Summary:

- Tesla’s price target sits at $316, aligning with the 1.618 Fibonacci retracement level, signaling potential upside momentum.

- The energy storage business grew 100% YoY in Q2 2024, with projections to exceed $13 billion in revenue by 2025.

- Autonomous driving market is set to grow to $2.8 trillion by 2033, with Tesla’s FSD leading the charge.

- Tesla’s revenue grew at a 31.56% CAGR over three years, showcasing substantial expansion into new, high-growth industries.

- Growing EV competition from Chinese and domestic manufacturers is intensifying, challenging Tesla’s market share and pricing power globally.

piranka

Investment Thesis

Tesla’s (NASDAQ:TSLA) (NEOE:TSLA:CA) outlook remains bullish due to its fundamental solid growth across all its business segments; in Q2 of 2024, Energy Storage revenues enhanced 100% YoY, recording a new high of 9.4 GWh deployed and setting the firm well on track to more than $13 billion revenue generation through 2025.

Tesla also constructs a capital-efficient business into autonomous driving and robotics at the bottom of the S-curve, underpinned by early leadership in full self-driving technology that should disrupt many industries.

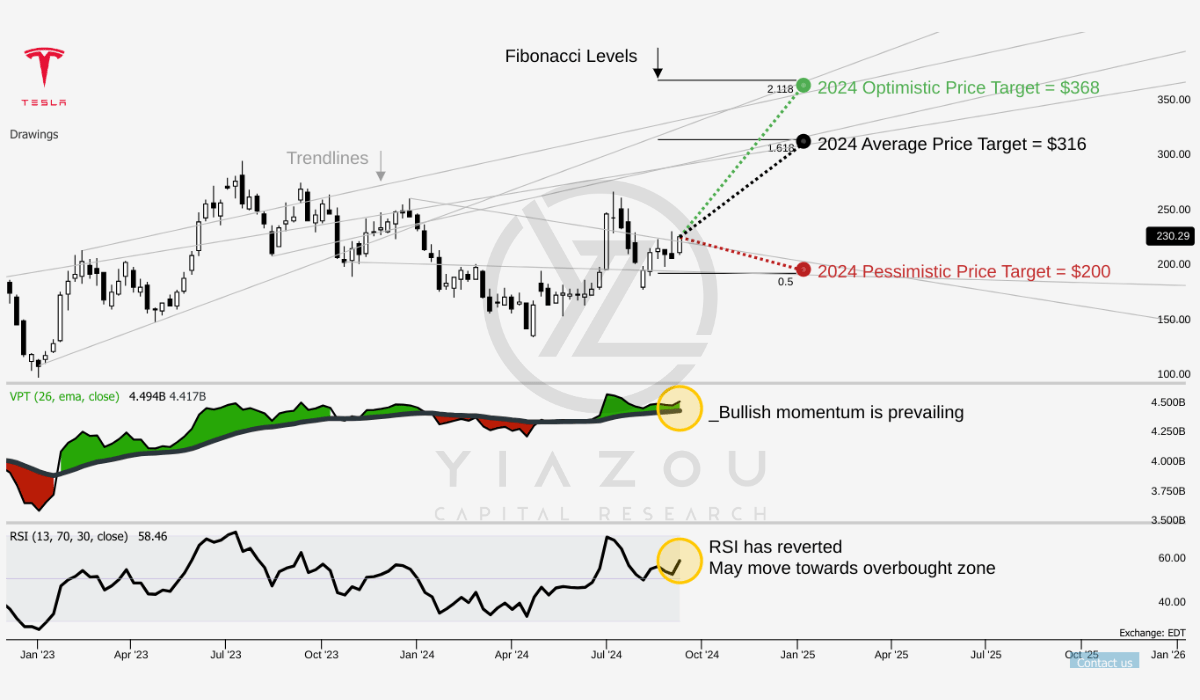

Following our strong buy rating in June with a $200 price target, Tesla reached and surpassed the target, delivering a 23% return. Updated technicals demonstrate continued bullish momentum.

Tesla’s Bullish Breakout: Fibonacci Levels Signal $316+ Upside

TSLA’s current price is $230, with an average price target of $316, which aligns with the 1.618 Fibonacci retracement level. This signals a potential bullish trend continuation. The optimistic price target of $368 corresponds to the 2.118 Fibonacci extension, suggesting that Tesla could experience a substantial upside if the market momentum remains strong. Conversely, the pessimistic target of $200 stands at the 0.5 Fibonacci level, which reflects a downside risk based on potential corrections or broader market downturns.

