Summary:

- Broadcom’s strong financials, AI growth, and diversified portfolio support a “Buy” rating, despite recent stock consolidation and market volatility.

- AVGO’s Q3 revenue reached $13.07 billion, driven by AI-related products, with AI revenue projected to hit $12 billion for the fiscal year.

- I believe Broadcom’s leadership in networking and AI positions it well for sustained growth and market share gains.

- Despite AVGO trading at over 30x next year’s earnings, I don’t believe it is overvalued right now.

- In my opinion, Broadcom is one of the leading AI companies currently, deserving of investors’ attention. Therefore, I reaffirm my “Buy” rating.

G0d4ather

My Thesis Update

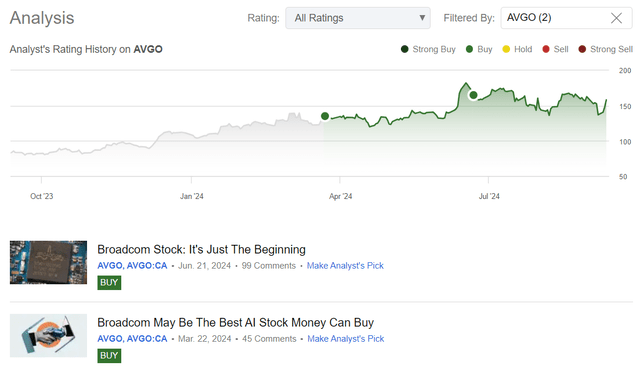

I first initiated coverage of Broadcom Inc. (NASDAQ:AVGO) on March 22, 2024, stating that “the company’s strong financials, sales structure updates, and AI prospects pointed to further outperformance in the future.” Since then, AVGO’s total return has outperformed the S&P 500 (SPY) (SP500) by approximately 3 times. But since I updated my bullish thesis in June, AVGO stock went into a consolidation phase amid rising volatility, so AVGO is actually lagging behind the market since my last call:

Seeking Alpha, Oakoff’s coverage of AVGO stock

Despite the heightened volatility as I said above, I still believe Broadcom is one of the best AI plays to date as the recent corporate events clearly indicate that growth expectations for the company are likely well-founded, and we should expect more top-line growth, higher margins, and continued dividend growth supporting the high valuation multiples. So I decided to update my coverage today with a “Buy” rating as my main current thesis remains largely unchanged.

My Reasoning

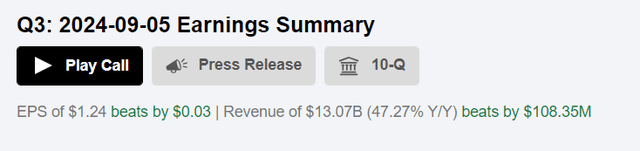

Broadcom reported for its fiscal Q3 FY2024 with revenue reaching $13.07 billion (+43% YoY, or +5% sequential rise), exceeding the consensus estimate of $12.96 billion – that wasn’t the heaviest beat of the past few quarters (AVGO beat by <1%), but the very fact looks impressive, given that analysts have been raising their estimates consistently since Q2. Of course, the inorganic part of the growth, coming from the VMware acquisition was the main driver with the organic part amounting to just 4% YoY, but still. Total costs of revenue went up by almost 74% YoY, so the gross profit surged less than the top line did – by just over 35% YoY in Q3. The operating expenses nearly doubled, amounting to $4.5 billion for Q3 alone, so Broadcom’s EBIT figure of ~$3.8 billion was actually a YoY decline of -1.7%. Despite the net loss on a GAAP basis, the adjusted diluted EPS of $1.24 was up 18% from the previous year and surpassed the consensus forecast of $1.21:

Seeking Alpha, AVGO

Certainly, not all business areas of AVGO were strong in Q3. Storage server connectivity and broadband faced challenges, with broadband revenue down 49% YoY. Despite these headwinds, Broadcom’s overall performance was bolstered by its diversified portfolio and strong AI growth, which more than offset these weaknesses. One of the key drivers of Broadcom’s success this quarter was its AI-related revenue, which remained robust at around $3.1 to $3.2 billion. This segment is on track to generate $12 billion in revenue for the fiscal year, up from earlier guidance of $11 billion.

