Summary:

- Amazon’s AWS segment drives significant growth and profitability, boasting a 35% operating margin, far surpassing the marketplace’s 5% margin.

- The increasing revenue mix from AWS, driven by its broad functionality, superior security, extensive partner ecosystem, and AI capabilities, is boosting overall business profitability to new heights.

- The marketplace business remains resilient, with the international segment turning profitable and smaller projects gaining momentum.

- Despite these strong growth tailwinds, Amazon is currently undervalued, trading below its historical averages. Hence, I reiterate my “Buy” rating.

JHVEPhoto

Introduction

Artificial intelligence has been the theme of the year and I believe it will persist for an extended period. While investors and analysts talk about many companies benefiting from AI, I think they often overlook one of the largest companies in the world.

Amazon (NASDAQ:AMZN), traditionally a retail business, has experienced significant growth opportunities this year thanks to Amazon Web Services (“AWS”). The stock has not participated in the AI mania, and it is not up nearly 150% like Nvidia (NVDA). This does not mean, however, that it lacks fundamental improvements in earnings.

While the stock’s performance has been slightly below the market in the last three months since I started covering the company with a “Buy” rating, I think its competitive advantage remains strong and this is beginning to reflect in financials.

The market is still not convinced by this growth and is concerned about the state of the consumers hurting the retail side of the business. While this is a valid concern, Amazon has shown its resilience.

Despite strong growth tailwinds, the stock appears inexpensive. Therefore, I reiterate my “Buy” rating.

Business Description

I will not go through the business in great detail. Please refer to my previous article for that. However, I want to highlight a few key points that are important for my thesis.

Amazon has three operating segments. North America and international segments are related to Amazon Marketplace and other Amazon products, including but not limited to the online store, physical stores, third-party seller services, advertising services, and products like Kindle, Alexa, Ring, and Blink.

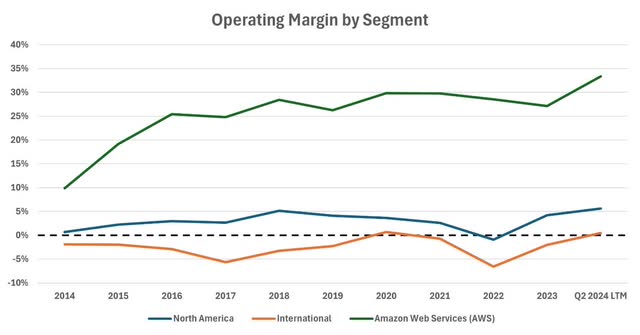

Historically, the profitability of the North America segment financed the growth of the international business, which has remained unprofitable. The international segment just turned profitable for the first time since 2021 this quarter LTM (last-twelve-months), although only slightly. We will touch on this in the following sections.

Our focus today is the AWS segment. Through this segment, Amazon offers various technology services including machine learning, storage, database, computing, and analytics. It has been growing significantly while being far more profitable than the marketplace business. AWS’ operating margin was just below 35% in Q2 2024 on a last-twelve-months basis, while that number was just above 5% for the North America segment.

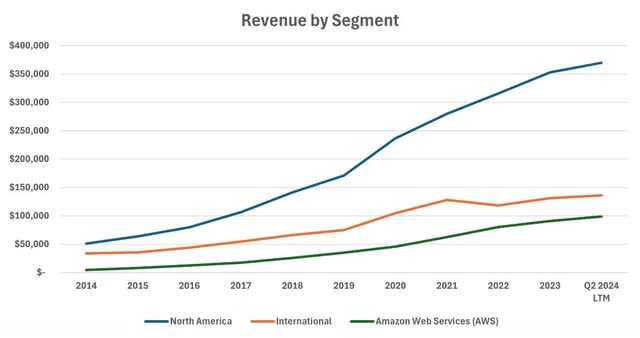

The charts below show that revenue kept growing in each of these segments, however, AWS now generates a higher percentage of total revenue. In addition, while Amazon sustained operating margins for the marketplace business, AWS’s profitability has soared.

We’ll discuss the drivers of this growth and its sustainability in the following sections.

