Summary:

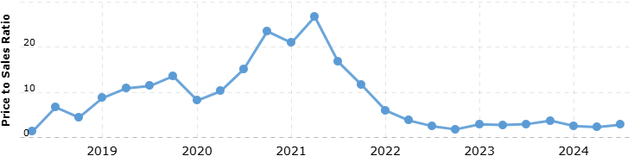

- Roku’s valuation is at a historically low forward price/sales ratio of 2.71x, suggesting potential for a stock price rebound.

- CEO Anthony Wood highlighted growth in Streaming Households, Streaming Hours, and Platform Revenue in Q2 2024.

- Despite high costs, Roku’s improving net margins and fiscal discipline signal potential for positive net income and cash flow in upcoming quarters.

- Strong user engagement and ad revenue growth, alongside hardware rollouts, indicate promising future performance and stock price improvement.

Giuliano Benzin

Roku (NASDAQ:ROKU) shares have suffered a rough 2024 with the shares down around -18% year-to-date. I believe there is potential for a bounce from this level and will outline my reasons here.

An introduction to Roku

Roku is a connected tv (CTV) streaming provider that was developed in collaboration with Netflix. Ahead of the launch of Roku’s first streaming device, which was similar to Amazon’s Fire Stick, Netflix decided to spin off the company in order to protect its own business interests and negotiations.

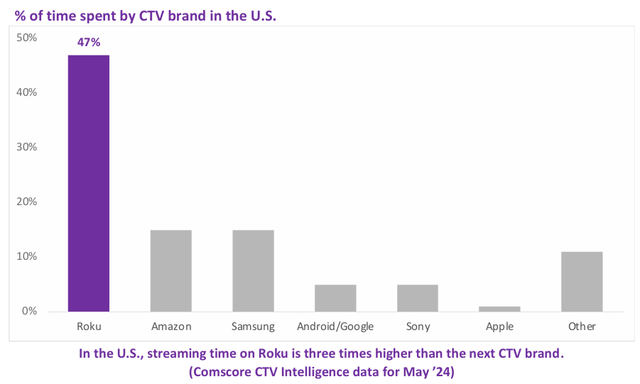

Roku has since grown to be the dominant player in the CTV space, three times larger than its nearest competitor.

Roku has since expanded its business from TV apps on third-party devices to developing its own smart TVs.

Roku’s share price rose to a record high of $90.76 in July 2021 as analysts projected strong growth for the firm. However, the stock price has since slumped more than 80% from those highs after the company’s growth bubble burst.

Roku’s valuation now seems unfair

The first thing that caught my eye about Roku was that the company is currently valued at a forward price/sales ratio of 2.71x, according to Seeking Alpha data.

Going back six years, this is at the extreme lower bound for the stock.

Roku Price/Sales History (Macrotrends)

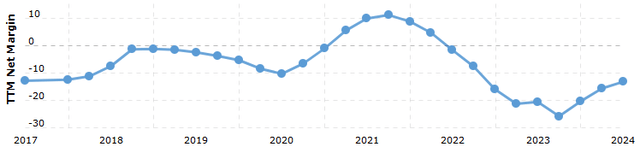

A metric that has been improving lately is the company’s net margins.

Despite a slump to almost -30% in net margins, the company is back near -10% and could be on a path to positivity.

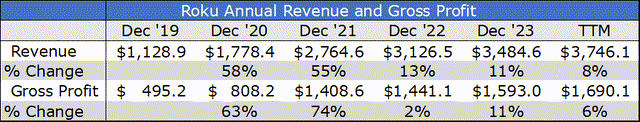

A big problem for the company’s lack of favor has been a slump in growth. Despite improving on annual revenue each year since as far back as 2015, the pace of that revenue improvement has slowed, alongside gross profit.

Roku Revenue/Gross Profit (Seeking Alpha)

With only one positive net income year during that time, investors lost patience with the stock’s outlook.

Seeds of a growth rebound are emerging

CEO Anthony Wood highlighted some green shoots of growth in the company’s latest earnings call for Q2 2024.

“We grew Streaming Households 14% Y-o-Y, Streaming Hours 20% Y-o-Y, and Platform Revenue 11% Y-o-Y. In the U.S., Roku is the #1 TV OS by both TV unit sales and hours streamed, and our share of each is more than double the next largest operating system.”

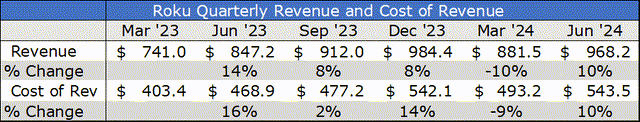

On quarterly revenue, Roku delivered a 14% Y-o-Y improvement to $968 million. Platform revenue at $824 million was up 11% Y-o-Y.

However, the company continues to see revenue boosted by the addition of the Roku-branded TVs, which led to a 39% Y-o-Y gain for Devices revenue in Q2.

Roku’s Average Revenue Per User was $40.68 in Q2, which was flat year-on-year, but this was due to an increased share of Streaming Households in international markets where the company is in the early stages of increased scale and monetization.

Roku Revenue and Costs (Seeking Alpha)

The issue for the company’s financials is that developing hardware and seeking to deliver it at scale means that cost of revenue has always been around 50% or more of total revenue on a quarterly basis.

Eventually, I believe that more hardware deliveries will start to see streaming revenue outpace a steady stream of hardware.

Streaming and apps continue to deliver

Roku continues to see strong growth in its viewer experience and streaming.

In Q2, the percentage of app sessions launched from one of its owned and operated features was higher by 35% Y-o-Y.

The company also launched a new AI-powered recommendations app on the Roku Home Screen. Management said that “these recommendations drove an increase in Streaming Households and ad reach.”

The Roku Channel also grew its reach and engagement in Q2, leading to a 75% y-o-y boost in streaming hours.

On advertising, Roku added a new video addition to its marquee add feature, with an invite-only beta version selling out in the first month to the likes of Home Depot (HD) and Disney (DIS).

A deeper look at the financial landscape

On a quarterly basis, net income at Roku has improved from -$330 million in Q3 2023 to -$34 million in the latest quarter. That puts the company close to its first positive net income quarter since Q4 21. The latest figure also included a $10 million drag from asset writedowns and restructuring and a $-109.5 drawdown from changes in accounts payable.

That figure had an average positive input of $25 million in the previous ten quarters. I believe the third quarter could see a positive boost to the company’s cash flow outlook and cash position.

The company’s price/cash flow of 32.28 receives a D- from Seeking Alpha’s metric grading. It is well above the 7.12 of its sector, but I expect that gap to close in the third quarter. Overall the company’s metrics could improve in Q3 and lead to an improvement in the stock price.

Downside Risks to the thesis

Despite the continued hit to margins from cost of revenue, it is still a worry that total revenue has slowed into the single digits on a trailing-twelve month basis. But I believe that the current price level is appealing and net margins are climbing higher, while there is potential for a growth rebound.

Management has also guided for an 11% increase in quarterly growth for Q3.

Conclusion

I believe that Roku has now reached a value point for a stock price improvement. Growth has slowed in the company and that has led to a valuation decrease, but there are hopeful signs for a resurgence. Margins are improving as fiscal discipline continues in a time of scale. During that scaling period in the company’s hardware, profits are hard to come by. However, over the coming quarters, I believe that the continued roll-out of hardware will boost streaming hours and ad revenue. That is already being seen in the latest quarter with some strong gains in user engagement. The company also looks on course for further margin improvement, a positive net income and improved cash flow position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.