Speaking of the Semiconductor Solutions segment, AVGO’s revenue on that front was $7.27 billion, with AI-related products accounting for >40% of this total amount. From what I see, Broadcom’s leadership in networking, particularly with Ethernet products and custom AI accelerators, has been a major growth area. Networking revenue alone was $4.0 billion, up 43% year-over-year, driven by “the demand for AI clusters and the transition to higher-speed networks.”

“Weaker demand and inventory reductions in the storage, broadband, and industrial chip end markets have partially offset strong organic AI chip growth”, as Morningstar analyst William Kerwin recently noted (proprietary source), but the management positively guided for sequential growth in the October quarter during the latest earnings call, and so we may expect multiyear rebounds to start meaningfully in fiscal 2025.

We expect Q4 semiconductor revenue of approximately $8 billion, up 9% year-on-year. For infrastructure software, we expect revenue to be about $6 billion. So we are guiding Q4 consolidated revenue to be approximately $14 billion, which is up 51% year-on-year.

We also expect this will drive Q4 consolidated adjusted EBITDA to approximate — to achieve approximately 64% of revenue. This Q4 guidance would imply we are raising the outlook for our fiscal 2024 revenue to $51.5 billion and adjusted EBITDA for the year to 61.5%.

I think Broadcom is indeed on track with its integration of VMware and cost-cutting measures, with guidance calling for a 64% non-GAAP EBITDA margin in the October quarter that we saw in the above quote. Also, the expectation that up to 40% of revenue will come from software suggests a favorable margin profile, which should support continued profitability, in my view.

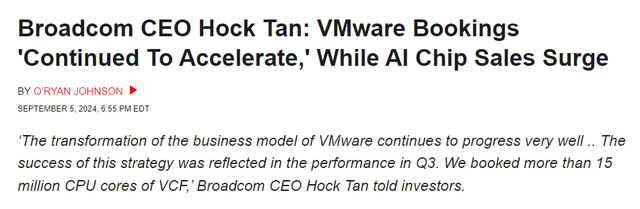

While some fellow SA analysts expect that “Broadcom’s termination of VMware’s perpetual license model and controversial pricing changes may drive partners to competitors”, it’s clearly not the case yet – the recently acquired VMware’s bookings “continue to accelerate”, according to the CEO and President Hock Tan. It doesn’t seem like the company’s preparing for a massive customer exodus, certainly having a differentiated and “moaty” business model.

CRN

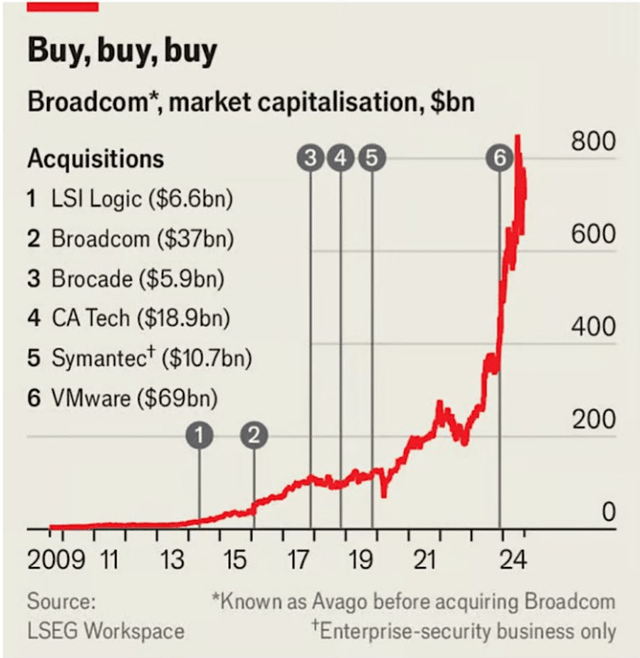

I believe Broadcom’s strategic focus on AI and infrastructure software, combined with its ability to adapt and integrate acquisitions like VMware, positions it well for sustained growth and further market share gains. This has been the case for the past few years, even before the AI hype began to dominate the market – Broadcom is a silent compounder, that has greatly expanded its portfolio through systematic M&A deals, so that today, in view of the growing demand for chips, it occupies a dominant position in certain niches and is unlikely to leave the “breeding ground” it has been creating for years to anyone else.

