Summary:

- Seeking Alpha’s quant analysis rates AT&T at hold, with strong valuation, profitability, and momentum ratings, but poor growth and revisions ratings.

- AT&T’s valuation is favorable with P/E, price/cash flow, and price/sales ratios trending upward over the past year.

- Despite declining revenues, AT&T shows strong momentum with its price above key moving averages, indicating positive investor sentiment.

- Declining EPS and downward revisions imperil market sentiment, momentum, and ultimately share price.

- I recommend investors carefully consider selling AT&T at current market prices.

jetcityimage

Background

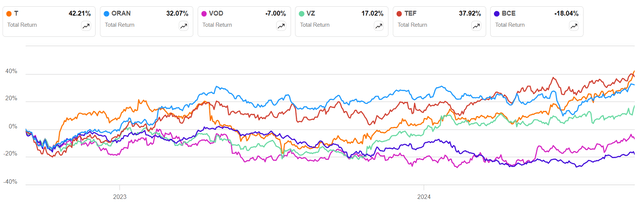

On September 12th, of 2022, I published a review of wireless services providers including AT&T (NYSE:T) and its peers. At that time, I highlighted the industry’s defensive performance and reliable dividends while identifying Orange S.A. (ORAN) and BCE Inc. (BCE) as the industry’s best and worst prospects respectively. I’m proud to report that the forecast proved true through the first quarter of this year.

Wireless Providers Total Return, 9/12/22 – Present

More recently, AT&T has emerged with the best total return in the industry. This analysis will focus on AT&T within the framework of Seeking Alpha’s Quant ratings with additional focus on debt, dividend safety and recent quarterly results.

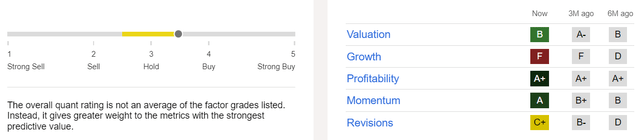

Quant Rating & Factor Grades

Seeking Alpha’s quant currently rates AT&T at hold with superlative valuation, profitability, and momentum ratings and poor growth and revisions ratings. We will dive into these five factors, debt, and dividend safety below.

Valuation

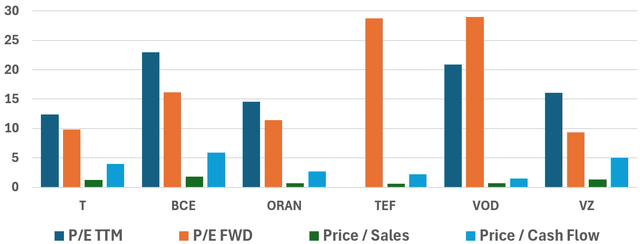

Seeking Alpha scores AT&T favorably at B within the communication services sector. A closer look at valuation within the wireless providers industry is plotted below.

Wireless Providers Valuation

With relation to P/E over the last twelve months and forward P/E estimates, AT&T is most favorably valued among its peers. AT&T price/sales and price/cash flow ratios land closer to the middle compared to its peers.

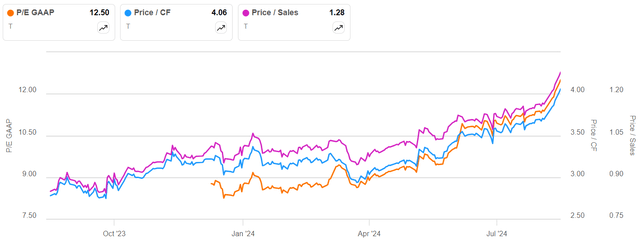

AT&T 1YR Valuation Trend

It appears as though investors have warmed up to AT&T over the last year. P/E, price/cash flow, and price/sales multiples have each trended upward over the year and even accelerated to new highs most recently.

Growth and Profitability

AT&T’s growth (F) and profitability (A+) scores land at the opposite ends of the scale. Revenue and net income trends are plotted below.

