Summary:

- Microsoft Corporation is a leading tech giant and one of the most valuable companies globally.

- Raising its dividend and announcing $60B in share buybacks is instilling more confidence in free cash flow and Microsoft’s ability to return value to shareholders.

- The article highlights Microsoft’s robust financial performance, diverse product portfolio, and strong market position.

- The key investment thesis includes cloud computing growth, innovative product development, and strategic acquisitions.

- The article also discusses the risks to MSFT, and what may cause it to underperform.

HJBC

Introduction

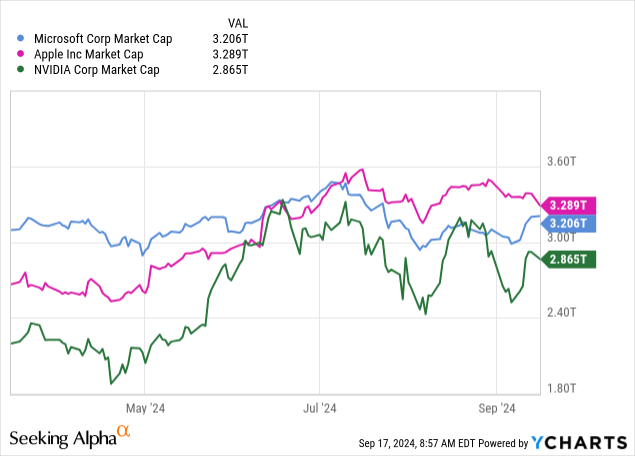

Microsoft Corporation (NASDAQ:MSFT) is a tech giant in the US and one of the most valuable companies in the world. For the last few months, it has been battling with tech rivals Apple (AAPL) and Nvidia (NVDA) for the number one spot.

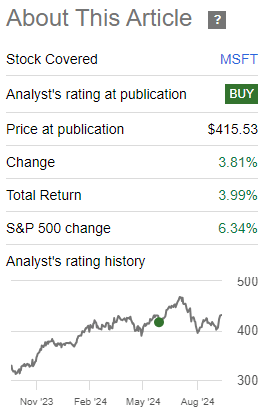

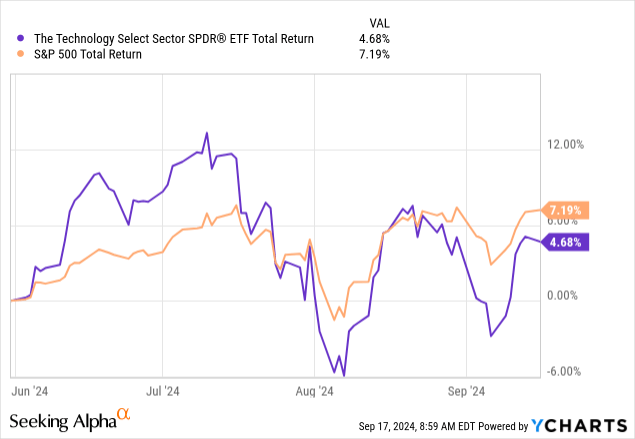

Back in May, I covered MSFT for the first time in an article I am rather proud of: Microsoft is Going to Win the AI War. Since then, MSFT has performed well, but underperformed the broader market because of weakness in the broader tech sector since then.

