Summary:

- RIOT’s current valuation is likely to attract significant attention as the sector’s valuation is undergoing mean reversion which presents a potential 2x upside.

- The pessimism surrounding RIOT could derived from its underperformance in operating cost efficiency; if this is true, the prospect of RIOT operating at full capacity will positively change its outlook.

- RIOT’s acquisition of BITF makes sense as BITF helps RIOT diversify its operations away from curtailment-prone Texas, but limited benefits can be derived due to BITF’s scale and % ownership.

- We think that the likelihood of RIOT operating at full capacity is low given it is systematic to Texas, putting our thesis into question: Will RIOT ever operate at full capacity?

mikkelwilliam/E+ via Getty Images

Introduction

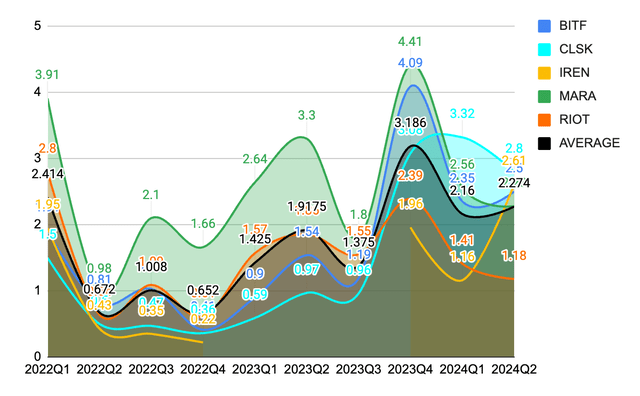

At the time of writing, RIOT’s valuation is likely attracting significant attention. Not only is it trading below book value, but it is priced at half the sector average Price-to-book value (‘PBR’) (Fig A). Riot Platforms is currently trading at $1.9bn, while its liquidation value (based on our terms: tangible assets + deposits – total liability) is worth $2.16bn. That’s ~10% below the liquidation price.

Fig 0. PBR of major Bitcoin mining companies (Author)

This excites us because instances of a Bitcoin miner trading below liquidation value are rare when the crypto market is expecting a bull run anytime soon. We found several deals like this during the bear market or the recovery phase, such as Iris Energy Limited (IREN) back then, but rarely in a bull market.

In this article, we identified a situation where RIOT could rank high on our watch list as we prepare for a potential Bitcoin USD (BTC-USD) bull run in about 1 month.

