Summary:

- Apple’s iPhone 16 launch is supposed to drive the iPhone supercycle thesis.

- However, initial pre-order delivery estimates have failed to inspire confidence in its bullish proposition.

- Apple faces increasingly strong headwinds in China, a pivotal battleground to drive the supercycle growth inflection.

- AAPL’s valuation is hard to justify, although I’m not bearish. I explain why investors shouldn’t buy into its iPhone supercycle thesis at the current levels.

Justin Sullivan/Getty Images News

Apple’s iPhone Launch Event Fails To Inspire

Apple (NASDAQ:AAPL) investors are likely still assessing whether the thesis of an AI-driven supercycle could lift its iPhone sales following Apple’s iPhone 16 launch event. Accordingly, AAPL topped out in mid-July 2024 (well ahead of its September iPhone event) before it fell toward its early August 2024 lows. Dip-buyers capitalized on the battering, aggressively adding exposure and positioning for the next upwave in AAPL. While the stock has remained well-supported above the $200 level, it has failed to close in against its mid-2024 highs.

In my previous AAPL article, I urged investors not to overreact to Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett’s decision to dump AAPL stock. However, I’ve also cautioned that Apple Intelligence’s bullish thesis could be overhyped, leading to potential disappointment in chasing the implied AI upcycle.

The tepid momentum following AAPL’s pivotal iPhone launch event has corroborated my cautious posture, suggesting investors want more proof points first. Recent pre-order delivery estimates suggest initial shipments for its iPhone 16 could disappoint, potentially weaker than the initial shipment numbers for its iPhone 15 last year. Apple’s decision to space out the full launch of Apple Intelligence has likely contributed to the weaker-than-anticipated initial shipments weakness.

Apple Investors Need More Proof Points Of An iPhone Supercycle

However, Wall Street has bolstered AAPL’s estimates, justifying underlying strength in its buying sentiment. Therefore, I assess that the medium-term outlook for Apple’s iPhone 16 is expected to remain robust, as more than “300M iPhones have not been upgraded in more than four years.” As a result, there could be a significant pull-forward effect on Apple’s iPhone shipment estimates over the next two years, driving a solid revenue growth inflection. However, an AI-driven iPhone “supercycle” could also lead to a growth normalization phase from 2027, suggesting investors must be careful about the strength of its AI growth inflection thesis. Therefore, I assess that the upgraded Wall Street estimates have not led to another surge in AAPL stock, suggesting the market is likely cautious about the momentum in relying on Apple’s iPhone event alone.

Bearish Apple investors will likely point to potentially significant execution risks in relying on an iPhone supercycle. Therefore, Apple’s decision to upgrade the health and fitness functionalities for its iPhone users is assessed to be a critical development. Accordingly, Apple has obtained FDA approval to strengthen the recent revisions to its AirPods to be utilized as hearing aids. Hence, Apple has consolidated its competitive moat in its iOS ecosystem, even though the overall upgrades to its iPhone 16 are likely considered “incremental” and not revolutionary. Furthermore, Wall Street is pleasantly “surprised” with the sleep apnea detection capability, justifying Apple’s innovative capabilities.

Notwithstanding my optimism, Apple’s rivals aren’t standing still. Masimo’s (MASI) decision to partner with Qualcomm (QCOM) and Google (GOOGL) (GOOGL) in embedding its biosensing technology into their wearable devices could represent a significant competitive threat. Hence, investors must assess the inroads made by Apple’s rivals as they look to shake out Apple’s dominance in the wearables and services business. In addition, regulatory scrutiny over Google’s search contract with Apple could be struck down, as the DoJ won its recent monopoly case against the search giant. However, it could also open up more opportunities for Google’s search rivals to bid for Apple’s contract, potentially improving the terms for the Cupertino company.

Apple’s services business is under intense regulatory scrutiny. As regulators worldwide frown upon the practices and take rates Apple charges on developers, it could also weaken the strength of the iOS walled garden. Hence, it intensifies Apple’s competitive risks, possibly hurting its premium valuation. In addition, Huawei’s resurgence could be an increasingly worrying competitive dynamic for CEO Tim Cook and his team as it looks to compete against Apple and Samsung (OTCPK:SSNLF) in the premium smartphone segment. Given China’s macroeconomic struggles in 2024, as it navigates a weak consumer spending environment, it could increase Apple’s ability to drive a more robust iPhone “supercycle” proposition in China.

Is AAPL Stock A Buy, Sell, Or Hold?

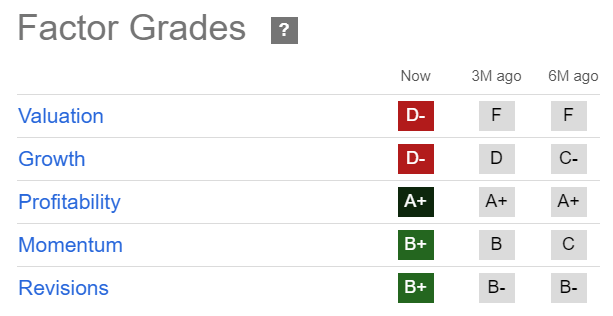

AAPL Quant Grades (Seeking Alpha)

AAPL stock is still valued at a premium (“D-” valuation grade), suggesting the company needs to execute well. Notwithstanding the recent Wall Street upgrades, Apple’s “D-” growth grade underscores the relative pessimism in its supercycle proposition. Hence, investors must be careful in assessing the sustainability of the iPhone 16 upgrade cycle, as initial shipment estimates disappointed. Moreover, a possible growth normalization phase from 2027 could follow, potentially pressuring a valuation re-rating over the next two years.

AAPL’s forward adjusted PEG ratio of 3.85 is more than 100% above its tech sector median, underscoring its relative overvaluation. Hence, I assess that the market seems too optimistic about the robustness of Apple’s iPhone upgrade cycle, potentially worsening its execution risks.

While I’m confident of AAPL’s bottom above the $200 level, I find it challenging to upgrade its stock as we enter a pivotal fourth calendar quarter for the newly launched iPhone.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!