Summary:

- Medtronic, a global developer and manufacturer of medical devices for chronic diseases, is now a $111 billion (by market cap) healthcare behemoth.

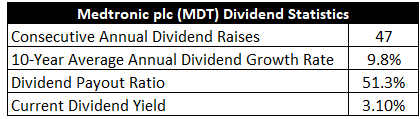

- Medtronic has increased its dividend for 47 consecutive years, with a 10-year dividend growth rate of 9.8%.

- Medtronic advanced its revenue from $20.3 billion in FY 2015 to $32.4 billion in FY 2024, a compound annual growth rate of 5.3%.

- Medtronic has been slowly paying down debt since the big Covidien acquisition in 2015.

CottonCandyClouds/iStock via Getty Images

Medtronic PLC (NYSE:MDT) is a global developer and manufacturer of medical devices for chronic diseases. Founded in 1949, Medtronic is now a $111 billion (by market cap) healthcare behemoth that employs 95,000 people. The company reports results across four segments: Cardiovascular, 37% of FY 2023 revenue; Neuroscience, 29%; Medical Surgical, 27%; and Diabetes, 7%.

Medtronic’s product portfolio is comprised of a variety of life-saving and life-improving medical devices that include implantable defibrillators, heart valves, insulin pumps, glucose monitoring systems, pacemakers, stents, and surgical tools. Medtronic has a product portfolio that’s both broad and dominant.

Morningstar highlights this broad product lineup: “Medtronic’s standing as the largest pure-play medical device maker remains a force to be reckoned with in the med-tech landscape. Pairing Medtronic’s diversified product portfolio aimed at a wide range of chronic diseases with its expansive selection of products for acute care in hospitals has bolstered Medtronic’s position as a key partner for its hospital customers.”

When you can bring breadth, depth, scale, and expertise to the table, you build that lasting trust with customers and become dominant. Speaking on this dominance, Morningstar adds: “Medtronic has historically held roughly 50% share in its core heart devices. It’s also the market leader in spinal products, insulin pumps, and neuromodulators for chronic pain.”

A 50% share of market! Most companies would love to have that kind of market share. And this is a great area of the economy to have such command over. I say that because of “triple tailwinds” from demographics. The world is growing larger, older, and wealthier – all at the same time.

What does a larger pool of older people with more money mean? Well, it means rising demand for quality healthcare, as aging – something that’s part of the human condition – naturally leads to all kinds of health issues which often require intervention, and more wealth leads to more access. This is on top of a base level of demand for general healthcare purely from the standpoint of human beings aging over the course of time. Plus, this is inelastic demand we’re talking about.

Healthcare spending, especially when it comes to medical devices, is often non-discretionary. A life-or-death circumstance – say, a sudden heart problem – does not lend itself to price sensitivity or on-the-spot negotiation. If something like emergency surgery is suddenly needed, survival becomes far more important than the pricing of the medical devices required to save one’s life.

A rising level of base demand that’s also inelastic, all while dominating the field? Medtronic almost can’t lose. And that’s why the company’s revenue, profit, and dividend should all continue to grow nicely for many years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

Already, Medtronic has increased its dividend for 47 consecutive years. That very impressive track record easily qualifies Medtronic for its status as an esteemed Dividend Aristocrat. Actually, Medtronic is nearly a Dividend Aristocrat two times over.

The 10-year dividend growth rate of 9.8% is very strong, especially for a business that was already nearly four decades into growing its dividend a decade ago. However, the business got hit by the pandemic hard, and recent dividend raises have been modest. The five-year dividend growth rate of 7.4% shows some of that deceleration, but the most recent dividend increase of only 1.4% hammers the point home.

Medtronic has a rich history of growing its dividend at a high rate, and I don’t think the last few years of troubles (which I’ll delve into later) are emblematic of what this business is capable of over the long run. That said, the market has taken things into its own hands and adjusted this stock’s yield far higher than it usually is – just in case this growth scare is lasting.

