Summary:

- Alibaba’s new leadership, with Eddie Wu as CEO, focuses on improving customer experience and stabilizing market share.

- GMV growth has shown resiliency for two consecutive quarters.

- The Cloud and International Commerce segments are improving and could prove to be key economic profit drivers in the future.

- Still, the sentiment surrounding the stock is as pessimistic as it gets, creating a great risk/reward scenario with a strong double-digit total return potential.

Robert Way

What’s going on with the company?

Management shakeup

Alibaba’s last three years have been tumultuous. At this point, we believe that the firm’s previous CEO, Daniel Zhang, has been neglecting innovation and his inability to execute allowed formidable competitors like Pinduoduo (PDD) to emerge in the Chinese e-commerce space. Alibaba had to get more agile quickly, and beyond the reorganization plan that resulted in the formation of six distinct business groups, it was clear that leadership had to change. The Chairman and CEO roles have been separated (much to our liking). Joe Tsai, one of the original founders who holds a considerable ownership stake worth ~$2.8 billion, took the Chairman position, while another co-founder named Eddie Wu took the helm as group CEO in September 2023. Wu was reportedly the company’s very first programmer, and he played a pivotal role in developing Alibaba’s monetization strategy centered around search-based advertising on Taobao and Tmall. He decided not to pursue IPOs and spinoffs of strategically important businesses as a way to “enhance shareholder value” in an already weak equity market environment. Instead, he became steadfast in improving the company’s competitive position, rooted in his “User First” approach. As Joe Tsai noted in a recent podcast episode:

“When we look internally, and self-reflect over the past several years, we have fallen behind because we forgot about who our real customers are. Our customers are the users that use our apps, that are shopping, and we did not give them the best experience. So, in a way, we kind of stepped on our foot […] .”

Market share is stabilizing

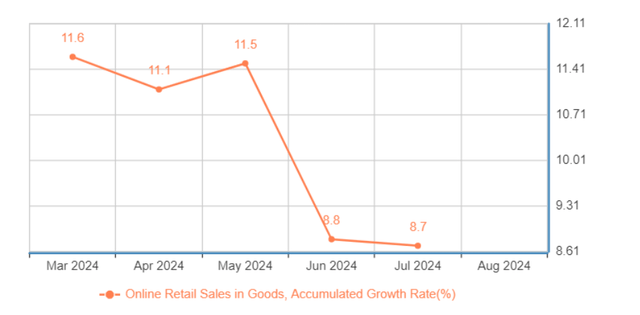

As a result of the previous management team’s missteps in a highly competitive market, Alibaba has been losing market share to Pinduoduo and Duoyin. The firm’s share, measured by online gross merchandise value (GMV) in China’s e-commerce market, dropped from ~70% in March 2022 to below 60% currently. However, Eddie Wu’s measures to improve the customer experience have begun to bear fruit. After a long streak of horrendous performance, Alibaba managed to stabilize its market share in the past two quarters. In other words, Alibaba’s GMV has grown in line with the overall online retail sector in China. Management also noted on the Q1 2025 earnings call that “internal and external data […] indicates a positive trend in our gradual market share stabilization”. We can validate these results after looking at numbers reported by the Chinese National Bureau of Statistics, which show that online retail sales of goods grew by about 10% in the last five months, aligning well with Alibaba’s reported GMV results.

