Summary:

- NIO is in a liquidity crunch with current liabilities higher than its cash balance, which could see it resort to a dilutive capital raise in the next 2 quarters.

- NIO’s 3-brand strategy could help boost delivery volumes, but could lead to margin contraction.

- I expect NIO’s losses to increase as it increases its marketing spend to drive demand for the ONVO L60, set to launch on September 19.

- The opening of a third factory in Q3 2025 could have a negative impact on vehicle margins and operating costs.

- My price target for NIO is $2.93, representing a 45% downside from its current valuation.

tang90246

Last February, I was bearish on NIO Inc. (NYSE:NIO) due to its market share loss in China, its main market, its investments in the loss-making battery swapping business, and lackluster expansion in the European market. Following my coverage, NIO reached a 52-week low of $3.61, before surging recently on the back of its Q2 earnings that were highlighted by improving margins and better cost management. Despite this, I expect the company’s losses to increase in the coming quarters due to the upcoming launch of the ONVO sub-brand’s L60 model, that targets China’s mass market, on September 19.

While this endeavor could help boost delivery volumes, it would come at the expense of higher marketing costs, margin contraction, and possibly cannibalizing ES6 sales, NIO’s best-selling model, in my opinion. Moreover, I expect NIO to raise capital in the near future to deal with its current liabilities, which are significantly higher than its current cash balance. For these reasons, I’m reiterating my sell rating with a price target of $2.93 per share, implying 45% downside from current levels.

Q2 Overview

In Q2, NIO reported YoY revenue growth of 99% to $2.4 billion driven by an 118% increase in vehicle sales, and QoQ growth of 76%, also driven by an 87% increase in vehicle sales. During the quarter, NIO generated $2.2 billion from vehicle sales as it delivered a record 57,373 vehicles compared to 30,053 in Q1 2024 and 23,520 in Q2 2023.

In terms of margins, NIO reported a vehicle margin of 12.2% in Q2 compared to 9.2% in Q1 and 6.2% a year ago, due to lower material costs and realizing the benefits of economies of scale during the quarter. As a result, total gross margin in Q2 was 9.7% compared to 4.9% and 1% in the prior quarter and year, respectively.

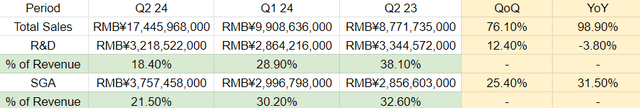

Looking at NIO’s cost structure, R&D costs declined 3.8% YoY to $442.9 million, however, that represented an 11.6% QoQ increase from $396.7 million. Meanwhile, SG&A costs increased 31.5% YoY and 25.4% QoQ to $517 million due to higher personnel costs and sales and marketing activities. Despite this, R&D costs represented 18.4% of total revenue, compared to 38.1% a year ago and 28.9% in Q1. Similarly, SG&A costs represented 21.5% of total revenue compared to 32.6% and 30.2% in the prior year and quarter, respectively.

Accordingly, NIO reported an operating margin of -29.9% in Q2, a significant improvement from -69.2% a year ago and -54.4% in Q1.

For Q3, NIO expects deliveries to be between 61-63 thousand and revenues between $2.63-$2.7 billion, representing YoY growth between 0.2-3.2%.

Liquidity Concerns

At the end of Q2, NIO had $5.7 billion in cash, restricted cash, short-term investments, and long-term time deposits, compared to $6.3 billion at the end of Q1 and $8.1 billion at the end of Q4 2023, meaning that NIO’s cash burn during the quarter was around $600 million. At this rate, NIO should have enough cash to last 9 quarters. However, it should be noted that the company has more than $6.9 billion in current liabilities which must be paid within 1 year. In comparison, the company has short-term liquidity of only $5.5 billion and total liquidity of $6.25 billion.

