Summary:

- Broadcom is a semiconductor bellwether with growing AI exposure.

- AVGO’s AI revenue outlook disappointed the market as investors likely wanted more.

- I assess that there isn’t a structural slowdown in the AI upcycle, suggesting near-term weakness is likely overstated.

- Broadcom is well-positioned to ride the AI growth inflection and the non-AI revenue recovery as the cycle likely bottomed.

- I explain why investors should consider catching the falling knife as weak holders flee.

JHVEPhoto

Broadcom’s Leading Position In AI

Broadcom Inc. (NASDAQ:AVGO) is one of the most important semiconductor companies beyond the semi value chain. Its exposure to the leading hyperscalers and cloud data center customers underscores its vital position in the AI upcycle. In addition, it has substantial non-AI revenue that’s inherently more cyclical, affected by broad macroeconomic cycles. The recent integration with VMware has also enhanced its enterprise software and cybersecurity capabilities, bolstering its infrastructure software revenue segment.

Therefore, there’s little doubt that Broadcom is widely considered a semiconductor bellwether. Understanding AVGO’s primary growth drivers is crucial to assessing whether the AI-led semiconductor upcycle can continue its stellar performance. In my previous bullish article in July 2024, I highlighted that I was too cautious about the company’s leading position in the AI growth inflection thesis. As a result, I’ve understated its custom AI chips opportunity while overstating its cyclical non-AI revenue prospects.

While AVGO has underperformed the S&P 500 (SP500) since my previous article, its bullish proposition has been assessed to remain intact. Therefore, the recent weakness in the stock has opened up another solid opportunity for investors to add more exposure.

In the third fiscal quarter earnings release last week, the market was palpably disappointed with its relatively tepid guidance. As a result, it sent AVGO into a tailspin, as investors likely took profit to protect their gains. Notwithstanding the near-term caution, I’ve not assessed a structural decline in the AI infrastructure thesis. Accordingly, the AI arms race involving big tech and the leading hyperscalers is expected to intensify, bolstering growth prospects for semiconductor leaders like Broadcom.

Should You Worry About Broadcom’s Tepid Guidance?

As a reminder, management indicated Broadcom attained AI revenue of $3.1B in FQ3 and guided to AI revenue of $3.5B for FQ4. However, the full-year AI revenue outlook of $12B (up from $11B previously) disappointed the market, potentially raising risks of a growth normalization phase from the next fiscal year.

Given Broadcom’s less enthusiastic guidance upgrade, the market is justified in reassessing its optimism on the AI growth momentum. It also follows Nvidia’s (NVDA) recent earnings, suggesting a lack of significant follow-through on their guidance upgrades from the leading semi-companies.

Despite that, the AI investment theme is alive and well. There’s a need to continue upgrading the AI infrastructure to ensure that leading tech companies stay ahead of the curve. However, I concur that software companies must demonstrate that they can monetize Generative AI effectively, lending credence to the AI investment thesis. Microsoft (MSFT) has reportedly faced challenges in improving the adoption of its AI co-pilot, potentially dampening investor optimism about its software peers. Hence, I assess that the market will likely remain cautious over a more aggressive valuation re-rating on AVGO until they garner more visibility from the leading software companies.

Notwithstanding the caution over AI growth opportunities, management anticipates an inflection on its non-AI revenue. Therefore, investors should continue to assess whether its non-AI bookings could translate to more revenue visibility over the next few quarters. Broadcom highlighted that non-AI bookings increased by 20% YoY. Therefore, it corroborates management’s confidence that its cyclical revenue segments have “passed the bottom.” That should afford investors more confidence as the company navigates the market’s caution on its AI revenue streams in networking and compute. I assess that the competitive advantages in Broadcom’s networking solutions should continue to underpin its ability to provide an integrated portfolio encompassing critical solutions across the AI value chain.

Is AVGO Stock A Buy, Sell, Or Hold?

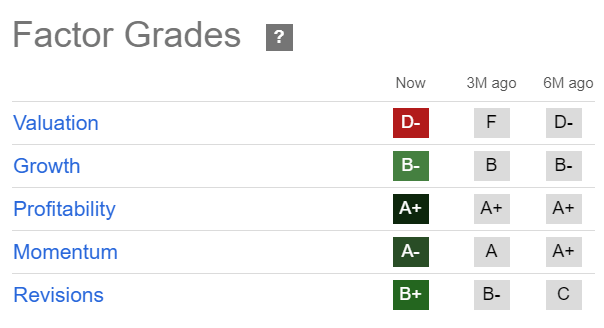

AVGO Quant Grades (Seeking Alpha)

AVGO is still priced for growth (“D-” valuation grade), even though it hasn’t improved markedly from the optimism observed three months ago (“F” valuation grade). However, its best-in-class profitability (“A+” profitability grade) underpins its robust buying momentum, suggesting a buy-the-dip opportunity remains intact.

AVGO’s forward adjusted PEG ratio of 1.46 is nearly 20% below its sector median, underscoring a relative undervaluation thesis. Wall Street estimates have also been lifted, potentially bolstering the buying sentiment on the stock.

Risks To AVGO Thesis

Investors are palpably concerned about whether the AI upcycle could be nearing its peak, potentially leading to a growth normalization phase for Broadcom. Investors must scrutinize the investment and monetization drivers closely, as they could determine the revenue trajectory of AVGO and its leading peers.

In addition, the stock is still priced for growth. While the company is confident its non-AI revenue segments have seen their worst, the recovery remains uncertain. If macroeconomic headwinds intensify, they could lengthen the recovery of the company’s more cyclical solutions, potentially impacting their earnings recovery.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!