Summary:

- eBay is one of the dinosaurs of online retailing. Despite not being a growth company, it is still well alive.

- Its stock has seen a strong uptrend since the separation with PayPal in mid-2015 – mainly due to aggressive buybacks. However, its user base is crumbling.

- All in all, the EBAY stock seems to be more of a melting ice-cube at a premium price than a deep value bargain.

ymgerman

Introduction

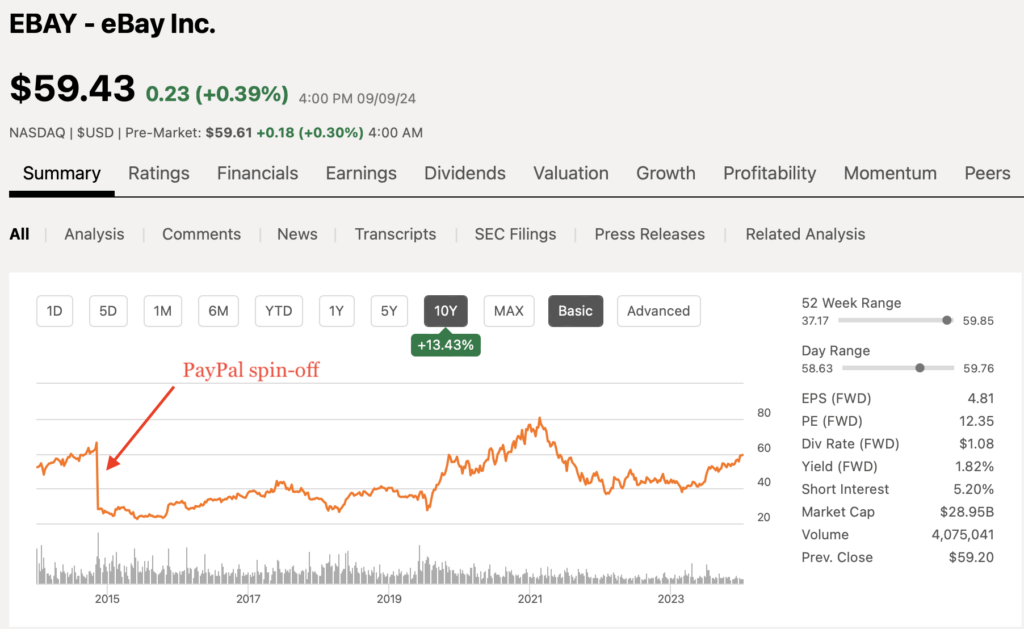

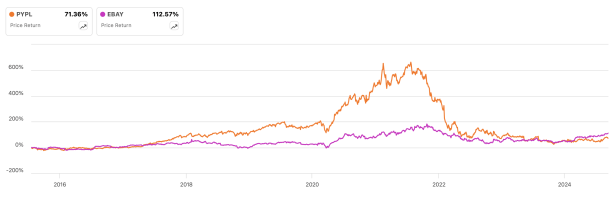

I’m tempted to say that (almost) everyone knows eBay (NASDAQ:EBAY). The online retailing dinosaur, which was once declared dead due to explosively growing and more modern competitors, is still alive. In fact, it’s even the most profitable of such platforms. Not noticed by many, its stock has been climbing up to the second-highest point after the separation with PayPal. In fact, it even outperformed PayPal (PYPL) by more than 50 percentage points since the separation in 2015. Speak of surprises!

With the momentum being upwards, the market doesn’t seem to expect it to be dying, either. However, looking at a few critical numbers, this does not add up for a lucrative case. Read below for a detailed investment assessment.

Long live the dead

As a first step in my research process for this analysis, I briefly thought about my personal online shopping behavior while being reminded of Peter Lynch and his boots-on-the-ground research regarding – in his times physical – retail stores.

It might be shocking to some, but I must confess that I am at least buying as often from eBay as from Amazon (AMZN). Without a doubt, I may be a big outlier, but the latter hasn’t become the “everything store” for me. I am also reluctant to go for a prime subscription as I personally try to avoid too many of these convenience offerings.

From time to time, though, it makes absolute sense for me to order something from eBay, especially when I am searching only for one particular item or book instead of being indirectly forced to buy more stuff only to reach the threshold for free shipping. That’s how I came to the idea of looking at the stock of eBay.

Seeking Alpha

On the chart above, we can make the observation that the general long-term trend is up – and not down like one might be tempted to assume. Since eBay and PayPal went separate ways, eBay’s stock has doubled until today.

And not only that, it has even left PayPal way behind it:

Seeking Alpha

Valuation matters – sooner or later!

Though not a brutal growth story, it does not look like a dying one, either. Leaving the tech and internet bubble of 2021 aside (at least for small and mid-sized companies), eBay’s stock has even reached its highest level. There must be something in it; otherwise, the stock wouldn’t be consistently rising for years.

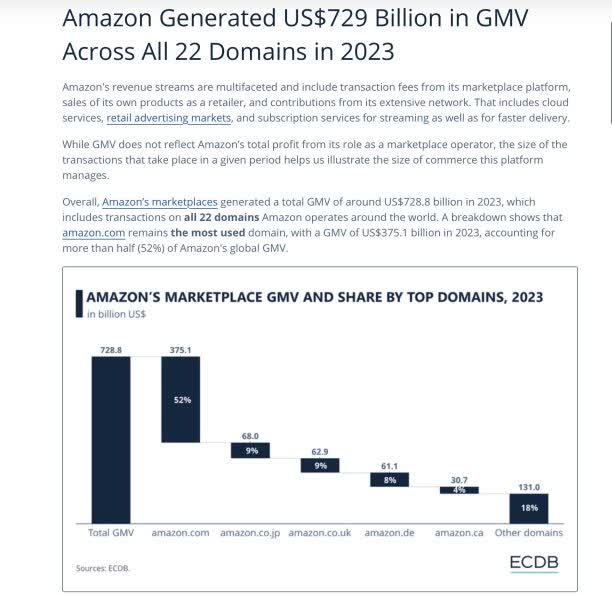

Before we dive into the company’s financial statements, first for a better comparison, eBay’s gross market value (GMV), i.e. the value of all traded items on its platform in 2023 was $73 billion. USD. In comparison, Amazon as a whole with all its 22 domains saw $729 billion in GMV and about half of that on amazon.com alone.

Or, in other words, eBay today is only a tenth of Amazon using this metric.

ECDB

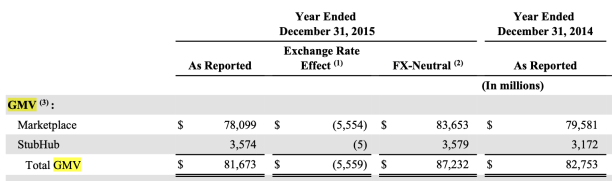

On one side, we see a big difference, but on the other, it is surprising to see eBay still being relevant. As it seems, I am not the only buyer on eBay. eBay says in their latest annual report that they have 132 million buyers on their platform. Also, part of the truth is, though, that eBay had a higher GMV ten years ago with $82–83 billion in 2014 and 2015 each, so this figure is down by 10% over the last decade. It is an important yardstick because platforms like eBay or Amazon take their cut in the form of fees from it.

eBay annual report 2015

I purposefully did not use the equity market capitalization of eBay (~$29 billion) and Amazon ($1,800 billion or 60x eBay), as it is misleading due to Amazon being way more than a pure-play online retailer. The more so, as the money is earned in its cloud segment – one that eBay lacks.

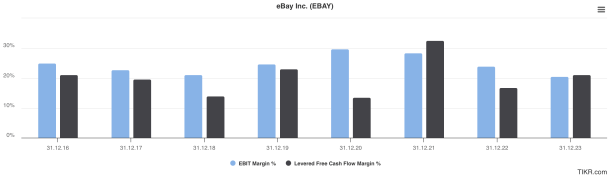

What is interesting and astonishing, though, is operating profitability. Despite GMV being down, we can see that eBay has been able to generate operating margins of at least 20% in each year since having spun off PayPal. Free cash flow generation also looks fairly strong with double-digit values, though it’s more volatile.

