Summary:

- Adobe’s stock fell 10% post-3Q earnings despite beating estimates due to weak 4Q guidance, signaling slower-than-expected AI monetization and decelerating top-line revenue growth.

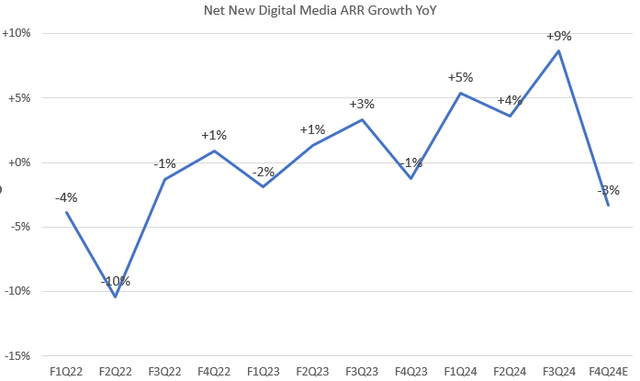

- Digital media ARR grew 9% YoY in 3Q FY2024, but the 4Q guidance implies a -3% YoY growth, reflecting a demand pull-forward from 4Q into 3Q.

- Management indicated that Cyber Monday week is expected to be pushed into 1Q FY2025, resulting in a weaker-than-expected revenue outlook for 4Q.

- The new Firefly Video Model shows promise, with a 6x increase in Firefly image generation over the past six months, but translating this usage growth into revenue will take time.

- The stock’s 29.4x forward non-GAAP P/E is in line with the Nasdaq 100 index, reflecting the current growth trend; I maintain a neutral rating until there is more clarity on AI monetization.

JHVEPhoto

What Happened

Adobe (NASDAQ:ADBE)’s stock fell by 10% following its 3Q earnings report, which beat both revenue and non-GAAP EPS estimates. However, the company issued weak 4Q guidance, signaling a deceleration in top-line growth to the high single digits. This raise concerns that AI monetization is still in its early stages, as investors are eager to see a growth inflection. In my previous analysis, I downgraded the stock to a hold rating, believing that AI monetization may take longer than expected due to the company’s focus on usage growth. We previously noticed that 3Q revenue guidance had already fallen short of expectations. Since then, the stock has underperformed the S&P 500 index by 1.5%.

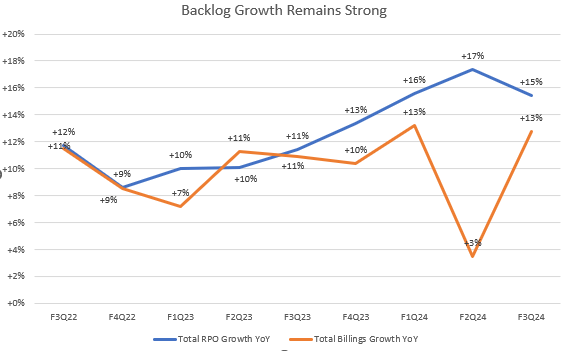

Despite this, Adobe’s total backlog and billings remain resilient, showing growth reacceleration compared to the prior year. Given the current premium valuation following the post-3Q earnings selloff, I reiterate my hold rating on ADBE, as the inflection point in revenue growth has yet to be triggered.

Muted ARR Growth in 4Q

While the company delivered better-than-expected Q3 earnings, and its AI-related products continue to grow strongly, AI monetization remains slow. Firefly feature in Adobe Photoshop now has generated 12 billion imagines in 3Q, growing 33% sequentially from the previous quarter. Although demand for AI powered tools is strong, the key growth driver is monetization. Digitial Media revenue (which accounts for 74% of total revenue) grew 11% YoY, in line with previous growth momentum.

