Summary:

- Unity’s stock surged after canceling a controversial fee and raising subscription prices.

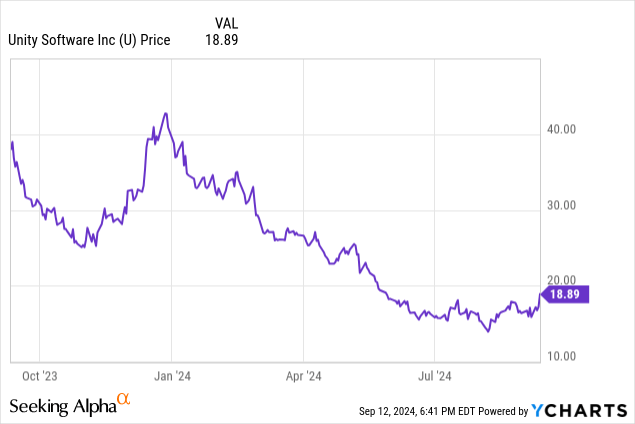

- U stock has struggled this year as the company works through a strategic reset.

- The reduction in guidance has impaired my confidence in the growth thesis.

- I am downgrading the stock and detailing where I’d be interested in the stock again.

Trevor Williams

Unity (NYSE:U) saw its stock soar on Thursday after revealing that it was canceling a controversial fee as well as raising subscription prices. This was a welcome surprise for investors after the company had released a disappointing second quarter earnings result, in which management significantly lowered full-year guidance targets. While the stock still remains much lower than where I purchased shares, I am taking advantage of the rally to dispose of my position. I am of the view that I have misassessed the growth trajectory of this business, and now cannot discount the significant risk posed by the high debt load and lack of profitability. While the company has indeed made significant progress on profitability, largely through cost discipline, I am skeptical about the near term outlook given the uncertain growth trajectory. I am downgrading the stock to a neutral rating.

Unity Stock Price

I last covered the stock in February, where I rated the stock a buy after the stock plunged due to a guidance reset. The stock has underperformed the broader market by a whopping 50% since then due to, you guessed it, another guidance reset.

I will not make the same mistake again – despite the reasonable valuation of the stock, I can no longer retain conviction in the name.

Unity Stock Key Metrics

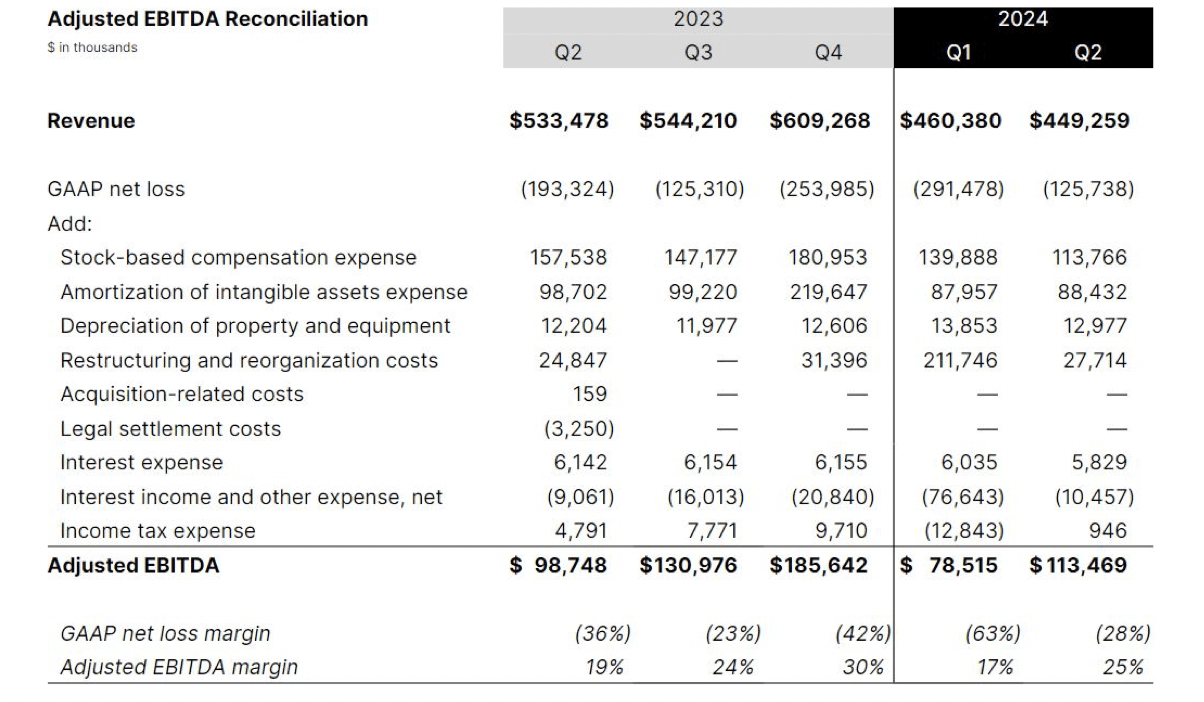

The video game engine and software provider saw revenues decline 16% YoY to $449 million as it continued to lap tough comparables from exiting non-strategic businesses.

