Summary:

- Verizon is a solid dividend stock, but the recent Frontier acquisition may limit upside, leading me to downgrade them to a hold.

- Verizon’s share price appreciated by nearly 11% in five months, outperforming the S&P 500’s 8.5% gain.

- Despite improvements in debt reduction and free cash flow over the past year, the Frontier deal could increase debt and impact investor confidence.

- Regulatory risks and uncertainty around the Frontier merger’s impact on cash flow and debt has contributed to my cautious outlook.

- Verizon also made improvements in EBITDA, CAPEX, consumer post paid adds, and wireless service revenue, which likely contributed to their strong price appreciation.

RiverNorthPhotography/iStock Unreleased via Getty Images

Introduction

Let me get this out of the way. Verizon Communications (NYSE:VZ) is one of my favorite dividend showers, those with little dividend growth but respectable track records of maintaining a steady dividend.

But I did sell my position and used the funds in what I perceived to be better investment opportunities. The reason being is I thought their upside was limited and my REIT positions offered more at the time.

Turns out I was right. However, I did re-initiate a small position due to the income the stock provides, and I am looking to add to it near or below $35. Moreover, their recent announcement to acquire Frontier Communications (FYBR) may limit their upside. And in this article, I discuss why.

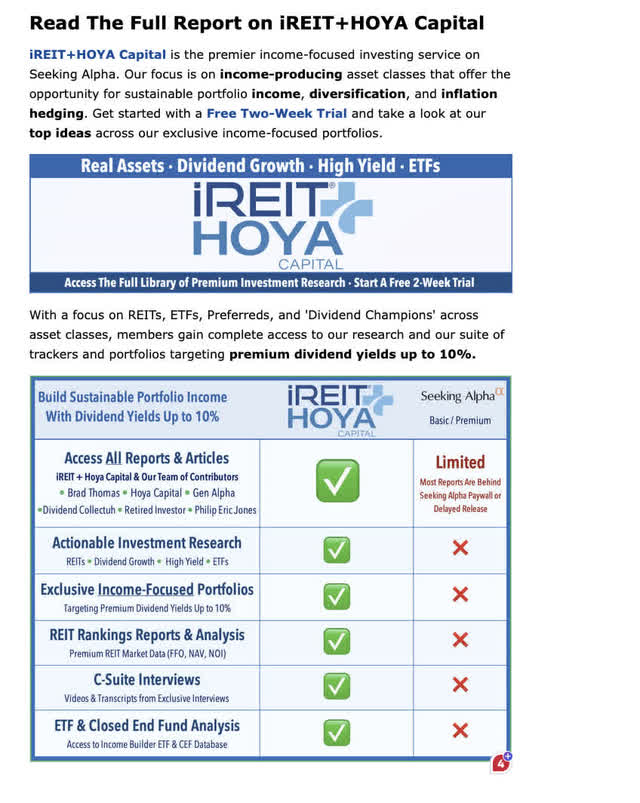

Previous Buy Rating

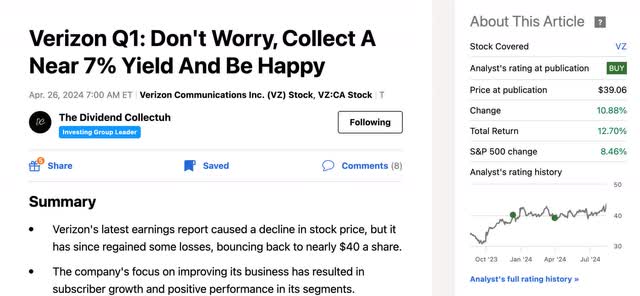

I last covered Verizon Communications nearly 5 months ago in an article titled: Don’t Worry, Collect A Near 7% Yield And Be Happy. Of course, the stock’s share price was trading lower at the time, which made them highly attractive along with their well-covered dividend.

Since then, however, the stock has enjoyed some nice price appreciation, up double-digits at nearly 11%. This is even more than the S&P who is up roughly 8.5% over the same period.

I also discussed the company’s Q1 earnings report that at the time saw them beat on their bottom line by $0.03 but miss on their top line by $230 million.

This resulted in their share price falling below $40, but as you can see, the stock has recovered to near $44 at the time of writing.

I also had a price target of $51 for the stock, but for reasons discussed later in this article, it may take some time for VZ to reach this. I am not suggesting current shareholders sell, but uncertainty surrounding this recent deal leads me to downgrade them to a hold for now.