The company model

Despite a muted top-line growth, customers are willing to pay more for its Cloud services annually. As shown in the chart, net digital media ARR has accelerated over the past quarters, growing 9% YoY in Q3 FY2024, which exceeded its previous growth trend. However, the company has guided for $550 million in net digital media ARR in 4Q FY2024, implying a -3% YoY growth. This suggests that while AI monetization is on track, it may face some bumps ahead. During the 3Q FY2024 earnings call, management explained that a few deals expected to close in 4Q had closed earlier than anticipated in 3Q, resulting in weaker YoY ARR growth for 4Q. Lastly, the company will not provide its FY2025 ARR outlook until its 4Q FY2024 earnings report.

Cyber Monday Sales Pushes Out to 1Q FY2025

The company model

ADBE’s total backlog and billings growth continue to accelerate year-over-year. However, the company provided weaker-than-expected guidance for revenue and non-GAAP EPS in 4Q FY2024. The midpoint of its revenue outlook indicates 9.4% YoY growth, down from 11.6% YoY in 4Q FY2023, suggesting that total RPO growth may continue to soften in 4Q.

In previous 4Qs, Cyber Monday sales were included in revenue outlooks, but management noted that Cyber Monday week will now be pushed to 1Q FY2025, which has been factored into the 4Q guidance. However, I believe investors are not fully appreciating this narrative, as evidenced by the post-earnings selloff. Despite this, GenAI monetization is still ongoing, with the Firefly product showing strong QoQ growth, which will be a key growth driver for ADBE. However, the monetization efforts remain weak. Firefly saw a 6x increase in content generation over the past six months, but revenue growth was only 4.4% sequentially compared to 1Q.

New Firefly Video Model

Earlier this month, at the IBC event, ADBE introduced another milestone feature, Firefly Video Model. This new model enables filmmakers and content creators to customize existing videos by adding or removing objects from scenes, creating cinematic portraits from prompts, and generating creative clips from reference frames. I believe this will require more tokens compared to image generation, accelerating AI monetization in the future. Additionally, the company announced that Generative Extend will be added to Premiere Pro later this year, enabling users to adjust clip lengths and smooth transitions with AI. Furthermore, I believe ADBE will allow enterprises to automate video content at scale through Firefly Service APIs, driving further demand for AI-related products.

Valuation Multiples Should Reflect the Pace of AI Monetization

Seeking Alpha

Despite the post-earnings selloff, ADBE is still trading at a premium valuation. While its EV/sales TTM is below its 5-year average, trading at 12.4x remains lofty. This multiple is higher than the 10.2x in my previous analysis. On a forward 12-month basis, its EV/sales fwd is currently at 11x, suggesting a stronger growth outlook driven by accelerated AI monetization. However, we have yet to see a reacceleration in revenue growth over recent quarters. In contrast, Microsoft (MSFT) has a higher growth outlook but trades at a similar forward sales multiple, making ADBE’s valuation appear less attractive.

ADBE’s non-GAAP P/E fwd is currently 29.4x, nearly in line with the Nasdaq 100 index’s 29.2x. However, its non-GAAP operating margin has remained flat year-over-year, indicating no improvement in operational efficiency to drive earnings growth. With weaker-than-expected 4Q FY2024 guidance for both revenue and EPS, I anticipate sequential margin pressure in 4Q. Therefore, it’s reasonable to adjust valuation expectations accordingly. I remain neutral on the stock until we gain more color into its AI-related disclosures in 4Q FY2024 and the growth outlook for FY2025 to better assess its AI monetization efforts.

Conclusion

In conclusion, I admit ADBE’s 3Q FY2024 earnings demonstrated resilience in terms of usage growth in AI-related products like Firefly but market expectations about its AI monetization and top-line growth are higher. While digital media ARR showed a strong YoY acceleration in 3Q, the company’s 4Q guidance reflects a slowdown due to irregular seasonality. The company’s decision to push Cyber Monday sales into Q1 FY2025 has failed to reassure investors, contributing to the post-earnings selloff. Despite new innovations like the Firefly Video Model, it takes time to translate into revenue growth. I believe that the stock’s premium valuation remains difficult to justify given its lack of growth acceleration and stagnant margins. Therefore, until there is more clarity on AI monetization and growth outlook in FY2025, I maintain a neutral on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.