Summary:

- The Federal Reserve is expected to start cutting interest rates this week, continuing into 2025, benefiting consumers and businesses.

- Amazon is poised to benefit from these anticipated rate cuts, potentially boosting its financial performance and market position.

- Amazon’s Q2 report and current valuation support the investment thesis of potential gains from rate cuts.

10’000 Hours

All expectations are that the Federal Reserve will start cutting interest rates at this week’s meeting. The process of rate cuts is expected to continue into 2025, and this should provide multiple benefits for both consumers and businesses. One name that, I think, could benefit a bit from this process is Amazon.com, Inc. (NASDAQ:AMZN), a name that could look to continue its longer-term rally.

Previous coverage of the name:

It was back in late 2023 when I last covered Amazon. At that time, I liked the setup going into this year, because of a number of factors. The company had a decent growth profile, and with inflation coming down, I expected consumer spending would be strong. Amazon Web Services (“AWS”) was also looking good as more investments were being made in the cloud. I also noted how one of the biggest investor fears regarding the company, its valuation, didn’t always mean much.

Amazon has definitely been a winner so far this year. The stock finished last week up almost 26% since I last covered it, beating the S&P 500 by almost five percentage points. This is despite the stock being about $15 off its all-time high from a few months ago. Just like I noted last time, if you were scared off by a high price-to-earnings number, you missed a big rally.

Looking back at the Q2 report:

When Amazon reported its second quarter results back in early August, the report was a bit mixed. On one hand, the company reported year-over-year revenue growth of just over 10%, but the dollar figure missed by almost $800 million. Additionally, the current quarter guidance was a little light. However, the company did smash bottom line estimates and reported AWS revenue growth that was ahead of expectations.

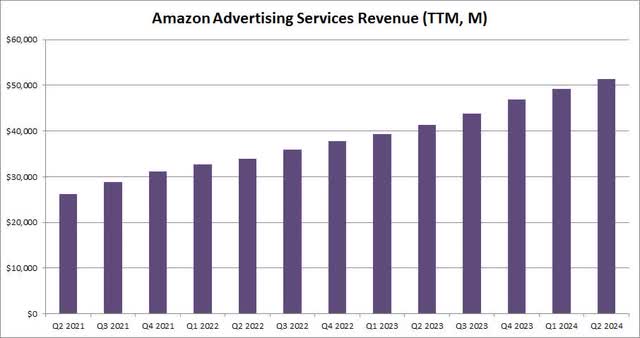

AWS should surpass $100 billion in trailing twelve-month revenue sometime in the back half of this year, and the segment is now a profit monster. Operating income was over $9.3 billion in Q2 2024, up 74% over the year ago period. Additionally, as the chart below shows, Amazon’s advertising services business has become a more than $50 billion a year revenue giant.

Amazon Ad Revenue (Company Earnings Reports)

The company roughly doubled its overall net income year over year to almost $13.5 billion in Q2. A small part of this was due to a surge in cash flow, which had Amazon in a net cash position of over $26 billion at the end of June, based on a look at the balance sheet in its most recent 10-Q filing. The company has over $89 billion in cash and marketable securities, against a little more than $7 billion in short-term debt and nearly $55 billion in long-term debt. This is a stark reversal from the $3.5 billion net debt position it had a year earlier. This alone swung a nearly $800 million benefit to interest income over Q2 2023. With Amazon now kicking off tens of billions in cash per year, we’re either likely to see acquisitions coming to further boost sales or perhaps a material focus on share repurchases.

Here comes the Fed:

While inflation rates have come back down to more reasonable levels, they aren’t quite at the Fed’s 2% goal just yet. However, if we see just a modest level of month-to-month increases moving forward, we could easily be there sometime in early 2025. As a result, the Fed is expected to start cutting rates, hoping to stimulate a bit more growth that might have been hampered by its significant tightening policy.

