Summary:

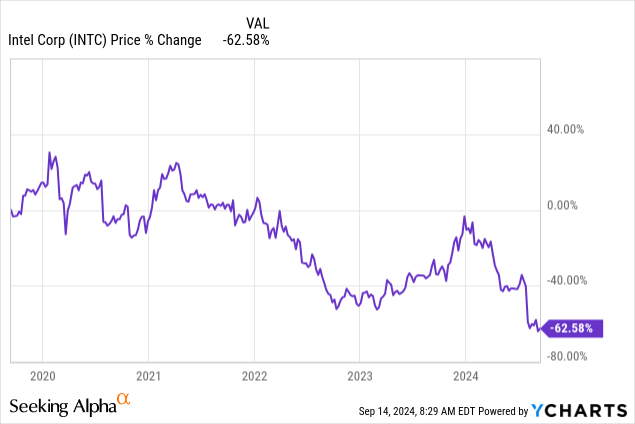

- Intel’s financial decline stems from past decisions and delays in advancing chip manufacturing technology, leading to a significant decline in stock price and market position.

- The hope for recovery lies in the Intel 18A node, which promises substantial improvements in technology and margins, potentially launching in 2025.

- Despite challenges, Intel’s strategic importance to the US economy and potential government incentives offer a cushion against complete failure.

- I am bullish on Intel, believing it can deliver solid, double-digit returns, making it a speculative ‘buy’ with a favorable risk-to-reward ratio.

- The valuation sensitivity analysis supports the value component of the investment thesis, as even conservative assumptions indicate strong upside potential to intrinsic value.

Mitsuru Sakurai/DigitalVision via Getty Images

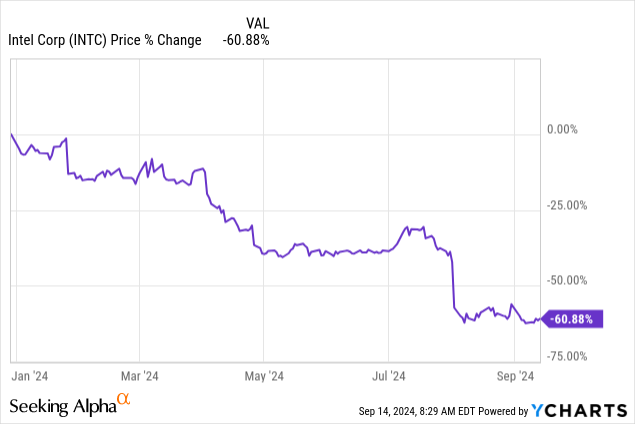

Intel (NASDAQ:INTC) doesn’t need much introduction, as the Company has been stealing financial media attention for quite some time. One of the leading global semiconductor players experienced severe headwinds, resulting in significant stock price drops. Intel recorded over 60% stock price decreases in the last 5 years and YTD.

What Happened To Intel?

Financial reflection

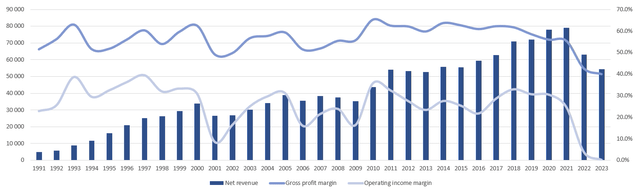

Intel reached its revenue peak in 2021 and followed that year with significant revenue decreases, accompanied by severe profitability cuts. Q1-Q2 2024 brought a negative 11.9% operating income margin, which wasn’t recorded in the last few decades.

Everything seemed fine until 2020. Operating income margin typically ranged from 20 to 40%, averaging 22-32% depending on the decade. The gross profit margin looked healthy, and revenue kept on growing at a moderate pace, which is characteristic of a mature business.

On the other hand, the 2021–2023 period looks dramatic, but it has worsened year after year, driving the gross operating margin below 40% in 2024 YTD and the operating income margin as low as -11.9%.

What brought us here? INTC’s problems started years ago

Such rapid changes result from historical decisions, especially given INTC’s business model. Nothing happens here overnight. For instance, historically, the Company changed its chip manufacturing technology (node) generation every two to three years. For example, look at INTC’s 2000–2014 period, when Intel delivered 8 steps to achieve more efficient and powerful nodes, starting from 180nm in 2000 to 14nm in 2014.

After that, Intel struggled with moving from a 14nm to a 10nm node and, due to delays, provided some optimizations to its previously released 14nm node in 2016 and 2017. The long-awaited 10nm node was released only in 2018.

