Summary:

- Lumen Technologies is undergoing debt exchanges to defer maturities and reduce indebtedness, impacting interest expenses and potentially earnings.

- The new exchange offers involve swapping existing notes for new 10% secured notes due in 2032, affecting both Lumen and Level 3 debt.

- The exchanges will add $30-$35 million in annual interest expenses, posing a headwind for earnings but likely not affecting share prices significantly.

- The growing secured debt holder class poses risks to unsecured note holders, but the shrinking unsecured debt class mitigates this risk somewhat.

John M Lund Photography Inc

Introduction

Lumen Technologies (NYSE:LUMN) is a telecommunications company that has been on a wild ride since the pandemic. The company began struggling financially and went through a management transition as well as a transition from copper to fiber infrastructure. I’ve covered Lumen several times over the past few years and wrote about the most recent earnings report last month. Since the earnings release, Lumen has announced two exchange offers for Lumen and Level 3 notes. This article details the exchanges and my reaction as a noteholder and shareholder.

This is Not Lumen’s First Exchange Offer

A debt exchange offer is when an entity offers new debt under new terms in exchange for retiring its existing debt. The exchange is meant to primarily accomplish the deferring of debt maturities to a later date, the reduction of indebtedness through agreeing to an exchange for less than 100 cents on the dollar, or a combination of the two.

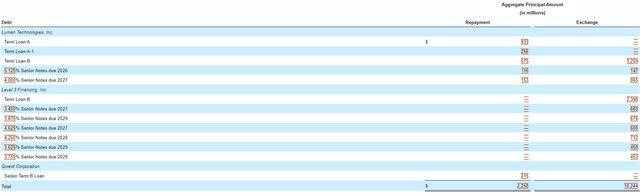

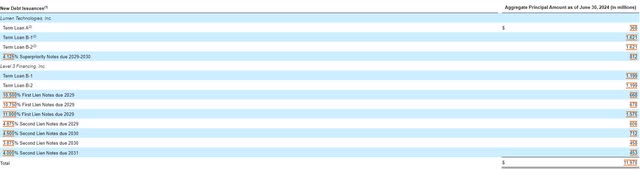

Last year, Lumen engaged in an expansive debt exchange offer that pushed maturities back and reduced overall indebtedness. The exchange came at a cost to Lumen. While the deal retired $2.25 billion of notes, nearly $12 billion of new debt was issued, with a significant amount of that debt coming with an interest rate above 10%. As of the end of the second quarter, year to date cash interest paid was only $10 million higher ($571 million) than a year ago, but the deal has not had a full year to pass.

The New Exchange Offers

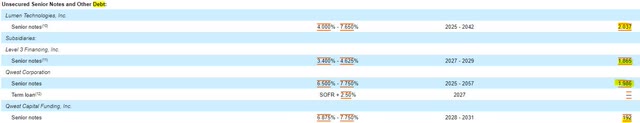

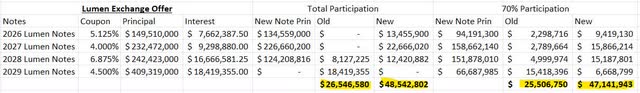

On September 3rd, Lumen announced two more proposed exchange offers. The first was to exchange certain Lumen notes for new 10% secured notes due in 2032. The notes being tendered (in order of priority) are the 5.125% notes due in 2026, the 4% notes due in 2027, the 6.875% debentures due in 2028, and the 4.5% notes due in 2029.

The company is offering 90 cents on the dollar in new debt and 10 cents on the dollar in cash for the 2026 notes, 97.5 cents on the dollar in new debt for the 2027 notes, 89.5 cents on the dollar in new debt for the 2028 notes, and 70 cents on the dollar in new debt for the 2029 notes. The offering is limited to $500 million in total, and the 2029 notes have a cap of $100 million to exchange.

The total principal of the four notes affected by the exchange was over $1 billion, although only $100 million of the $409 million 2029 notes were eligible. To estimate the interest expense impact on the exchange, I assumed 100% participation and a more likely 70% participation. Under both scenarios, I estimated approximately $22 million in additional interest expenses. The 100% participation scenario is impossible as the exchange is limited only to institutional buyers, which are qualified entities that have more than $200 million in total assets under management.