The Economist, shared on X

Another group of skeptics I read says that AVGO is an overvalued behemoth whose lofty valuation and limited FCF yield may limit future investors’ returns. I respectfully disagree with that.

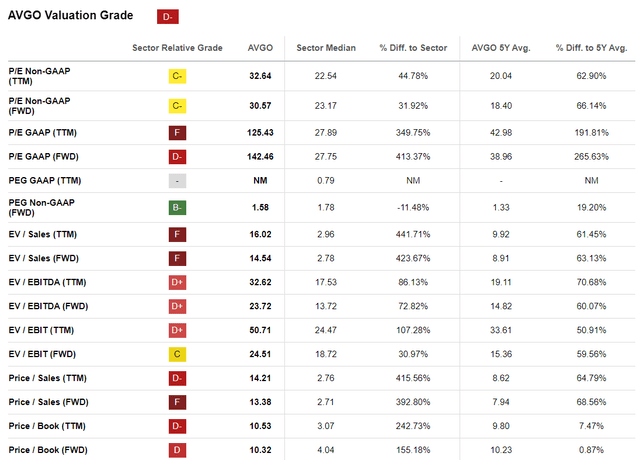

Indeed, Seeking Alpha Quant Rating says that AVGO is a “D-” stock in terms of its Valuation grade, trading at heavy 30.6x and 23.7x non-GAAP P/E and EV/EBITDA forward multiples, respectively.

Seeking Alpha, AVGO

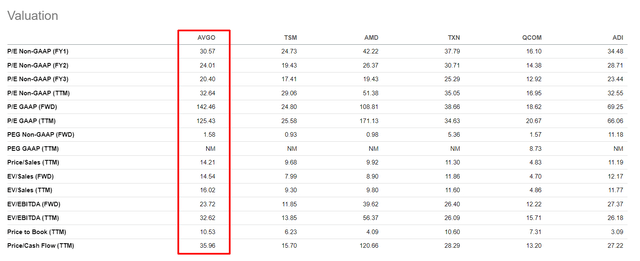

However, as Argus Research analysts noted in their recent update, peer group analysis shows AVGO trading below peers on EV/EBITDA and in line on P/E and price/sales. AVGO does have quite moderate multiples when we compare the stock to its closest peers:

Seeking Alpha, AVGO, notes added

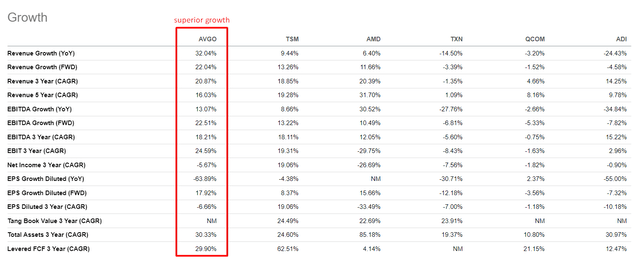

It should be noted here that Broadcom is now growing much faster and is higher-margined than in the past and has a fast-growing AI opportunity that didn’t exist 2-3 years ago. Therefore, its future growth rates are likely to experience a significant tailwind, which could theoretically easily justify an even higher valuation premium than AVGO has today. At the same time, when compared to the same group of peers that I cited above, Broadcom appears to fully justify its valuation based not only on the future but also on the present (i.e. TTM business growth rates):

