Summary:

- Cruise stocks present a compelling risk-reward balance, with strong demand and potential interest rate cuts enhancing margins, especially for debt-laden operators like Carnival Corp.

- CCL’s Q3 earnings are expected to show significant growth, driven by robust demand and a strategic focus on margin expansion, justifying an upgrade to a Buy rating.

- The Company’s valuation suggests an 8% sales CAGR and a 16% adj. EBITDA CAGR through CY26, implying a 17-18% upside despite high interest expenses.

- Rate cuts and strong demand will boost Carnival’s financial health, but any adverse changes in these factors could pose significant risks.

robyvannucci

Investment Thesis

Cruise stocks sit at one of the best intersections between risk and reward today.

On one hand, many cruise operators have raised their outlook for the year as demand tailwinds for cruise vacations continue to pan out across generations of users. Then, on the other hand, the set piece of a bevy of economic indicators, ranging from job data, inflation, etc., should give the Federal Reserve enough reason to cut interest rates.

With demand for cruises staying buoyant, interest rate cuts will give cruise operators even more breathing space to expand their margins in a high-demand environment, especially since most cruise operators racked up large volumes of debt on their balance sheets, putting pressure on operating leverage.

Carnival Corp. (NYSE:CCL) is one of the cruise operators that has one of the largest debt profiles as compared to its peers but has demonstrated efficient leverage as it benefits from growing demand for its cruises.

The company is expected to report their Q3 CY24 earnings results on Monday, September 30th, before markets open.

Based on the momentum demonstrated by its peers, I believe Carnival now has room for upside, and I am upgrading the company to a Buy.

The Cruise Industry Momentum Will Help Carnival’s Margin Expansions

In my previous coverage on Carnival, I expressed my neutral view on the name, solely because the company was not demonstrating the required growth pace. Per my estimates, the growth that Carnival was posting, specifically in operating profit, needed to grow much faster than its peers because of its debt load.

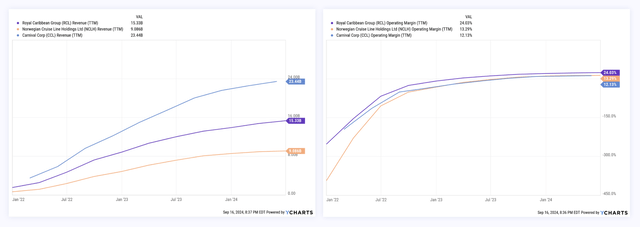

Based on the respective Q2 results from Royal Caribbean (RCL) and Norwegian (NCLH) and the last Q-report from Carnival, I observe the latter’s top-line growth has exceeded its peers. Unfortunately, Carnival has struggled to operate its business at a margin profile that allows it to manage its debt more efficiently than its peers.

Exhibit A: Carnival’s revenue trends and GAAP operating margins versus its peers (YCharts)

Investors will find this line of reasoning particularly useful because comparing a company’s pace of operating growth versus its ability to service debt via interest payments will point to the valuation multiples that should be used, which I will cover later in the valuation section.

For now, investors can see that despite Carnival having debt leverage ratios of 2.9x on a TTM basis, much more favorable than Norwegian or Royal Caribbean’s, which are in excess of 4x for both of them, Carnival incurs higher interest expenses, which is why it is paramount for Carnival to continue to grow its margins, which currently stand at 12.1% on a GAAP operating basis or ~20% on an adjusted EBITDA basis.

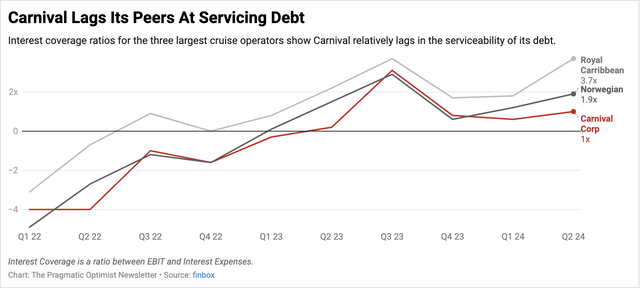

Exhibit B: Carnival Corp’s Interest Coverage ratios are lower than its peers (Author)

In the Q2 call, when Carnival’s management was asked about their strategic priorities between expanding margins and reinvesting in the business to capture more demand, they sounded more focused on raising margins first:

I don’t have a metric that says this is how much we’re going to do [invest] in any particular quarter or any particular year. I mean clearly our operating margin; we still got work to do. Our EBITDA margins, if we get to June guidance, it WILL be about a five point bump from last year, and it leaves us a few points short of where we were in 2019. So we got more work to do, and so the team is very focused on it.

