Summary:

- PayPal’s stock has taken a beating in the last year–but the market may have taken things too far.

- Secular growth trends are on PayPal’s side.

- Management is working with activist hedge fund Elliott Management to increase shareholder value.

- Despite the drop in stock price, PayPal’s business remains profitable and should continue to grow.

Justin Sullivan

Shaking Off 2022

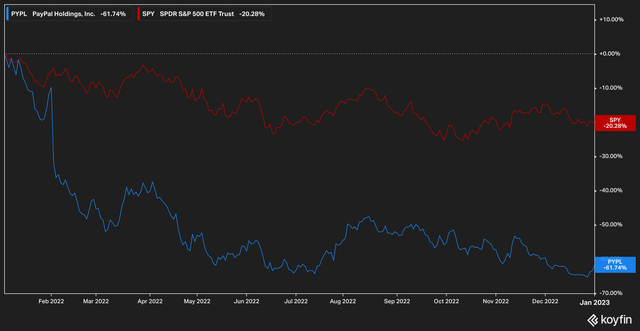

Like most other tech companies, PayPal’s (NASDAQ:PYPL) 2022 was a year to forget. The stock plummeted by over 60% against a backdrop of rising interest rates and recession fears.

PYPL vs SPY 2022 Performance (Koyfin)

In our view, the selloff of last year was warranted (the company had been trading at over 60x forward earnings), but alas, the market now seems to have gone too far. We believe that PayPal is attractively priced at these current levels, that activist investors will assist management in producing solid results and margins, and that the company has many years of runway ahead of it. All of this, in our view, presents a compelling case for investors.

Slowing Growth – For Now

PayPal’s fall in price from its high of just above $300 to its current level just south of $80 is a result of slowing growth. Most analysts expect PayPal’s 2022 revenue to have grown only 8% from 2021 levels, a rate which falls far short of the company’s historical record of delivering double-digit growth rates. Further, consumer softness across the U.S. economy, worsening macro conditions around the globe, and tales of woe from retailers that this past holiday season was slower than usual have contributed to the steady downward pressure on the stock.

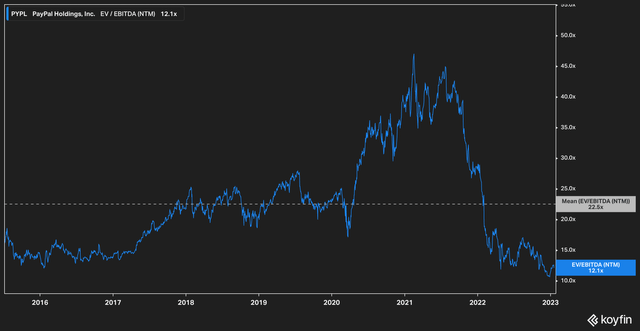

This pressure has reduced PayPal’s valuation to levels not seen since, well, ever in the company’s publicly traded history. PayPal currently trades at a 12.1x EV/EBITDA multiple, far below its historical mean of 22x.

Based on the chart above, someone with no knowledge of PayPal’s business might be forgiven for assuming that PayPal is just another tech-wreck–an unprofitable and overvalued company that soared too close to the sun only to be brought down by rising interest rates. But of course, they would be wrong.

To demonstrate the scale of the overreaction the market has had with PayPal, let’s go back to the last time the stock traded close to 12x EV/EBITDA, which was around 2016. In that year, PayPal recorded $10.8 billion in revenue with an EBITDA of $2.1 billion. Fast forward to today, where the stock trades at an even lower multiple: PayPal is expected to report $27 billion in annual revenue and just over $4 billion in EBITDA in 2022.

This, to us, demonstrates the madness of the market–the company’s sales have nearly tripled while EBITDA has doubled in the last seven years. The company’s profitability has remained intact, and the balance sheet is a model of good health. Can anyone reasonably say that the company today deserves a lower multiple than it did in 2016? We remind readers that the company has not stopped growing, only that growth is expected to slow to the high-single digits for 2022.

Growth Will Return

Amidst the gloom of recent headlines that this past holiday season was a bit of a flop, it might be surprising to know that it held signs of hope for PayPal’s business, which we believe will reflect positively on the company’s upcoming earnings report.

Mastercard’s (MA) analytics unit SpendingPulse recently reported that, despite the blaring negative headlines, spending was actually up nearly 8% year-over-year during the holiday season. What’s more, PayPal’s niche–e-commerce spending–was the highest performing category, clocking in nearly 11% increase.