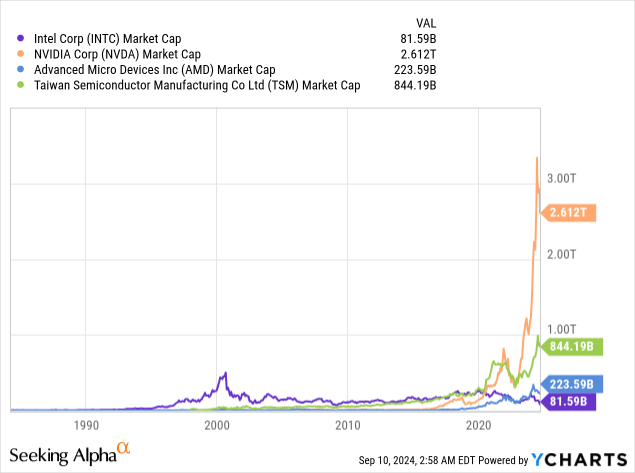

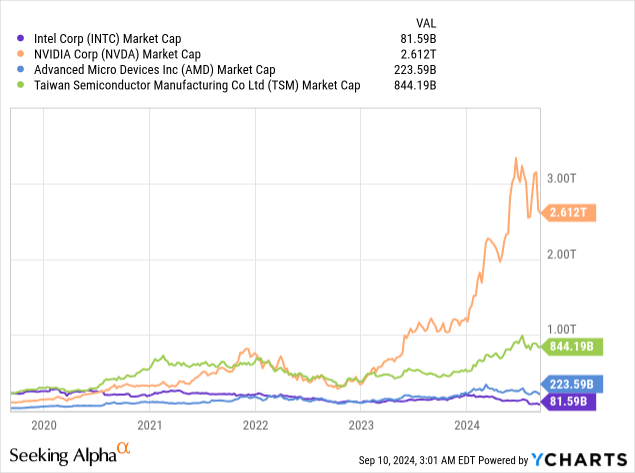

While Intel struggled, some of the other global players like NVIDIA (NVDA), Taiwan Semiconductor Manufacturing Co (TSM) or Advanced Micro Devices (AMD) kept on growing and innovating production capabilities. As a result, Intel lost its leadership position regarding market capitalization around 2020 and hasn’t regained it ever since. It currently holds the lowest market cap out of each entity mentioned.

Good decisions, bad decisions, and lack of decisions – they all tend to take time to fully manifest themselves. I believe that Intel’s current financial stance reflects the stumbles it experienced in the mid-late 2010s.

Is there a way out? The hope lies in Intel 18A

The management changes and announcement of 5 nodes in 4 years plan (highly ambitious) haven’t saved the situation (yet).

However, that may be for the very same reason – the current financial stance reflects the decisions and stumbles that occurred in the past. Current decisions will likely manifest in financial results in the upcoming years (hopefully for INTC’s shareholders).

Also, it’s worth pointing out that the ‘5 nodes in 4 years plan’ has some PR into its name, as 2 of these 5 nodes are enhancements of the other 2 of them:

- Intel 3 based on Intel 4

- Intel 18A based on Intel 20A

I haven’t seen many discussions about that, but it’s worth recognizing that not each of the 5 abovementioned nodes will be a full node but rather a half-step or enhancement of the previous ones.

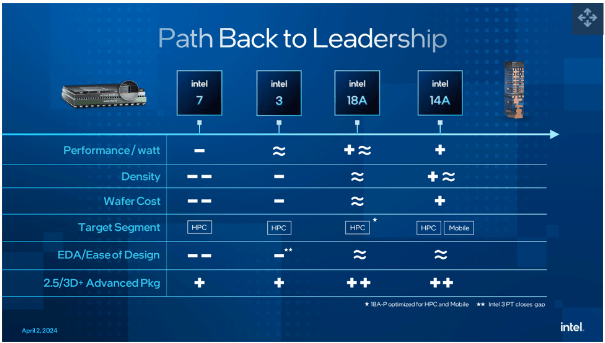

The Angstrom era – Intel 18A may be the holy grail

Intel

A quick disclaimer – I am an M&A advisor with a transactional and valuation-based background. Although I’ve been involved with many technological businesses and follow many tech players closely, I am not and never will be a technological expert in the field.

Nevertheless, my research led me to believe that if anything is to improve Intel’s market position – it will be the 18A node. For those unacquainted with the nomenclature, the ‘A’ represents a unit of length (angstrom = 0.1 nanometers), so 18A will be another (after 20A) leap forward for INTC compared to the 10nm or 7nm technology.

What does Intel itself have to say about it?