Moreover, the RSI is currently at 58.46, which indicates that Tesla is moving towards the overbought territory. The upward trend in the RSI line (after taking support near 50) suggests renewed buying interest, which means the current price action may move towards the upside for the short- to mid-term.

Further, the VPT line points to a recovery of bullish volume momentum after short-term weakness. The line stands at 4.49 billion, and the moving average of 4.42 billion supports the likelihood of a sustained price increase if the trend holds.

Yiazou (TrendSpider)

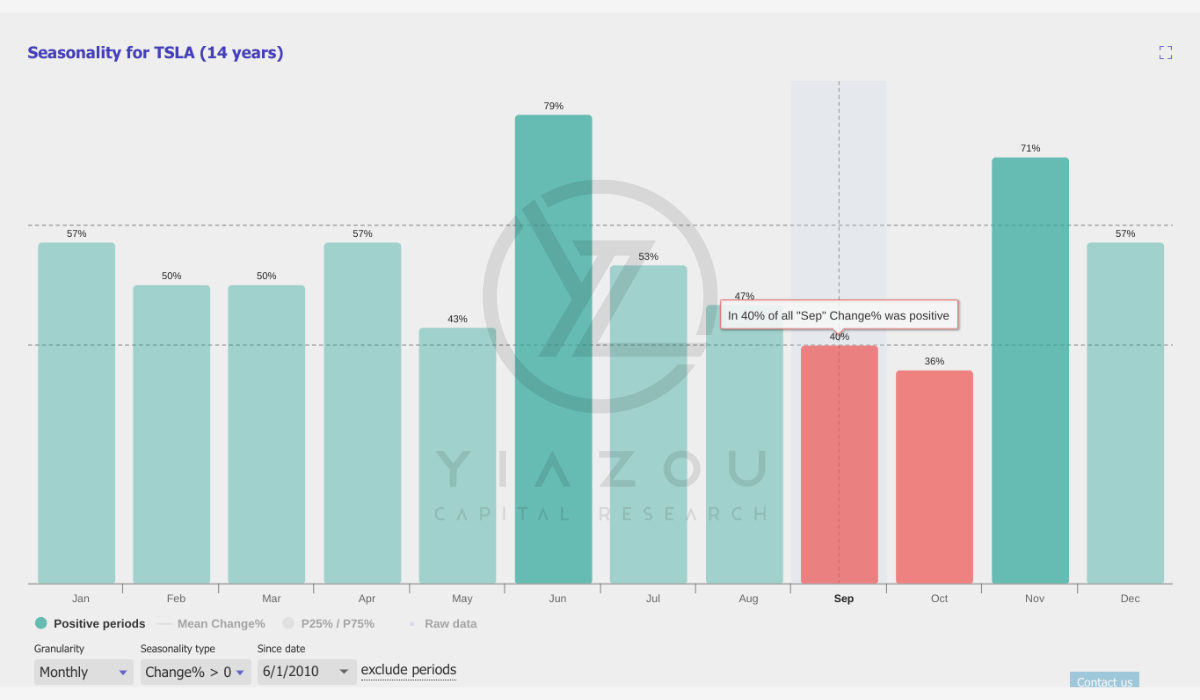

Tesla’s seasonality over the past 14 years shows mixed performance. September has a low 40% probability of positive returns, urging caution for investors this month. June stands out as the strongest, with a 79% chance of gains, followed by November at 71%, reflecting strong mid-year and late-year trends. Weaker months include October (36%) and August (43%), indicating more volatility or bearish tendencies. While September’s outlook is cautious, TSLA tends to perform better during mid-year and late-year periods, offering stronger historical opportunities for potential gains.

Yiazou (TrendSpider)

Beyond EV, A Lead in Autonomous Driving, Robotics, and Energy Storage Market

Tesla’s market opportunity is transforming into a solid lead in autonomous driving, robotics, and energy storage. Deutsche Bank marked Tesla as a “technology platform” with the potential to disrupt industries. This vision is anchored in Tesla’s focus on robotaxis and humanoid robots. The company aims to go beyond car manufacturing, expanding into new sectors.

