Summary:

- UnitedHealth was our top pick for 2024 due to its strong operating plan and attractive valuation.

- Despite trailing the S&P 500 by 11%, the stock’s long-term potential remains as industry headwinds, like Medicaid and Medicare slowdowns, ease into 2025.

- UNH’s large size and data advantages enable cost-savings and better patient outcomes, making it a strong investment amid rising competitive pressures and regulatory scrutiny.

- We remain bullish on UNH, and expect the stock will rebound towards $700 per share in the coming quarters.

- We re-iterate our ‘Strong Buy’ rating.

Yagi Studio/DigitalVision via Getty Images

In late November of last year, we called UnitedHealth (NYSE:UNH) our ‘Top Idea for 2024‘.

While there are loads of stocks that we were bullish on back then, we thought UNH had the highest percentage chance to produce meaningful returns throughout the year. This was due to the company’s strong operating plan, in addition to – what we viewed as – an attractive multiple at only 24x net income.

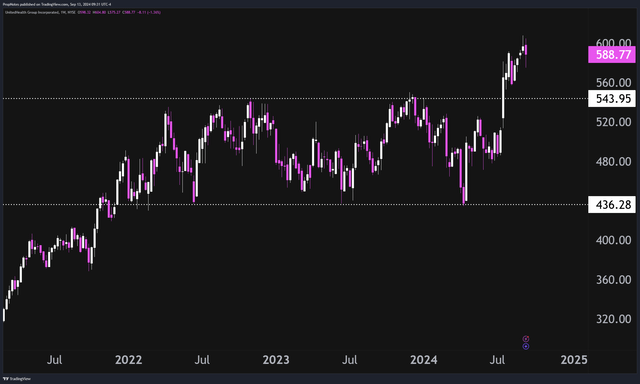

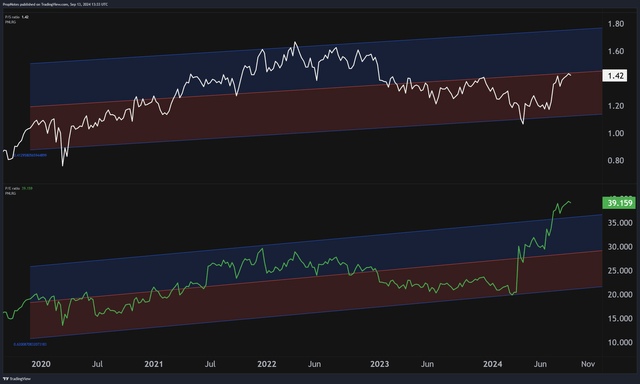

Fast-forward to the present, and our thesis hasn’t quite played out how we saw it going. While the stock is actually up since our call, it’s trailed the S&P 500 this year by 11% or so, which is considerable:

Why the underperformance?

In short, there have been a number of headwinds facing the industry that haven’t yet been sorted through, including a slowdown in Medicaid and Medicare expenditures that have pressured everyone in the industry, from UNH to CVS, HUM, and others.

While these headwinds are still present in the market, we expect that they will ease somewhat as we head into 2025 and beyond. Given that by most metrics UNH still appears to be a strong relative value, we see market-beating long-term potential in this mega-cap consumer healthcare play.

Today, we’ll explain where we think the stock is headed, and why we’re happy paying a slightly above market-average price for this consumer healthcare compounder.

Sound good? Let’s dive in.

UNH’s Financials

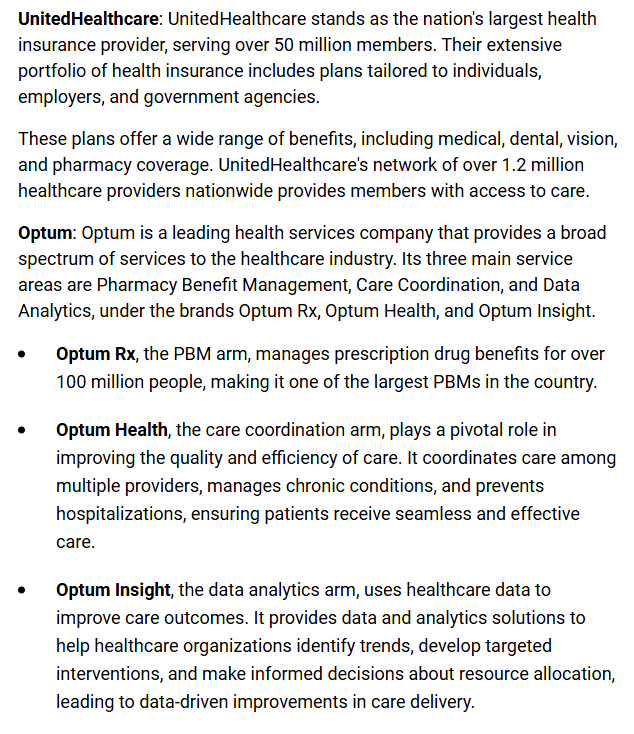

Just to set things up a little bit, if you didn’t read the first article, or are unfamiliar with the stock, UNH is a healthcare company focused on health insurance and healthcare facilitation.

