Summary:

- I hate poor cell service. I love hearing my income pouring in. Verizon solves both problems simultaneously.

- Invest in boring income sources where others pay you without a second thought.

- Money can’t buy happiness, but it can help reduce stress and provide more room for happiness.

Meeko Media/iStock via Getty Images

Co-authored by Treading Softly

When was the last time that you had a second thought about paying your power bill, cell phone bill, or Internet bill? When was the last time you thought deeply before flipping on a light switch or starting your car?

You see, there are many things that we do without even a second of additional thought. We do them because they’re necessary, or we do them because we need to. We turn on the lights when we enter a room because we need visibility. We don’t think about the cost of doing so. We text with our cell phone without thinking of the cost of that monthly cell phone bill. I’m a huge fan of owning income from essential sources, but I’m not the only one.

Legendary investor Peter Lynch, who is mostly known for the continued outperformance of his Magellan Fund at Fidelity Investments between 1977 and 1990, has laid out several criteria for his picks. One of the most prominent ones is to select companies from boring industries that produce products (or services) that people keep buying during good times and bad. The telecom business in North America enjoys such a status, with well-established companies dominating the market, offering limited room for competition or disruption.

Today, we’re going to look at an excellent source of boring income.

Let’s dive in!

Boring Income Means Big Rewards

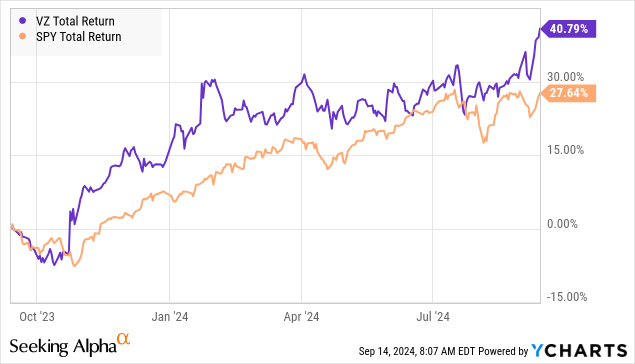

Verizon Communications Inc. (NYSE:VZ) (NEOE:VZ:CA), yielding 6.1%, is one of our favorite picks, and over the past year, this boring old stock has outperformed the S&P 500.

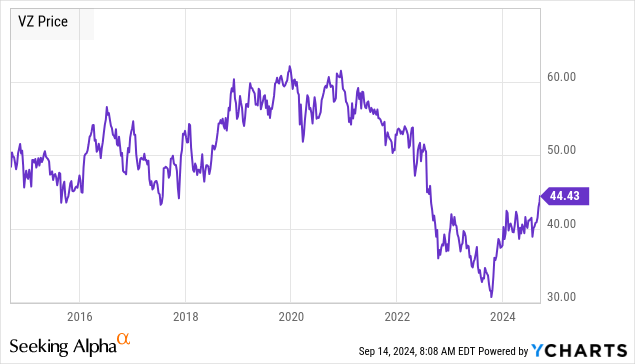

Despite this rally, VZ continues to trade at prices unseen over the past decade, making this dividend steward a compelling buy.

It is interesting that for most of 2023, Wall Street could only seem to talk about the company’s debt levels threatening the dividend, but lost sight of the fact that lenders can’t just come knocking when they want to. While higher interest rates are weighing down on the income statement, at $1.7 billion for Q2 (up from $1.3 billion in Q1), they remain manageable, with VZ generating $12.3 billion in adj. EBITDA for the quarter. As of June 30, 2024, VZ had $122.8 billion in net unsecured debt, placing its leverage ratio (net unsecured debt to adjusted EBITDA) at 2.5 times (down from 2.6x after Q1). The company’s effective interest rate stood at 5.1%.

Another topic of concern among the investor community has been the potential disruption from satellite-based internet and phone services. Earlier this year, VZ invested $100 million into AST SpaceMobile, a satellite connectivity company pioneering the space-based cellular broadband network that will allow existing, unmodified smartphones to connect to satellites in areas with coverage gaps. The company also recently announced its plans to launch a satellite messaging service in partnership with Skylo. These position VZ well for expansion into urban areas with their cost-effective service offerings.