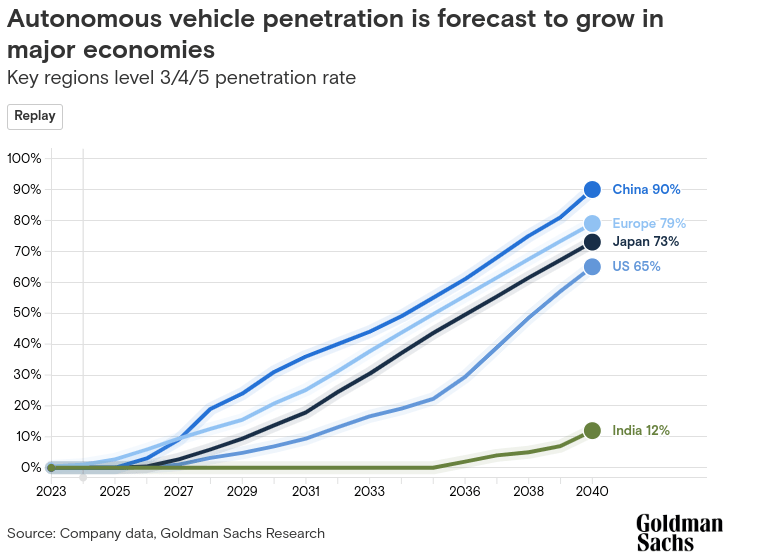

The autonomous driving market is predicted to soar in developed markets. Based on an annual growth of 33%, it may exceed $2.8 trillion by 2033. Tesla’s early lead comes from its advanced AI and vast driving data. Its FSD software is central to this push. As FSD’s price drops and its capabilities grow, mass adoption becomes likely. This shift could cement Tesla’s top-line growth and street sentiment about its dominance in autonomous technology.

Goldman Sachs

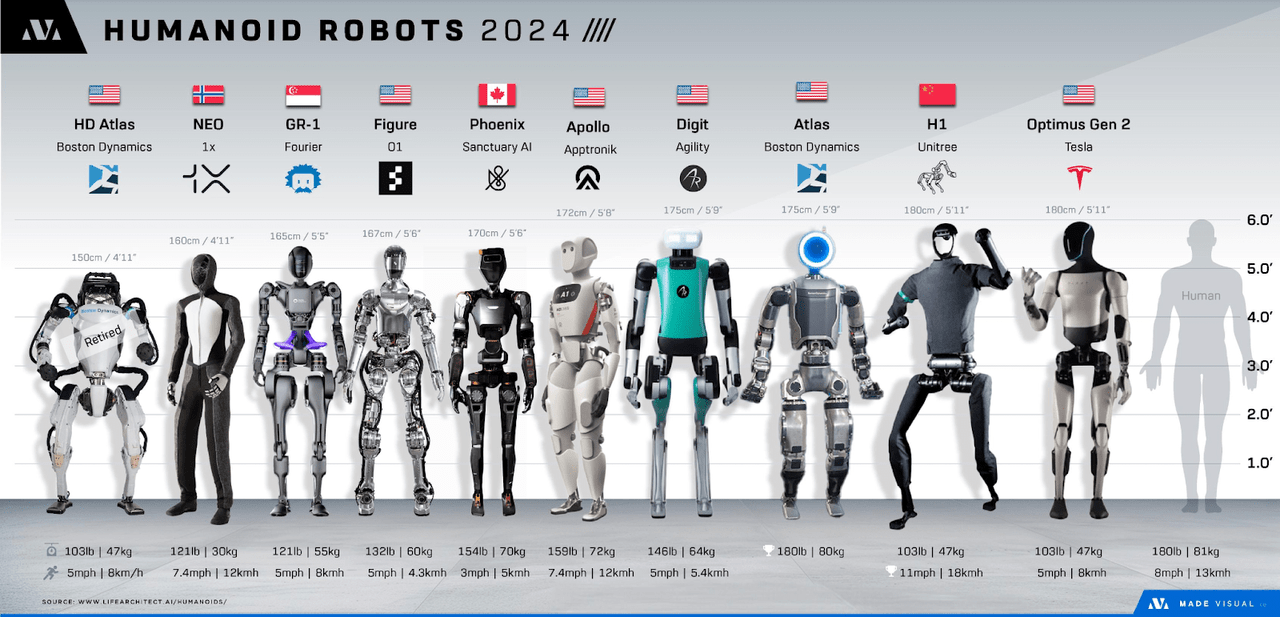

Tesla’s humanoid robot, Optimus, is in early development and performs well in repetitive or hazardous tasks. The global robotics market could surpass $375 billion by 2035. The number of US humanoid robots may hit 63 million by 2050, with a $3 trillion market shift. Tesla’s expertise in AI and robotics may help the company capture a significant market share. The ongoing development of its technologies will likely derive top-line growth in a whole new segment.