RIOT At Full Throttle

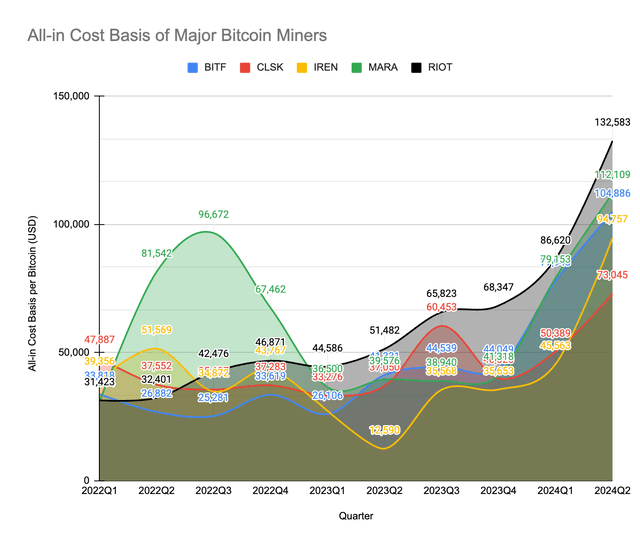

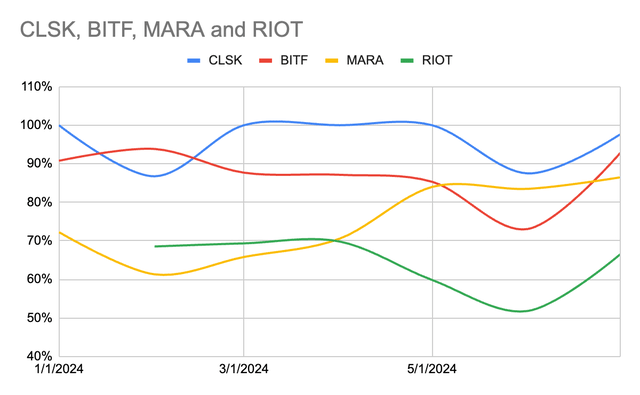

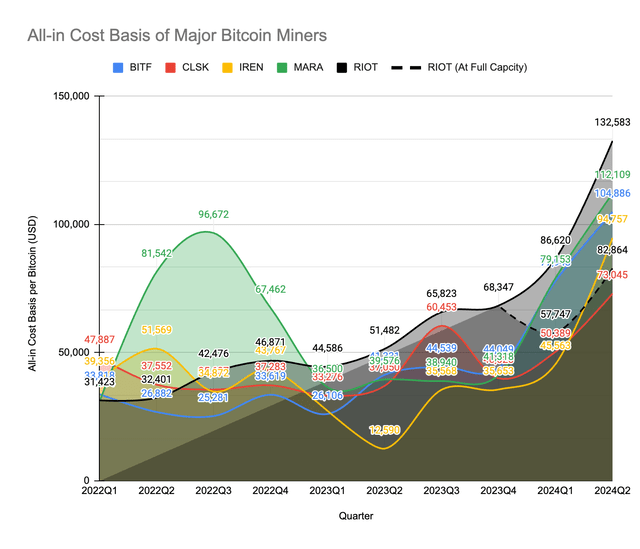

We have always found it difficult to justify an investment in RIOT because of its cost basis, making it very unprofitable. Referring to Fig 1, it is observable that RIOT spends the majority of the time having the highest all-in cost basis per Bitcoin mined. Note that even the historic amount of curtailment credits received isn’t enough to revert it back to the sector mean.

Our previous thesis, based on 2023Q3, concluded that RIOT could mirror Core Scientific, Inc. (CORZ) as it aims to expand ambitiously to 100 EH/s despite being unprofitable (due to a high all-in cost basis). However, the recent 2024Q2 earnings report changed our perspective on RIOT’s operating efficiency, and thus, the entire outlook of RIOT.

Fig 1. All-in cost basis per Bitcoin of major bitcoin miners. (Author)

Firstly, a portion of RIOT’s high-cost basis can be explained by its aggressive depreciation of Bitcoin mining fleets. Since our early coverage, we’ve assumed a 5-year useful life for the mining fleet, whereas RIOT had assumed only 2 years. Recently, RIOT extended the expected useful life of its fleets from 2 to 3 years which helped minimize the accounting depreciation cost. This cost can further be reduced if RIOT adopts the same 5-year useful life.

Effective January 1, 2024, the Company changed the estimated useful life of its miners and mining equipment from 2 years to 3 years.

Depreciation and amortization for the three months ended March 31, 2024 and 2023, were $32.3 million and $59.3 million, respectively, a decrease of approximately $27.0 million. The decrease was primarily due to the change in the estimated lives of our Bitcoin miners from 2 years to 3 years.

Since depreciation is subject to different accounting methods, and we’re unable to adjust them for a fair comparison, we’ll omit depreciation cost during comps. This is justifiable because the total depreciable costs are generally similar across Bitcoin mining companies. For instance, RIOT and CLSK‘s purchase costs are $16 million per 1 EH/s. Hence, the depreciable cost is also capped at $16mil per 1 EH/s. Hence, only the rate of depreciation should differ.

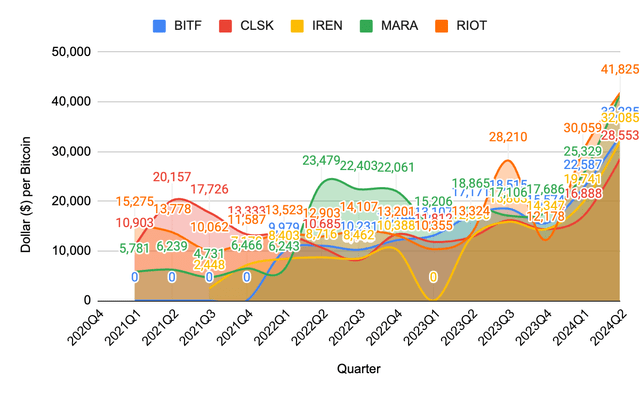

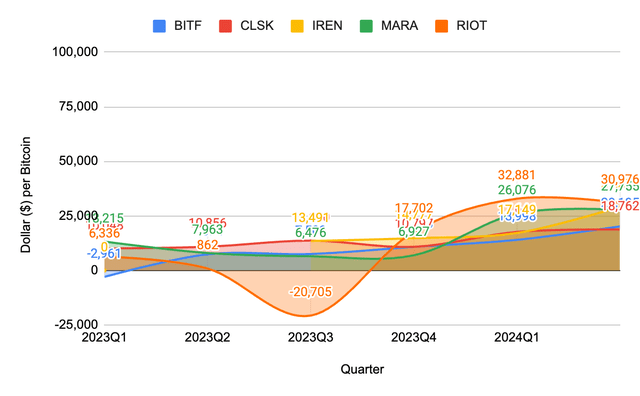

Secondly, we observed that RIOT’s variable cost component (cost of revenue per Bitcoin) closely tracks the sector average. In contrast, its fixed cost components-such as SG&A, SBCs, and professional fees-remain elevated. This suggests that RIOT may not suffer from operational cost inefficiencies, and its challenges likely lie elsewhere.

Fig 4. Cost of Revenue per Bitcoin of Major Bitcoin Miners (Author) Fig 5. SG&A (fixed cost component) per Bitcoin of major Bitcoin miners (Author)

SG&A typically consists of human capital-related expenses. Since Bitcoin mining companies are like factories, higher-than-sector SG&A suggests 2 potential causes: either RIOT’s team is oversized for its operational capacity, or RIOT is not operating at full capacity. Our findings point to the latter.