Seeking Alpha

Financial Review

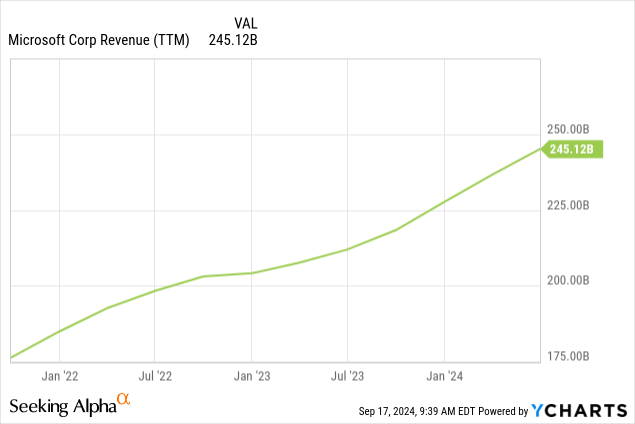

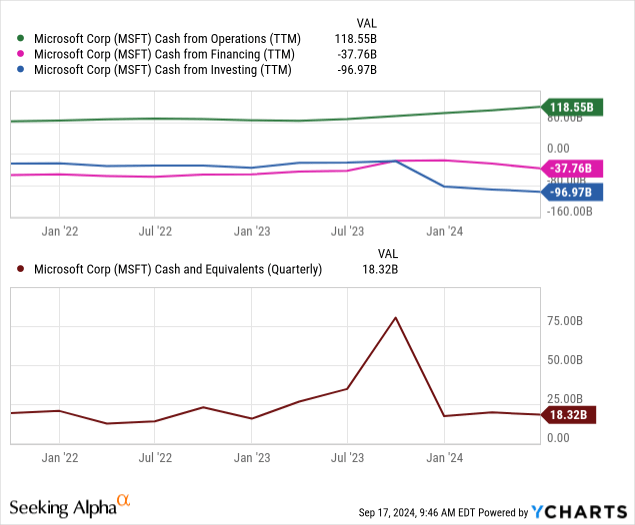

MSFT is a cash king, and this is something that I have liked about them for some time. Revenue is still rising, and is showing no signs of slowing like we saw in Q4 of 2022. We are back on a very strong-looking trend.

One of the reasons I am writing about MSFT today is what they are doing with their cash. They have had a lot of cash on hand recently, and have been seemingly unable to deploy it as fast as it comes in. Despite that $10B investment in data infrastructure, they are still sitting on a ton of cash.

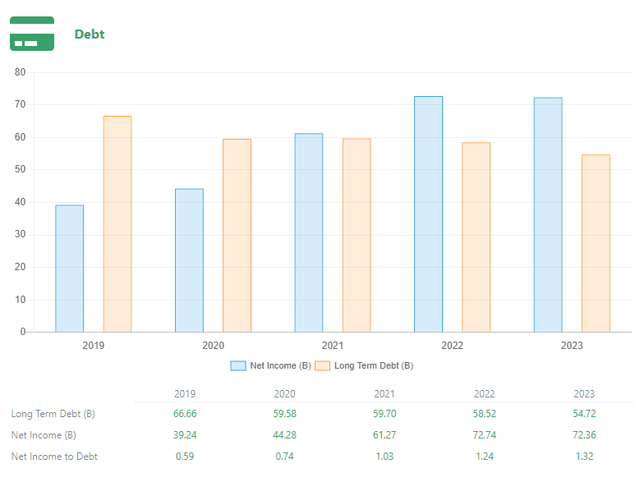

The reason that financing cash is negative is that MSFT is so cash-rich that it is taking the time, while rates have come up and are very high compared to the last twenty years, to pay off its long-term debts. This is part of a larger 5-year trend, but has accelerated recently.

MSFT Debts (Grasshopper Stocks)

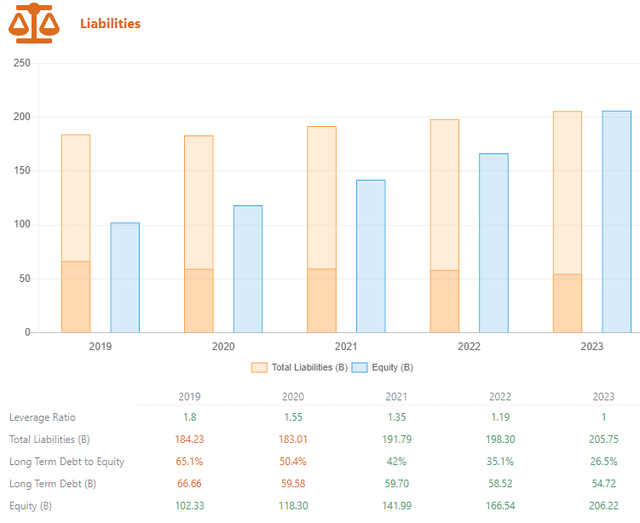

Repaying these debts and lowering their financing requirements has not lowered their total liabilities, however, which is not something I am concerned about, but may be of interest to readers nonetheless.

MSFT Liabilities (Grasshopper Stocks)

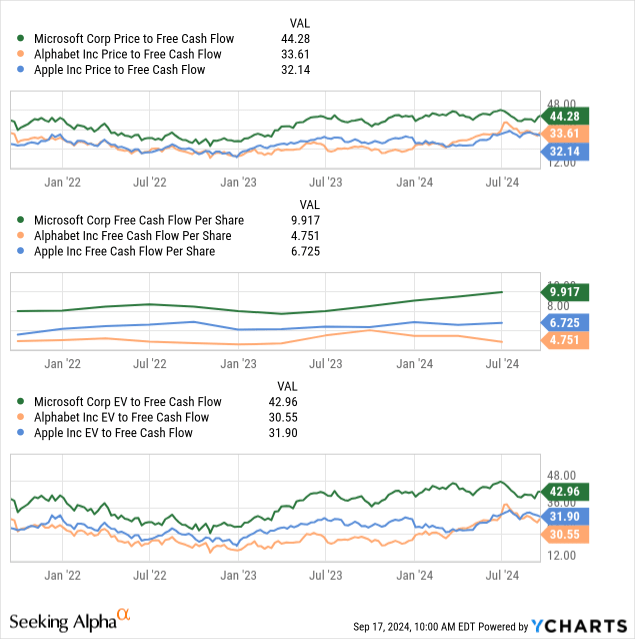

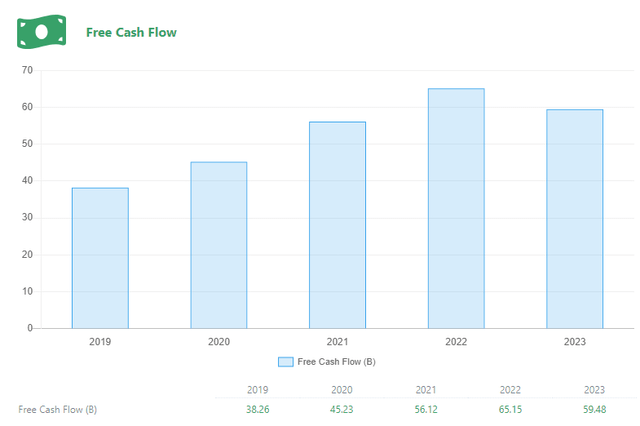

The last bit I want to cover, which, I think, is the biggest selling point for MSFT, is its free cash flow. By almost all metrics, it is one of the best companies to own when it comes to FCF.

While 2023 saw a dip in FCF for MSFT, this shift was not isolated to them and hit the entire sector. Even then, the 2023 figure was still above 2021 by a strong margin.

MSFT Free Cash Flow (Grasshopper Stocks)

What has drawn me to cover MSFT again isn’t necessarily any changes in the above metrics, but a change in what Microsoft is doing with this cash.

Raising the Dividend

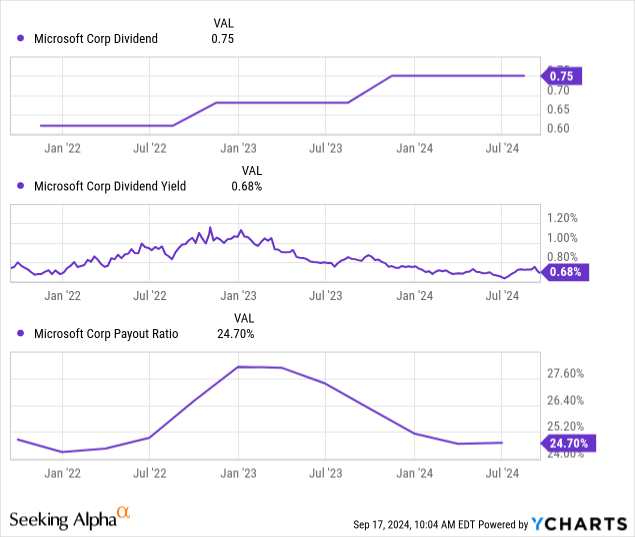

MSFT is not well known for paying a large dividend. Its yield is still below 1%. However, it is a consistent and timely payer, which is critical for those relying on dividends coming in, no matter how big or small.

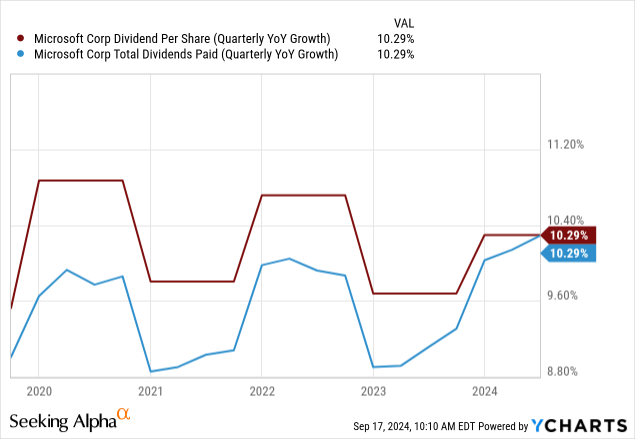

On Tuesday, Sept. 17th (today, at the time of writing), MSFT announced an increase to the dividend, up to $0.83 over its current $0.75. While a small nominal jump of a few cents, this represents a 10.7% increase in the dividend.

This growth is consistent with MSFT’s trajectory over the last few years, and is very welcome by myself because it represents stability and confidence in the company’s FCF and ability to retain earnings long term.

The Big Buyback

The MSFT cash pile rivals that of small governments (they have cash on hand equal to twice Liberia’s GDP), and they are intending to use it to enhance shareholder value.

In that same announcement with the dividend increase, MSFT announced a $60B buyback agreement with no expiration date. Immediately, this represents a 2% increase in value to shareholders. I expect the stock to receive this news very positively.

This buyback is confidence-boosting for me as a Microsoft investor, and as an analyst who gave them a buy rating. I am very pleased to see this change.

The AI Thesis

I have not gone “full AI” in the sense that I believe it is some cure-all for a business. I’ve noticed that idea peddled in investing spaces recently. Instead, my argument in that previous article was fairly simple: MSFT is outspending and out-hiring its competition. Engineers from Google’s AI project, Deep Mind, are now on board MSFT’s team, MSFT’s venture capital fund has a deep portfolio of AI startups, and they are investing over $10B in 1st and 3rd world data infrastructure and training.

As far as this goes, it has not changed, and I maintain that MSFT is the best positioned tech company to be profitable in the AI space as of right now.

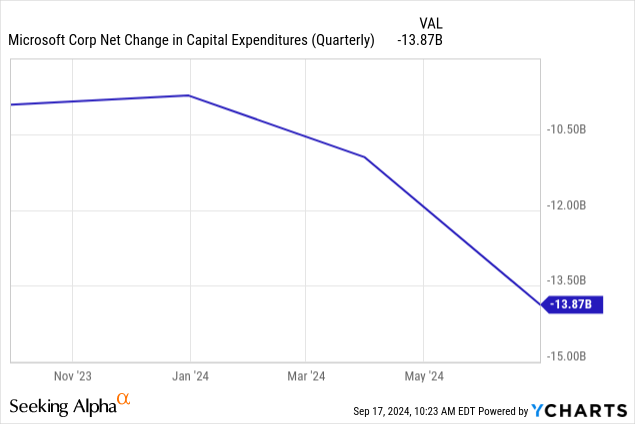

This hasn’t changed, despite falling CapEx, which the company said back in July would be higher in the AI and cloud space. It’s fallen elsewhere, leading to an overall negative trend.

I am still waiting for the thesis I wrote about in May to play out, and I am eager to see what the AI division at MSFT cooks up next for its B2B offerings.

