Summary:

- Transocean Ltd. announced the sale of two drillships for a total of $342 million with proceeds directed towards reducing debt.

- Transocean’s net debt and normalized net debt are substantially higher than those of its offshore drilling peers.

- Despite an upswing in offshore drilling, Transocean’s unlevered free cash flow was less than cash interest paid over the twelve-month periods ending in the two most recent quarters.

- I would caution RIG investors to carefully weigh optimism on next year’s expected profits against continuing concerns around debt and cash flows.

PM Images

Drillships Sale

Early this month, Transocean (NYSE:RIG) filed Form 8-K to report a major event to shareholders, as required by the SEC. The drillships sale was described as follows:

On September 3, 2024, as part of our ongoing efforts to dispose of non-strategic assets, Transocean Ltd. (the “Company”) announced that a subsidiary of the Company entered into agreements (the “agreements”) with a third party to sell the Development Driller III and associated assets for $195 million and the Discoverer Inspiration and associated assets for $147 million. The Company expects the sale of these assets, for an aggregate $342 million, will result in an estimated non-cash charge for the third quarter 2024 ranging between $630 million and $645 million associated with the impairment of such assets.

The transactions contemplated by the agreements are subject to customary closing conditions and are expected to close in the third quarter of 2024. The Company intends to use substantially all of the proceeds from these transactions to repay existing indebtedness.

While the two drillships discussed are currently warm stacked and not high specification, their sale raises some concerns. Transocean may have been compelled to sell producing assets in order to shore up its balance sheet. Although an offshore drilling upswing is underway, RIG’s debt could still be a lingering problem.

How Does Rigs Debt Compare With Peers?

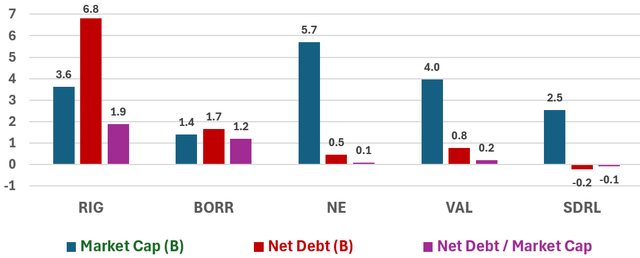

RIG’s nearly $7B net debt is almost four times higher than that of its most heavily indebted peer, Borr Drilling Limited (BORR).

Offshore Drillers: Normalized Net Debt

If net debt is normalized by dividing the figure by market cap, RIG’s normalized net debt is 1.9 compared to Borr’s 1.2 ratio. Please note, Seadrill Limited (SDRL) stands out from the group with negative net debt and is omitted from the following discussion.

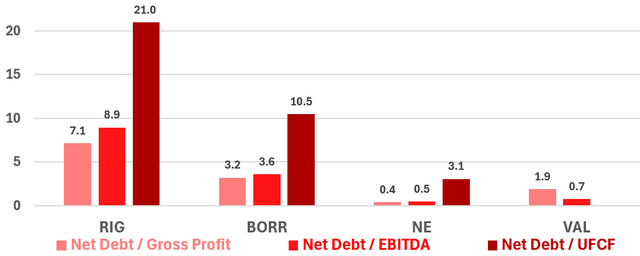

Net debt can also be considered with relation to profits and cash flows. .

Offshore Drillers: Net Debt & Cashflows

RIG’s ratios of net debt to gross profit, EBITDA, and unlevered free cash flow are substantially larger than those of Borr, Noble Corporation plc (NE), and Valaris Limited (VAL).

RIG’s most recent investor presentation, stated the following:

We believe that the cashflow-generating capability of our high-specification rig fleet can support full-cycle leverage of $4 – $4.5 billion, approximately 3x mid-cycle EBITDA

RIG’s net debt is currently almost $7B and its ratio of net debt-to- EBITDA of 8.9 is well over the 3x leverage ratio targeted by management.

Is Transocean Debt Improving?

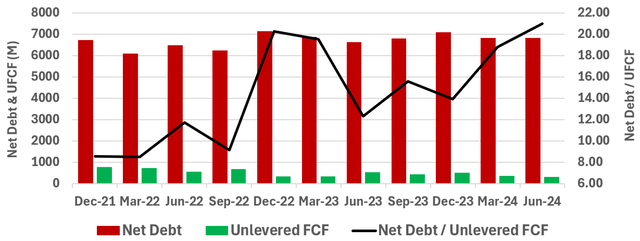

Many analysts have observed an offshore drilling upswing with growing day rates, but it is not immediately clear if RIG has yet been able to improve its debt situation and cashflows.

RIG Net Debt & Unlevered Free Cash Flow (Quarterly TTM)

Since December 2021, these data show RIG’s net debt trending slightly upward while unlevered free cash flow (UCFC) has trended down. Consequentially the ratio of net debt-to-UCFC has recently peaked at around 21.

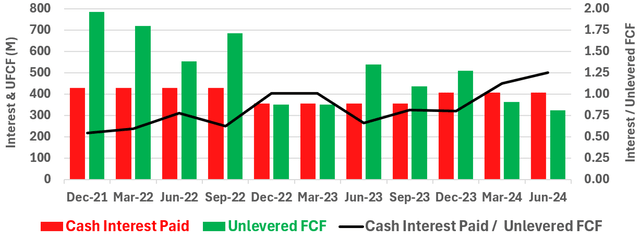

RIG Cash Interest Paid & Unlevered Free Cash Flow (Quarterly TTM)

Perhaps most alarmingly, unlevered free cash was less than cash interest paid over the twelve-month periods ending in the two most recent quarters. This shortfall may provide some insight with relation to the recent drillship sale.

RIG’s First Priority

RIG’s most recent investor presentation identifies strengthening its balance sheet as its first priority and notes several recent transactions:

- Exchanges of certain bonds with nearer-dated maturities

- $525M secured financing on Deepwater Titan

- $1.175B refinancing of four secured notes with improved amortization profile

- Conversion of remaining $25M 2.5% Senior Guaranteed Exchangeable Bonds due 2027 into RIG shares; obligation fully discharged

- $325M secured financing on Deepwater Aquila

- Equitization of ~$100M of the outstanding 2025 and 2029 Exchangeable Bonds

- Extension of revolving credit facility to mid 2028

- Issued $1.8B in Senior Guaranteed Notes to refinance near term maturities to improve debt maturity profile and simplify the capital structure

- $130M unsecured PGN financing on Transocean Norge

Investor Takeaways

Clearly, RIG management recognizes the risk imposed by its balance sheet to shareholders and I find no fault with management ongoing efforts on that front. The drillship sale proceeds of $342M applied to existing debt can reasonably be considered a small step in a positive direction.

Analysts expect rig to return to profitability in 2025 with earnings forecasted at $0.25/share on estimated revenues over $4B. Investor optimism is not entirely unsupported. I would caution investors to carefully consider RIG’s financial strength with regard to its ability to generate sufficient cash flows to not only carry its current liabilities, but also reduce leverage to its target range of $4 – $4.5B.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.