TIKR

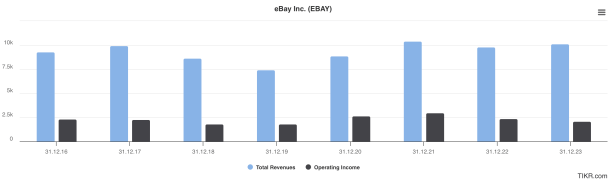

Having in mind that GMV is down over the last decade, it is quite an achievement to see that eBay was able to, even though only slightly, increase its sales over the same time period. With around $10 billion in sales, we do not need to start a discussion about that compared to Amazon – these are almost peanuts.

TIKR

But as said, eBay is very profitable, sales have not been declining and expectations are rather low for the stock as the PE ratio of only 12x (see the first chart above) suggests.

Financials: balance sheet, cash flow and buybacks

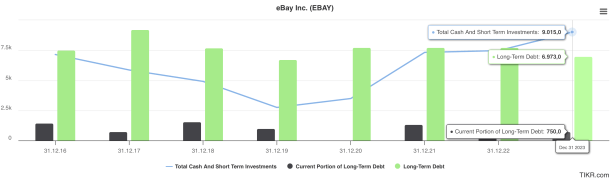

First of all, eBay has been a serial acquirer of lots of smaller companies, as this list on Wikipedia (see here) shows. From time to time, they also dispose of some assets, but all in all, eBay remains what it is – eBay. Going a bit deeper into the numbers, we can see that by the end of 2023, eBay had a balance sheet with about $1.5 billion in net cash.

TIKR

As per the latest numbers (30 June 2024), this has changed a bit. The numbers flipped to a small net debt position of $2.5 billion (with $5 billion of cash, $7.6 billion in financial debt).

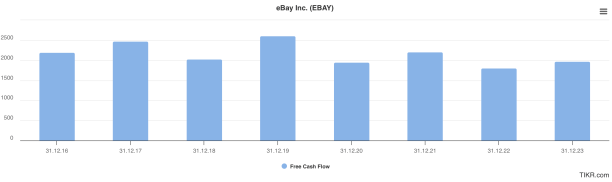

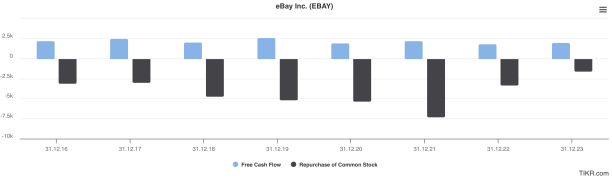

Free cash flow generation is the next key topic to have a look at. We don’t see any growth, but it is fair to say that eBay is able to hold the numbers steady – more or less, with roughly $2 billion in annual free cash flow. Putting the debt number against it, the balance sheet looks stable.

TIKR

Not only since eBay was pressured by activist investors Elliot Management and Starboard Value (see here, here and here), has the company been buying back its own stock frequently. We can see that in most years, the total amount spent on buybacks even exceeded total free cash flow generation. Nonetheless, until this day, eBay’s balance sheet is only modestly leveraged, as they also sold occasionally some assets.

TIKR

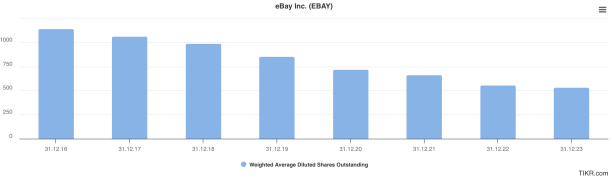

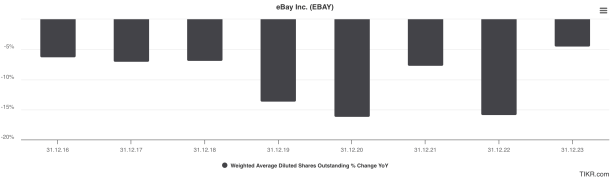

The bottom line is that the share count has dropped massively. If you’re looking for an example of a beast or a cannibal, look no further than eBay. Stock outstanding decreased from 1.1 billion to 0.5 billion, or more than 50% in not even eight years!

TIKR

In every year with the exception of 2023, the share count dropped by at least 5%, on three occasions even by more than 10%. During 2024, the number is until now –2.5% – the pace is being kept up.

TIKR

Bull thesis on shaky ground

There are a few things that make this seemingly good-looking set-up a too risky adventure.