Source: National Bureau Of Statistics Of China

High-margin e-commerce revenues will not lag forever

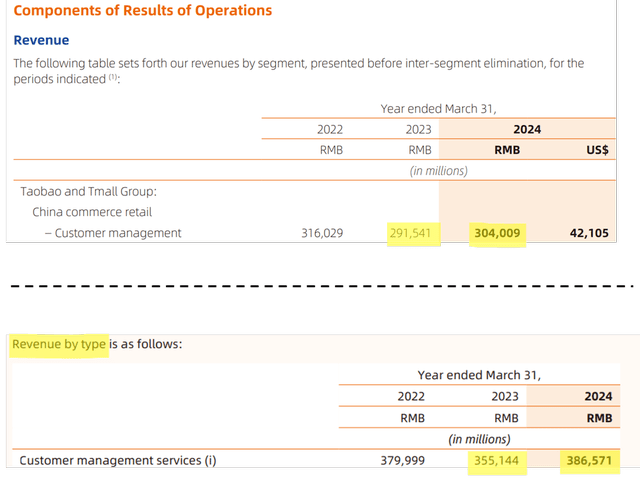

Investor’s main concern today is that despite a decent growth in GMV, Alibaba’s lucrative customer management revenues (CMR), which primarily include sales of advertisements, have only grown by low-single-digits over the past two quarters. Eddie Wu explained that this is because an increasing proportion of volume is generated from new models that currently have lower monetization rates. That said, monetization efforts are advancing step by step, and management has made it very clear that they expect CMR growth to align with GMV expansion in the coming two to three quarters. If the two metrics converge, we will see a vastly different story compared to previous years. We believe there is a high probability that most of the incremental CMR revenues could fall to the bottom line, and we see no evidence of the narrative that says profits in the Taobao and Tmall Group will lag behind the segment’s top-line growth. This thesis has held up in prior quarters, even amid intensive reinvestments.

Alibaba Cloud could return to its glory days

Management stuck an optimistic tone regarding the cloud business in the latest earnings call. Total sales were up 6% in Q1, with public cloud revenue maintaining its double-digit growth rate and low-quality project-based income winding down. This marks a nice improvement compared to the last quarter (where revenues were up 3%), and management is confident in returning to double-digit top-line growth in the second half of this fiscal year, with gradual acceleration thereafter. Demand in the sector is still far from being satisfied, and adverse macro conditions are not resulting in softening enterprise demand. Eddie Wu said that he expects to see a very high ROI on cloud infrastructure investments because Alibaba is “building compute power to meet existing demand,” with resources being “instantly taken up at full capacity on day one.” These remarks are highly encouraging, and after lackluster performance lately, the cloud business could finally turn into a meaningful profit driver with constantly expanding margins.

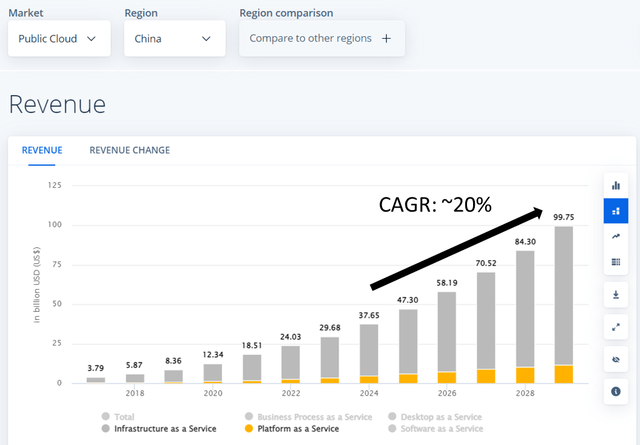

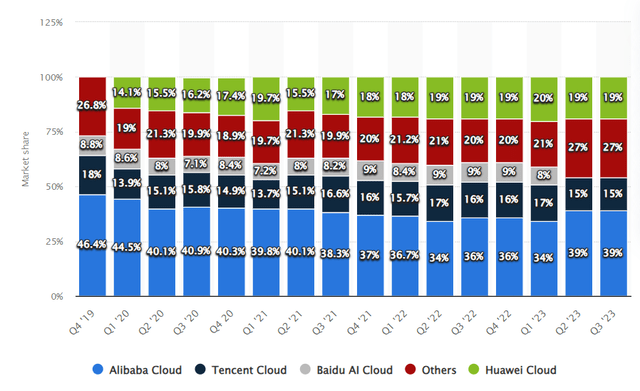

After conducting further research, we think that China’s cloud market could realistically grow to $200-$300 billion in 15–20 years (up from about $40 billion currently), and we believe Alibaba’s ~40% market share (shown below) will be much tougher to compete away than in the e-commerce sector. Assuming an AWS-like margin at maturity, this segment could eventually deliver tens of billions of dollars in true economic profits.