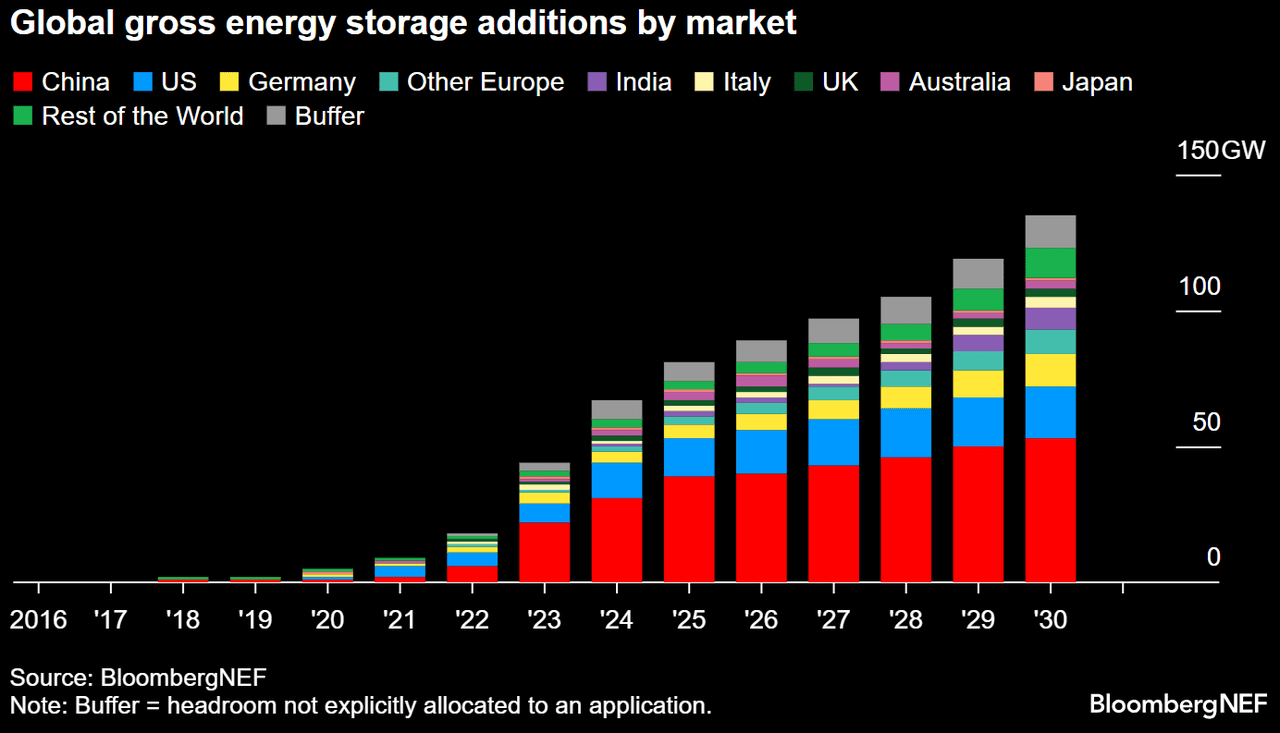

Similarly, Tesla’s energy storage business is also bringing in substantial revenue expansion (100% YoY in Q2 2024) that could generate over $13 billion in sales by 2025. Investments in battery storage in 2024 are booming and surpass $50 billion. In Q2 2024, Tesla deployed 9.4 GWh in energy storage (more than 40GWh in 2024), setting a new record. The rising demand for energy storage stems from the shift to renewable energy. Tesla’s products like the Megapack and Powerwall are key to this strategy.

Fundamentally, Energy storage is a high-margin business for Tesla that complements its EVs and strengthens its brand. As solar and wind energy become popular, reliable storage becomes more crucial. Tesla has a significant opportunity to tap into this demand, as the energy storage market had 3X YoY growth in 2023. This may create room for Tesla’s top-line growth, and its focus on cost reduction and technology improvements will support its expansion.