The company operates through a number of different divisions, each of which work together to finance and provide healthcare to millions of Americans:

PropNotes

Right now, in the market, the company’s large size and data advantages mean they can, for the most part, deliver better medicine within their healthcare network, saving on costs while trying to improve patient outcomes.

This model has produced excellent results, especially as the company has flipped more fully to this value-based-care model.

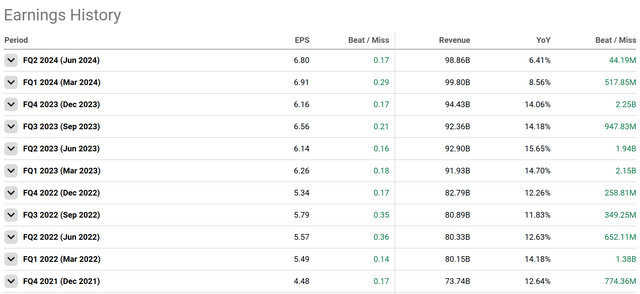

Over the last several quarters, UNH has managed to beat on both top and bottom line consistently, and top-line sales per quarter are still growing at a mid-single digit clip, although that has slowed somewhat YoY since the start of 2024:

This slowdown has largely been behind the underperformance in the stock and is due to a couple of different things.

First off, UNH suffered from a cyberattack that affected Change, one of Optum Insight’s segments:

On February 21, 2024, CHC became aware of deployment of ransomware in its computer system. Once discovered, CHC quickly took steps to stop the activity, disconnected and turned off systems to prevent further impact, began an investigation, and contacted law enforcement. CHC’s security team worked around the clock with several top security experts to address the matter and understand what happened. CHC has not identified evidence this incident spread beyond CHC.

This attack hurt UNH financially (to the tune of roughly $22 million directly, and hundreds of millions indirectly), but also hurt the company’s reputation more broadly. UNH has taken measures to mitigate the effects of this intrusion, but it’s proven to be a real sentiment headwind for the stock given how much management attention has been diverted to the issue.

On top of that, industry headwinds have remained inflamed in 2024, which explains why most healthcare companies have been underperforming the market YTD.

Many have views on this, but a recent article by Yuval Rotem did a good job of explaining the margin issues present in the industry:

As we’ve discussed extensively in my previous articles, five key forces are pressuring the industry: (1) Increasing utilization trends, helped by pent-up demand from COVID-19; (2) Misalignment between CMS rates and said utilization trend, pressuring medical care ratios, primarily in Medicare and Medicaid; (3) Medicaid redeterminations, as members joined under the looser COVID-19 criteria are losing eligibility; (4) Rising competitive pressure, as aggressive pricing and benefits from companies like CVS Health Corporation (CVS) and Humana Inc. (HUM) results in either membership losses or lower margins; (5) Regulatory scrutiny, specifically on PBMs.

Between the increasing benefit utilization, weakening margin performance, Medicaid situation, and regulatory interest on the PBM side, UNH’s business has been facing pressure on all fronts.

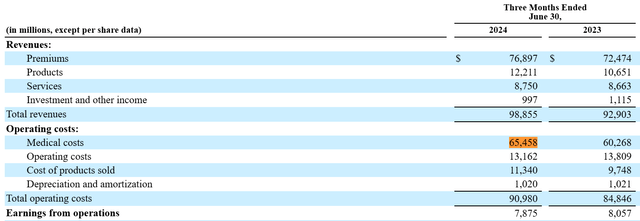

In particular, the increase in utilization and poor Medicare advantage trends are mostly responsible for the drop in margins:

While management admits they may have mis-priced their future outflows given increased rates of senior outpatient procedures, they’re confident they can reign in some of this spending in the future:

Our medical cost trends primarily relate to changes in unit costs, care activity and prescription drug costs… We have continued to observe increased care patterns, primarily related to outpatient procedures for seniors, which may continue in future periods. We endeavor to mitigate those increases by engaging physicians and consumers with information and helping them make clinically sound choices, with the objective of helping them achieve quality, affordable care.

While this will likely result in more claims being denied in the future (which is neither here nor there from a moral standpoint), it will serve to protect the financial viability of the company given the slow growth in Medicaid base rates which have put huge pressure on UNH’s margins between last year and this year:

Medicare Advantage rate notices over the years have at times resulted in industry base rates well below the industry forward medical trend. For example, the Final Notices for 2024 and 2025 rates resulted in an industry base rate decrease, both well short of an increasing industry forward medical cost trend, creating continued pressure in the Medicare Advantage program.

While this all appears to be ‘bad news’, we think margins are near a bottom and should climb higher in the future.

Why? Utilization ratios are set to decrease as the demand wonkiness around Covid may finally be fully flushed through the system. Procedures and treatment delayed by the pandemic have likely been fully completed at this point, which should help UNH’s pricing and margin predictability going forward. When combined with a new administration (on either side) that will likely devote more resources to benefits, we expect UNH to fare better in 2025 and beyond.

Thus, with the headwinds mostly set to pass, we anticipate that UNH is well positioned to get back to its positive long-term business dynamics.

