Summary:

- UnitedHealth’s aggressive M&A strategy, including the $13 billion acquisition of Change Healthcare, has strengthened its data analytics and improved margins, justifying a ‘Strong Buy’ rating.

- Despite a major cyberattack, UnitedHealth’s financial impact is manageable, with expected EPS reduction and increased CAPEX for cybersecurity enhancements.

- UnitedHealth’s divestiture of its Brazilian business reduces FX risk, aligning with its focus on U.S. market growth driven by rising healthcare spending.

- I estimate UnitedHealth’s 8% revenue growth, supported by market expansion and strategic acquisitions, leading to a one-year target price of $700 per share.

jetcityimage

UnitedHealth (NYSE:UNH) is the world’s largest health insurance company, offering a full range of health benefits and operating Optum health services business that serves the broad healthcare marketplace. UnitedHealth has been leveraging its strong balance sheet to pursue both large and small acquisitions, consolidating the market and expanding their data analytics business. As I believe the stock price is undervalued, I am initiating a ‘Strong Buy’ rating with a one-year target price of $700 per share.

Consolidating Industry Players

UnitedHealth has been pursuing a quite unique M&A strategy to consolidate the healthcare benefit providers. Over the past three years, UnitedHealth spent more than $36 billion on acquisitions.

In October 2022, UnitedHealth completed the acquisition of Change Healthcare for $13 billion, despite challenges from the Department of Justice due to antitrust concerns. The big acquisition has enhanced UnitedHealth’s competitive advantage in several areas:

- Change Healthcare provides software and data analytics for the healthcare marketplace. With the acquisition of Change Healthcare, UnitedHealth boosted their Optum Insight business with substantial data assets and an expanded customer base. Optum Insight revenue increased by almost 30% in FY23.

- Optum Insight is a high-margin business as they offer software and data analytics. In FY23, Optum Insight delivered 22.5% of operating margin, compared to the group’s overall operating margin of 8.7%. This acquisition has thus improved UnitedHealth’s overall margin profile.

- Change Healthcare increased UnitedHealth’s overall backlog for. Over the earnings call, the management disclosed that the total backlog reached $33 billion, growing by 3% year-over-year. The backlog growth was driven by business process and information technology services for health systems.

In February 2023, UnitedHealth closed their $5.4 billion acquisition of LHC group, one of the nation’s largest home health providers. The deal enables UnitedHealth’s Optum business to expand their high-quality home and community-based care.

I view these acquisitions as highly value-accretive to UnitedHealth, with both significant revenue and cost synergies. As a result, UnitedHealth has built an empire in the healthcare benefit market.

Cyberattack and Consequences

UnitedHealth experienced a major cyberattack this February, leading to a shutdown of hospitals and pharmacies systems for more than a week. The media reported that a ransom payment of $22 million was paid to the hacker in the form of bitcoin. Currently, the company has already restored the majority of the affected Change Healthcare services. During their Q2 FY24 earnings, the management disclosed that the company has provided more than $9 billion in advance funding and loans to affected care providers. Financially, the cyber incident is expected to reduce overall EPS for FY24 by $1.90 to $2.05.

I estimate that UnitedHealth is going to face additional financial costs including penalties from regulators, settlement for patient record holder class actions and substantial customer support expense. In addition, I anticipate UnitedHealth will increase their capital expenditure over the next few years to upgrade their legacy IT systems and enhance cybersecurity measures. In 2017, Equifax (EFX) experienced a similar cyberattack, which compromised the data of 147.9 million Americans and 15.2 million British citizens. As a result, Equifax significantly increased their CAPEX from $173 million in 2016 to $421 million in 2020 to overhaul its IT and database systems.

Other than these financial burdens, UnitedHealth will likely face reputational damage; however, it would be hard to quantify these damages. Having said that, I believe the overall impact of the cyberattack is manageable.

Recent Result and Outlook

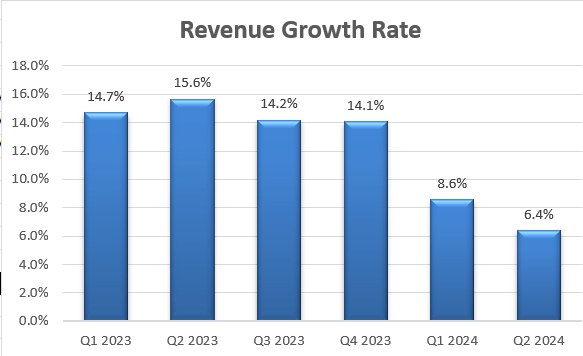

On July 16th, UnitedHealth released its Q2 FY24 result, reporting 6.4% year-on-year in revenue, primarily driven by strong expansion in people served at Optum and UnitedHealthcare.

