Summary:

- Canoo’s poor balance sheet, heavy losses, and unsustainable cash burn have materially clouded its future outlook.

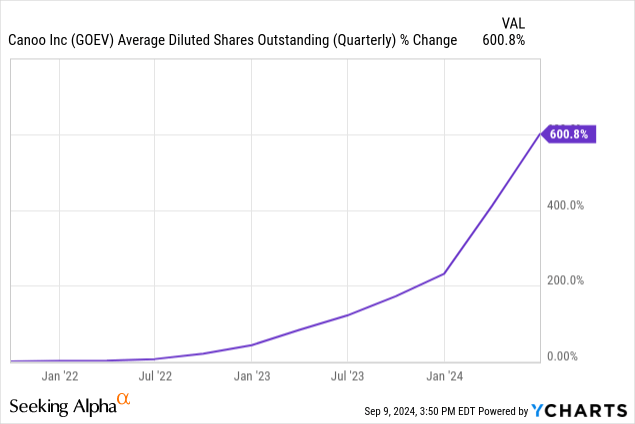

- The company is heavily dependent on dilution to plug a liquidity gap that remains wide.

- Bears face some risk if consecutive rate cuts spark a revival of positive investor sentiment.

Emanuel M Schwermer/DigitalVision via Getty Images

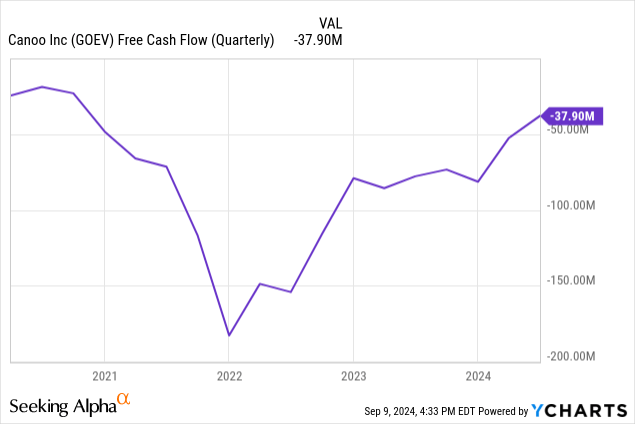

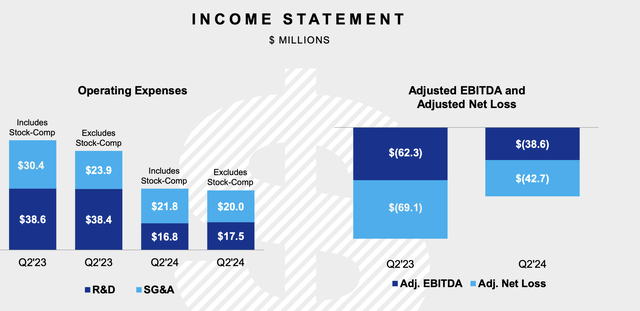

Canoo Inc. (NASDAQ:GOEV) has staged a rally hot off the heels of its reverse stock split, which I flagged in my last article on the company as a reason to sell the EV upstart. The short case for GOEV has always coalesced around the company’s poor balance sheet, heavy losses, and unsustainable cash burn. The figures from fiscal 2024 second quarter earnings are not great, with revenue of $610,000 and an adjusted EBITDA loss of $38.6 million. This loss was a year-over-year improvement of 38%, with GOEV’s comprehensive net loss during the second quarter at $6 million. The company expects its adjusted EBITDA loss for the second half of 2024 to be between $120 million to $140 million.