Management has guided for 40% growth in 2024 adjusted EBITDA to $5.83 billion per the last report. This adj. EBITDA targets were raised by ~3.6% since management was seeing elevated levels of demand. The company said higher levels of demand gave them the confidence to guide stronger net yields of ~10.3%, 75 basis points higher than what they were projecting at the start of the year.

Carnival’s peers have all reported strong growth in their respective Q2 reports while forecasting even stronger growth ahead.

Norwegian raised their 2024 targets for the third time in a row, stating that they “expect our adjusted EPS to grow approximately 120% compared to 2023, driven mainly by our ability to capitalize on the robust market demand.” Royal Caribbean also said that “consumer spending onboard, as well as pre-cruise purchases, continue to significantly exceed 2023 levels, driven by greater participation at higher prices.” Royal Caribbean’s management also added additional insight on their earnings call:

In fact, our research suggests that consumers are spending more on travel than any other leisure category and that they intend to increase their travel spend in the next 12 months.”

My expectation for Carnival would be for management to announce a beat and raise, projecting higher growth overall, starting from net yields down to adjusted EBITDA.

Carnival Corp.’s Valuation Points To Some Upside

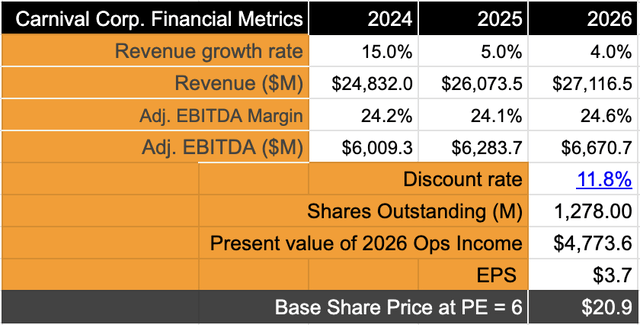

In my prior coverage, I had projected Carnival to grow its top line by ~7.4% through CY26, with strong growth being seen this year. However, due to strong progress demonstrated by the cruise industry as well as a robust outlook, I am raising my growth targets for Carnival as well, and I now expect the company to report ~8% sales CAGR through CY26.

I expect moderate revisions to Carnival’s margin profile as well, and I expect a larger boost to Carnival’s adj. EBITDA. I now expect Carnival to post at least 16% CAGR in adj. EBITDA through CY26, given management’s reiteration of focusing on margin expansion as their priority.

This should imply a forward earnings multiple of ~30x, but with interest expenses of $1.9-2 billion annually, Carnival will see its earnings multiple getting depressed in my view to ~6x.

Exhibit C: Carnival Corp. valuation points to some upside (Author)

Assuming a discount rate of 11.8% and shares outstanding worth 1.28 billion, factoring in a dilution of ~1%, this implies ~17-18% upside from the stock’s current levels.

Risks & Other Factors To Know

Interest rates are a huge factor that will impact the earnings potential for Carnival. In my valuation earlier, I have still not factored in any change from the current interest rate environment.

Morningstar’s estimates for rate cuts lie in the range of 1-2 rate cuts, consistent with market expectations. It is difficult to estimate the exact impact on Carnival Corp. because the company does not exactly spell out the tenures of its debt nor does it divulge the median/effective interest coupon rates of its debt profile, unlike its peers.

In the last earnings call, management added:

From a rate cut perspective, we’re in an environment where for us, we’re an improving credit. And hopefully, our interest rate, our future interest rates will come down not just because of rate cuts but because of the improving credit and the lower credit spreads. And on top of that, we would expect to do some refinancings. And those refinancings should drive our interest expense down. So we do have some very good opportunities that we’re looking at in the future, which should be net present value positive.

Therefore, rate cuts and a robust demand environment for the cruise industry should add a boost to Carnival Corp. However, expect severe headwinds if either of those factors, demand or interest rate, fail to turn favorably to Carnival’s benefit.

Takeaways

Carnival Corp. should continue to benefit from a strong demand environment as its Q3 report comes up at the end of September. In addition, rate cuts should alleviate the company’s debt servicing goals, allowing margins to grow. As a result, investors are highly likely to see an expansion in earnings multiple as well.

I am upgrading my rating on Carnival Corp. to a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.