In addition to these opportunities, Tesla’s automotive business may boom by introducing new models. It is preparing to ramp up Cybertruck production and lower-cost models by 2025. Short-term margin softness has occurred due to higher costs, restructuring, and AI investments, but these challenges are temporary. Tesla’s margins may improve as it achieves cost efficiencies with innovations like the 4680 battery cell production and robotaxi initiative. Tesla’s FSD software is one of the most advanced systems today, and it targets the first to hit a fully autonomous robotaxi fleet (the first mover advantage against Waymo) as the robotaxi market could surpass $10 trillion by 2030.

Beyond all this, Tesla’s upcoming Q3 earnings and robotaxi event (in October 2024) are vital as the street looks for signs of recovery from its recent margin pressures. The consensus estimate for Tesla’s normalized EPS is $0.63 (-5.02% YoY). The revenue estimate for Q3 2024 stands at $25.66 billion, representing a YoY growth of 9.88%.

While this is solid growth, it’s slower than Tesla’s history, reflecting the hit the company is taking from pricing pressures and increasing competition in the EV market. For Q4 2024, though, Tesla revenues are forecasted to grow 7.53% to $27.06 billion, promising a rebound in performance from new and refreshed models now hitting the road.

Tesla’s Explosive Growth: High Volatility, Massive Potential

Tesla’s revenue growth has a 31.56% CAGR over the last 3 years. Over the past decade, the top-line CAGR was even higher at 44.29%, highlighting the company’s ability to expand rapidly. However, recent revenue growth slowed to 1.37% YoY due to external pressures. These include supply chain disruptions, inflation, and increased EV competition. At the bottom line, operating income growth has been strong, with a five-year CAGR of 84.75%. Yet, in the last year, EBIT declined by 43.03% due to spending on AI, robotics, and growth initiatives. This temporary setback should reverse as these investments yield results.

Moreover, Tesla’s EPS growth has followed a similar path. The company’s EPS has expanded 77.89% over the last three years but reported a decline to 1.06% YoY in the trailing twelve months. The company targets long-term growth rather than short-term profits, and the boom in its EPS growth could happen when its energy storage and autonomous driving sectors start to grow. This may lead to high stock valuations and massive price changes in upcoming quarters.

Finally, Tesla’s stock has a 24-month beta of 1.95, indicating it is more volatile than the market. For example, competitors like Toyota (TM), BYD (OTCPK:BYDDF), and Ferrari (RACE) have far lower betas. Tesla’s high volatility owes to its high-growth expectations, but this risk is partly compensated for by Tesla’s strong financial position and capacity utilization. Tesla stands at an Altman Z-Score of 10.76, a low risk of financial distress that places it in another league, relatively speaking, with other car manufacturers. By comparison, Toyota has a Z-score of only 1.67 and a BYD of 1.72, which is substantially lower.

Downsides: Weak Earnings and Revenue Projections, Challenges Ahead, And High Valuations

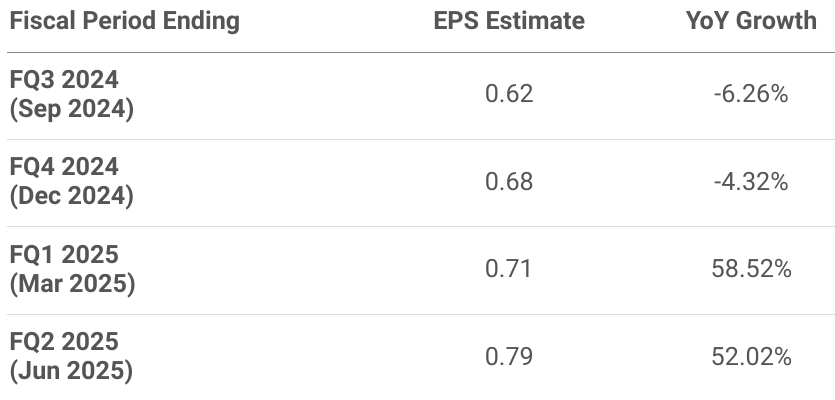

The divergence in EPS growth estimates between Q3-Q4 2024 and Q1-Q2 2025 indicates that while Tesla faced short-term headwinds, its financial performance may improve towards the end of the year. For Q4 2024, the EPS estimate rises to $0.68, reflecting only a modest YoY decline of 4.3%. There are uncertainties in Tesla’s near-term outlook, particularly regarding vehicle pricing and cost inflation. Hence, these factors may affect consumer purchasing power, particularly for high-priced EVs.