Holiday Spending Increase by Category (SpendingPulse)

Further, e-commerce represented 21.6% of total estimated retail sales, up from 20.9% in 2021. These trends aren’t glitches–they are part of a larger, high-level behavioral shift in buying trends that will continue for several years and which will directly benefit e-commerce payment solution providers like PayPal.

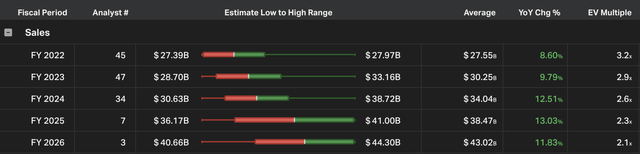

Analysts also expect that double-digit top line growth will return to PayPal within the next few years.

PYPL Analyst Revenue Consensus (Koyfin)

By FY2024, the consensus view among 34 analysts is that the company will post a 12.5% top-line gain year-over-year. True, these levels are lower than the 20-something-percent growth rates of years past, but they are sustainable, and they mark a critical transition of PayPal from a scrappy growth company with uncertain prospects as a publicly traded company to one that is solidly part of the e-commerce firmament.

To bolster this growth, PayPal has also taken steps to further penetrate the market–the company recently announced a partnership with Amazon that allows customers to make purchases with Venmo.

Prudent Management

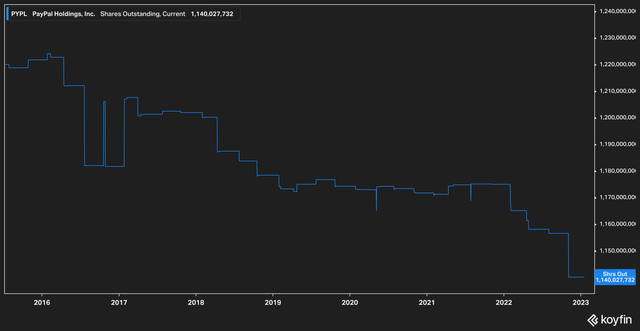

PayPal is also unique among tech companies in that it is consistently profitable. Management has proven themselves to be very good allocators of capital. PayPal is also unique among Silicon Valley companies in that it doesn’t suffer from an over-reliance on dilutive stock-based compensation. In fact, over the years, PayPal’s outstanding share count has had a net decrease.

PYPL Outstanding Shares (Koyfin)

This chart is as startling to us as it is appealing. Even a cursory examination of a few tech companies’ historical share counts–Snap (SNAP), Meta (META), Salesforce (CRM)–shows that, generally, tech companies over-compensate their employees with stock at shareholder’s expense. Not so at PayPal.

Executives at PayPal also show no signs of reversing this trend. In August the company announced that the pace of buybacks would increase dramatically with $15 billion authorized for share repurchases. This announcement coincided with a second, high-profile revelation.

Enter The Activists

When PayPal announced its buyback authorization, it was also made known that Elliott Management had taken a sizable stake in the company. For those unfamiliar, Elliott Management is a hedge fund run by Paul Singer which often runs high-profile proxy battles and has high demands of management (Singer once, famously, seized an Argentinian warship as part of his dispute with the country over its defaulted debt).

The mere announcement of Elliott’s involvement in a company is usually enough to give the stock a positive boost. Thankfully, Elliott appears to be working well with management. The hedge fund and the company have entered into an information sharing agreement and are holding constructive dialogues about the forward path for PayPal.

So far, we have little to go on about Elliott’s intentions, but investors can rest assured that management will feel pressure to perform while Elliott is around.

The Bottom Line

While we believe that the 2022 selloff from dizzying highs was justified, it is our view that the market has now gone too far. The current situation provides an attractive entry point for investors who think PayPal is making the right moves in a changing and growing e-commerce landscape.

Some risks to our thesis include a deeper-than-expected recession that drives consumer spending much lower than anticipated. Even in this case, however, we expect that negative effects would be short-term in nature. Longer-term risks include new or disruptive entrants into the e-commerce payment processing market. On this front, we believe that partnering with Amazon was a good preemptive move.

Our main case for PayPal is as follows:

- PayPal is trading at the lowest EV/EBITDA valuation in its publicly traded history.

- The market share of e-commerce transactions vs. physical ones will continue to grow.

- PayPal’s management team has shown themselves to be very good allocators of capital.

- The specter of Elliott Management will keep management even more focused on creating shareholder value.

We think the stock has long-term room to run and have a target price of $110, which would price the stock at 20x its expected FY2024 earnings.

For the reasons outlined above, we think PayPal’s best days are ahead and that the stock is worth a closer look from investors at these levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.