Summary:

- Tech stocks are crashing, but not Apple.

- That is undoubtedly in large part due to the aggressive share repurchase program.

- The company continues to show solid results even against a tough macro backdrop.

- With the stock trading at 22x earnings, shareholders should question whether share repurchases are the best use of capital.

Sean Gallup

Apple (NASDAQ:AAPL) stock has been spared from the crash in tech stocks, but I fear that danger may be lurking just around the corner. AAPL has seemingly done everything right – maintaining strong profit margins, paying a growing dividend, and aggressively repurchasing stock. Yet, investors should question why those capital allocation decisions are seemingly on autopilot even as tech valuations crash to such pessimistic levels. Should AAPL really be buying back its own stock at 22x earnings when it could instead be sifting through the wreckage of the tech crash? While AAPL does retain significant defensive characteristics, investors need to moderate their hopes for future growth prospects as many of the key growth drivers of the past may not repeat in the future.

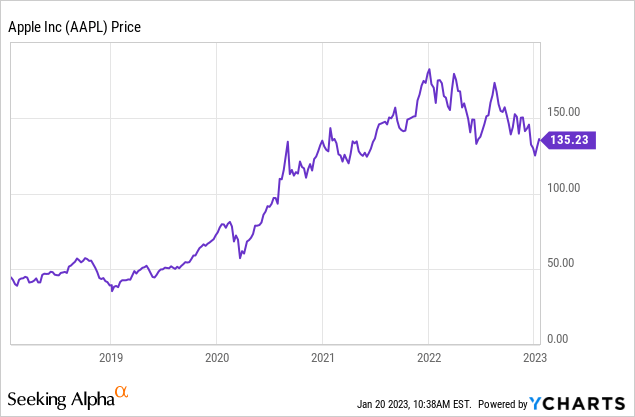

AAPL Stock Price

Many consider AAPL to be a tech stock, but its stock price has not behaved like a tech stock over the past year, as its decline from highs has been easy to miss.

I last covered AAPL in July, where I rated the stock a hold, as the valuation did not look attractive in light of the projected forward growth rates. My view remains the same even after a double-digit decline in the stock since then, and management commentary on capital allocation is flashing yellow flags.

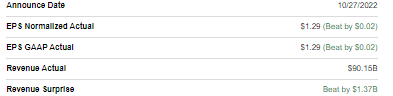

AAPL Stock Key Metrics

As usual, AAPL beat earnings on both the top and bottom lines. While typical for the company, it is worth noting the strength even amidst a tough macro environment.

Seeking Alpha

While revenue grew 8% YOY to $90.1 billion, operating income grew by only 4.7% as the company faced both the effects of inflation as well as rising headcount costs. Earnings per share grew by only 4%, lower than operating income growth, which is surprising considering the aggressive pace of share repurchases. The discrepancy was due to the 400 bps higher tax rate paid in the quarter.

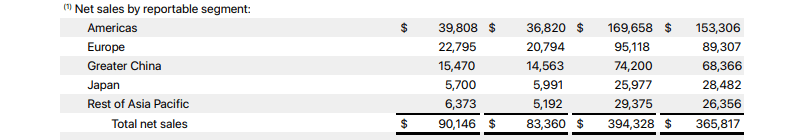

While AAPL saw continued strength in the Americas and Europe, it saw some weakness in China, which grew sales by only 6.2%.

2022 Q3 Press Release

The Services segment historically has been a primary growth driver for the company, but that ironically was a laggard in the quarter, growing by only 5%. On the conference call, management did note that the Services segment was held back by 600 bps of foreign exchange headwinds. Whereas AAPL saw Mac sales grow by 25.4%, iPad sales declined 13.1% YOY. Both segments were constrained by supply, but iPad sales were hurt by the fact that this year’s new iPad release was launched one month later than in 2021.

AAPL ended the quarter with $169.1 billion of cash versus $120.1 billion of debt. The company returned $29 billion to shareholders through $3.7 billion of dividends and $25.2 billion of share repurchases in the quarter – exceeding the $20.7 billion in GAAP net income.