International commerce as a growth engine

Alibaba’s international commerce retail business outside of China is booming, with sales up 38% year-over-year in the last quarter. Management’s strategy here is twofold: enhancing operational efficiency while actively investing in key markets to drive scale. Losses have widened year-over-year due to intensive reinvestments, but we think Eddie Wu would not plow back money into this venture unless he was convinced that it is going to yield handsome returns. All businesses here, such as Lazada or AliExpress, are third-party platforms at heart, so there is a real chance they will deliver new high-margin revenue streams outside of China. In fact, after diving deeper into Alibaba’s annual report, we can already see (figure below) a pretty sizable gap between the reported CMR revenues of the domestic Taobao and Tmall Group and the total annual CMR-like revenue streams reported under the “revenue by type” section. This difference likely stems from marketing fees generated by the international segment.

Source: Alibaba 2024 Annual Report

As investors, it is our primary job to distinguish between short-term operational weakness and the erosion of a company’s long-term value-creating potential. We think Alibaba continues to rest on solid fundamentals, making it a firm member of our shortlisted group of exceptional quality-growth businesses, or EVA Monsters, as we like to refer to them. For reference, Economic Value Added (EVA) measures the company’s economic profit after deducting all costs, including the cost of giving the stock’s investors a full, fair, and competitive return on their investment. Let’s delve into the key characteristics of Alibaba that support our EVA Monster classification.

How does the company make money?

Alibaba’s Taobao and Tmall Group amounted to ~43% of sales in fiscal 2024, primarily resting on Taobao generating revenue through advertising and Tmall deriving revenue from commission fees. The Alibaba International Digital Commerce Group (~10%) mainly comprises commissions from Lazada (Southeast Asia’s leading e-commerce platform) and merchant fees on AliExpress. The Cloud Intelligence Group arm (~10%) generates revenue from selling large-scale computing, storage, and big data analytics services to enterprise customers. Cainiao’s logistics service fees account for ~10% of sales, while the Local Services Group (including the food delivery service Ele.me) makes up another ~6%. Alibaba’s other business segments (mainly direct sales from physical retail and digital media) contribute another 21% to its top line.

Value Creation: What type of moat rating is warranted?

We tend to prefer companies whose businesses are protected by large and enduring economic moats, as buying their stock at the right price generally leads to outperformance, as outlined in our research article. The existence of a durable competitive advantage is essential to sustain outstanding profitability, and this is where qualitative, subjective judgment comes into play.

From a qualitative standpoint, Alibaba derives its wide moat from a network effect, where the platform’s perceived value increases with more customers and sellers. Just a few figures to illustrate Alibaba’s true scale: in fiscal 2022, the firm generated a combined gross merchandise volume (GMV) of almost $1.25 trillion, roughly twice as much as Amazon. In 2023, Alibaba was responsible for ~17% of China’s total retail sales (down an estimated 100bps from 2022). At the end of fiscal 2022, the firm had more than 1 billion active users, with ~125 million spending more than $1,400 on its China retail marketplaces annually, while the retention rate of these frequent consumers is at a staggering 98%. Chinese high-value customers remain extremely loyal to Alibaba, as demonstrated by the steady rise in 88VIP members (over 42 million as of Q1 2025), a program similar to the Amazon Prime membership model. Based on our estimates, 88VIP members are responsible for more than 20% of total annual GMV despite representing less than 4% of users.

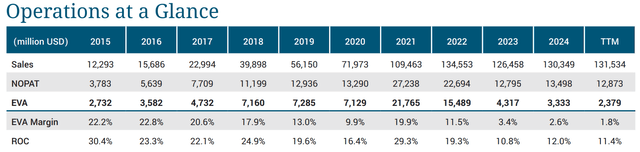

From a quantitative standpoint, EVA Monsters are characterized by consistently high returns on invested capital and EVA Margin levels. In the EVA framework, the EVA Margin (EVA/Sales) will serve as our ratio to define a company’s moat. It is the percentage of sales that ends up as EVA after all operating expenses, taxes, and capital charges have been paid. This indicator consolidates pricing power, operational efficiency, and the quality of asset management into one overall score that effectively measures business model productivity.

