Summary:

- Broadcom’s growth is slowing, and its stock dropped over 25% due to reliance on acquisitions and risks from major customers like Apple.

- The company’s acquisition-driven strategy faces challenges as fewer large acquisitions are feasible, potentially limiting future growth.

- Despite strong revenue growth from VMWare, Broadcom’s lofty valuation and limited FCF yield suggest it may struggle to generate future returns.

- The risk of major customers cutting ties to save costs could significantly impact Broadcom’s ability to maintain its growth trajectory.

G0d4ather

Broadcom (NASDAQ:AVGO) dropped double-digits on Friday, and is now more than 25% below its all-time highs. The company announced earnings, which showed strong YoY growth, primarily driven by the acquisition of VMWare. As we’ll see throughout this article, the company’s growth is slowing down, which will result in its share price declining.

Broadcom Formation

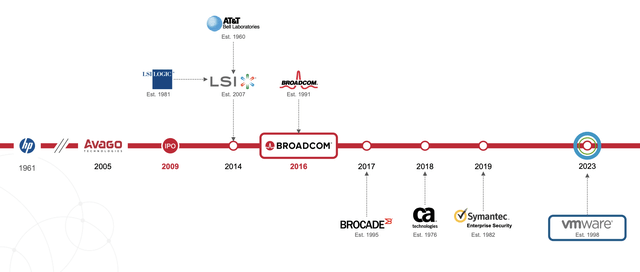

Broadcom is a merger of many different major companies, as the company and its CEO Hock Tan have made numerous acquisitions.

Broadcom Investor Presentation

The company has almost $36 billion in net revenue and has major R&D spending at $5.3 billion annually. It has numerous divisions that operate in vastly different segments, and that has expanded as the company’s acquisitions have led to 26 different divisions with ~21k patents. Still, it’s worth noting the company has an acquisition-based portfolio.

The company doesn’t appear anywhere near the companies which had the most patents assigned to them in 2023.

Broadcom Investor Presentation

The company has been built up through numerous acquisitions. In the midst of all of this was a failed attempted acquisition of Qualcomm, blocked by the U.S. government on security concerns. The company moved its headquarters from Singapore to the U.S. after this. The latest is the almost $70 billion acquisition of VMWare. This integrated company with more than $100 billion in acquisitions is now worth >$600 billion.

The takeaway here is one of our fundamental concerns with the company. The company is growing larger, and it’s more difficult to find acquisitions that can move the needle without facing regulatory concerns. A central part of the company’s growth has been acquiring and integrating existing businesses and driving efficiency in those businesses.

Slowing down or turning off that lever will hurt the ability for future returns.

Broadcom Segment Overview

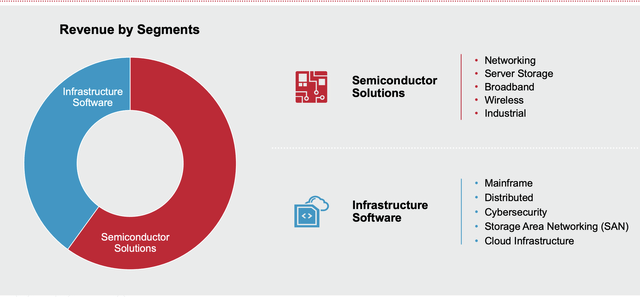

The company has several segments, with its two core offerings – infrastructure software and semiconductor solutions.

Broadcom Investor Presentation

These two segments are split across numerous subsegments, some of which are Broadcom’s core businesses, and many others which are newly acquired businesses. VMware is now the largest business in infrastructure software, with Symantec and CA Technologies making up the vast majority of the rest of the company.

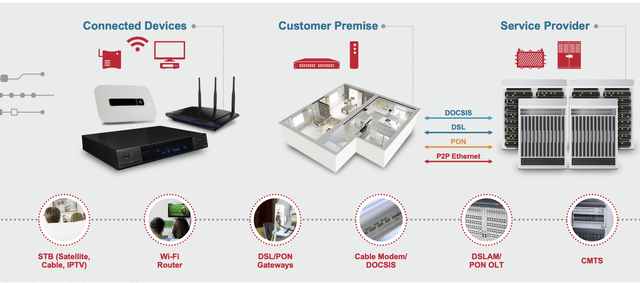

Broadcom Investor Presentation

An example here is the company’s Broadband business. The company offers solutions at nearly every level and in many areas is a leader here. It works primarily business to business. For example, in the company’s wireless segment, it signed a multi-billion dollar deal with Apple (AAPL), showing its ability to outperform what other tech companies can do.

However, having such large customers is also a risk. Apple makes up 20% of Broadcom’s revenue, and the rumor is that Apple plans to replace Broadcom with its own Wi-Fi / Bluetooth chips in the next few years to capture the cost savings. That is a major risk for Broadcom and its ability to continue performing, given that once the business is lost, it has no marketing or direct to customer businesses that can easily make it up.

Broadcom Financial Performance

Broadcom has managed to grow its revenue in recent quarters, but it’s been mostly lifted by the acquisition of VMWare.

Broadcom Investor Presentation

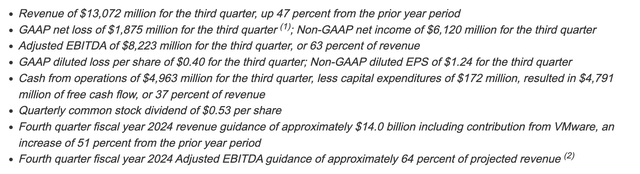

The company’s revenue grew 4% YoY not counting the impact of VMware, although true revenue growth was 47% to $13 billion. This means a more normal rate for revenue growth is in the mid-single-digits not counting acquisitions, slightly above inflation but not by much. For a company with a FCF yield of ~3%, that’s slow growth.

The company continues to grow its dividend rapidly, but with rapid share price growth, that dividend is still ~1.5%. That’s a dividend that’s below the S&P 500.

Valuation

To us, one of Hock Tan’s comments indicates how the company is potentially hyped up and overvalued as part of the artificial intelligence hype. Hock Tan states, “The integration of VMware is driving adjusted EBITDA margin to 64%”. So here’s a $70 billion acquisition that’s increasing both margins and revenue by 50%, but the underlying company is worth almost $640 billion.

That indicates how much the company could be worth off of its earnings and margins alone. Nailing down Broadcom’s competitors is difficult because of how varied its business is today, VMware has massively different competitors from its Wi-Fi chip business. Qualcomm (QCOM), which has a similar business with cellular chips, has a P/E of ~20 or <70% of it.

Another metric is the S&P 500 which has a P/E similar to Broadcom but with an 11% forecast EPS growth in 2024. Removing the impact of VMware on the company’s results, Broadcom is well below that, indicating that it’s undervalued versus a simple and much lower risk S&P 500 ETF investment. That shows how Broadcom is overvalued.

Thesis Risk

The largest risk to our thesis is that Broadcom is a core company to its customers the same way that TSMC is. It might not be a household name in terms of selling to customers, but it’s a core business that has an efficient business with long-term potential. That could affect its ability to drive long-term shareholder returns.

Conclusion

Broadcom has achieved massive growth through acquisitions, the artificial intelligence revolution, and the company’s strong ability to provide its customers with cutting-edge designed chips. However, the company now trades at a lofty valuation and growth is slowing down substantially, with new acquisitions becoming much harder to find.

The company, at the same time, has the risk that its largest customers are looking to cut it out to save money. Given the company’s focus on acquisitions, and the lack of deals there, that could hurt its ability to continue growing. That was clear with the company’s recent earnings, and we expect it to struggle to generate future returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.