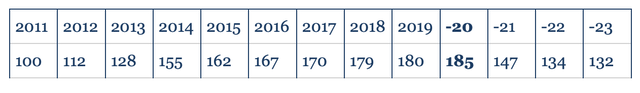

First of all, the active user base. So far, we’ve seen GMV and the figure of 132 million buyers from the latest annual report. The issue here is that this number has been declining as of late at a rather too high pace for me. I checked it for all years since 2011 and put them down in the following table (until 2014 called “active users”, and since then “active buyers”; numbers in the second row all in millions):

own table, data from annual reports since 2011

In 2021, eBay sold its assets of StubHub, a non-core ticketing service, for $4 billion, and that’s why the drop in active user numbers might look a bit harsher than it was on an adjusted basis. However, we can see that in the following years, the decline continued.

Over the years, I started to develop a rather negative feeling when I see a company which depends on an at least stable, but ideally growing user base. In the case of eBay as is, the company is back to 2013–2014 in terms of its active user base, which is not what I like to see.

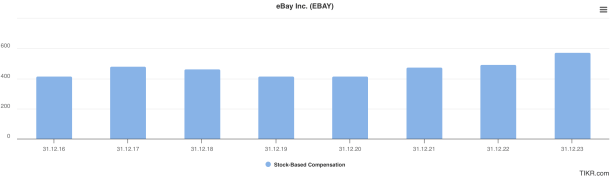

Point number two is free cash flow and the valuation. Free cash flow numbers need to be adjusted for stock-based compensation (SBC), which has been rising over the last years.

TIKR

So if we pull out the ~$600 million in SBC, the effective free cash flow for shareholders is about $1.5 billion, or about a quarter less for FY 2023. Over the last twelve months, the trend has even worsened, as free cash flow minus SBC has even dropped to below $1 billion.

Nonetheless, let’s be generous and use last year’s number of $1.5 billion (after subtracting SBC), and putting that against an enterprise value of ~$32 billion (market cap ~#29 billion, net deb ~$3 billion), this definitely does not look like a bargain with a multiple of ~20–21x.

Even adding strong buybacks of 5–10% p.a. into the calculation (assuming they will continue, but realistically at current prices rather on the lower end) with lackluster top-line growth, it is not possible to convince me of this case. So, we are not having a lucrative deep value play here, despite at low-looking 12x PE ratio.

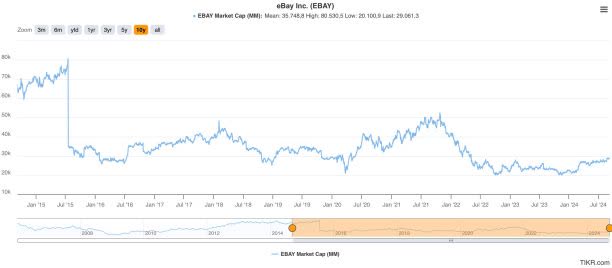

And third: development of the total market cap over time. As net debt is low, we can use the equity market cap.

TIKR

It only makes sense to draw a conclusion since the PayPal spin-off in mid-2015. Since then, eBay’s market cap has fallen and despite its recent run (of its stock), the entire market cap is still somewhere in the bottom half during this time span. Above, we can see that the thesis of eBay seeing a long-term uptrend at the latest at this point cannot be defended anymore. The stock is trending higher due to massive buybacks, similar to the case I presented last week.

Buybacks, of course, are not bad per se, as neither I nor my readers (likely) are interested in buying the whole company, but only pieces of it. Nonetheless, with too many headwinds (especially falling GMV and active buyers), combined with a rather maxed out valuation and on top now consumer sentiment also rather weakening, I am folding at this point. It looks promising at first sight, but it is rather a melting ice-cube at a premium price.

Risks to my thesis

eBay still has a decent user base, is highly profitable, and it comes with a strong balance sheet. Aggressive buybacks have helped the stock to climb up and there is currently no indication this could end.

Conclusion

eBay’s stock has seen a strong uptrend since the separation with PayPal in mid-2015, mainly due to aggressive buybacks. However, its user base is crumbling. All in all, this appears to be more of a melting ice-cube at a premium price than a deep value bargain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.