Summary:

- Carnival Corporation & plc reported surprising profits, even in off-peak months, with record customer deposits and increased cash flow.

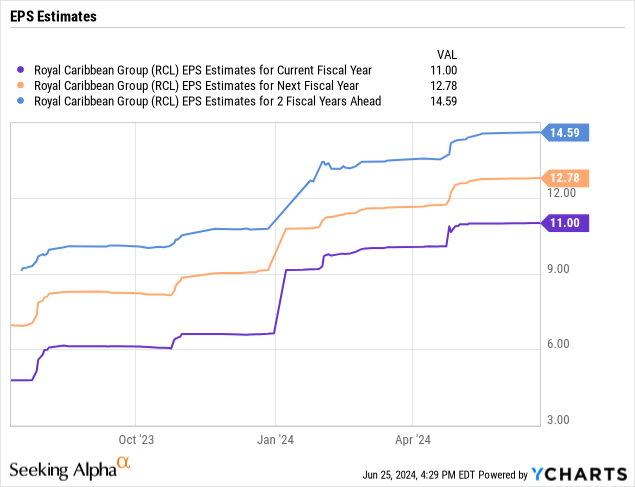

- The numbers should provide confidence in Royal Caribbean Cruises Ltd. topping 2024 EPS targets of $11.

- Royal Caribbean Cruises stock is cheap at only 11x ’26 EPS targets.

KenWiedemann/iStock Unreleased via Getty Images

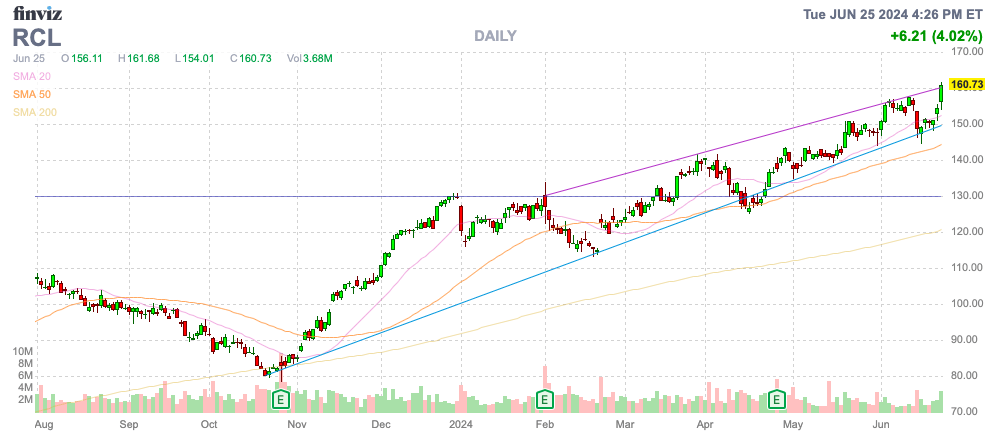

Before the open, Carnival Corporation & plc (CCL) reported another strong quarter. Even the worst cruise line is now solidly profitable, leaving Royal Caribbean Cruises Ltd. (NYSE:RCL) incorrectly priced for the current earnings stream, much less the likely upside. My investment thesis is still Bullish for RCL even as the stock zooms to new all-time highs.

Source: Finviz

Positive Carnival Signs

Even the weakest of the cruise lines is now reporting solid profits in the off-peak months. Carnival reports quarterly results shifted towards the prime June, July and August summer cruising months in the same quarter, yet the cruise line still reported a solid $0.11 EPS in the May quarter.

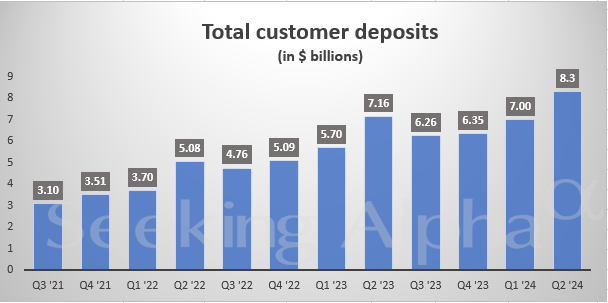

The demand equation remains so positive that Carnival reported another record in customer deposits. The FQ2 ’24 deposits reached $8.3 billion, providing a huge cash flow boost to the cruise line with the worst debt levels, with $1.1 billion in additional funds this year.