Press Release, Author Spreadsheet

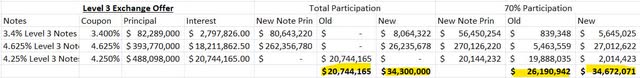

The second offer has to do with three note issuances under the Level 3 subsidiary. The company is offering to exchange up to $350 million of these notes in exchange for new 10% second lien notes due in 2032. The three issues involved in this exchange offer are (in order of priority) 3.4% Level 3 Senior Secured Notes due in 2027, 4.625% Level 3 senior Notes due in 2027, and 4.25% Level 3 notes due in 2028.

The company is offering 98 cents on the dollar of new debt for the 3.4% and 4.625% notes (if tendered early) and 86 cents on the dollar for the 4.25% notes. Other than the total cap, there is no cap on the three issuances. Once again, the offer is limited to qualified institutional investors, so retail note holders are unable to participate.

While total participation is impossible, I ran the total participation scenario against a 70% participation rate to see if the results were like the Lumen exchange. What I found is the lower participation rate led to a lower increase in interest expenses. I believe the increase in interest expense for the Level 3 exchange will be around $10 million per year.

Press Release, Author Spreadsheet

The Effect of the Exchange Deal

I believe there will be enough interest among institutional investors for the debt exchange to go through. Based on my estimates, the deal will add $30 to $35 million in additional interest expense per year. This will be a headwind on earnings and could impact shares if earnings expectations aren’t properly adjusted to all of the company’s moving parts. The fact that this deal is coming amidst an AI boom and a plethora of sales opportunities for Lumen makes its inception a likely non-factor for the share price.

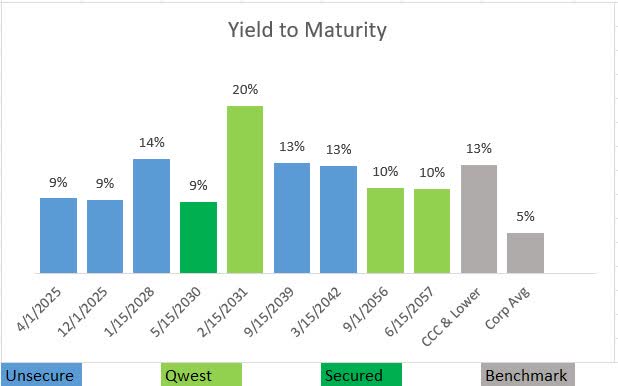

For retail note holders, the deal is more meaningful. I own the 2028 Lumen notes being tendered and I am looking forward to the amount of debt due between now and 2028 falling even further, although I felt it was manageable prior to the exchange deal. Prior to the deal, Lumen had approximately $6 billion in unsecured debt. Therefore, I expect the deal to reduce that amount to $5.2 billion. I am going to hold my 2028 notes as many unsecured bonds have rallied since my last article, and I’m collecting a great coupon yield based on my cost.

FINRA

Risks to Unsecured Note holders

As I have pointed out in the past, the growing secured debt holder class (now projected to reach $12 billion) represents a challenge for unsecured note holders as they are being further subordinated to a growing senior class. If operations do not materially improve, and unsecured debt is coming due, secured creditors sometimes prefer to force a company into restructuring to preserve the value of their secured interest versus allowing that capital to exit in the form of cash. With the unsecured class shrinking, however, this risk is becoming smaller.

Conclusion

While I am interested to see how the debt exchange offer turns out and what the third quarter’s earnings will be like, I believe Lumen’s fourth quarter earnings announcement and 10-K are the biggest upcoming event. The 10-K will give us a look at the cash flow situation following the announcement of the company’s sales and new sales opportunities, but management is also expected to provide guidance for 2025. Management’s free cash flow guidance for 2025 compared to what was presented in their turnaround plan a couple of years ago will be a great indicator for investors to see just how promising (or not promising) this turnaround plan is. For now, I am holding on to my Lumen debt maturing in 2028 and 2039 along with my shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.