Summary:

- Palantir Technologies Inc.’s recent 14% rally is due to its inclusion in the S&P 500 and significant partnerships, proving AI profitability.

- Despite strong performance and growth, Palantir’s valuation appears overstretched, leading me to downgrade from Strong Buy to Buy.

- Technical indicators suggest Palantir may be nearing a local top, with potential for a pull-back after approaching $40.

davit85/iStock via Getty Images

Thesis Summary

Palantir Technologies Inc. (NYSE:PLTR) rallied over 14% on Monday after it was added to the S&P 500 Index (SP500).

The stock is up over 30% in the last month, in stark contrast to many other SaaS and AI companies.

Palantir has taken it upon itself to prove to investors that AI can be profitable, and therefore so can Palantir.

The recent rally in Palantir is well justified, but is the stock getting ahead of itself? Based on fundamentals and technicals, we are overstretched.

I’m therefore downgrading from Strong Buy To Buy.

Why Did Palantir Rally On Monday?

In my last article on Palantir, I discussed the idea that following Q2 results, Palantir was showcasing how its technology was a game changer for corporations around the world. The recent string of deals it has secured since supports this, and it has certainly contributed to part of the rally over the last month.

However, the rally on Monday could be more specifically attributed to the inclusion of the stock in the S&P 500, which triggered the “S&P Effect,” something I actually discussed a few months back.

This now makes the stock eligible for S&P inclusion, which could happen this year, and would likely lead to a nice rally, based on the “S&P Effect”, which typically sees shares that are included in the index rise around 5%.

Recent examples of this include Airbnb (ABNB) and Uber Technologies (UBER), which gained 7.2% and 6.2%, respectively, on the day they were added.

This can happen because funds that track the index are now forced to get some exposure to the new stock that has been added, creating a sudden surge in demand.

Source: Palantir Q4; This Rally Is Just Getting Started.

Interestingly, plenty of people have pointed out more recent examples of stocks that were added to indices which have lost significant value. These include Super Micro Computer (SMCI) which has been the target of a short report and has fallen around 50%& since being added to the index.

So, while it is true that the S&P Effect can trigger some automatic buying and even create a self-fulfilling expectation rally, it is not enough of a justification as to why Palantir is back near its all-time high.

Palantir: Proving A Point

Since my last report on Palantir, the company has scored some meaningful deals with large names, which have also contributed to the latest rally.

Back in August, Palantir and Microsoft (MSFT) partnered up to bring AI to national security operations.

With this marquee deal solidified and MSFT leveraging PLTR for AI and LLM capabilities to the US government, the company can now increase the pace of AI implementation while PLTR continues to accelerate AIP adoption within the federal sector,

Source: Dan Ives, Wedbush.

Microsoft has given its seal of approval to AIP, which is taking the market by storm, and showcasing that AI can indeed be a profitable endeavor.

More recently, Palantir also renewed and extended its partnership with BP (BP).

Palantir’s AIP software will assist bp to safely and reliably harness large language models (LLMs) to improve and accelerate human decision-making with suggested courses of action based on automated analysis of the underlying data.

Source: Palantir Press Release.

With this and the evidence from its Q2 earnings, Palantir is proving two significant points to markets.

First off, that Palantir can be profitable. This is, in fact, a requisite for joining the S&P 500, and something that many investors were skeptical about a year ago.

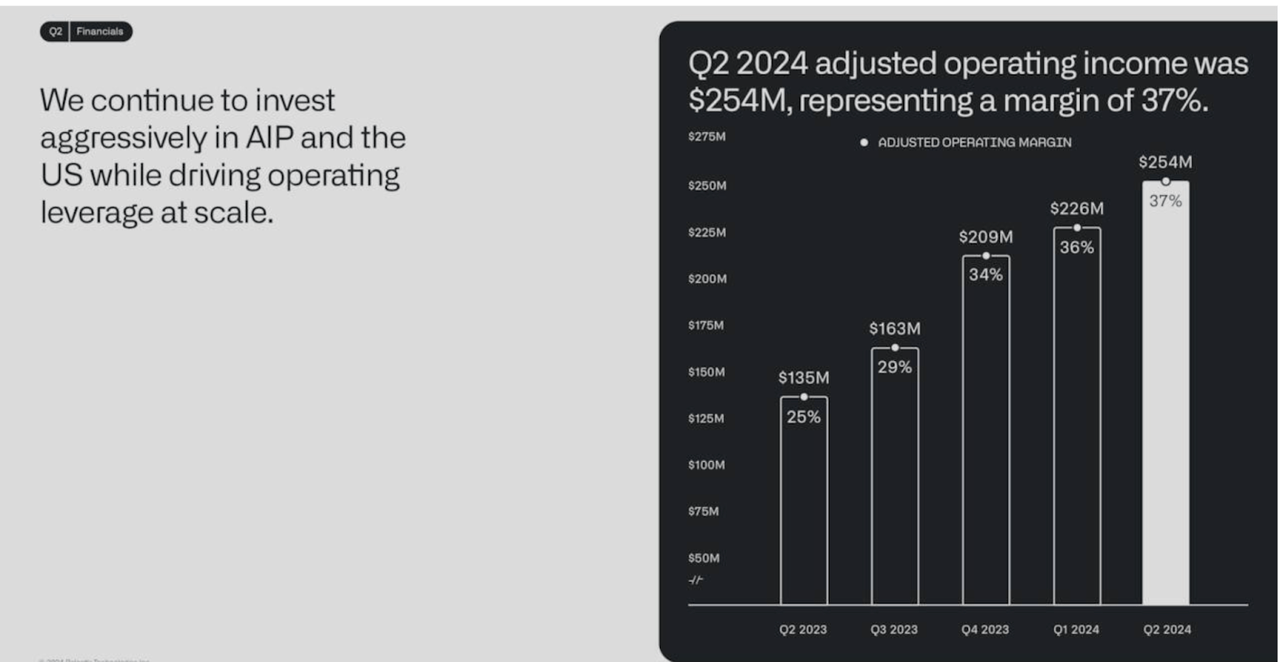

Palantir Operating Income (Q2 Results)

Operating income has increased every quarter for the last year, and in this time-frame the company has also posted positive earnings.

But more importantly, Palantir is proving that investments in AI can actually be profitable. This was actually highlighted by Alex Karp back in Q1.

And as far as I can tell, we’re really the only company to figure it out how to help our customers get beyond chat, leveraging the investments that we’ve made in ontology, really harnessing this pattern of implementation where you’re taking unstructured inputs and turning them into structured actions and outputs that drive economic value in the enterprise.

Source: Earnings Call.

This has been the big challenge of AI. Sure, ChatGPT and other LLMs can be useful chat assistants, but how can companies take this to the next level?

This is precisely what AIP is doing, and the proof is in the pudding. Palantir grew its SU customer base by 83% YoY in the last quarter and with every new partnership, the case for using AIP just strengthens.

Is Palantir Overextended?

With that said, the market may be getting ahead of itself. The stock is trading close to $35 after doubling over the last year.

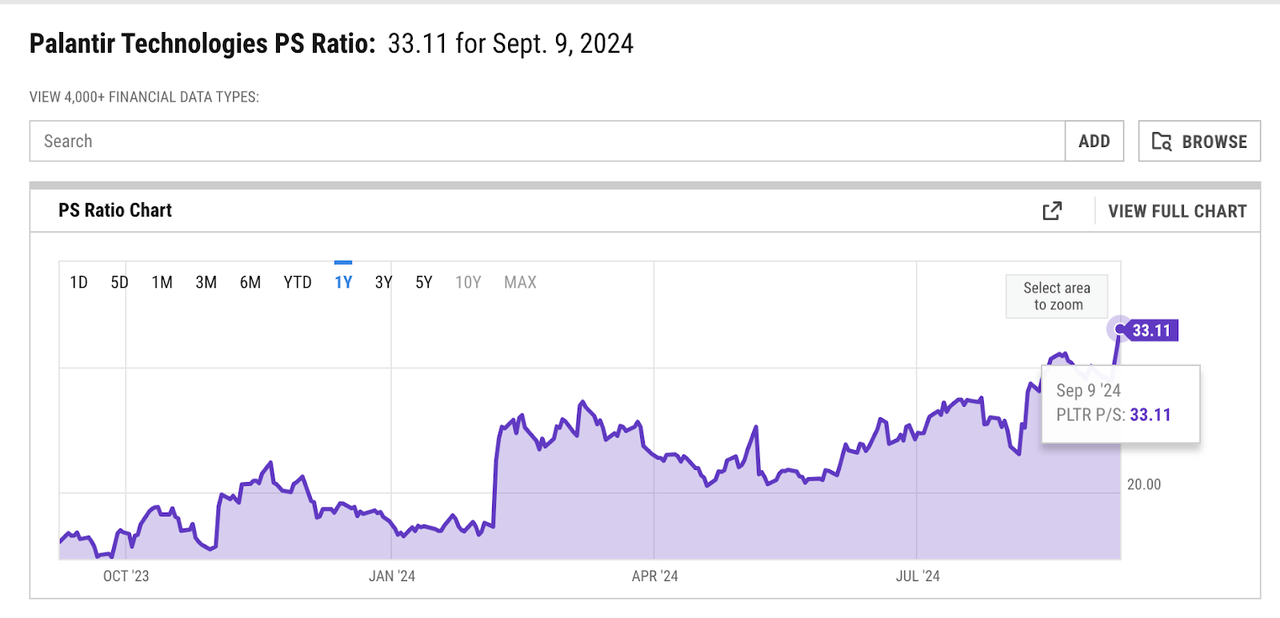

From a fundamental perspective, it’s difficult to deny the valuation is frothy. Palantir is still in its early days of profitability, so perhaps one of the best metrics to look at here is PS.

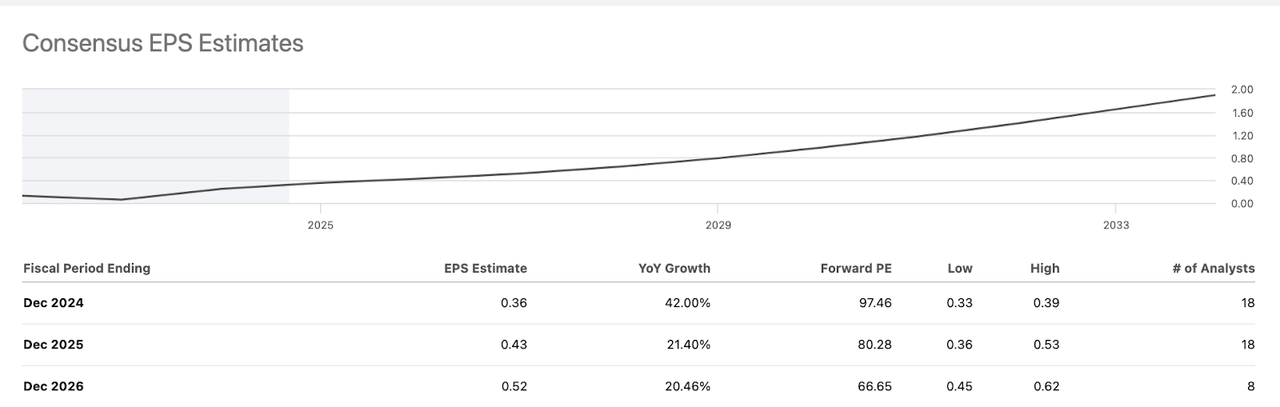

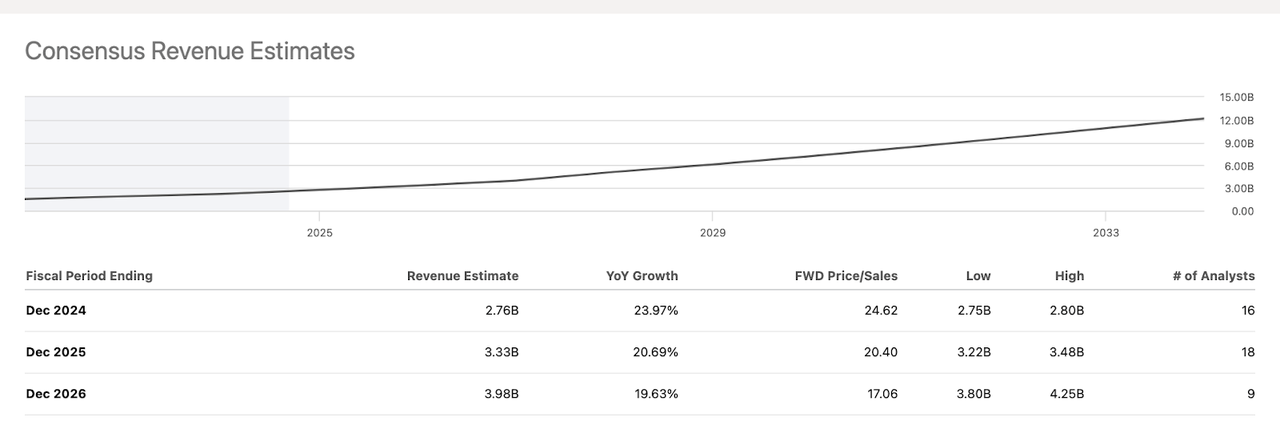

According to YCharts, Palantir’s PS is now over 30, which is rich, especially given the current consensus for earnings and revenues.