Since releasing the Intel 18A Process Design Kit (PDK) 1.0 in July, we have seen positive response across our ecosystem and are encouraged by what we’re seeing from Intel 18A in the fab. It’s powered on and booting on operating systems, healthy, and yielding well – and we remain on track for launch in 2025.

One of the benefits of our early success on Intel 18A is that it enables us to shift engineering resources from Intel 20A earlier than expected as we near completion of our five-nodes-in-four-years plan. With this decision, the Arrow Lake processor family will be built primarily using external partners and packaged by Intel Foundry.

Moreover, 18A should have a significant, positive impact on INTC’s margins, as the CFO suggested during the last conference:

And when you look at the progression from those pre-EUV nodes up through 18A, it’s like a 3x increase in pricing relative to cost. And so that alone drives the gross margin significantly. (…)

I think over time though, of course, scale is going to matter. I mean, it needs to have some scale to ultimately get to the 40%, 30%. But a lot of it is really within our control.

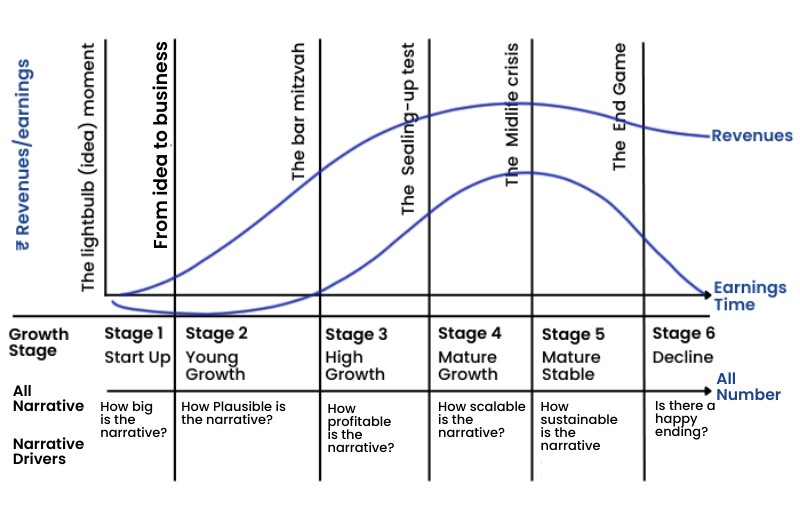

The Corporate Lifecycle – INTC Strives To Get ‘Younger’

Elearnmarkets

During the last couple of years, Intel has managed to move from an attractive ‘Mature Growth’ stage to the depressing ‘Decline’ stage, leaving many investors with a rightly asked question – is there a happy ending? The shift in its financial performance was so drastic that Intel completely skipped the Stage 5 of the above graphic.

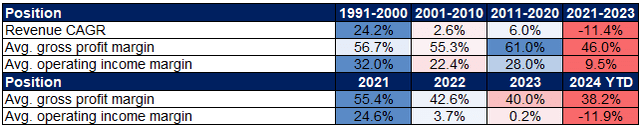

The stumbles of the recent decade seem to have been a wake-up call for Intel, as the Company ramped up its R&D activities (related to the 5N4Y plan), aiming to restore its innovative approach, competitive edge, and a meaningful position in the semiconductor landscape.

While it’s hard to assume that INTC still has a solid fighting chance for a leadership position, especially as its turnaround story relies heavily on the potential impact of 18A, I believe that Intel can return to the ‘Mature Growth’ phase and reestablish itself as a key chip player – just not a leader anymore. The market size and growth prospects certainly leave room for that.

While some uncertain news have been going around the market recently concerning a potential sale or separation of its foundry division, it’s more likely that INTC will take less drastic steps:

A potential separation or sale of Intel’s foundry division, which is aimed at manufacturing chips for outside customers, would be an about-face for Chief Executive Officer Pat Gelsinger. Gelsinger has viewed the business as key to restoring Intel’s standing among chipmakers and had hoped it would eventually compete with the likes of Taiwan Semiconductor Manufacturing Co., which pioneered the foundry industry. But it’s more likely that Intel takes a less dramatic step before it reaches that point, such as holding off on some of its expansion plans, the people said.

Moreover, one has to recognize Intel’s strategic significance for the US economy and national security. Intel plays a crucial role in the domestic semiconductor supply chain. Not only governments but also businesses should be interested in keeping Intel in business so as not to give even larger negotiating power to their chip suppliers.