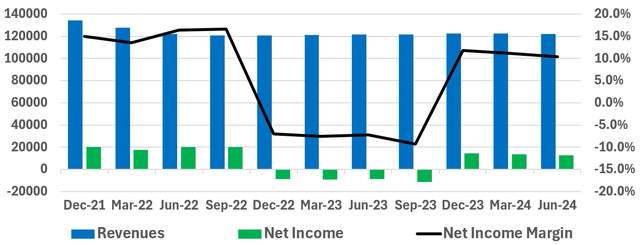

AT&T Revenue & Net income: TTM by Quarter

Given declining to flat revenues, Quant’s F score on the factor appears well justified. Quant’s A+ profitability score is not as well-supported, with three consecutive profitable periods recently, following mixed results between December 2022 and September 2023. I would prefer to see consistent profits over a longer period.

Momentum

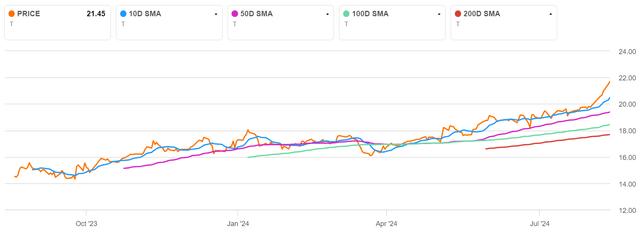

On momentum, Seeking Alpha scores AT&T favorably at A; simple moving averages are plotted below.

AT&T Momentum

AT&T’s current price is well above its 200D, 100D, 50D, and even 5D simple moving averages. Strong momentum underscores the expanding valuation multiples trend previously discussed and further indicate rosy investor sentiment.

Revisions

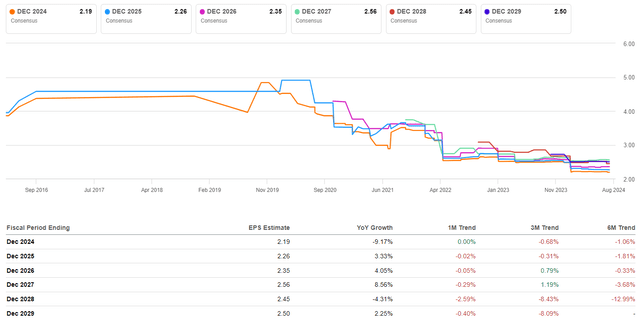

On revenue and EPS revisions, Seeking Alpha scores AT&T at C+; I find the EPS revisions trend most concerning.

Consensus EPS Revisions

I am most concerned with FY24 analyst revisions, with five upward and twelve downward revisions. These revisions are perhaps most relevant with respect to the growing trend of falling earnings with misses.

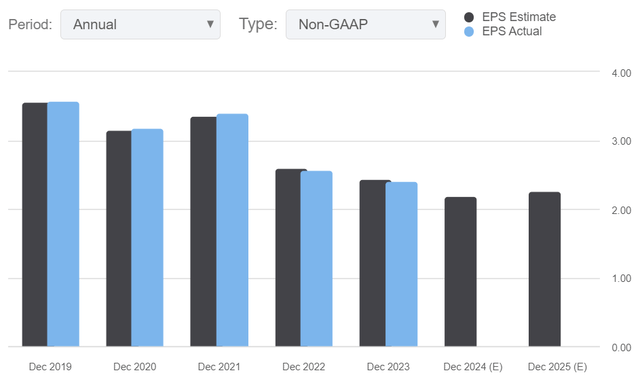

AT&T Earnings

Decreased FY22 earnings were expected after the Warner Bros. Discovery spinoff. However; continued earnings declines going forward could break the lean and focused AT&T recovery narrative and erode investor sentiment.

Debt and Cash Flow

Debt has been a persistent concern among AT&T investors and analysts for many years. However, net debt decreased moderately after the Warner Brothers Discovery spinoff and recently cash flow has improved.