EPS Estimates (SA) Revenue Estimates (SA)

While these are expected to grow at healthy rates, it’s not triple-digit growth as we saw with Nvidia (NVDA).

Nonetheless, I do expect these forecasts to be revised upwards, and perhaps in due time, Palantir will be able to post triple-digit growth. That’s still a big if, but it is this possibility that keeps me bullish, even at these prices.

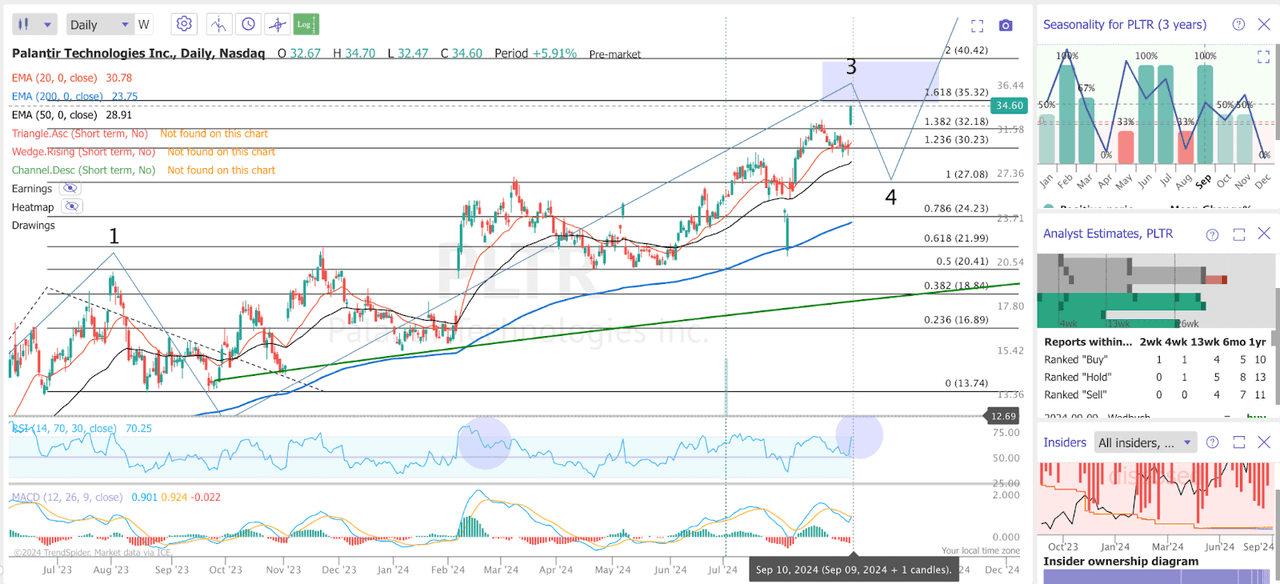

Now, looking at the technical chart, we could also be near a local top.

As we can see, Palantir has almost reached my initial target, which was the 1.618 ext of the wave 2 rally. Furthermore, the RSI is getting close to overbought levels, though the MACD has just seen a bullish crossover.

At these levels in the RSI, we have generally seen Palantir pull back somewhat. Personally, I think we could see a repeat of the top we formed back in March. Palantir continued to grind up in price, while the RSI fell, forming a bearish divergence.

I think we have room to approach $40 over the coming weeks, though I’d expect a meaningful pull-back after this, perhaps back towards the $27 region.

Final Thoughts

Palantir has proven the bears wrong by showcasing how AIP can actually make AI investments worthwhile. As a result, the company is gaining traction with businesses and I expect growth to continue, maybe even accelerate.

However, this doesn’t change the fact that the current price has gotten ahead of itself. I actually said in my last article that I would shed some Palantir if it neared $40, and that continues to be my game plan.

The real money was made by being ahead of the curve. Now, it is pretty clear that Palantir is doing an impressive job. The market has priced this in, and this leaves less room for upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video