It appears as though the market is already thinking this, as UNH’s stock recently hit an all-time high after stagnating for nearly two years:

All in all, UNH has been under pressure so far in 2024, but we think the company is ready to bounce back as things normalize.

UNH’s Valuation

But how expensive is the company?

Sure, right now might be a cyclical low in the company’s margin & growth profile, but that doesn’t necessarily mean that the stock is a solid buy.

Is the valuation over its’ skis?

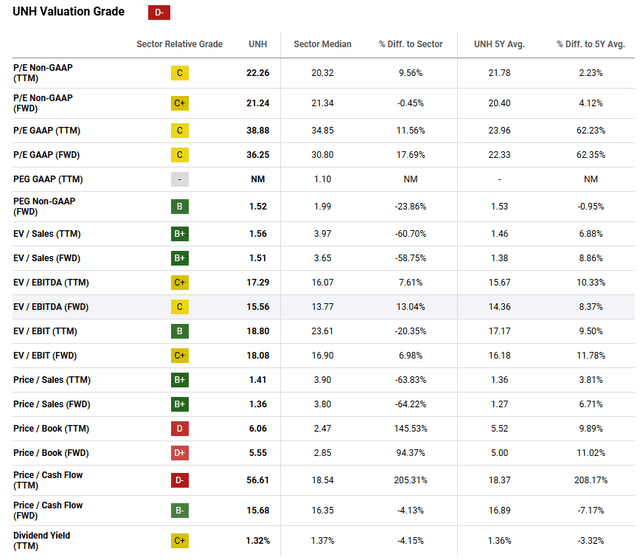

In our view, no – UNH is attractively priced:

Right now, as you can see, UNH is priced at roughly 1.4x sales, which is right in the middle of the company’s long term linear regression deviation bands.

On the bottom line, the P/E multiple has ‘expanded’ significantly, but this is largely due to unevenness around the company’s Latin American divestiture, which hurt net income but had no material impact on the company’s core operations or profitability.

If you look at EV/EBITDA on a forward basis, which, we think, is a better measure given the lack of this Brazil adjustment, UNH is trading at only 15x:

It’s true that Seeking Alpha’s Quant system pegs UNH as a ‘D-‘ on the valuation front, but we don’t agree. Looking ahead, a 1.5x PEG for a long-term compounder like UNH seems like a no-brainer.

Sure, it’s more expensive than other companies in the space, but the company’s size and operational efficiency deserve a premium, in our view.

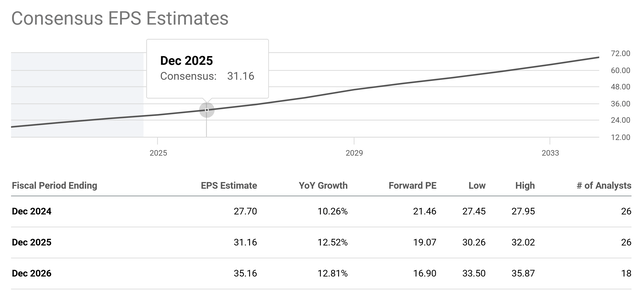

One year from now, we think Fair Value for the stock should be somewhere around $700 per share, if you bake in a rebound in margins, continued top line sales growth, and a slight boost in the multiple:

If you estimate an increase in margins and top-line sales that drives YoY EBITDA per share growth at around roughly 13% (slightly above where analysts are pegging), then you’d end up with FWD TM EBITDAPS at roughly $43. Apply some multiple expansion towards 16-17x, and you end up with the $700 per-share price target. Again, we’re avoiding using EPS due to the recent distortions around the Latam divestiture, and we’re a little more bullish on an earnings rebound due to the factors mentioned in the financials section.

Long term, expecting low teens organic EPS growth also wouldn’t be outlandish, leading us to think that UNH is in a great spot for those looking for a short, medium, and long-term investment.

There have been better ‘prices’ to get UNH at, but even with the recent all-time high, we think there’s significant upside in the next twelve months of roughly ~18% – with more to follow as the business continues cranking away into the second half of the decade.

Risks

At the same time, there are some risks to this thesis.

We’re bullish on UNH at this price, but there are reasons that our projections may not play out as anticipated.

First off, the Medicare issue may remain an overhang for longer than anticipated. Remember – if UNH has to pay out more and more for Medicare benefits to members, while the government payouts remain stagnant, then there’s no question that margins may remain under pressure.

Additionally, government regulation of the PBM industry may impact Optum Rx, which contributes a significant chunk of change to UNH’s top and bottom line. UNH enjoys large economies of scale here, but it’s a potential headwind, nonetheless.

Finally, if rates don’t head down into 2025 as the market is expecting, then there may be no room on the multiple expansion front, and potentially even some multiple contraction downside that isn’t baked in at all.

Summary

All in all, though, we like UNH as a long-term compounder investment. The company’s margins are likely set to rebound on lower utilization following the Covid distortion, and the multiple looks highly attractive at only 15x FWD EV/EBITDA.

While there are risks that the headwinds persist into the future, we’re confident in our UNH $700 price target over the next 12 months.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.