Source: The FALCON Method Inc. based on data from Institutional Shareholder Services Inc.

The solid EVA Margin and return on capital (ROC) figures are telltale signs of Alibaba’s competitive position, except in the recent past, mostly due to large one-off EVA items and, to a lesser extent, elevated investments to enhance its core businesses. We believe the business currently operates at an 8-10% EVA Margin after correcting for one-off items, and assuming a stabilizing moat trend, we see a clear path to durable EVA Margin expansion. For reference, the typical company in the S&P 500 index delivers an EVA Margin below 5% and a ROC barely above 10%.

Fundamental Return Potential

Alibaba’s end markets continue to ride on a plethora of tailwinds. The three most important are: rising domestic consumption, widespread adoption of the cloud, and the impact of globalization. Despite cautious spending caused by the bursting of the real estate bubble, China is gradually transitioning to a consumer society with a rising middle class and growing disposable income. As Tencent’s CEO noted on the most recent earnings call, a pickup in domestic spending is „not a matter of whether, but a matter of when.” The headroom for growth is enormous here: in 2023, China’s per capita GDP was still only about one-sixth that of the U.S., and it is forecasted to grow by ~5% annually over the coming decade. The second pillar of growth is the swiftly expanding cloud computing market, which is expected to grow at a rate of 15-18% globally over the next decade, with the Asia-Pacific anticipated to emerge as the fastest-growing region.

Taking a bird’s-eye view, if (1) CMR revenues can grow at a high-single-digit rate (near market growth), (2) the cloud segment can achieve a mid-teens top-line expansion with improving profitability, and (3) all other ancillary businesses reach breakeven, which management is committed to achieving in the next 1–2 years, then it is difficult to foresee a scenario where Alibaba’s core EVA could not grow by at least 10% per annum from the current baseline. Economic profit growth will be further aided by aggressive share repurchases and dividend payments. If the firm continues its current buyback pace, it is on track to reduce the share count by ~8% on an annualized basis. We consider buybacks hugely value-accretive at this share price. Just to stay on the conservative side, we assume that shareholder distributions could add ~5 percentage points to the annualized fundamental return formula going forward in our EVA-based total return model.

Combining the EVA growth and capital return components, it is not far-fetched to foresee Alibaba’s fundamental return potential firmly in the double digits, even with very conservative assumptions.

Valuation

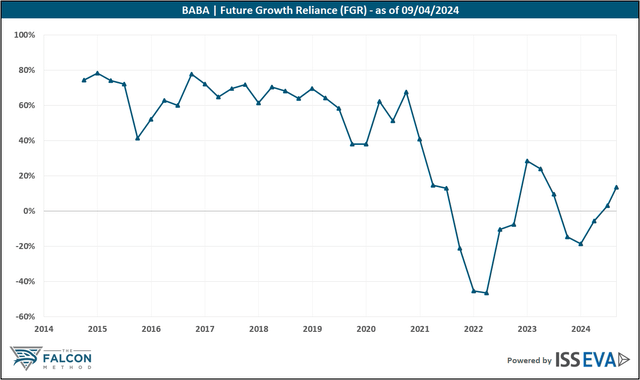

The second step in computing the prospective total return is estimating the impact of valuation. We use the Future Growth Reliance (FGR) metric, which indicates how much incremental EVA growth is expected as a percentage of the stock’s Market Value (MV). A higher number translates to a higher valuation, while a negative figure means that the market is pricing a decline in true economic profits. See our publication for further details.

It is important to note that Alibaba’s current profitability figures continue to be dampened by paper losses from its equity investments. Cleaned from these one-off items (but not assuming normalized profitability levels, reflecting the medium-term impact of heavy capital outlays), the FGR would stand at -20% as of today. It is incredibly rare when an EVA Monster trades with less than zero priced-in growth. Since we have every reason to believe that Alibaba will produce greater amounts of EVA in the coming decades, this stock appears unreasonably cheap from a fundamental perspective, whether you look at it from a market-relative or historical valuation standpoint.

