Summary:

- Devon Energy Corporation boasts a strong business model with a 5%+ dividend yield and a robust financial position, ensuring substantial shareholder returns.

- The company has paid out over $14 billion to shareholders since 2020, primarily through dividends and share repurchases.

- Devon’s acquisition of Grayson Mill Energy enhances its asset base, adding 100,000 BOE/day and significant cost savings, boosting future returns.

- Despite weak oil prices, Devon’s low breakeven and 9% FCF yield at $70 WTI underscore its resilience and investment value.

hirun

Devon Energy Corporation (NYSE:DVN) is a U.S. hydrocarbon company with a valuation of roughly $25 billion. The company has a dividend yield of more than 5% and is committed to generating strong shareholder returns, which it’s built a history of doing so recently. As we’ll see throughout this article, Devon Energy can continue generating strong shareholder returns.

Devon Energy Business Model

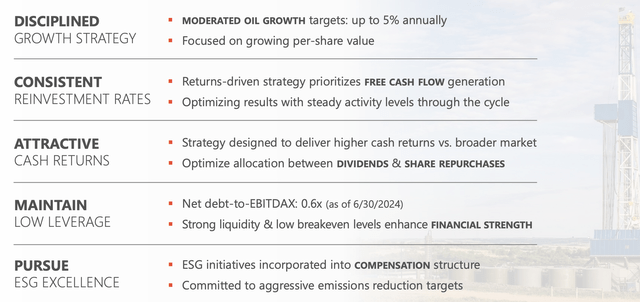

The company’s business model centers around growing its production and increasing overall shareholder returns.

Devon Energy Investor Presentation

The company is focused on continuing to generate strong shareholder returns. The company has a stronger than average dividend yield in the industry, at more than 5%. The company maintains an incredibly strong financial picture with a 0.6x net debt to EBITDAX. Overall, the company has strong assets and growth that will enable strong shareholder returns.

Devon Energy Shareholder Return History

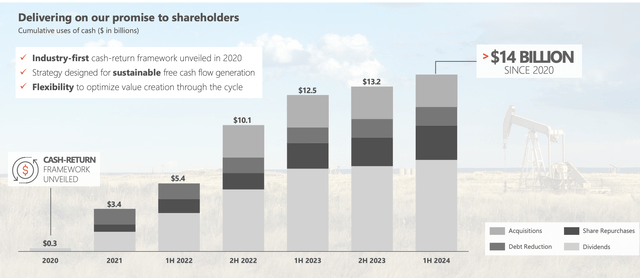

The company has worked hard to deliver strong shareholder returns since 2020 despite weakness in the market.

Devon Energy Investor Presentation

The company has paid out more than $14 billion to shareholders since 2020. That’s roughly 60% of the company’s market capitalization, which has been paid out primarily through dividends along with share repurchases. We’d like to see the company spend more on share repurchases while its share price remains low.

Regardless of how the company spends its cash, though, it continues to generate substantial cash it can use for shareholder returns.

Devon Energy Asset Overview

This provides an overview of the company’s assets, which are spread through numerous basins, but are primarily focused on the Delaware Basin.

Devon Energy Investor Presentation

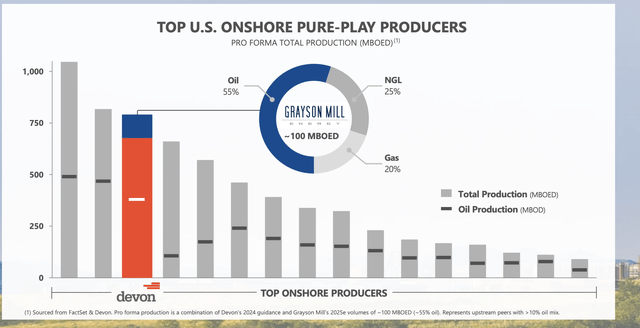

The company has more than 10 years of low-risk inventory, and its 65% cash acquisition of Grayson Mill is expected to close soon. The company expects the $5 billion acquisition to add $50 million / year in cost savings with additional midstream savings. The company expects the production to add 100 thousand BOE per day, which with high margins can enable the company to pay it off.

The company’s low-cost development inventory, upcoming benefits of the acquisition, and strong production will enable future returns.

Devon Energy Investor Presentation

This provided a picture of the company’s production as one of the largest producers in the United States onshore. The company has roughly 750 thousand barrels / day post-acquisition of BOE. This is roughly evenly split between oil and non-oil production. This shows the company’s incredibly strong positioning.

The company’s $25 billion market cap and oil focus, in our view, also makes it a potential acquisition target for a company looking to expand onshore production.

Devon Energy Outlook

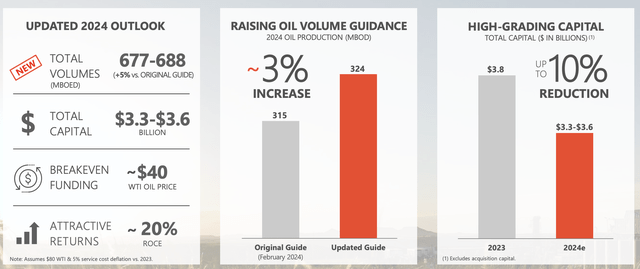

This shows the company’s outlook and guidance to continue its growth.

Devon Energy Investor Presentation

The company expects 680 thousand barrels / day in production, +5% versus its original guidance, as it continued to grow. The company expects roughly $3.45 billion in total capital, versus production of 250 million barrels, meaning capital expenditures at roughly $14 / barrel. The company’s breakeven funding is at $40 / barrel WTI.

That means that despite current market weakness, the company is still very profitable to the tune of more than $20 / barrel. That is billions of dollars in annual cash flow that the company is earning that it can utilize for shareholder returns. At current WTI prices of just under $70 / barrel, the company has a 9% FCF yield, which is quite respectable in a weak environment.

The company can use that to continue funding its dividend or various other shareholder returns. The company’s strong balance sheet means it doesn’t have any concerns there and is a valuable investment.

Thesis Risk

The largest risk to our thesis is current weak oil prices. Brent Crude prices (CL1:COM) are struggling to stay above $70 / barrel as production remains high. Companies like Devon Energy are continuing to be profitable in the current environment and raise prices. At the same time, markets remain weak and renewables decrease in cost. That could hurt Devon Energy’s ability to continue its shareholder returns.

Conclusion

Devon Energy Corporation has an impressive portfolio of assets. The company recently made the intelligent acquisition of Grayson Mill Energy, intelligently utilizing share issuances while primarily using cash, showing off the company’s incredibly strong balance sheet. The acquisition will lead to both synergies and increased cash flow.

The pro forma company will be one of the largest U.S. producers in terms of barrels of oil equivalent. The company has a low breakeven with a 9% FCF at $70 WTI. That’s a strong ability to generate cash flow in a weak environment, and it shows the company’s strength. Putting all of this together makes the company a valuable investment with continued growth potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.