|

Cash |

$3,392,295,000 |

|

Restricted Cash |

$507,663,000 |

|

ST Investments |

$1,598,439,000 |

|

ST Liquidity |

$5,498,397,000 |

|

LT Restricted Cash |

$13,777,000 |

|

LT Investments |

$739,756,000 |

|

LT Liquidity |

$753,533,000 |

|

Total Liquidity |

$6,251,930,000 |

Based on NIO’s available short-term liquidity, it has a $1.4 billion liquidity gap to fulfill its current liabilities. As such, I expect NIO to raise capital either in Q4 2024 or Q1 2025, which would be extremely dilutive to its shareholders. At the current share price of $5.28, raising $1.4 billion would entail the issuance of more than 265.7 million shares, which would increase its outstanding shares by 13%.

That said, NIO is set to launch the first model under its new sub-brand, ONVO, later this month and intends to launch another sub-brand, Firefly, next year, which could see NIO’s sales and marketing spend increase in the coming quarters, as I will discuss later in the article. As such, I believe NIO needs a cash injection of at least $3 billion in order to pay its current liabilities and continue funding its operations. This would result in NIO’s outstanding shares increasing by 28% at the current share price.

|

OS |

2,049,836,045 |

|

Share Price |

$5.28 |

|

Forecasted Capital Raise |

$3,000,000,000 |

|

Potential Dilution |

568,181,818 |

|

Dilution % |

28% |

In my opinion, NIO is likely to receive these funds from Abu Dhabi-based CYVN Holdings, which already owns a 20.1% stake in the company following its nearly $3 billion investments in NIO last year. I believe that could be the case due to CYVN’s interest in maintaining its ownership position in the company, since such a capital raise would significantly dilute its stake. As is, CYVN is entitled to nominate 2 directors to the company’s board as long as it owns more than 15% of NIO’s outstanding shares.

The ONVO Drag

Since its inception, NIO has been mainly focused on offering premium EVs with a starting price of more than RMB 300 thousand. However, the company is now attempting to penetrate the Chinese mass market with 2 new sub-brands.

The first sub-brand, ONVO, is set to launch its first model, the L60 on September 19, and the company plans to release a new model every year. At the same time, NIO plans to start deliveries of its second new sub-brand with the codename Firefly, in 2025.

According to NIO’s strategy, models under the ONVO sub-brand will have an ASP ranging between RMB 200-300 thousand. Meanwhile, models under the Firefly sub-brand will have an ASP ranging between RMB 100-200 thousand. In this way, NIO would be able to offer EVs ranging from RMB 100-800 thousand across its 3 brands.

Although this endeavor could boost NIO’s deliveries, I believe it will be a headwind to the company’s margins and bottom line. In the Q2 earnings call, management shared that ONVO deliveries will be minimal in Q3 and will ramp up to reach near 10 thousand per month in December and 20 thousand per month sometime in 2025.

Meanwhile, CEO William Li previously shared that ONVO will start contributing positively to NIO’s “P&L” when it reaches a sales volume of 20 thousand units per month. Accordingly, I expect NIO’s vehicle margin to contract significantly starting Q4 until ONVO reaches the targeted sales volume, as until then, it’s likely that NIO will realize a negative margin on ONVO sales. Even then, I don’t expect NIO’s vehicle margin to improve until the NIO brand reaches a sales volume of 40 thousand per month, due to the lower margins of the ONVO sub-brand since its ASP is much lower than the ASP of the NIO brand.

As is, management shared their long-term margin targets for each brand, with 25% for the NIO brand from 40 thousand deliveries per month, and 15% for the ONVO brand without stating the sales volume required to reach this target. Moreover, NIO’s vehicle margin could further contract when it launches the first model under the Firefly sub-brand which will have an ASP between RMB 100-200 thousand.

Given that management is forecasting ONVO’s long-term margins at 15%, Firefly is very likely to have an even lower margin, which I estimate to be around 10% in the best case. When combining these factors with NIO’s service segment, which is yet to post a positive gross margin, I don’t see a scenario where NIO’s overall gross margins significantly improve than the 9.7% reported in Q2.