Fair Value

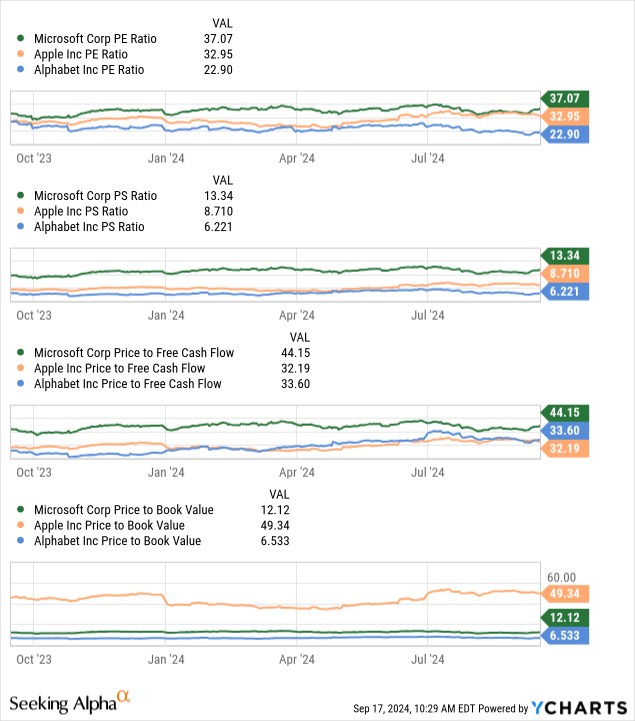

MSFT’s fair value is tough to estimate. Compared to its mega-cap peers, we can see that MSFT is currently pricier from an earnings, sales, and FCF perspective than Apple or Google.

This doesn’t worry me, necessarily. That is mostly because MSFT is the only of these three not involved in antitrust lawsuits. Apple’s suit over the App Store, and Google’s about monopolistic practices, are still ongoing and could really hurt these businesses if taken to an extreme ruling.

Risks

First and foremost, we need to address the elephant in the room: Microsoft isn’t part of an antitrust case like the latter two names I mentioned because they truly don’t have a moat product like they do. While MSFT is a fantastic business with a fantastic portfolio of products and services, it doesn’t have an iPhone or a Google Ads platform.

Microsoft Azure, MSFT’s cloud computing platform, is a massive moneymaker, but its competitive edge relies on its AI offerings being better than AWS or GCP. This may not come true, and could leave MSFT with falling revenue and rising expenses were it to fall behind its competitors.

The risks I posed in my last article on MSFT are still very relevant, as well.

The MSFT AI division could fall short, despite all of its major acquisitions and talent poaching. Good people and companies doesn’t guarantee that they will innovate or accelerate their revenue with these services.

Google, Apple, Meta, NVDA, or another big firm investing in AI may be able to outspend MSFT, which is not the leading R&D spender among mega-caps (actually, Amazon is).

Generative AI may have peaked…

Breakthroughs in AI research, fueled by the spending and acquisitions, could result in very little gains that do not produce enough ROI to make further investment worthwhile.

Breakthroughs in tech could be squandered by bad products, e.g. the Windows Phone.

A large market correction could harm MSFT more than some other mega-cap tech, because its valuation is richer than that of some of its peers like Apple and Google and has further to fall before it is in “value” territory.

Conclusion

Microsoft is still set to win the AI war. It has falling CapEx, rising FCF, and a consistent ability to contribute value to shareholders with consistent dividends and increases to those dividends, share buybacks, and reducing liabilities. It is set to catch up to market returns and potentially outperform if it stays on the same trajectory.

I am issuing a “buy” rating for Microsoft and have decided to add it to my equity portfolio. Aggressive investors are advised to limit MSFT to 5% or less of an equities portfolio, or 2% if the portfolio is already heavy on mega-cap tech like Google, Nvidia, Meta Platforms (META), Apple, etc. Conservative investors are advised to consider holding up to 2% of their equity portfolio in MSFT, or none if the portfolio is already heavy on mega-cap tech.

Thanks for reading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.