Looking ahead, management expects revenue growth to decelerate due to 10 percentage points of foreign exchange headwinds, continued tough comps for Mac sales, and headwinds to the Services segment (digital advertising and gaming). Such an outlook is still quite solid considering that consensus estimates were already expecting mild growth even without tough macro conditions.

In 2022, AAPL generated $109 billion of free cash flow and from that paid out $14.8 billion in dividends and $89.4 billion in share repurchases.

Is AAPL Stock A Buy, Sell, Or Hold?

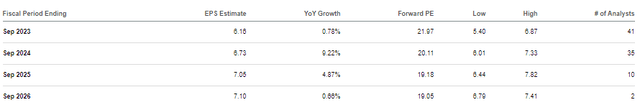

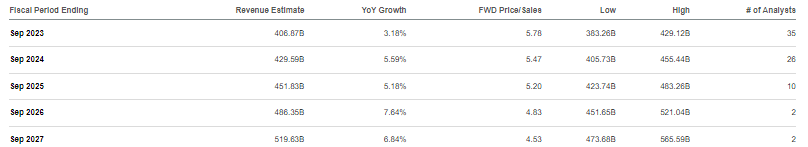

At recent prices, AAPL stock looks fully valued when considering the conservative projected growth rates. Revenues are expected to grow at a single-digit clip moving forward.

Seeking Alpha

That is expected to lead to single-digit earnings growth.

With the stock trading around 22x earnings and 8% projected forward earnings growth, the stock is pricing in roughly 12% forward annual returns. I note that this is already inclusive of any dividends and share repurchases as I am using earnings at face value.

12% returns should be enough to beat the market over the long term, and one can make a good argument for the premium valuation. AAPL has a strong balance sheet, has shown an ability to consistently generate free cash flow across a variety of macro conditions, and is led by a management team willing to return cash to shareholders. Moreover, AAPL’s business model appears very solid, as it has full control over its ecosystem from hardware to software. While Android remains dominant outside of the United States, AAPL has steadily increased its market share in the country to be the dominant operating system as of 2022. AAPL is being priced like a consumer staples stock, and it certainly has the characteristics of a consumer staples stock.

Yet I still have my doubts. On the conference call, an analyst asked whether they would change the cadence of their share repurchase program considering the magnitude of the tech stock crash. This was management’s response:

In terms of cash deployment, obviously, we like to look at the capital return program over the long arc of time. And we have done, since the beginning of the program, we’ve done over $550 billion of buyback at an average repurchase price of $47. So the program has been incredibly successful.

We are still in a position where we have net cash. And we said all along, we want to get to cash-neutral at some point. Our cash generation has been very, very strong over the years, particularly last year. I think, I mentioned in the prepared remarks, we did $111 billion of free cash flow. That’s up 20% year-over-year. And so we will put that capital to use for investors.

That commentary clearly suggests that their program is on autopilot regardless of the relative value offered in the tech sector. Shareholders should be concerned about such a strategy as shareholder dollars are not being invested at the highest rates of return. Share repurchases could make sense if AAPL is able to deliver stellar returns from here, but with the valuation multiple already quite rich and growth expected to slow considerably, how does one make an argument for greater than 12% forward returns? Meanwhile, as discussed with subscribers to Best of Breed Growth Stocks, I am seeing prospective forward returns in the 20% to 40% range and view a portfolio of beaten-down growth stocks as being an ideal way to take advantage of the tech stock crash. I find it questionable that AAPL is not aggressively conducting M&A or at least taking equity stakes amidst the tech carnage. It shouldn’t be an issue of regulatory risk, as at the very least AAPL could be taking the opportunity to build up an enterprise tech presence, something that it has not yet ventured into. Such M&A could boost forward growth rates and add diversification to the growth strategy, leading to multiple expansion and returns above and beyond the greater accretion. This may prove valuable because AAPL’s rich multiple is driven mainly by sentiment and not forward financial growth. Investors should be cautious in expecting AAPL to maintain a rich multiple indefinitely – in particular, I would not rule out the possibility that Alphabet (GOOGL) starts an aggressive smartphone price war in order to win back market share (though this has not yet happened). Even after the mild selloff from highs, I remain on the sidelines as the valuation is not compelling enough in its own right and I question the autopilot share repurchase program.

Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!