Another reason why I expect NIO’s margins to contract is ONVO’s L60 potential to cannibalize sales of NIO’s best-selling model, ES6, due to the similarities between both vehicles. At the end of July, NIO’s cumulative deliveries were 557,518, including 219,422 for the ES6 alone, meaning that the ES6 is responsible for 39.4% of NIO’s total deliveries since its inception.

Looking at both vehicles’ specs, the entry level ES6 boasts a CLTC range of 450-500 KM with dimensions of 4,854 mm*1,995 mm*1,703 mm, and a trunk size of 579 L. In comparison, the ONVO L60 will come in 3 range variants:

-

Standard range with 555 KM.

-

Long range with 730 KM.

-

Extra Long Range with 1000+ KM.

The ONVO L60 also has dimensions of 4828 mm*1930 mm*1616 mm, which is somewhat similar to the ES6. The only major differences between both vehicles are technology, trunk size, since the ONVO L60 doesn’t have a trunk, and price. While the entry level ES6 has an ASP of RMB 338 thousand, the ONVO L60 will have an ASP of RMB 219.9 thousand, 35% cheaper than the ES6.

I believe the significant price difference and the minimal difference in value proposition between both models could be a factor contributing to ONVO L60 cannibalizing ES6 sales in China due to the nature of the Chinese consumer. It is well known that Chinese consumers are value oriented, meaning that they are more concerned with getting the best value for their money. This view is supported by insights from Premia Partners, which shows that frugality has become a trend among young Chinese consumers, the main driving force of China’s consumer market.

In that case, NIO’s vehicle margins could deteriorate significantly, as this scenario would see the company’s revenue per vehicle decline due to the significant price difference between the L60 and the ES6. This would be concerning for NIO, in my opinion, since its revenue per vehicle has been constantly falling as it stood at RMB 273.3 thousand in Q2 compared to RMB 305.5 thousand in the prior year and RMB 278.9 thousand in Q1.

|

Period |

Q2 24 |

Q1 24 |

Q2 23 |

|

Deliveries |

57,373 |

30,053 |

23,520 |

|

Vehicle Rev |

RMB¥15,679,623,000 |

RMB¥8,381,318,000 |

RMB¥7,185,214,000 |

|

Rev/Del |

RMB¥273,293 |

RMB¥278,885 |

RMB¥305,494 |

In addition to potential margin contraction, NIO could see its operating costs, mainly SG&A, due to potentially higher marketing costs to stimulate demand for the ONVO sub-brand. In Q2, NIO’s delivery growth of 144% and 91% YoY and QoQ, respectively, was mainly driven by higher marketing spend of 31.5% and 25.4% YoY and QoQ, respectively. The company cited in the Q2 earnings call that the QoQ increase in SG&A was a direct result of higher marketing spend following the launch of the new ES6 model and other products in March and April.

With the company now launching a new sub-brand, I expect its marketing spend to grow at a higher rate, as the ONVO brand isn’t as recognizable as the NIO brand. Therefore, the company would have to increase its marketing spend to build awareness of the ONVO brand, establish a brand identity, and attract customers. The same will also apply when NIO launches its second sub-brand, Firefly, next year, which means that it might be on track to incur high SG&A costs over the coming 6 quarters at least.

NIO’s SG&A costs will also be impacted by the upgrade of its F2 factory to double shifts to support the production of L60, with the upgrade expected to be completed later this month or early October, per management in the Q2 earnings call. The company also expects to start production in its third factory by Q3 2025, which will impact both vehicle margins and SG&A costs.

In terms of margins, producing vehicles in 3 factories would increase NIO’s fixed costs such as utilities and maintenance, which will be a drag on margins until NIO is able to operate at full capacity. In terms of operating costs, producing vehicles in 3 factories will certainly lead to more costs related to hiring additional labor, managers, engineers, and technicians.

