Summary:

- Alphabet Inc./Google’s stock has dropped 23% since July due to market volatility and temporary uncertainty issues.

- Alphabet’s recent earnings beat estimates, showing strong growth in key segments like YouTube ads and Google Search, suggesting continued robust performance.

- Despite current uncertainties, Google’s forward P/E ratio is below 18, making it exceptionally cheap given its revenue growth and profitability potential.

- Wall Street’s average price target for Google is $201.55, indicating a potential 34% upside, with long-term projections suggesting significant gains by 2030.

Boy Wirat

I discussed Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka “Google,” in a previous article. Google has had a rough time since peaking at around $193 in early July. Since then, Google’s stock has cratered by 23% as the market goes through an increased volatility phase. Moreover, Google faces transitory company-specific issues. Yet, Google’s temporary problems will likely be resolved.

Meanwhile, Google’s stock has become exceptionally cheap, trading below a 20 P/E ratio (2024 EPS forecasts). Furthermore, Alphabet’s recent earnings announcement was solid, suggesting it can continue outperforming the estimates as we advance. Alphabet has enormous earnings growth power and could experience multiple expansion, enabling its stock price to move substantially higher in the coming years.

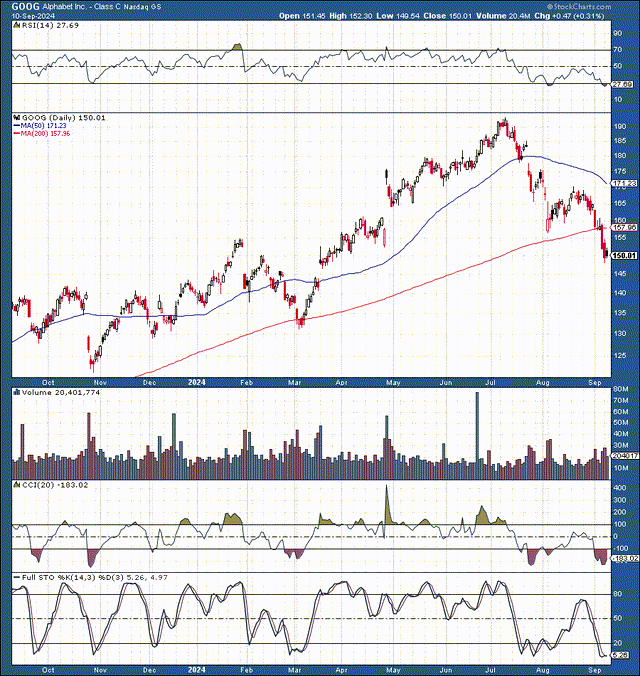

Technically — Google Stock is Likely Around a Low Point

GOOG (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools )

Google had a substantial correction, even dropping below its August low. The substantial selloff occurs because of the temporary general volatility in the tech sector and the transitory uncertainty surrounding the stock. The RSI is around 27, indicating oversold technical conditions. In addition, the CCI is bouncing back from about -250, and the full stochastic may turn upward, implying the probability of improving momentum. Google also has a crucial gap/support level of around $150-140, making it the ideal buy-in zone if Google drops in. Alphabet remains a compelling buy in the $160-150 technical area.

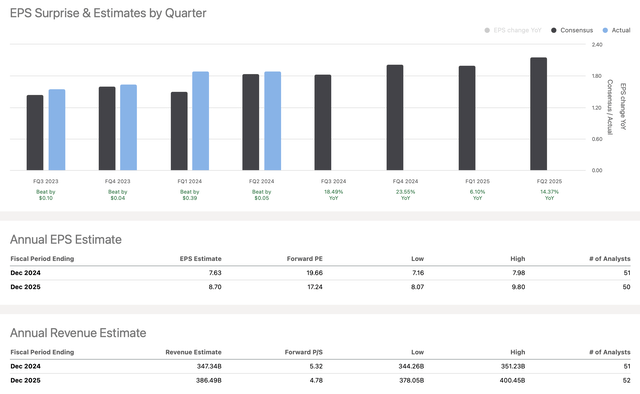

Alphabet’s Solid Earnings Are Reassuring

Google reported earnings on July 23rd, but its stock was already dropping by then. Alphabet reported GAAP EPS of $1.89, beating the estimate by four cents on revenues of $84.74B, a beat of $450M (13.6% YoY). YouTube ads revenues were $8.66B, a 13% YoY increase. Google Search and Other provided 48.51B in sales, a 13.8% increase YoY. Therefore, we’re seeing solid growth in Google’s most important segments.

Moreover, we should continue seeing robust growth as the economy shifts into higher gear (growth improves). Additionally, Google’s bottom line should benefit from the upcoming more accessible monetary atmosphere, AI-related efficiency increases, and other constructive factors. This dynamic implies that Google could continue surpassing consensus estimates, increasing profitability, expanding its multiple, and driving its stock price higher in the years ahead.