UnitedHealth Quarterly Results

During the quarter, UnitedHealth completed the divestiture of their Brazilian business, resulting in a quarterly EPS impact of -$1.28. I favor the company’s decision to divest their Brazilian business. Over the past few years, UnitedHealth has been exposed to FX risk related to the Brazilian real. As disclosed in the 10K, a hypothetical 10% increase in the value of USD against Brazilian real would reduce the net asset value by $590 million. Given Brazil’s volatile economic conditions, the depreciation of Brazilian real could have meaningful financial impact on UnitedHealth’s financials.

To estimate UnitedHealth’s near-term growth, several factors should be considered. In the U.S. market, healthcare spending represents around 18% of GDP. With an aging population and rising healthcare inflation, the overall healthcare spending has grown in recent years. The total healthcare spending is estimated to increase by 7.5% in 2023, according to the media. The Centers for Medicare and Medicaid Services (CMS) projects that the national health spending will grow at a CAGR of 5.1% from 2021 to 2030, reaching $6.8 trillion by 2030.

I think the overall market growth provides a solid foundation for UnitedHealth’s growth. UnitedHealth has been gaining market share from small players and integrating other healthcare benefit providers. I expect the company to deliver 6% organic revenue growth, comprising 5% market growth and 1% share gains.

Additionally, as acquisition is a key growth strategy for the company, I assume UnitedHealth will allocate 4% of revenues towards M&A, contributing 2% to the topline growth.

DCF Valuation

As analyzed above, I estimate UnitedHealth will deliver 8% revenue growth in the near future. Given that the health benefits industry is highly regulated, it would be challenging for UnitedHealth to rely on pricing as a primary growth driver. I calculate UnitedHealth can expand their operating margin by 10bps annually from the operating leverage of SG&A expenses. I estimate the total operating expenses will grow by 7.8% annually.

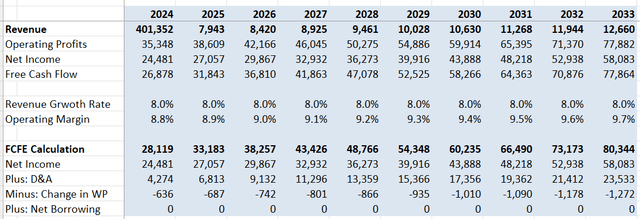

With these assumptions, my DCF can be summarized as follows:

The cost of equity is calculated to be 9.4% assuming: risk free rate 3.8%; beta 0.8%; equity risk premium 7%. Discounting all the free cash flow from equity (FCFF) in the above table, the one-year target price is estimated to be $700 per share.

Key Downside Risks

- Pricing: As a healthcare benefit provider, UnitedHealth is quite sensitive to the pricing trend for their insurance. Over the past few years, the company has experienced a challenging payment rate environment in Medicaid services. The tough payment rate caused some headwinds for their operating margin. I appreciate the company’s efforts to reduce their medical costs; however, the challenging payment rate could pose some growth challenges for the company.

- Antitrust: The acquisition of Change Healthcare has already drawn scrutiny from the U.S. Department of Justice (DOJ) due to antitrust concerns. Going forward, I think it would be hard for UnitedHealth to pursue any large-scale acquisition considering UnitedHealth’s current size and the heightened regulatory environment.

- Medicare Advantage Rates: both CVS Health (CVS) and Cigna (CI) have scaled back their Medicare Advantage programs following the Biden Administration’s announcement that final Medicare Advantage rates will increase by 3.7% in 2025. Over the earnings call, UnitedHealth’s management indicated that the company has filed their 2025 Medicare Advantage plan, which is currently under review by CMS. The outcome remains uncertain at this time.

End Notes

After years of business consolidation, UnitedHealth has become a dominant player in the healthcare benefit market, benefiting from the overall healthcare spending growth and market share gains. I am initiating a ‘Strong Buy’ rating with a one-year target price of $700 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.