Seeking Alpha

Furthermore, Chinese and domestic EV manufacturers introduce more competitive models as competition increases in the EV market. In addition, dependency for sales on Model 3/Y and the very slow rollout of new models such as Cybertruck and the Semi further reduces the ability to exploit the EV market. This is reflected by modest Q3 and Q4 revenue growth projections.

Tesla delivered 444K vehicles in Q2 2024, slightly below expectations, impacting the stock price. Analysts project 469K deliveries (Canaccord reduced the estimate) in Q3 2024, so its market value growth is directly tied to new models and production scaling. Thus, any continued issues in deliveries may hit the stock harder.

In terms of valuation, Tesla’s P/E ratio marks a weakness in its long-term growth potential. The forward P/E ratio is 96.92, massively higher than the sector median of 15.79, representing a 514% premium. Tesla’s short-term leads in the EV market justify some premium, but not to this level. Critically, the company’s P/E ratio is just 15% undervalued from its five-year average of 114.1, which limits potential upside against dropping earnings in upcoming quarters.

Similarly, Tesla’s price/earnings-to-growth (PEG) ratio of 8.93 is massively higher than the sector median of 1.39, reflecting the high street expectations of Tesla’s bottom-line growth due to high progress in areas such as energy storage, autonomous driving, and robotics. In short, while the company’s valuations may seem stretched compared to traditional automakers, they are justified as Tesla can consistently disrupt industries and generate significant growth across multiple business segments.

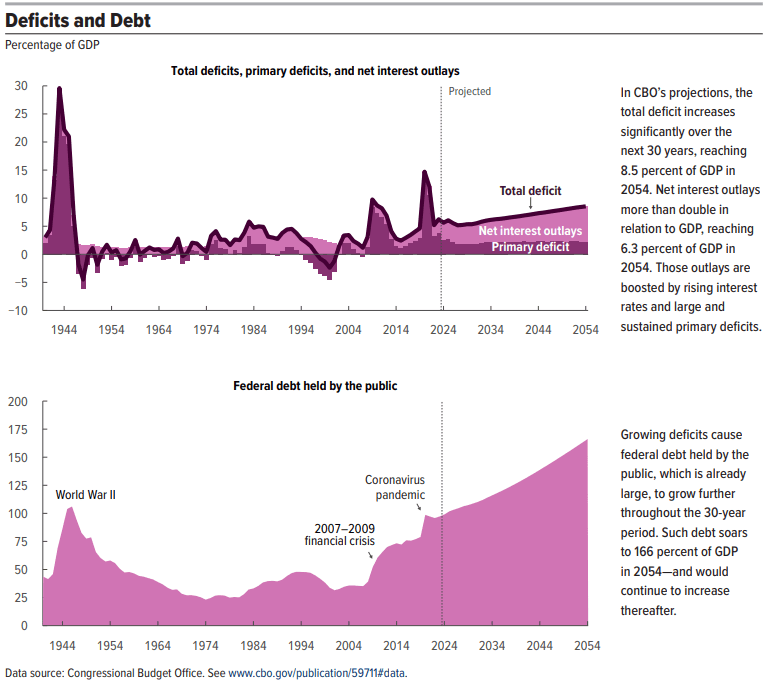

Finally, at the macro level, US elections and street worries about a potential full-scale war between NATO and Russia may lead to market-wide corrections. The market may perceive the war as highly probable, based on Western support for Ukraine’s use of long-range missiles (after the Kursk Oblast incursion) and the dollar’s de-stability (massive net interest outlays on federal debt surpassing WWII levels).

Congressional Budget Office

Takeaway

Tesla’s strong fundamentals paint a bullish outlook for the company. The energy storage business scaled 100% YoY in Q2 of 2024, and forecasts show it will reach over $13 billion in revenue by 2025. Leading in autonomous driving and robotics, aside from the developing sectors of FSD and humanoid robots, positions Tesla for tremendous expansion in the future.

Despite temporary setbacks from investment in AI and growth initiatives, Tesla’s strong revenue history and expansion across diverse industries indicate long-term value and strong growth potential across its business segments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.