Summary:

- Royal Caribbean Cruises Ltd. investors have outperformed the market over the past year.

- RCL investors have banished the worst hammering in recent times, triggered by the COVID pandemic.

- RCL and its cruise operators are expected to gain more share in the global vacation industry.

- RCL is expected to reduce its debt load further as it boosts its operating leverage.

- I argue why, while RCL is no longer assessed as undervalued, the rally is still far from over. Read on.

Ceri Breeze/iStock Editorial via Getty Images

Royal Caribbean: All-Time Highs And Outperforming

Royal Caribbean Cruises Ltd. (NYSE:RCL) investors have enjoyed a remarkable revival over the past two years, as RCL broke into new all-time highs earlier this year. As a result, RCL investors have finally extinguished the bitter memories of its COVID pandemic collapse. RCL’s initial post-pandemic recovery fizzled out as investors reassessed their optimism on the sustainability of the cruise operators’s earnings momentum. It wasn’t until mid-2022 that RCL finally staged its long-term bottom, providing the base for its recent stellar performance.

RCL continued its stunning market outperformance over the past year, delivering a 1Y total return of more than 60%. With RCL hovering at new highs in July 2024, is the risk/reward still favorable for investors who missed capitalizing earlier?

Royal Caribbean: Market Share Gains Expected

As a reminder, Royal Caribbean’s Q1 earnings release was well-executed, demonstrating the robustness of its recovery. Cruise demand has expanded from the baby boomers to the Millennials. Accordingly, RCL’s Q1 earnings commentary highlighted that “Millennials and younger generations have gained 11 percentage points in share” compared to 2019 levels. In addition, 50% of its guests are millennials or younger customers.

Moreover, Royal Caribbean upgraded its full-year 2024 guidance, driven by resilient gains in net yields. Notwithstanding the recent surge in underlying costs and higher oil prices, I assess the secular recovery in cruise demand to help drive RCL’s operating performance further.

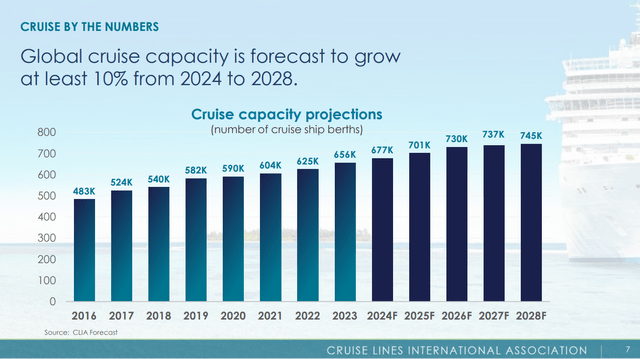

Cruise capacity forecasts (Cruise Lines International Association)

As seen above, global cruise capacity is estimated to increase at a CAGR of 10% through 2028. As a result, it should help underpin the ability of the cruise operators to meet resilient underlying cruise travel demand.

Accordingly, JPMorgan (JPM) expects the cruise industry to continue capturing the global vacation market share through 2028, reaching 3.8%. The industry’s ability to capture the value segment of the market should also help mitigate potentially weaker consumer spending headwinds moving ahead.

RCL: Reducing Debt Load Is Critical

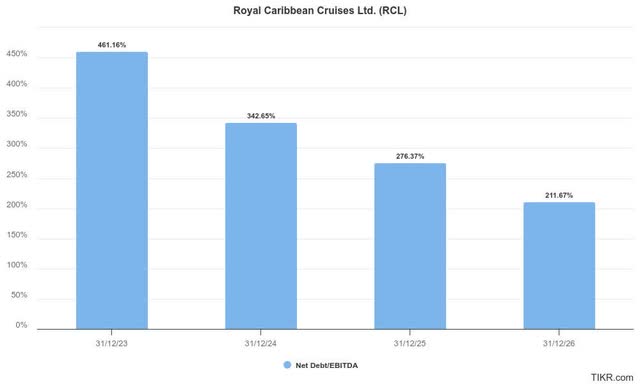

RCL adjusted EBITDA leverage ratio (TIKR)

RCL’s adjusted EBITDA leverage ratio is expected to fall further as it recovers its operating profitability and reduces debt. Royal Caribbean’s ability to guide toward its “trifecta” financial targets for FY2024 underscores the market’s optimism in its recovery.