Frontier Acquisition May Limit Upside

I’m sure by now everyone has heard of the acquisition Verizon recently announced with Frontier Communications. This was an all-cash deal, acquiring the company for $38.50 a share. This was a premium to FYBR’s 90-day trading volume and is why many believed the deal was too expensive.

This is expected to close over the next year and a half and provide $500 million in synergies, as well as expand their fiber footprint. Currently, I feel neutral on the deal, as I was anticipating management to provide an update on how it would impact their cash flows. I would expect other investors want to know as well.

This is due to the fact that Verizon and other telecom companies are CAPEX intensive businesses with high debt loads. And despite the company chipping away at its debt, this is what has likely played a part in their share price underperformance over the years.

Net debt did decline year-over-year by $3.7 billion to $122.8 billion. Total debt also fell from $152.7 billion to $149.3 billion, giving VZ a net debt to adjusted EBITDA of 2.5x, down from 2.6x in the year prior.

For comparison purposes, this is how the big three’s net debt looked year-over-year. AT&T saw the biggest drop in net debt at 3.87% followed by Verizon who saw a 2.9% drop. T-Mobile’s (TMUS) decline was far less, but to be fair, the telecom company has a significantly lesser debt load with $70.2 billion in total debt.

|

Q2’24 |

Q2’23 |

|

|

VZ |

$122.8B |

$126.5B |

|

T |

$126.9B |

$132B |

|

TMUS |

$73.5B |

$73.7B |

I will say I was impressed with the progress the telecom giant had been making. And I was also looking forward to them continuing to pay down debt, grow free cash flow, and maybe repurchase shares in the near to medium term.

This, in my opinion, would have increased investor’s confidence, and potentially sent their share price higher. Especially with interest rates expected to be much lower in the next 12–18 months.

But with the acquisition, this will likely increase their debt. No one knows how much, but any increase in debt, especially for telecom companies, will likely not bode well in regard to investor sentiment, at least in the near to medium term.

Improvements YoY

Verizon did make some improvements year-over-year during Q2 earnings, which I was glad to see. The biggest one, in my opinion, aside from their debt, was their free cash flow, which grew 3%.

This stood at $8.5 billion through two quarters, an improvement of $550 million from 2023. And this was despite lower cash from operations, which declined from $18 billion to $16.6 billion as a result of higher taxes related to C-band.

With the 1.9% dividend increase, this still gives Verizon a very safe payout ratio of 49.3%, up from 48.3% prior. As previously mentioned, it would have been nice to see the company buyback shares. Shares outstanding increased slightly from 2023, but as previously mentioned, the dividend remained well-covered.

Moreover, with the Frontier deal, VZ is unlikely to repurchase shares in the near term, which would have likely benefited the share price positively.

On the other hand, peer T-Mobile announced a repurchase program in September 2023. And at the end of their Q2, management repurchased a total of 150.2 million shares on a cumulative basis. In the quarter, TMUS repurchased $2 billion worth of shares.

Aside from VZ’s debt and free cash flow improving, wireless service revenue and EBITDA both increased 3.5% and 2.8% respectively. Consumer postpaid gross adds were up double-digits at 12%.

Earnings per share of $1.15 declined 5% while revenue of $32.6 billion was up slightly, less than 1%. Management attributed the drop in earnings due to higher expenses. But overall, Verizon is doing all the right things and looks to be in good shape.

Valuation & Risks

As a result of their share price appreciation, I don’t think the stock is as great a buy at current levels. I do, however, think they are a great dividend stock to hold long term. And as previously mentioned, I’m looking to get in under $35 a share.

At the time of writing, VZ has a forward P/E ratio of 9.44x, below peer AT&T’s forward P/E of 9.69x. Their current multiple is in-line with Fastgraph’s blended P/E of 9.45x. This is also not too far off from their 5-year average of 9.79x, implying upside could potentially be limited here.

Moreover, the company also faces regulatory risks due to their recent acquisition. Their CEO did state he was confident the merger would be approved, but of course this remains to be seen.

Companies Kroger (KR) and Albertsons (ACI) are currently in battle with the Federal Trade Commission to stop their announced merger. And if this merger is met with any negative sentiment from regulators, VZ’s share price could see some volatility going forward.

Bottom Line

Verizon is a good dividend stock to own for the long term. However, due to their recent acquisition, I think this may weigh on their share price upside going forward. The company stands to benefit from lower interest rates, but will likely see sideways action as investors wonder how the Frontier merger will impact their debt load.

Additionally, there is little known as of now how the merger is expected to impact their bottom line as well as free cash flow. As a result of the uncertainty surrounding whether the deal will even be approved as well as if it will impact their debt and bottom line, I am downgrading Verizon to a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.