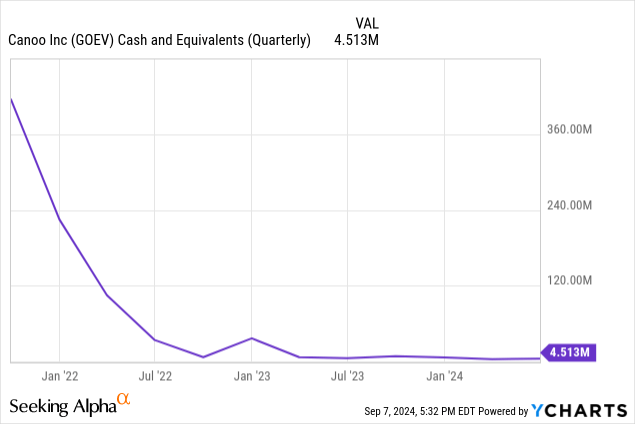

GOEV ended the second quarter with cash and cash equivalents of $4.5 million, down $500,000 from its year-ago comp. The company had another $5.4 million in short-term deposits against convertible debt of around $47.2 million. There is another $32.3 million in short and long-term financing liabilities. Critically, GOEV’s current liabilities of $195 million were far ahead of current assets of $33.4 million. Both capture amounts come due within 12 months, and mean that the company faces a glaring liquidity gap that has so far expressed itself as an aggressive dilution of its common shareholders.

Liquidity, Dilution, And Operations

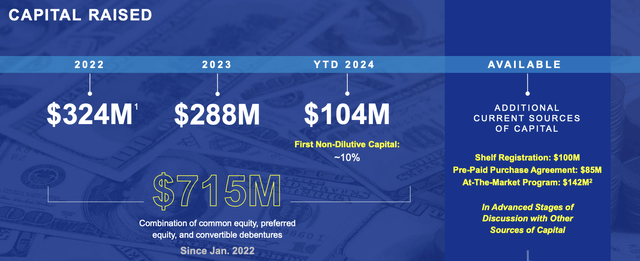

GOEV’s weighted average diluted shares outstanding was 69.6 million, up 600.8% over the last three years and a remarkable 217% over GOEV’s year-ago comp. The pace of this dilution is not sustainable, with GOEV in June filing to sell 5.6 million shares even as its commons have dropped 99% over the last 3 years. With the commons now trading hands for $1.31 per share, the market cap at $91.17 million will progressively be less able to raise the required amounts to meet a liquidity gap that has recovered from its worst levels but still sits well within a point of being extremely unsustainable.

In terms of operations, the company is following Tesla and is moving its corporate headquarters to Texas. GOEV will relocate 137 engineering positions to the Lone Star State and Oklahoma starting in the fourth quarter of 2024. Oklahoma houses the company’s manufacturing capacity, with the move being a positive, if it drives cost savings. GOEV’s core headwind is posed by its excessive losses compared to the money generated by its operations, everything the company does has to be through this lens, as the list of now-defunct EV companies continues to ramp up. From Fisker, Arrival, Proterra, and Electric Last Mile, the market for EVs has become brutally Darwinistic after the end of ZIRP-rendered liquidity scarce and expensive. GOEV has a poorer balance sheet than several companies on this list before their filings, including Proterra, which filed for Chapter 11 with $130 million of cash on its balance sheet.

Risks And How The Bulls Could Still Pull A Win

Canoo Fiscal 2024 Second Quarter Earnings Presentation

Bears face risks here. Firstly, the company has made some progress in reducing its costs, with operating expenses of $38.6 million, including stock compensation, down from its year-ago comp of $69 million. GOEV’s continued move to reduce its operating footprint could also help reduce costs further. This is as the Fed funds rate is set for its first dip since 2020, when the FOMC meets on the 18th of September. While the 25 basis points movement has to some extent been priced in by the market, consecutive rate cuts could spark tepid euphoria for investor sentiment in heavily sold-off stocks. A recovery of sentiment and a rise of subsequent liquidity into the commons represents the core risk for the short base, it would also provide a platform for GOEV to issue more shares to bolster liquidity.

Canoo Fiscal 2024 Second Quarter Earnings Presentation

Ultimately, it’s hard to see the value here outside of the pie-in-the-sky speculation. GOEV’s balance sheet faces severe funding constraints, with the primary dilution strategy unsustainable, as the commons now sits on the edge of slipping below NASDAQ’s $1 minimum listing requirement once again. This is because revenue remains anemic, and the company faces an intensely competitive market for EVs, where hybrid cars have become more popular with US consumers. GOEV went public in a ZIRP world, and only a return to this would provide the backdrop for the company to recover more broadly, a scenario also faced by Faraday Future (FFIE), which I covered.

GOEV had to engineer a 1-for-23 reverse stock split in March, and now faces the specter of once again running foul of this requirement on the back of the sheer volume of dilution and stock price decline. GOEV has an at-the-market program to sell at least $142 million of new shares, and a shelf registration for the sale of $100 million shares. This continued dilution means the commons are a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.