When combining these factors with NIO’s margins potentially contracting due to the new sub-brands, the company could realize more losses until it is able to produce and sell vehicles at an optimum level, which may take years to materialize. Considering the company’s liquidity position, NIO might have to resort to additional dilutive capital raises in the future to fund its operations, especially since it appears to be far from generating any profits or cash flow.

Valuation

With $4.99 billion in cash and $4.56 billion in debt, NIO has an EV of nearly $10.4 billion at its current share price of $5.28. Given that the consensus revenue estimate for the company in FY 2024 is $9.82 billion, the stock would be trading at an EV/sales multiple of 1.06.

|

OS |

2,049,836,045 |

|

Share Price |

$5.28 |

|

Market Cap |

$10,823,134,317.60 |

|

Cash |

$4,990,734,000 |

|

Debt |

$4,558,006,000 |

|

EV |

$10,390,406,318 |

|

Revenue Estimates |

$9,820,000,000 |

|

EV/Sales |

1.06 |

In comparison, Chinese EV makers Li Auto (LI), BYD (OTCPK:BYDDF), and ZEEKR (ZK) are trading at the following EV/sales multiples.

|

Company |

EV/Sales |

|

LI |

0.41 |

|

BYDDF |

0.94 |

|

ZK |

0.35 |

|

Average |

0.57 |

By using the average EV/sales multiple of NIO’s competitors, my price target for the stock is $2.93 per share, implying 45% downside from its current valuation.

|

NIO Price Target |

|

|

Projected Sales |

$9,820,000,000 |

|

Target EV/Sales |

0.57 |

|

Implied EV |

$5,564,666,667 |

|

Net Cash |

$432,728,000 |

|

Equity Value |

$5,997,394,667 |

|

OS |

2,049,836,045 |

|

Price Target |

$2.93 |

|

Share Price |

$5.28 |

|

Downside |

-45% |

Technical Analysis

Looking at NIO’s daily chart, the stock has been in a downtrend since August 2023 and started forming a descending triangle pattern last April. Following the company’s Q2 earnings results, NIO broke out of the downtrend, the descending triangle pattern, and the upper Bollinger band, a sign of high volatility. That said, the stock has failed to break through a key resistance level, the 200 EMA, with the RSI regulating, which can be a sign of the stock losing momentum.

Therefore, I recommend waiting for a break of the 9 EMA support level for investors looking to enter a short position, as breaking this support level could see the stock test the 0.618 Fibonacci retracement level near $4.4 and potentially the $3.66 support in the near-term.

Upside Risks

Risks to my thesis include NIO receiving non-dilutive funding to deal with its current liabilities either through debt financing or receiving a bailout from the Chinese government similar to the $1.4 billion injection it received from the municipal government of Hefei in 2020. Another risk to consider is NIO perfecting its 3-brand strategy by gaining significant market share in China’s mass market through ONVO and Firefly. In that case, NIO could grow its topline rapidly and expand its vehicle margins, which would help offset the expected increase in operating costs, possibly leading to improved bottom-line performance.

Conclusion

While NIO’s Q2 earnings showed signs of disciplined cost management, I remain bearish on the stock due to the company’s liquidity concerns, as well as potential vehicle margin contraction and higher losses. The company’s cash balance is insufficient to pay off its current liabilities, and with the launch of the ONVO L60 on September 19, NIO is very likely to increase its marketing spend in the coming quarters to drive demand for the new sub-brand.

Moreover, the L60 might have negative margins until it reaches a sales volume of 20 thousand per month, the target set for the new sub-brand to start contributing positively to “P&L”, per CEO William Li. The L60 could also cannibalize sales of NIO’s best-selling model, ES6, due to the similarities between the 2 models, especially as the L60 is 35% cheaper than the ES6, which would negatively impact NIO’s margins. In light of these factors, I’m reiterating my sell rating for NIO with a price target of $2.93, representing 45% downside from current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.