Management anticipates reaching 15% in ROIC, bolstered by its ability to achieve double-digit adjusted EPS growth “one year earlier than prior expectations.” With the Fed expected to reduce interest rates from the September 2024 FOMC meeting, macro and interest rate headwinds are expected to ease further.

RCL: Valuation Still Not Excessive

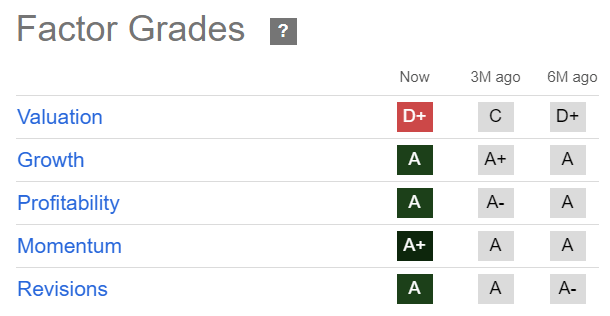

RCL Quant Grades (Seeking Alpha)

With four “A” range Quant factor grades supporting RCL’s bullish thesis, I believe my optimism is justified. RCL’s robust buying sentiments are supported by constructive fundamental factors, underlining Royal Caribbean’s solid execution. In addition, the favorable industry tailwinds should help further bolster RCL’s competitive moat, defending its market leadership among its peers.

Notwithstanding my optimism, some concerns over RCL’s “D” valuation grade might lead to some reluctance about RCL’s bullish proposition. However, RCL’s forward adjusted EBITDA multiple of 11x is still below its 10Y average of 11.7x. While it represents a 16.5% premium over its sector peers, I don’t consider it excessive. With RCL’s “A” growth grade and upgraded Wall Street estimates justifying its valuation re-rating, I assess the risk/reward profile on RCL’s fundamental thesis remains attractive.

Is RCL Stock A Buy, Sell, Or Hold?

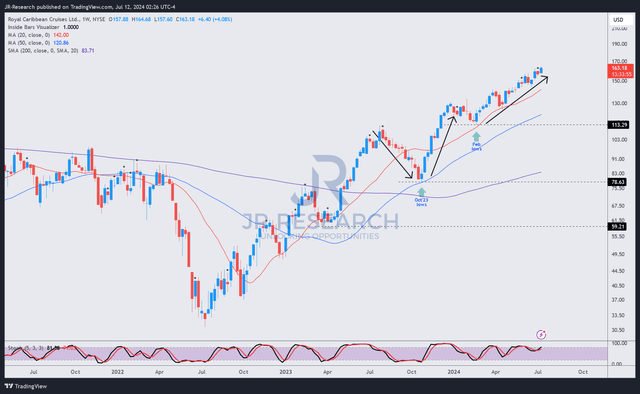

RCL price chart (weekly, medium-term) (TradingView)

RCL’s price action underscores my conviction of its “A+” buying momentum. Investors have resiliently supported steep pullbacks in RCL, especially the one that formed RCL’s bottom in October 2023.

Furthermore, I’ve not determined red flags in RCL’s price action, suggesting a need to cut exposure significantly to protect gains. RCL’s fundamental factors corroborate RCL’s rock-solid price action, suggesting RCL’s rally is likely far from over.

Royal Caribbean investors must still be careful not to over-allocate to the cruise industry leader. Unanticipated macroeconomic headwinds leading to a deep recession could untether its rally, as RCL is no longer assessed to be undervalued. Moreover, its debt load remains relatively high.

The leverage is assessed to be broadly in line with pre-pandemic levels. However, “black swan” events like the COVID pandemic could rupture its ability to maintain its earnings momentum, leading to a potentially significant decline. The cyclicality of the global vacation industry also needs to be considered, even though cruise operators are expected to continue gaining market share.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!