The stock yields 3.1%. To put that in perspective, it’s 60 basis points higher than its own five-year average. A huge spread? No. Enough yield to make up for low-single-digit dividend growth indefinitely? Again, no. But I think the market is (appropriately) sniffing out a temporary issue with the business, bringing the yield up by a noticeable amount now (allowing for more cash flow out of the investment now) in order to compensate for the near-term growth issue.

If the business were collapsing, this stock would be way cheaper (and the yield would be way higher). But that’s not happening. On the flip side, if Medtronic can get back to its old ways of high-single-digit dividend growth, a 3%+ starting yield on top of that is awfully appealing. And there are signs it can do that.

With a payout ratio of 51.3%, based on midpoint guidance for FY 2025 adjusted EPS, which is about as close as it gets to a perfectly balanced payout ratio (one that equally divides earnings between business retainment and shareholder rewarding), this dividend is about as healthy as it’s ever been. The overall dividend profile from this Dividend Aristocrat (recent troubles notwithstanding) is very attractive.

Revenue and Earnings Growth

As attractive as the profile may be, though, some of these numbers are based on what’s happened in the past. However, investors must always be looking toward the future, as the capital of today gets risked for the rewards of tomorrow. As such, I’ll now build out a forward-looking growth trajectory for the business, which will come in handy when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth. I’ll then reveal a professional prognostication for near-term profit growth. Blending the proven past with a future forecast in this way should give us the kind of information we need to make an informed decision on where the business could be going from here.

Medtronic advanced its revenue from $20.3 billion in FY 2015 to $32.4 billion in FY 2024. That’s a compound annual growth rate of 5.3%. Very respectable.

I’m usually looking for a mid-single-digit top-line growth rate (or better) from a mature business, and Medtronic hit the mark squarely. However, Medtronic’s revenue was positively impacted in a big way starting in FY 2016, after Medtronic acquired Covidien PLC in 2015 for almost $50 billion. This complementary addition to the company (with Covidien focusing on endomechanical instruments, adding to Medtronic’s cardiovascular and orthopedic offerings) significantly increased the sales base of the combined company.

Meanwhile, earnings per share grew from $2.41 to $5.20 (adjusted) over this period, which is a CAGR of 8.9%. That’s actually a pretty solid result during a rough stretch for the business – especially considering the fact that it takes into account the dilution that occurred as a result of the aforementioned acquisition.

You’ll notice how closely EPS growth and dividend growth over the last decade line up, showing us how deftly management has guided that dividend. Notably, I used adjusted EPS for FY 2024. Not a totally fair, apples-to-apples comparison, but I only did so because FY 2024 included a number of special items that threw off GAAP results. I think the ~9% result shown above is a fairly accurate reflection of Medtronic’s true growth. Looking forward, CFRA is projecting a 4% EPS CAGR for Medtronic over the next three years.

Circling back around to the troubles I touched on earlier, Medtronic has struggled over the last few years as the pandemic-related disruptions to the US healthcare system caused many people to delay certain health treatments (such as elective surgeries). Adding to Medtronic’s woes, there were also issue with hospitals meeting staffing needs.

If a health fix could be delayed, it probably was. However, a temporary delay is not the same thing as a permanent cancelation, and all these delaying is causing pent-up demand.

A secondary headwind for Medtronic over the last few years was the fact that the company had a hard time bringing products to market, including a poorly-timed rollout of a key robotic-assisted surgery platform (called Hugo) – something that could not be fully utilized at the time (due to the aforementioned healthcare complex issues). So Medtronic suffered from both supply and demand constrictions.