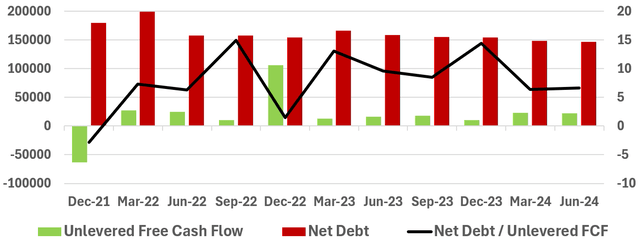

Net Debt and Cashflow: TTM by Quarter

Over the twelve months ending in March 2022, net debt/unlevered free cash flow was nearly 15. Most recently, that ratio has contracted to under 7.

Dividend Yield and Safety

AT&T’s quarterly dividend has been consistent at $0.275 since April 2022 and the yield is 5.1% at current share prices.

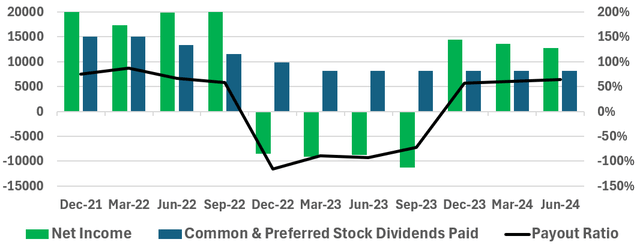

Dividend Payout Ratio: TTM by Quarter

Over the last three quarters (TTM), dividends appear safe, with a pay-out ratio averaging around 60%.

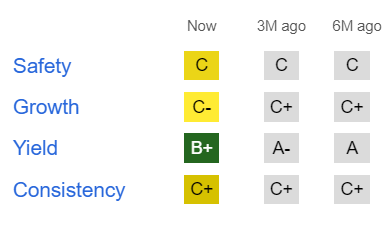

Dividend Grades

Seeking Alpha

However, considering the four previous quarters, I would hesitate to describe the dividend as particularly safe. AT&T’s Seeking Alpha dividend safety grade at C+ appears to support my assessment.

Lastly, the yield scores well at B+ but, dividend growth and safety are mediocre at C- and C respectively.

AT&T 2Q24 Results and Guidance

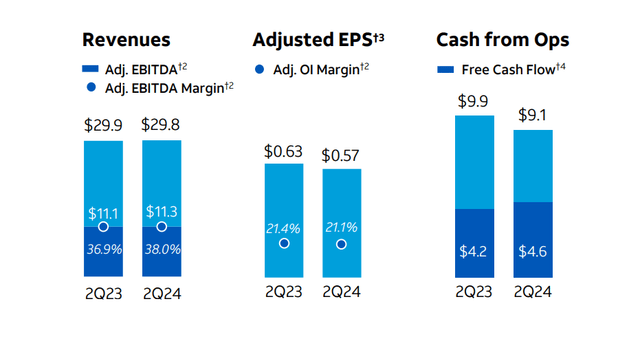

AT&T’s most recent investor presentation highlights the growing trend of flat revenues and declining earnings.

2Q24 Results

Year-over-year, 2Q24 revenue is essentially flat, while earnings fell almost 10% versus 2Q23 results. AT&T attributes the disappointing results to lower equipment revenues, higher depreciation, non-cash pension/post-retirement costs, lower capitalized interest, and lower equity income from DIRECTV.

FY24 guidance calling for earnings between $2.15 – $2.25/share suggest earnings decline will continue. Compared to FY23 EPS of $2.41, FY24 EPS results on the high end of the range at $2.25 forecast a 7% annual earnings decline.

Investor Takeaways

Seeking Alpha currently rates AT&T at hold with solid valuation, profitability, and momentum ratings coupled with poor growth and revisions ratings. I suspect most AT&T investors did not buy expecting growth, but the risk regarding falling earnings and downward revisions is considerable. I would expect market sentiment to deteriorate and momentum to reverse if earnings continue to decline going forward.

Furthermore, I’m tempted to rate AT&T at hold in order to avoid the wrath of its most enthusiastic investors. However, given the falling earnings and downward revisions, the recovery seems fragile. I recommend investors carefully consider selling AT&T at current market prices.

Chance has little effect upon the wise man, for his greatest and highest interests are directed by reason throughout the course of life. – The Principal Doctrines of Epicurus

.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.