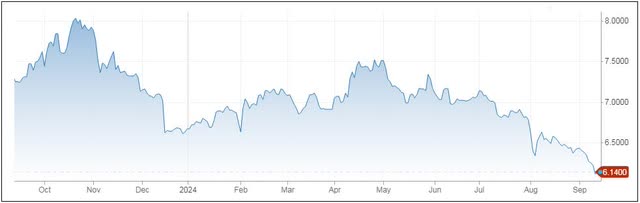

Bond yields have already come well off their highs. That will be good for businesses looking perhaps to refinance or get some extra capital at a rate lower than what we’ve seen in the past year or two. At the same time, as the chart below shows, the 30-year Mortgage rate has come down almost two full percentage points from its high in late 2023.

Anyone who got a mortgage in the 7% range or even higher is probably looking to refinance currently, and that activity has definitely picked up recently. At the same time, energy prices have come well off their highs. Lower gas prices will certainly be good for consumers during the holiday shopping season, and winter heating bills could also be a bit lower this year. If Amazon just has a decent few quarters here in terms of retail sales, but you throw in strong growth from AWS, advertising, etc., the company is set up for some nice profits moving forward.

There are two risks I should discuss here. The first is that the Fed waited too long to cut rates, and US growth peters out, and we enter a recession. In this case, consumer spending would obviously slow, and Amazon wouldn’t be able to achieve the revenue growth rates that are currently expected. The other risk is that by cutting rates, we see a return of inflation into early 2025, at which point we could see spending slow as well, or perhaps the Fed has to hold rates higher for longer (or even raise them back).

The current valuation analysis:

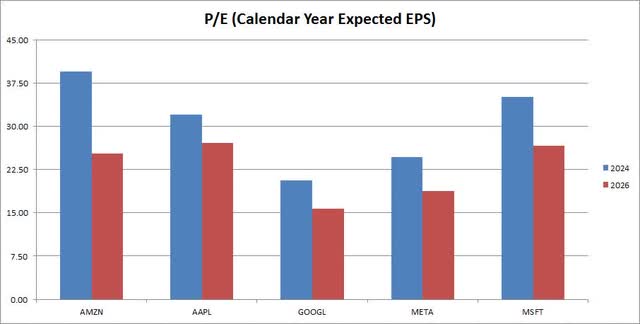

For a number of years, Amazon’s price-to-earnings ratio was sky-high, or even non-existent, due to low net income or even losses. Now that the company has started to generate reasonable profits, the valuation on this basis looks a lot more reasonable. In the chart below, I’ve compared the name to five other tech giants – Apple Inc. (AAPL), Alphabet Inc. (GOOG) (GOOGL), Meta Platforms, Inc. (META), and Microsoft Corporation (MSFT). For each name, the valuation is based on analyst estimates for each name’s calendar year this year and in 2026, which makes the comparison between them equal since a couple of these names do not use calendar fiscal years.

Calendar Year P/E (Seeking Alpha)

Amazon finished Friday’s session at just over 39.5 times the street’s current average for earnings this year. That was a more than 40% premium to the other four names. However, due to stronger earnings growth moving forward, the 2026 valuation of 25 times is a little more than a 14% premium, which is much more reasonable. If Amazon can fetch about the midpoint of those two valuations, say 32 times earnings and the 2026 street expectation is $7.50 two years from now (the current street average is $7.39), that would mean a price target of $240 per share. That would be a nice $50-plus upside from here.

Final thoughts and recommendation:

With the Fed set to cut rates, consumer and business sentiment should start to improve in the coming quarters. As homeowners can refinance at lower rates and US growth should pick up, Amazon seems to benefit on both the retail and AWS fronts. The company looks set to continue its top line growth moving forward, but now we’re also starting to see some decent profitability reported. With the cash position also doing better, investors might see some acquisitions to further bolster growth, or perhaps some share repurchases.

With Amazon’s valuation looking better as we look to the next couple of years, I’m reiterating my buy recommendation today. The stock isn’t as expensive if we look to 2026 as it is now, and I think we’ll see some better growth here than from some other large-cap tech giants. As we look forward to the holiday shopping season, it would not surprise me if Amazon eventually sets some new all-time highs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.