CFRA touches on all of this: “We expect strong results from [Medtronic] as its health care provider customers serve pent-up demand for procedures that had to be postponed due to the pandemic and then subsequent staffing shortages at medical facilities. [Medtronic] also stands out from medical device peers because of its product innovation and new launches, which drove market share gain during the pandemic and should continue to do so over the long term. One product line that has particularly immense potential is [Medtronic’s] robotic-assisted surgery platform, which we see ultimately being adopted worldwide, up from around 13 countries using the technology in FY 24.”

There’s palatable optimism running throughout that passage, and I think there’s good reason to be optimistic over the long run. While it’s difficult to say just how much of a bounce back we’ll see over the next year or two, Medtronic’s breadth, depth, and market share all add up to a winning business model. In my view, it’s fair to be cautious over the near term, and I don’t take issue with CFRA’s 4% number.

If that were to persist for years to come, that would be super disappointing. On the other hand, if it’s only a short-term phenomenon, which starts to fade away once everything in the industry normalizes, it’s not a major problem. Backing up CFRA’s number to a large degree is Medtronic’s own FY 2025 adjusted EPS guidance. At $5.46 (at the midpoint), this would represent 5% YOY growth. That’s not far away from where CFRA is at.

While I wouldn’t expect much more than mid-single-digit EPS and dividend growth out of Medtronic over the next year or two, it’s hard to see how Medtronic can’t get back to high-single-digit growth over the longer term. There’s nothing to indicate a permanent impairment of any kind here.

And so I would give Medtronic the benefit of the doubt and assume the long-term dividend growth profile is not something that is forever tainted by the pandemic. Given that, a 3%+ yield and high-single-digit dividend growth from a Dividend Aristocrat is not bad at all.

Financial Position

Moving over to the balance sheet, Medtronic has a decent financial position that should improve over the coming years (as the business and industry normalize). The long-term debt/equity ratio is 0.5, while the interest coverage ratio is nearly 8. That latter number is negatively impacted by GAAP results, and I suspect it’ll look much better in a few years.

The good news is, Medtronic has been slowly paying down debt since the big Covidien acquisition in 2015. Long-term debt is down by nearly 30% since FY 2015. Also, Medtronic carries cash that amounts to about 1/3 of long-term debt. I’d also just quickly point out that less than $25 billion in long-term debt is not concerning for a company with a market cap of over $100 billion.

Profitability is okay, but this might be the most disappointing aspect of the business’s fundamentals. Return on equity has averaged 8.3% over the last five years, while net margin has averaged 13.7%. Margins are pretty good. But I’d really like to see higher returns on capital here, as single-digit ROE and ROIC (close to WACC) make it difficult to generate excess returns.

While Medtronic isn’t quite the powerhouse business it was a decade ago, it’s still a formidable force in its industry. And with IP, R&D, switching costs, economies of scale, a global distribution network, high barriers to entry, and a diversified portfolio of entrenched products, the company does benefit from durable competitive advantages.

Of course, there are risks to consider. Regulation, litigation, and competition are omnipresent risks in every industry. I see all three of these risks as being elevated for this business model in comparison to many other business models.

Any changes in the way healthcare spending is managed, especially in the United States, would almost certainly impact the company. Medtronic occasionally has to recall products, which involves costs and possible reputational damage.

Demand for medical devices is fairly disconnected from economic cycles, but a recession could cause people to delay or cancel elective surgeries. Any major technological changes in medical devices can alter the competitive landscape, which pressures Medtronic to constantly innovate and stay ahead of the tech curve. GLP-1s may reduce the severity of, or even altogether eliminate, a range of health issues, leading to lower demand for medical devices broadly.