The Uncertainty Should Fade

Google has faced increased uncertainty recently, which is partially the reason for the decline in its stock price. A top EU court recently rejected Google’s appeal against a 2.42B Euro fine. Google is still fighting two other EU penalties. Google is also in an antitrust showdown with the DOJ over its monopolistic-style business practices in search. Google has already lost one antitrust suit to the DOJ, and Google is now involved in a second antitrust suit over advertising.

If Google loses this court battle, it may be exposed to lawsuits from advertisers. Therefore, there is substantial uncertainty hanging over the stock now. The favorable factor about uncertainty is that it typically fades over time. The uncertainty surrounding Google’s stock should fade once Google is acquitted of any wrongdoing or forced to pay a fine that should not materially weaken its business, especially in the long term. While there may be more transitory volatility ahead for Google’s stock, it will not likely be negatively impacted in the intermediate and longer term.

Google Is Now Dirt Cheap

EPS vs. estimates (seekingalpha.com )

Due to the persistent uncertainty and volatility, Google’s valuation has decreased drastically. Google’s 2025 consensus EPS estimate is $8.70. This dynamic implies that Google’s forward P/E ratio is below 18, which is exceptionally cheap, given Google’s robust revenue growth and profitability potential. Furthermore, while Google’s TTM consensus EPS estimate was around $6.39, Alphabet delivered $6.97, a solid 9% outperformance rate.

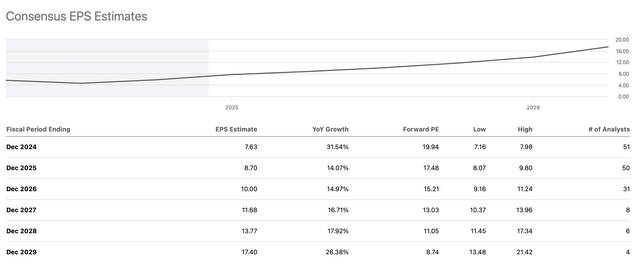

Alphabet — Likely To Outperform Future Estimates

EPS estimates (seekingalpha.com )

The consensus EPS estimate for next year is $8.70. Yet, the higher-end EPS estimates range to around $9.80, suggesting Google can surpass the consensus estimate figure. Furthermore, factoring in a potential 9% outperformance rate in future quarters implies that Google could earn about $9.50 in 2025. Therefore, Google’s forward P/E ratio may be only around 15-16 for Google now, representing an attractive buy-in area and a likely solid entry point for the long term.

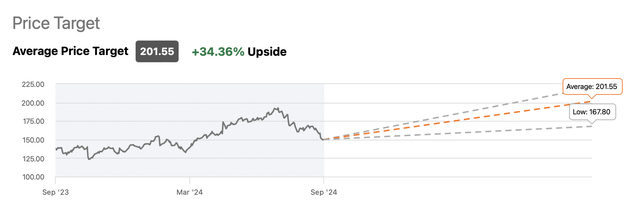

Wall Street Has a $200+ Average Price Target

Price targets (Stock Market Analysis & Tools for Investors )

The average price target on Wall Street is around $201.55, roughly 34% above Google’s recent price action. Moreover, higher-end estimates go up to around $225, illustrating the potential for about a 50% gain over the next year in a bullish case scenario. Even the lower-end price targets are around $168, roughly 12% above current depressed levels. Based on the price targets, Alphabet’s stock has a high probability of appreciating, while the downside is likely minimal, creating a highly favorable risk/reward dynamic for Google’s stock.

Where Google’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $349 | $394 | $440 | $482 | $530 | $580 | $620 |

| Revenue growth | 14% | 13% | 12% | 10% | 9% | 9% | 7% |

| EPS | $8 | $9.25 | $10.50 | $12.80 | $15.40 | $18.80 | $22.50 |

| EPS growth | 38% | 16% | 14% | 22% | 20% | 21% | 20% |

| Forward P/E | 21 | 23 | 25 | 27 | 25 | 23 | 22 |

| Stock price | $195 | $242 | $320 | $416 | $470 | $518 | $550 |

Source: The Financial Prophet.

Google’s sales and EPS growth will likely continue. Moreover, Alphabet could achieve significant EPS growth, and its multiple should expand as the uncertainty fades. Therefore, we could see Alphabet’s depressed 15-18 forward P/E ratio transition to a 20-25 or higher valuation in the coming years. The higher sales, profitability, and valuation could be supported by continued growth in Google’s primary segments, increased revenues from Alphabet’s developing segments, increased efficiency, and other constructive factors. Due to this intermediate and long-term bullish dynamic, Google could reach $500-550 or higher by 2030.

My 2024 year-end price target range for Google: $180-200

Risks To Google

Despite the constructive outlook, Google faces risks. Alphabet faces increased competition in search, AI, cloud, and other essential segments. The competition is especially prominent in the search and the AI arena. Microsoft’s Bing is a top threat to Google, as it has gained market share and has an AI advantage. Google must close the AI gap to prevent giving more market share in search and other segments. Google must continue innovating perpetually to increase sales and profitability metrics. Investors should consider these and other risks before investing in Google.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!