It’s also worth mentioning that despite realizing huge investment expenditures, Intel can also rely on its partners’ contributions and government incentives. There’s not just doom and gloom around the Company; there are also some positive news released regularly, but they tend to get lost in the negative noise, such as:

Let’s Talk Valuation With A Different Outlook

The story behind the numbers

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

However, given Intel’s and the whole semiconductor industry’s specific situation, I don’t consider a multiple valuation method valid in this case. Therefore, let’s take another tool at our disposal—the income approach, specifically the FCFF variation of the discounted cash flows methodology.

Key considerations and assumptions:

- I will explain my assumptions, but please remember that it’s not my intention to accurately ‘predict’ Intel’s performance. It’s just for a reference point to provide a base for discussion. I will provide different scenarios to facilitate my final thesis.

- I assume that 18A will give INTC a chance for a solid turnaround; however, I take a rather conservative approach to growth and profitability (by historical standards and management’s expectations).

- I don’t believe INTC will regain leadership, but it can still be a valid investment and a strong player in an attractive market.

Free Cash Flow to Firm Estimation

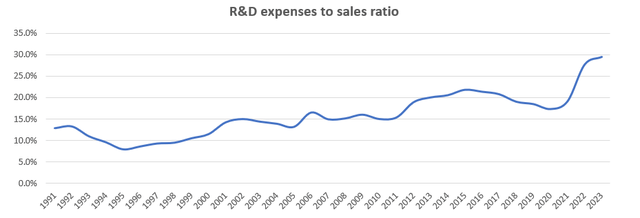

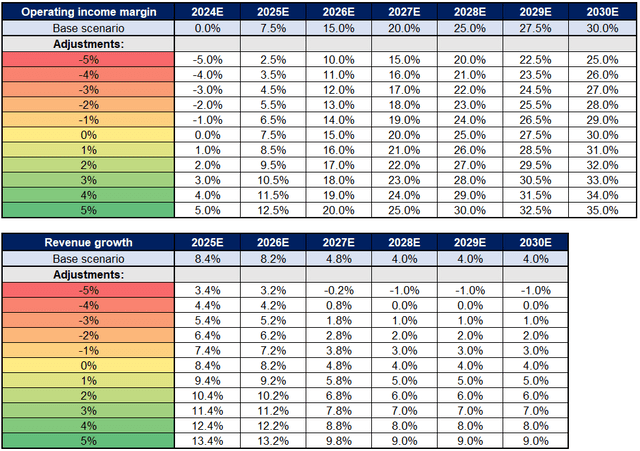

The revenue growth and operating income margin in the table above constitute my ‘base’ scenario for INTC’s future. For 2024-2026, I assumed revenue growth coherent with consensus estimates, but assumed slower growth moving forward.

I assumed the operating income margin to gradually improve, but fall a bit short of the management goal in 2030 (30%). I assumed US corporate tax rate to arrive at NOPAT (net operating income after tax). CAPEX for 2024 and 2025 has been assumed on a net basis (net of partners’ contributions and government incentives, presented by Intel here) with D&A coherent with historical levels. Both positions were assumed to grow according to revenues moving forward.

Please note that I haven’t used a complete FCFF formula, as I haven’t forecasted inflows/outflows related to changes in the net working capital. It would be too easy to curve the results by providing easily defendable subjective assumptions in this area.

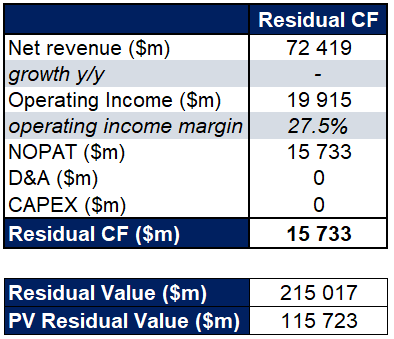

Residual Value and Base Target Price

Author based on Intel

Not many investors are aware of that, but when utilizing the DCF method, it’s crucial to take a unique approach to residual value estimation. Many practitioners assume the lase FCF of the forecast period as their residual flow used for Residual Value estimation. However, it should be adjusted in terms of D&A and CAPEX – both metrics should be assumed at the same level, indicating that the Company has reached a relatively stable level and will continue realizing predominantly ‘restoration’ investments to sustain its operations. That’s the reason for the ‘zeros’ presented in the table below – please feel free to ask any questions on this matter, as I won’t take more space to discuss it here.