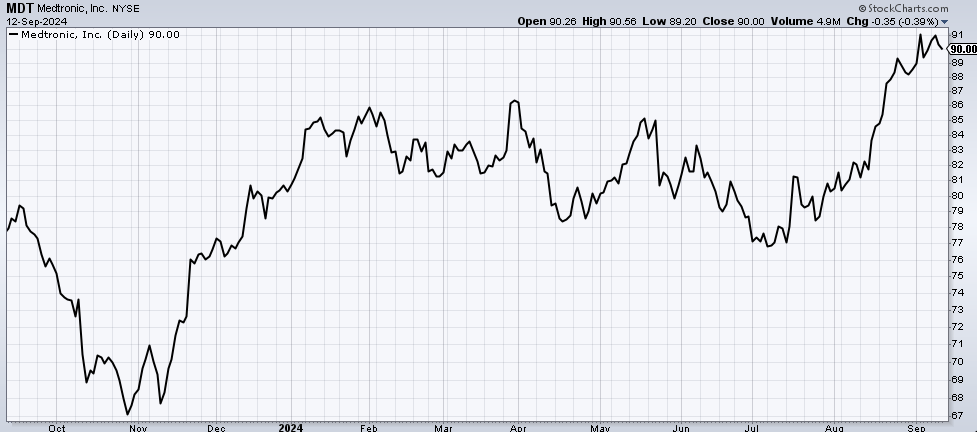

Medtronic has its fair share of risks, but that’s true for just about every business out there. However, with the stock down more than 30% from all-time highs, the valuation seems to be pricing in an unreasonable amount of risk…

Valuation

The P/E ratio on the stock is 30.4. That looks high, but it’s only because of GAAP results which have inadequately expressed the company’s true growth profile over the last few years. This has been a recurring trend, as the stock’s five-year average P/E ratio is 30.3. We’re basically on the button right now. However, referring back to midpoint guidance for this year’s adjusted EPS, the forward P/E ratio drops to just 16.5. That’s more like it.

Moreover, the sales multiple of 3.7. which factors out the GAAP nonsense, is very undemanding, and it compares favorably to its own five-year average of 4.2. And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 7%. This kind of expectation can look aggressive or cautious, depending on how you view the business.

Based on the EPS and dividend growth over the last decade, a 7% growth rate isn’t a particularly high hurdle for Medtronic to clear. However, recent business and dividend growth has been in a low-single-digit range, and the near-term forecast for EPS growth calls for more of that.

I want to reiterate this is a long-term dividend growth rate expectation. Over the next few years, Medtronic is likely to hand out mediocre dividend raises. But if we zoom out and look at the next decade or two, it’s just difficult to imagine a scenario in which this business can’t get its old mojo back. It has the kind of market dominance and portfolio breadth that makes it hard to do poorly.

The DDM analysis gives me a fair value of $99.87. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide. The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today. I find it to be a fairly accurate way to value dividend growth stocks. My sense of this stock is that it’s priced a bit cheaper than it ought to be. But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates MDT as a 4-star stock, with a fair value estimate of $112.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold. CFRA rates MDT as a 4-star “buy”, with a 12-month target price of $99.00. I’m almost exactly where CFRA is at on this one. Averaging the three numbers out gives us a final valuation of $103.62, which would indicate the stock is possibly 13% undervalued.

Bottom line: Medtronic PLC is a dominant force in the medical devices space that has built a commanding share of its market. Its broad portfolio of life-improving and life-saving products often have inelastic demand and secular demographic tailwinds are blowing its way. With a market-beating yield, high-single-digit dividend growth, a balanced payout ratio, nearly 50 consecutive years of dividend increases, and the potential that shares are 13% undervalued, long-term dividend growth investors on the lookout for an inexpensive Dividend Aristocrat have an obvious target here.

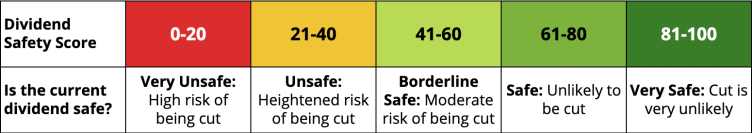

Note from D&I: How safe is MDT’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 99. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, MDT’s dividend appears Very Safe with a very unlikely risk of being cut.

Disclosure: I’m long MDT.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.