photoman/iStock via Getty Images

With Johnson & Johnson (NYSE:JNJ) taking the lead, Big Pharma returned to dealmaking in H1 2024 even as the number of M&A deals in the life science sector dropped over the period, healthcare data analytics firm Iqvia (IQV) said in a report this week.

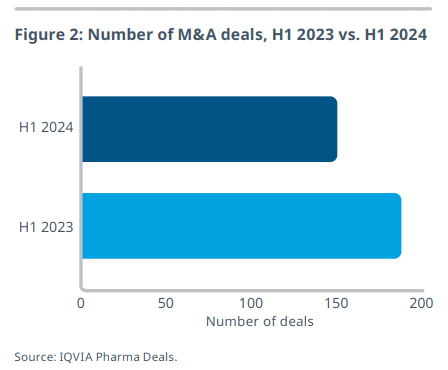

Unveiling its Pharma Deals Half-Year Review, the contract research organization said that while the number of M&A deals announced by life science companies dropped 20% from H1 2023 to H1 2024, their median and mean values sharply increased.

However, the overall dealmaking activity remained muted during the period as macroeconomic uncertainties discouraged cautious dealmakers.

The total value of all M&A deals signed during the period dropped 12% to $89.3B, including Pfizer’s (PFE) $43B agreement to acquire cancer drugmaker Seagen in Q1 2023.

However, excluding the PFE-Seagen mega-merger, both mean and aggregate total deal value rose 54% YoY in H1, while the median deal value, which removes the effects of outliers, jumped 307%. Meanwhile, 23 M&A deals surpassed $1B in value, compared to only 15 a year ago.

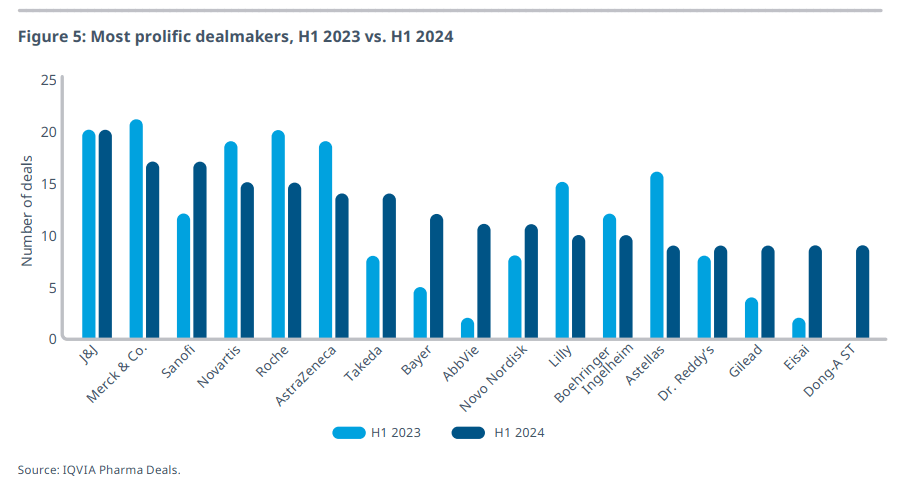

With 20 publicly announced deals, J&J (JNJ) became the top dealmaker during H1 2024, overtaking Merck (NYSE:MRK), the winner of H1 2023.

JNJ’s dealmaking activity was primarily focused on cancer and immunology, with the New Jersey-based healthcare giant adding antibody-drug conjugate (ADC) developer Ambrx Biopharma and bispecific antibody developers Proteologix and Yellow Jersey Therapeutics.

Meanwhile, Merck’s (MRK) deal activity fell 19% in H1, with the cancer drugmaker opting for clinical trial collaborations and supply agreements related to its blockbuster anti-PD-1 therapy Keytruda in more than 50% of its 17 deals.

European pharma majors Sanofi (NASDAQ:SNY), Novartis (NYSE:NVS), and Reche (OTCQX:RHHBY) took third, fourth, and fifth positions in H1 deal activity, respectively, while Novo Holdings, the investment arm of Novo Nordisk’s (NVO) controlling shareholder, claimed the top spot in M&A activity.

With Novo (NVO) struggling to fulfill the demand for its weight loss products, Novo Holdings struck a $16.5B agreement in February to acquire contract manufacturer Catalent (CTLT), a deal expected to close by year-end.