Recent Developments

I initiated my coverage of Amazon with a “Buy” rating in June. The stock has surged 1.3% since then, while the S&P 500 has gained 2.8%. So, Amazon has slightly underperformed the market in the past three months.

Although it is the third-best performer year-to-date among the Magnificent 7, its performance has been considerably below the equal-weighted Magnificent 7, mainly due to the exceptional performance of Nvidia. The second-best performer was Meta (META).

The main reason for this underperformance in the last three months is the market reaction to Q2 earnings, which the company released at the beginning of August.

Results were mixed, as Amazon beat EPS but missed revenue estimates, despite a 10% year-over-year increase. The market just expected more. Each segment grew, with North America up 9%, International up 7%, and AWS growing a significant 19%, hitting record revenue.

What disappointed investors was the Q3 guidance? Net sales guidance was slightly below the consensus. However, the market seems to be missing how much more profitable the overall business is getting thanks to the increasing revenue mix from AWS. With new partnerships and strong demand, this growth seems sustainable in the medium term.

The Growth Story Continues

Amazon Web Services

AWS is the main contributor to growth. This is not only an AI-driven business. AWS is the natural partner for companies that want to build or modernize their infrastructure and move to the cloud. As the CEO Andy Jessy states, “AWS is the customer’s top choice as we have much broader functionality, superior security and operational performance, a larger partner ecosystem, and AI capabilities”. AI is a part of a long list of capabilities AWS provides to its customers, which has contributed to significant growth.

The strength of AWS in Q2 surprised Wall Street and analysts from major banks stated that they expect strong growth and margin expansion during the rest of the year. I have a very similar view. And this was before AWS announced a partnership with Oracle (ORCL).

Recently, Oracle and AWS announced the launch of Oracle Database@AWS, an offering allowing users to access Oracle Database within AWS, making it easier for customers to integrate data and manage databases. Although these companies have been competing for a long time, they are now joining forces for mutual benefit. Larry Ellison, CTO of Oracle, said that they are seeing huge demand from customers who want to use multiple clouds, and this partnership gives customers flexibility. Both companies will surely benefit from this.

To summarize, AWS continues to grow and become more profitable. It is already significantly bigger than the marketplace business in terms of operating profits and is a central focus of the company. Amazon deserves to be called a big tech company.

Amazon Marketplace

There have been concerns about the state of the US consumer, with a potential recession looming and economic metrics pointing to a slowdown. Consumers trading down has already hurt many consumer-focused businesses, and Amazon was expected to be in line. However, the business seems to be holding up well.

Both the North America and International segments kept growing in Q2 on an LTM basis. Not only that, but they are becoming more profitable as well. Since the pandemic, the international business reported positive profitability for the first time LTM. If sustainable, this would change the perception that the North America business finances unprofitable growth internationally. Having a stand-alone, profitable international retail business is crucial for Amazon’s long-term success.

Other Investments

In the last article, I mentioned that the company has been investing in smaller innovative areas to diversify its offerings. Although these are immaterial compared to the three segments, they may prove to be important in the near future.

Along with Amazon’s former investments in affordable housing, AI startups, and the Indian streaming market, Amazon invested in “Project Kuiper”, aimed at providing broadband connectivity from space. This project sails forward, with the acquisition of land in New Zealand and the pending approval from United Kingdom regulators.

The Stock Price Doesn’t Reflect Growth Tailwinds

I find historical valuation multiples to be a great way of assessing the market sentiment about a company compared to how it has been historically.

Below are the adjusted historical forward price-to-earnings and price-to-book charts. Although Amazon is getting more profitable and is experiencing re-accelerated growth thanks to AWS, the market prices it at lower multiples compared to long-term averages.

This implies that the stock has room to run. I expect both multiples to move towards their long-term averages soon, and therefore an appreciation in the stock price.

Conclusion

Amazon continues to be an undervalued opportunity. It has strong growth tailwinds thanks to AWS, and its marketplace business has been resilient at a time when many other consumer-facing businesses have struggled.

Although it benefits from AI, as discussed, the growth opportunity is not only tied to developments in that area. The company continues to thrive thanks to its diversified demand base.

With this article, I reiterate my “Buy” rating as the stock appears inexpensive despite strong growth tailwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.