Fig 6 illustrates major Bitcoin miners’ capacity utility rate (the ratio between the monthly average operating and deployed hash rates). By referring to it, we can see that RIOT is operating below its full capacity. This implies that RIOT has to incur the fixed costs (such as more human resources, depreciation costs, etc.) of having a higher capacity (23.3 EH/s) but produce Bitcoin with 15.5 EH/s capacity. Knowing this, when assuming RIOT’s full capacity, RIOT’s fixed cost component (SG&A) now falls to the sector average (Fig 7). This also caused RIOT’s total all-in cost basis to fall to the sector average cost basis (Fig 8).

Therefore, it is reasonable to expect RIOT’s cost basis to recover when it operates at full capacity.

Fig 6. Capacity Utility Rate of major Bitcoin miners (Author) Fig 7. SG&A (fixed cost component) per Bitcoin of major Bitcoin miners, assuming RIOT at full capacity (Author) Fig 8. All-in cost basis per Bitcoin of major bitcoin miners. (with RIOT at full capacity, represented by —Dotted Line) (Author)

How Acquisition of BITF Helps RIOT’s Cost Basis

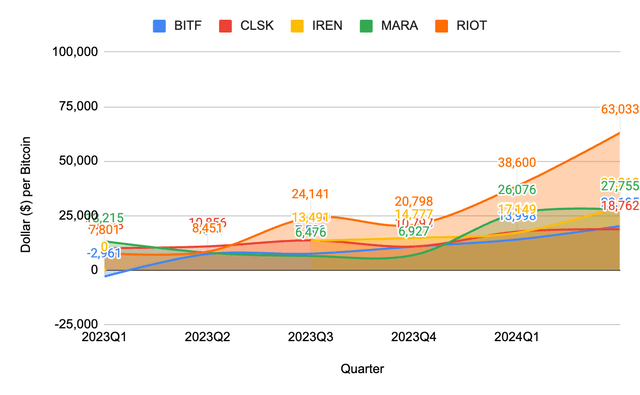

Given the context we provided throughout the article, RIOT’s acquisition of BITF makes sense. RIOT disclosed how the acquisition of BITF is compelling for both parties. Among the key benefits, we think “geographical diversification” ranks at the top because it can help RIOT improve the capacity utility rate.

A large portion of RIOT’s operations is in Texas, which is prone to curtailment. We think it is a ‘systematic risk’ (unavoidable) because MARA also faces curtailment issues (We covered it in detail here). Although RIOT receives curtailment credits, we think that it is more profitable to operate at full capacity than to rely on curtailment credits. For instance, in July, RIOT averaged an operating hash rate of 15.5 EH/s, short of 8 EH/s from its full capacity. At that capacity, RIOT produced 370 Bitcoins, which implies 23.9 Bitcoins per 1 EH/s. At full capacity, RIOT could’ve earned 191 more Bitcoins, which are worth $11 million at $60k per Bitcoin, which is 3x more of the credits it received.

Considering BITF mining sites are diversified and outside of Texas and Kentucky, BITF’s stable uptime can improve RIOT’s overall capacity utility rate, which improves cost basis and overall profitability.

Not to mention, BITF’s valuation (based on Implied Bitcoin Price (‘IBP’) without depreciation) is also the lowest, making this acquisition strategic from both an operational and valuation standpoint.

|

Company |

BITF |

CLSK |

IREN |

MARA |

RIOT |

|

IBP w/o Depr |

41,995 |

71,188 |

87,431 |

94,748 |

81,669 |

Verdict

We speculate that the pessimism surrounding RIOT is related to its all-in cost basis being the worst in the sector by a margin (Fig 1). While the actual reasons for RIOT’s falling out of favor with the market remain unclear to us, we are reasonably confident that RIOT offers significant upside potential if it can operate at full capacity, especially at its current valuations. This is because the profitability outlook of RIOT operating at full capacity is very attractive, rivalling even CLSK (Fig 8).

Currently, there’s also an ongoing mean reversion in the Bitcoin mining sector, where the PBRs of Bitcoin mining companies are converging around the 2.3 PBR level. RIOT is the only remaining Bitcoin mining company yet to revert. If RIOT reverts, it could present investors with a 2x return (assuming constant book value and sector-average PBR).

Combining the prospects of RIOT achieving profitability (at full capacity), RIOT’s current valuation (below book value and half the sector’s PBR), and the ongoing mean reversion, RIOT looks really attractive.

That being said, we lack confidence that RIOT can improve its capacity utilization rate in a short period of time, even after the acquisition of BITF. Recently, RIOT experienced another decline in its average operating hash rate in August, highlighting a significant challenge. Furthermore, RIOT currently only owns 20% of BITF while BITF’s capacity is half that of RIOT. Therefore, the positive impact that can be derived from the acquisition is expected to be limited.

If our speculation holds, it implies that RIOT may not even return to the sector mean. This uncertainty calls our entire investment thesis for RIOT into question: Will RIOT ever operate at full capacity?

As we prepare for a potential Bitcoin bull run by October 17th, we believe it’s unlikely that RIOT can make significant operational improvements within a short, one-month period. For now, RIOT will remain on our watch list, with potential catalysts to monitor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, BITO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.