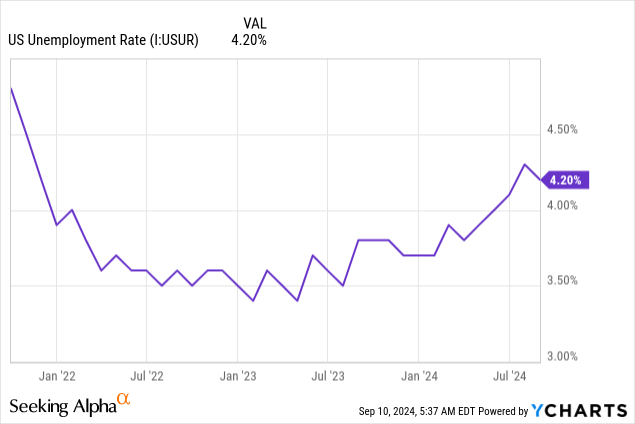

While I have a positive broader outlook due to the expected interest rates cuts from the Fed, it is crucial to acknowledge that a potential recession in the U.S. is still not off the table. The unemployment rate has climbed steadily since 2023 lows. The metric remains within the Fed’s initial 4.4% targeted level, but if it breaks above this level, it might trigger the stock market panic.

Competition risks are extremely high in the EV industry. Even Elon Musk acknowledged that Chinese EV markers are the real threat. To understand competition risks more, I want to describe the competitive landscape a bit.

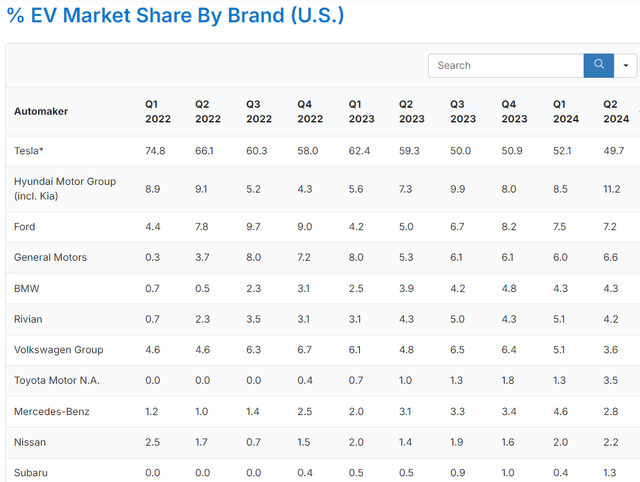

Tesla dominates the domestic market, with around a 50% market share in the USA. Tesla’s market share in the U.S. is naturally decreasing. The explanation is simple: it was the pioneer of the industry and as the EV market expands, more players are competing. Still, I think that such a massive market share is a strong basis to remain the dominating force in the U.S. None of the other players are close to Tesla’s market share. Moreover, Joe Biden introduced a 100% tariff on Chinese-made EVs earlier this year, which will be a good protection for Tesla’s domestic market share.

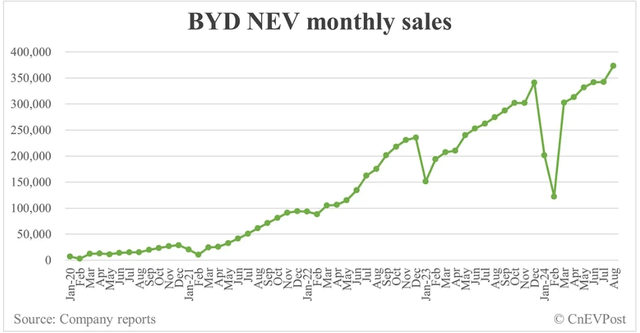

The competition is much more intense internationally. There are several Chinese players who are ramping production at an impressive pace. BYD’s (OTCPK:BYDDF) EV monthly sales chart since 2020 looks very impressive, and this company is Tesla’s closest rivals in terms of delivery volumes. There are other Chinese companies that are much smaller than BYD but have also demonstrated exponential delivery growth over the last few years. Examples include Li Auto (LI) and NIO (NIO). Therefore, competition in China is intense, but Tesla can differentiate with its unique software.

Competition in Europe is also intense as there are several German legacy automotive giants like Volkswagen (OTCPK:VWAGY), Mercedes-Benz (OTCPK:MBGAF), and BMW (OTCPK:BMWYY). All these well-known companies with vibrant histories are also betting big on ramping EV production, as vehicles with internal combustion engines (‘ICE’) will be banned in the EU starting from 2035. Good information for Tesla’s prospects in Europe is that the EU has recently raised tariffs on Chinese EVs as well. To conclude, I think that competition risks are low for Tesla in the U.S., moderate in Europe, and high in China.

Conclusion

I believe that several positive fundamental factors suggest that Tesla is still a compelling investment opportunity for long-term portfolios. Moreover, the stock’s current valuation is still attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.