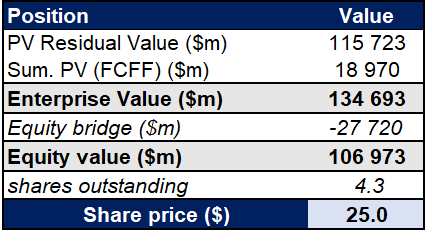

Author based on Intel

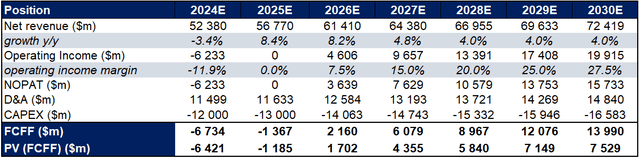

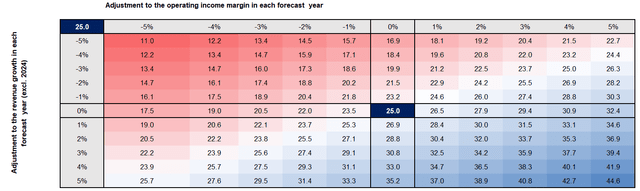

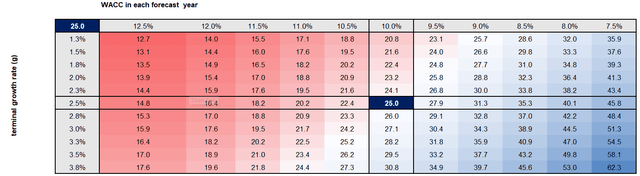

After discounting each cash flow to present value, I arrived at an Enterprise Value of $134.7B, which, after adjusting for the equity bridge, led to an equity value of $107B. The result is a base scenario target share price of $25.0.

Sensitivity analysis – the base scenario is already quite conservative, and it would be hard to fail to deliver

As promised, I prepared a sensitivity analysis, which is vital for my final investment thesis. Let’s take a look at two perspectives:

- Revenue growth and operating income margin

- Terminal growth rate and weighted average cost of capital

Firstly, the sensitivity analysis will answer the question:

- What would happen if revenue growth or operating income margin was X percentage points higher or lower in each year of the forecast period (incl. residual cash flow)?

With that in mind, please review the tables below presenting base scenarios regarding revenue growth and margin levels, as well as adjusted scenarios given depending on what ‘X’ we put into the above question.

Where did we arrive? For example, if one assumes that the operating income margin is 200 basis points lower in each forecast year, all else equal, the target stock price would amount to $22.0. On the other hand, if we assumed 200 basis points more dynamic revenue growth and 100 basis points higher margin, the target price would amount to $30.4.

I believe these examples will facilitate your review of the table below, presenting our first sensitivity analysis. Feel free to look at the tables above to better grasp the assumptions underlying each scenario.

Openly speaking, I consider my base scenario realistic, and the failure to deliver such results is highly unlikely. Frankly, I consider the risk-to-reward attractive, as I don’t believe that Intel will approach the ‘red zone’ of the above graphic.

Secondly, let’s look at a similar analysis based on valuation metrics – terminal growth rate and WACC. The base scenario assumed a 10% WACC and a rule-of-thumb terminal growth rate of 2.5%. To play the devil’s advocate, I would eliminate the bottom three rows from the analysis, as assuming the terminal growth rate of 3.25% and above would be wishful thinking while considering any business from my perspective. Nevertheless, I left it to provide you with additional perspective.

Investment thesis – I Have Skin In The Game

For transparency, as of last week, I joined the group of INTC’s shareholders, so one could say that I took my own advice. I have skin in the game. However, that’s a small and rather speculative position. A dominant part of my portfolio is oriented around stable, buy-and-hold businesses generating reliable income and operating within mission-critical/sticky business models.

Intel obviously doesn’t match the ‘stable, reliable income’ part, so it stands for a small portion of my portfolio. I believe most of you are well aware of the risk factors accompanying Intel:

- Geopolitical risks

- Failure to deliver the promised technological level

- Delays, which occurred historically

- Inability to transform substantial R&D expenses into cash-generating products

- Inability to properly capitalize on strategic expansion initiatives

Nevertheless, I consider its valuation below its intrinsic value should the Company deliver its (conservative, as I believe) base scenario results I presented earlier. Intel 18A has the potential to turn the table and restore Intel’s relevance. While it may not be able to regain its leadership position, it can certainly restore its meaningful place within an attractive, mission-critical sector. The ‘red zones’ presented in the sensitivity analysis constitute scenarios too pessimistic to materialize.

Therefore, I am bullish on INTC and believe it will provide solid, double-digit returns in the upcoming years. I’ll closely monitor its performance and provide any updates should my position change. Intel is a speculative ‘buy’ for me, with enough rationale to recognize its value proposition and accept the risk-to-reward relationship accompanying the Company.

The night looks the darkest before the dawn.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.