Seeking Alpha, AVGO, notes added

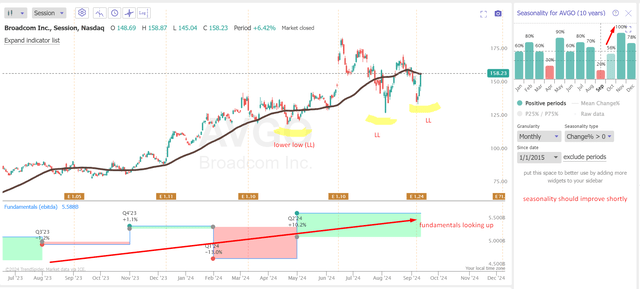

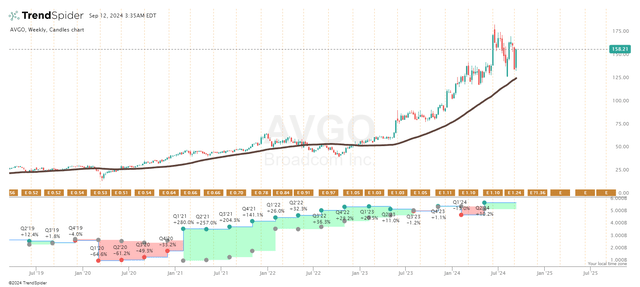

Speaking of technical analysis, I see on the daily chart that AVGO stock is consolidating around its long-term 200-day simple moving average. The price did not fall below the previous low during the last correction, which is a good sign for buyers. There is also a fundamental basis for future growth here – I wrote about it in the financial analysis part of today’s article above, and it is also shown on a separate small chart in terms of EBITDA growth. September is historically the weakest month of the year for AVGO: according to statistics from the last 10 years, AVGO has only grown 20% of the time in this month. From October until the end of the year, however, the seasonality for AVGO should change drastically:

TrendSpider Software, AVGO stock, Oakoff’s notes added

Based on both fundamental and technical analysis, as well as the current state of the industry, I believe Broadcom remains one of the top AI companies in the US today. Despite some challenges, the company’s strong position in the end markets supports my decision to rate the stock as “Buy” for the medium term.

Risks To My Thesis

As I noted in my previous articles, despite my positive view on the market for customized AI silicon chips and Broadcom’s market positioning from other peers, there are some key risks that any potential buyer of Broadcom stock should consider.

One major concern is potential competition from Nvidia (NVDA), which could impact Broadcom’s market share. As Morgan Stanley pointed out last quarter (proprietary source), there are press reports suggesting that Google (GOOG) could develop its own ASIC, possibly in collaboration with MediaTek, which could jeopardize Broadcom’s Google TPU business. There is also the risk of a continued downturn in semiconductors and challenges in integrating VMware into its portfolio that we shouldn’t ignore.

Although the company has been conservative in its customer assessments – we can see that from the earnings call – any EPS shortfalls could lead to massive multiple contractions.

I’m also confused by the fact that AVGO shares look quite stretched on a weekly timeframe, technically speaking: The stock may go through a longer consolidation phase, and for new buyers, now may not be the best time to buy. But again, the fundamentals look good and may more than justify such kind of a move.

TrendSpider Software, AVGO stock, Oakoff’s notes added

Your Takeaway

I believe Broadcom’s significant advantage lies in its proactive management, which has ensured sufficient diversification and expansion of its portfolio. Notably, the company ventured into artificial intelligence offerings well before the hype surrounding AI began. Recent business expansion deals should have a strong positive impact on the firm, as evidenced by the latest financial statements showing current business growth. According to management guidance, this growth is projected to continue into FY2025 and possibly beyond.

Despite the stock trading at over 30 times next year’s earnings, I don’t believe it is overvalued right now. In fact, compared to its peers, AVGO appears to be in a more favorable position. In my opinion, this is one of the leading AI companies currently, deserving of investors’ attention. Therefore, I reaffirm my “Buy” rating and eagerly anticipate updates from Broadcom.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.