Source: Seeking Alpha

Carnival only reported a $90 million beat in the quarter for sales growth of nearly 18%. As a reminder, the cruise business began to reopen after nearly 2 years of shutdowns towards the end of 2021 and into 2022. The business was full speed ahead last FQ2 and the company still topped sales by $0.5 billion for the May quarter.

The cruise line produced FQ2 ’24 revenues of $5.4 billion, topping the $4.8 billion level of FQ2 ’19 before Covid. Carnival peaked at sales of $6.5 billion in the big August quarter before Covid and the numbers support a monster upcoming quarter with targets of a $1.11 EPS and revenues of $7.74 billion heading into the guide up.

Carnival even continues to see 2025 bookings top the 2024 levels. The market predicts minimal sales growth in the 5% range for FY25, but the company is pointing towards meaningful pricing power next year.

The cruise line is set to earn a $1.25 EPS in the last 3 quarters of the FY before the company hikes EBITDA targets by $200 million for the year to $5.83 billion. The cruise line hiked the EPS target for the year from analyst consensus of $1.01 to $1.18 now.

Royal Implications

The Carnival guidance provides confidence that cruise line demand isn’t rolling over. In addition, investors questioning whether Royal Caribbean can hit the nearly $11 EPS target for 2024 should disappear now.

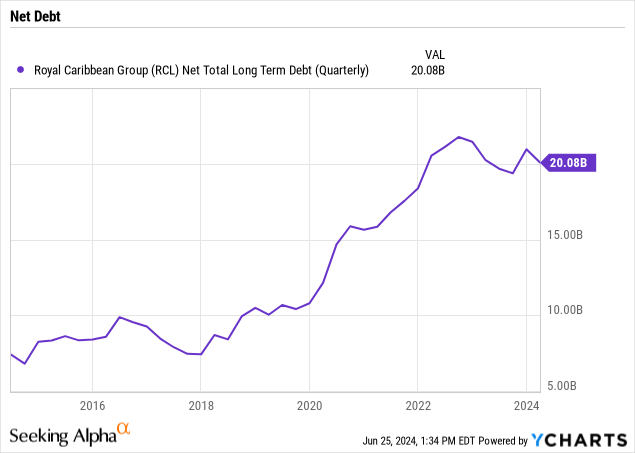

Royal Caribbean has much higher net yields and profit margins than Carnival. Just as important, though, Royal Caribbean remains heavily in debt, with the cruise line still stuck with $20 billion in net debt.

The company has over $30 billion in net PP&E, so the debt loads aren’t a major concern as much as an opportunity. Royal Caribbean was hit with $419 million in net interest expenses in Q1’24 providing similar upside as with Carnival story where the reduction in interest expenses will provide substantial upside to earnings.

If Royal Caribbean cuts interest expenses by $1 billion, the company would see a big boost to EPS with only 281 million shares outstanding. The prime example of the difference in the cruise lines is how Royal Caribbean reported a massive March quarter profit of $1.77 per share, while Carnival squeaked by with an EPS of only $0.11 in the more favorable period ending in May. The large cruise line even produced ~$2 billion in extra revenues.

The big focus on the upcoming Q2 ’24 earnings report for Royal Caribbean will be cutting the debt levels. Previously, the company regularly operated with half the net debt as now.

The stock has already rallied some $45 since the prior research report. The market now has far more confidence in Royal Caribbean not only hitting an $11 EPS in 2024, but also reaching the targets for $13 in 2025 and over $14.50 in 2026. The stock only trades at 11x EPS targets for 2026 and investor confidence will start to increase that these numbers are achievable.

Takeaway

The key investor takeaway is that Royal Caribbean probably has even more upside following the strong results from Carnival. Investors should continue riding the stock higher, with a breakout to new all-time highs indicative that the rally isn’t over.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.