Source: The FALCON Method Inc. based on data from Institutional Shareholder Services Inc.

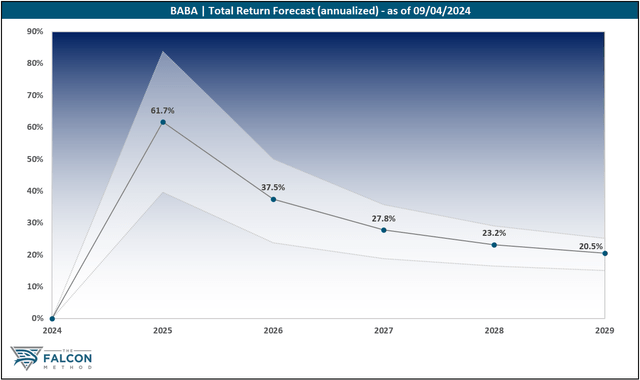

Putting the pieces together, we build a 5-year EVA-based financial model for each company we cover. Our models employ both an enterprising and a conservative fundamental scenario, reflecting our assumptions for sales growth and the underlying profitability. We also take into account the impact of shareholder distributions (dividends and share buybacks), which add to the fundamental return outlook alongside the annualized EVA growth component.

Regarding the “exit multiple,” we consider an FGR range that seems feasible based on the historical valuation profile and the underlying business growth characteristics. The annualized total return is highly dependent on the length of time it takes for the FGR to reach the level included in our model; this is one of the main reasons why you may see significant differences between the one and 5-year annualized total return percentages in the charts. The lower end of the shaded band represents our conservative scenario, the upper end shows the result of the enterprising calculation, and we also mark the midpoint values.

Here’s what the annualized total return outlook looks like for Alibaba from today’s levels, based on the inputs outlined above:

Source: The FALCON Method Inc.

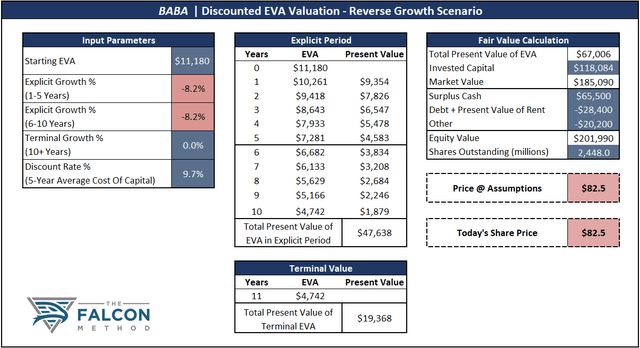

Turning our valuation framework upside-down, we also like to compute the market’s expectations baked into the share price, expressed as the annualized EVA growth rate that would justify the stock’s current valuation. Considering a 9% EVA Margin as a normalized baseline today, the current stock price implies an ~8% annual contraction in Alibaba’s EVA. In other words, the market believes that nearly two-thirds of the company’s current economic profits will evaporate in a decade. The baked-in EVA Margin in 10 years sits at roughly 2%, which is far from the double-digit figure we expect to see. In a nutshell, our reverse discounted EVA valuation model also confirms that investors’ expectations regarding Alibaba are ridiculously low. At the current market cap, excluding roughly $65 billion of excess cash, you can buy the core Chinese e-commerce cash cow at a free cash flow multiple of 5, plus you get everything else (the cloud, the international business) for free.

Source: The FALCON Method Inc.

Final assessment

All in all, while risks remain and position sizing must be cautious (we aim for a 3% maximum exposure), the new leadership team’s skill set, progress, and honest assessment of past mistakes are encouraging. The key thing to monitor is the stabilization of market share, measured by GMV growth in the e-commerce arm. Domestic consumption in China is far from glamorous, yet we think the risk-reward ratio is extremely favorable at the moment. We have been waiting for two consecutive quarters of seemingly stable market share before adding to our positions; consequently, two of our analysts made purchases in August at a price below $85. We believe that investors comfortable with at least some direct China exposure have a „now or never” moment to scoop up shares in Alibaba.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.