2024 Q2 Shareholder Letter

Focusing on the “strategic portfolio,” revenue declined 6% YoY to $426 million, coming in ahead of guidance for $420 million to $425 million. Adjusted EBITDA of $113.5 million exceeded guidance of $75 million to $85 million, as well as the $88 million posted in the prior year. Notably, the company’s cost reductions have borne real fruit: the company would have been almost profitable even after accounting for stock-based compensation and interest expenses. The company saw continued weakness in its Grow Solutions segment, as it has struggled to improve its monetization products. The Create Solutions segment was a lone bright spot as the company benefited from subscription price increases.

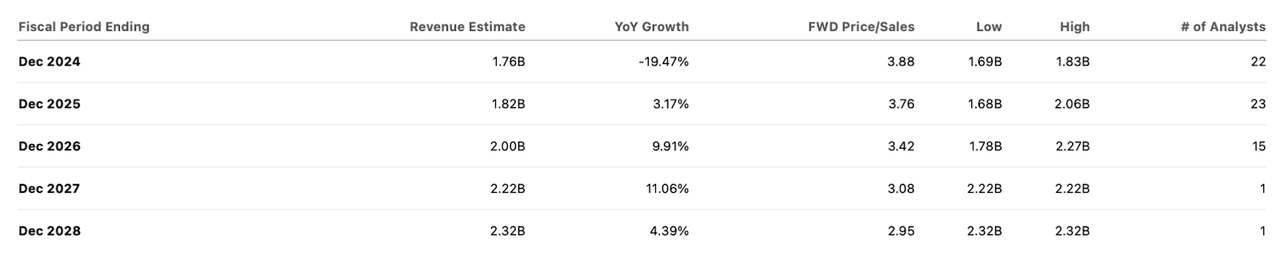

Looking ahead, management has guided for the third quarter to see revenue from the strategic portfolio to decline 4% to 6% YoY and end up at between $415 million to $420 million. Adjusted EBITDA is expected to decline sequentially to $75 million to $80 million. For the full-year, management lowered expectations for strategic revenue to $1.68 billion to $1.69 billion, down from the prior guidance of $1.76 billion to $1.8 billion. Management also reduced adjusted EBITDA guidance down to up to $350 million, down from the prior guidance of $425 million. On the conference call, management explained the move as being due to wanting to be more conservative, but investors can hardly be blamed for wondering why this conservatism wasn’t already baked in the prior guidance given that the bar had already been lowered previously.

The company ended the quarter with $1.3 billion of cash versus $2.2 billion of debt, representing a $900 million net debt balance sheet. While these notes mature in 2026 and 2027 and carry very low interest rates (due to being of the convertible nature), the road bumps to the growth story may make the net leverage an important risk factor moving forward.

Is Unity Stock A Buy, Sell, or Hold?

The stock had initially plunged hard following this report, but has since seen signs of life, perhaps due to the prospects of lower interest rates, and most recently after the company announced plans to cancel the controversial runtime fees and raise subscription prices for its larger customers. It is not immediately clear to me if this move will be enough to rectify the damage done to its reputation following the fallout from the runtime fee fiasco, but perhaps investors are looking forward to the tangible growth from raising prices. Unfortunately, this latest rally may have already priced this in, with the stock now trading hands at around 4.4x this year’s sales estimates.

I previously stated that I could see the company sustaining a 30% long term net margin. However, this move to raise prices once again has caused me to doubt my original bullish thesis. I had previously expected Unity to find its footing and re-accelerate growth to the double-digit level. But raising prices does not feel like a very sustainable way to drive that growth, as I had hoped the growth would instead be driven by the monetization efforts. I now lower my long-term net margin estimate to 20%. The stock then might not look that expensive at 22x long-term earnings, but we must account for some considerations. I fear that the company might struggle to post consistent revenue growth moving forward, which would make it difficult to generate the operating leverage needed to move towards that long-term target. The company’s high debt load elevates the risk profile and justifies a lower valuation multiple. The current valuation looks justified only if growth accelerates meaningfully to the double-digit level, but, as just mentioned, I no longer expect this to be the case.

Unity Stock Conclusion

I would be more comfortable with the stock if it traded at around 2x sales, which would equate to roughly 10x long-term earnings. This is due to the uncertain growth outlook, the lack of profitability, and the net debt on the balance sheet. Investors should keep a close eye to see if the price increases help spark a sustained acceleration in revenue growth rates, or if the company continues to struggle with the promised acceleration. The software sector still has plenty of attractively valued names, making it difficult to stand by Unity stock at these valuations. I am downgrading the stock to a neutral rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!