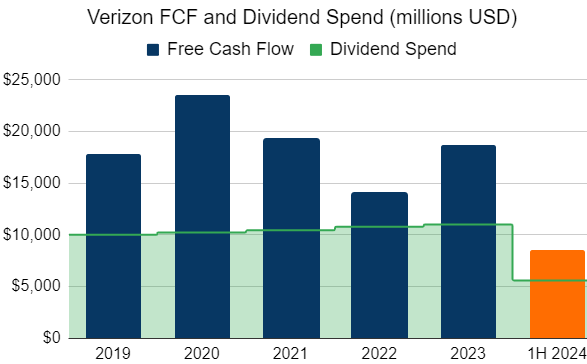

During Q2, VZ generated $16.6 billion in cash flow from operating activities, and $5.8 billion in FCF (Free Cash Flow).

Author’s Calculations

The importance of the above chart cannot be overstated. It indicates two factors:

-

Consistent Excess Cash Availability: FCF reflects the real cash a company has on hand, making it a highly reliable means of measuring dividend payability. Earnings, on the other hand, often include non-cash items like depreciation, which don’t represent actual cash flow.

-

Sustainability: Paying dividends from FCF ensures that the company isn’t stretching its finances to pay shareholders. This approach helps maintain the long-term health of the business and makes the dividend more sustainable.

VZ’s $5.5 billion dividend spend for 1H 2024 is placed at a comfortable 65% FCF payout ratio ($8.5 billion FCF for 1H 2024). The company also reported ~$3.4 billion reduction in net debt, and its unsecured debt carries an A- rating from Fitch. VZ has reaffirmed its guidance for FY 2024, with 1-3% YoY adj EBITDA growth and adj EPS between $4.50 – $4.70, placing its current annual dividend at 58% at the midpoint.

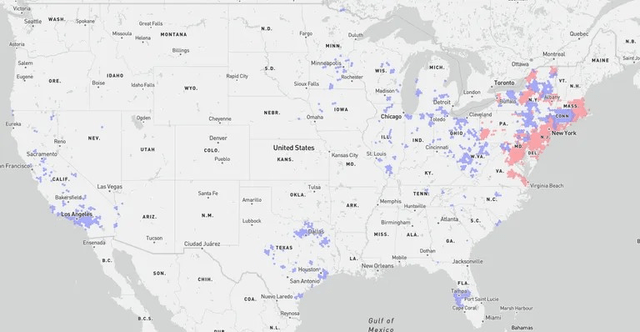

VZ and Frontier Communications recently entered into a definitive agreement in which VZ will acquire its fiber competitor for $20 billion in an all-cash transaction. Frontier has a significant fiber footprint of 2.2 million subscribers from 7.2 million locations across 25 states, and the company has plans to expand to 10 million locations by 2026. This acquisition, which is expected to complete in 18 months subject to shareholder approval, will significantly boost VZ’s combined fiber network to 25 million units across 31 states, particularly expanding the company’s footprint in the North East and matching or surpassing rival AT&T’s (T) fiber coverage.

VZ recently announced a 1.9% YoY increase to its dividend, marking 18 years of consecutive payment increases. The stock currently trades at an 8.9x forward PE, making it a bargain from a highly profitable company providing essential services to an increasingly digital economy.

Conclusion

Verizon used to have commercials advertising the reliability and strength of their overall network by having someone walking around and saying, “Can you hear me now?” over and over again. It illustrated that no matter where you were in the entire country, the person on the other end of the phone call would be able to hear you clearly. While it was a ridiculous example to highlight the strength of their network, it was something tangible because I think almost every one of us who has a cell phone has been in a place with poor reception where you’ve asked that question – “Can you hear me? Hello? Can you hear me?”. So, they illustrated this effectively by showing someone testing that everywhere to show the strength of their network.

When it comes to retirement, the question shouldn’t be, “Can you hear me now?” The question should be, “Can you hear your income now?” Because every time those dividend dollars pour into your account, you should be able to hear the coins clinking against each other, filling your coffers. If your portfolio isn’t generating a high level of income that is routinely pouring in from the market into your coffers, then perhaps your portfolio is not fine-tuned effectively to provide you with what you need the most in life. You can’t buy happiness, but you can definitely make life easier and allow you to find more happiness by having the financial means to smooth problems over or find solutions effectively.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +8000 members. We are looking for more members to join our lively group! Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our Model Portfolio targeting 9-10% yield, our preferred stock and Bond portfolio. Don’t miss out on the Power of Dividends!

We’re offering a limited-time 17% discount on our annual price of $599.99 via this link only: