Summary:

- AT&T and Verizon are companies that pay an attractive Dividend Yield [FWD] (5.68% and 6.24% respectively).

- Through Dividends, these types of companies can help you generate a significant amount of extra income.

- In today’s comparative analysis, I will show you which of these two companies from the Integrated Telecommunication Services Industry I currently consider to be more attractive.

Justin Sullivan

Investment Thesis

Companies such as Verizon (NYSE:VZ) and AT&T (NYSE:T) could be excellent choices for your investment portfolio, because they can contribute to elevating the Average Dividend Yield you reach.

In the following, I will show you why I currently consider Verizon to be the slightly more attractive choice when compared to AT&T: Verizon has a slightly higher Dividend Yield [FWD] (6.24% compared to 5.68%) and has shown a higher Dividend Growth Rate [CAGR] over the past 5 years (2.06% compared to -5.69%). Both are indicators that Verizon is the better choice for investors seeking dividend income and dividend growth. In addition to that, my DCF Model shows a higher compound annual rate of return for Verizon (10% per year) than AT&T (8% per year). Furthermore, Verizon’s 60M Beta Factor of 0.34 indicates that an investment in the company is less risky than investing in AT&T (60M Beta Factor of 0.73).

At this moment in time, Verizon receives my buy rating, while I rate AT&T as a hold.

AT&T and Verizon’s Performance within the past 12 Months

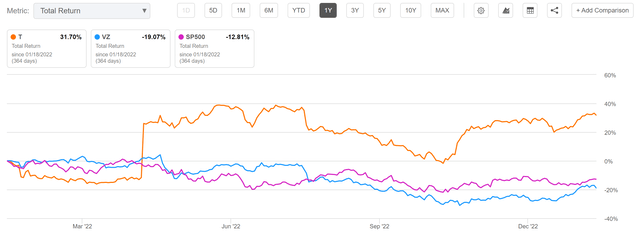

When considering the past 12 month period, the performance of AT&T and Verizon has been very different: while the S&P 500 has shown a Total Return of -12.81% in this period, the AT&T stock has gained 31.70%. Verizon’s Total Return of -19.07% over the last 12 months, however, is below the performance of the S&P 500 and significantly below that of AT&T. Verizon’s negative performance within the past 12 months has contributed to the attractive Valuation it has today.

The Valuation of AT&T and Verizon

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of AT&T and Verizon. The method indicates a fair value of $18.31 for AT&T and $45.69 for Verizon, giving AT&T a downside of 6.3% and Verizon an upside of 8.8%.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

AT&T |

Verizon |

|

|

Company Ticker |

T |

VZ |

|

Tax Rate |

20% |

23% |

|

Discount Rate [WACC] |

8.75% |

9.00% |

|

Perpetual Growth Rate |

2% |

3% |

|

EV/EBITDA Multiple |

5.8x |

8.1x |

|

Current Price/Share |

$19.55 |

$42.00 |

|

Shares Outstanding |

7,126 |

4,200 |

|

Debt |

$160,595 |

$178,639 |

|

Cash |

$2,494 |

$2,147 |

|

Capex |

$19,873 |

$20,286 |

Source: The Author

Based on the above, I have calculated the following results:

Market Value vs. Intrinsic Value

|

AT&T |

Verizon |

|

|

Market Value |

$19.55 |

$42.00 |

|

Upside |

-6.3% |

8.8% |

|

Intrinsic Value |

$18.31 |

$45.69 |

Source: The Author

Internal Rate of Return for AT&T

Below you can find the Internal Rate of Return calculated with my DCF Model where I have assumed different purchase prices for the AT&T stock.

At AT&T’s current stock price of $19.55, my DCF Model indicates a compound annual rate of return of approximately 8%. (In bold you can see the compound annual rate of return for the company’s current stock price of $19.55.)

|

Purchase Price of the AT&T Stock |

Internal Rate of Return as according to my DCF Model |

|

$12.00 |

13% |

|

$14.00 |

12% |

|

$16.00 |

10% |

|

$18.00 |

9% |

|

$19.55 |

8% |

|

$20.00 |

8% |

|

$22.00 |

7% |

|

$24.00 |

6% |

|

$26.00 |

5% |

Source: The Author

Internal Rate of Return for Verizon

At Verizon’s current stock price of $42.00, my DCF Model indicates an Internal Rate of Return of approximately 10%.

|

Purchase Price of the Verizon Stock |

Internal Rate of Return as according to my DCF Model |

|

§34.00 |

13% |

|

$36.00 |

12% |

|

$38.00 |

12% |

|

$40.00 |

11% |

|

$42.00 |

10% |

|

$44.00 |

10% |

|

$46.00 |

9% |

|

$48.00 |

8% |

|

$50.00 |

8% |

Source: The Author

Taking into consideration the results of my DCF Model, it can be highlighted that Verizon seems to be the more attractive choice among the two competitors from the Integrated Telecommunication Services Industry: at the companies’ current stock prices, it indicates a compound annual rate of return of 8% for AT&T and 10% for Verizon, thus reinforcing my investment thesis to select Verizon at this moment in time.

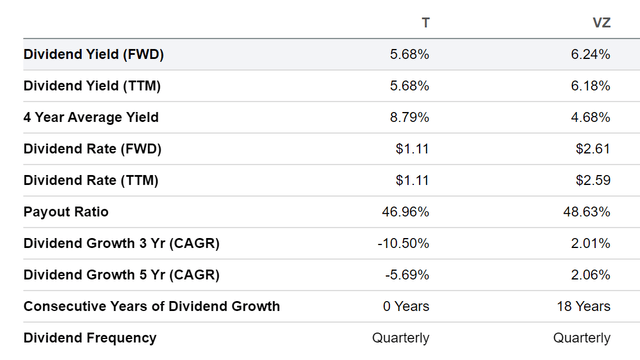

Fundamentals: AT&T vs. Verizon

Let’s take a closer look at the Dividend that both companies pay its shareholders: at the companies’ current stock prices, AT&T pays its shareholders a Dividend Yield [FWD] of 5.68% while Verizon pays 6.24%. This indicates that Verizon is the more attractive choice for investors looking for Dividend Income.

When looking at the companies’ Dividend Growth Rates, we can see that Verizon also seems to be the more attractive choice for dividend growth investors: while AT&T has shown a Dividend Growth Rate [CAGR] of -5.69% over the past 5 years, Verizon has shown one of 2.06% over the same period. In addition to that, Verizon has been able to raise its Dividend for 18 consecutive years while AT&T had to cut its Dividend in 2022.

By analyzing the Dividend Yield and Dividend Growth of both competitors, we get further indications for selecting Verizon over AT&T.

AT&T has a slightly higher EBIT Margin [TTM] (21.31%) when compared to Verizon (19.73%). However, Verizon’s Return on Equity [ROE] is significantly superior to its rival: while AT&T has a ROE of 11.92%, Verizon’s is 23.66%, serving as an indicator that the latter is superior in terms of Profitability.

In terms of Growth, it can be highlighted that AT&T is superior when taking into account its EBIT Growth Rate [CAGR] over the past 3 years: while AT&T’s EBIT Growth Rate is 5.76%, Verizon’s is negative (-5.54%). However, the opposite is the case when considering Revenue Growth Rate [CAGR] over the past 5 years: AT&T’s is -0.68% and Verizon’s is 1.74%.

Below you can find an overview of AT&T and Verizon’s Fundamental Data:

|

AT&T |

Verizon |

||

|

General Information |

Ticker |

T |

VZ |

|

Sector |

Communication Services |

Communication Services |

|

|

Industry |

Integrated Telecommunication Services |

Integrated Telecommunication Services |

|

|

Market Cap |

139.32B |

175.80B |

|

|

Profitability |

EBIT Margin |

21.31% |

19.73% |

|

ROE |

11.92% |

23.66% |

|

|

Valuation |

P/E GAAP [FWD] |

7.74 |

8.93 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

-5.21% |

1.07% |

|

Revenue Growth 5 Year [CAGR] |

-0.68% |

1.74% |

|

|

EBIT Growth 3 Year [CAGR] |

5.76% |

-5.54% |

|

|

EPS Diluted 3 Year [CAGR] |

6.90% |

5.74% |

|

|

Income Statement |

Revenue |

155.32B |

135.65B |

|

EBITDA |

53.01B |

43.44B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

114.73% |

201.21% |

Source: Seeking Alpha

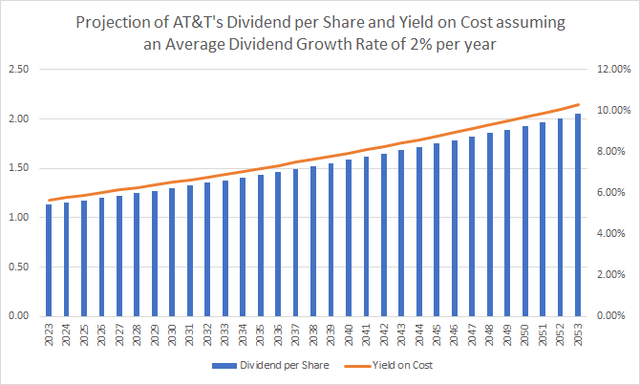

Projection of the Companies’ Dividend per Share and Yield on Cost

The graphic below illustrates AT&T’s Dividend per Share and its Yield on Cost when assuming that AT&T would be able to increase its Dividend by 2% per year in the following 30 years. The graphic shows that you could expect a Yield on Cost of 7.06% in 2033, 8.61% in 2043 and 10.49% in 2053.

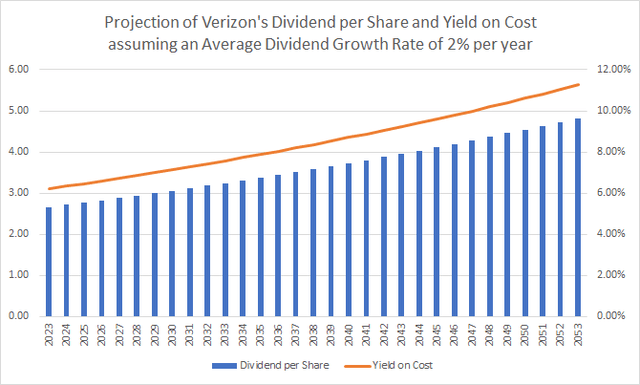

In the graphic below, the same is projected for Verizon: again, is assumed that the company were able to raise its Dividend by 2% per year on average. Assuming this, shareholders could expect a Yield on Cost of 7.73% in 2033, 9.42% in 2043 and 11.48% in 2053.

The projection of the companies’ Dividend per Share and Yield on Cost serve as additional indicators that Verizon is the slightly better choice, particularly for dividend income investors: assuming an Average Dividend Growth Rate of 2% for both companies, AT&T’s shareholders would achieve a Yield on Cost of 10.49% in 2053, while Verizon’s shareholders would reach 11.48% in the same year.

The High-Quality Company [HQC] Scorecard

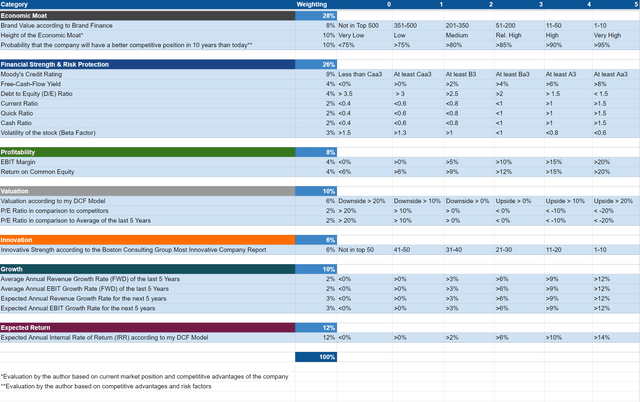

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

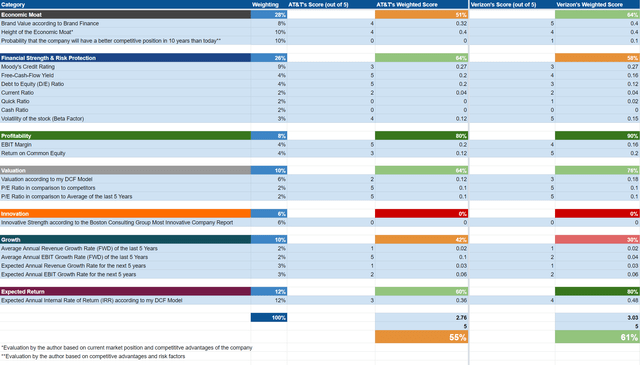

AT&T vs. Verizon According to the HQC Scorecard

When considering the results of the HQC Scorecard, we get further proof that Verizon is currently the more attractive choice: while AT&T is rated as moderately attractive in terms of risk and reward (reaching 55/100 points), Verizon is rated as attractive (61/100).

Verizon is rated significantly higher than AT&T in the categories of Economic Moat (64/100 compared to 51/100) and Expected Return (80/100 compared to 60/100).

Verizon’s higher overall ranking as according to the HQC Scorecard supports my theory to select the company over AT&T.

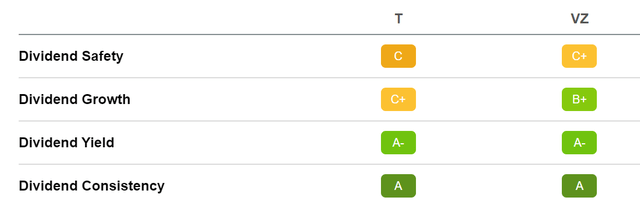

AT&T vs. Verizon according to the Seeking Alpha Dividend Grades

The results of the Seeking Alpha Dividend Grades once again strengthen my belief that Verizon is the better pick for dividend income and dividend growth investors: Verizon receives a C+ rating for Dividend Safety while AT&T gets a C rating. For Dividend Growth, Verizon gets a B+ while AT&T is rated with a C+. For Dividend Yield [A-] and Dividend Consistency [A], both companies achieve the same rating.

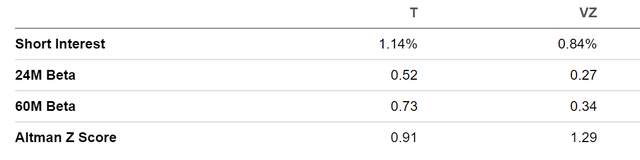

Risks

When comparing the companies’ Beta Factors, my opinion to rate Verizon over AT&T is yet again supported: AT&T’s 24M Beta Factor is 0.52 while Verizon’s is even lower (0.27). The same is confirmed when looking at the 60M Beta Factors of both companies: AT&T’s 60M Beta Factor is 0.73 and Verizon’s is 0.34. Both confirm that an investment in Verizon comes with less risk than an investment in AT&T and that the Verizon stock could contribute to protecting your portfolio during the next stock market crash to a better degree.

In case one of the two companies needed to cut its Dividend in the future, this could significantly affect its stock price. However, I see the risk of a Dividend cut to be relatively low for both in the near future. My opinion is based on AT&T and Verizon’s relatively low Payout Ratio of 46.96% and 48.63% respectively. However, it should be highlighted that one of the reasons for AT&T’s Payout Ratio being relatively low is the fact that it already cut its Dividend back in 2022.

Another risk factor I see for both AT&T and Verizon is the fact that they have limited growth prospects. This is underlined by the companies’ Revenue Growth Rate [CAGR] of -0.68% (AT&T) and 1.74% (Verizon) over the last 5 years. These limited growth prospects contribute to the fact that you should not expect exceptionally high capital gains when investing in one of the companies. However, when planning to benefit from their constantly growing dividend payments, both are attractive picks.

Summarizing the above, I see Verizon as being slightly ahead of AT&T when considering the risk factors that come attached to an investment. This is further underlined by the results of the HQC Scorecard, which rates Verizon (61/100 points) slightly ahead of AT&T (55/100) in terms of risk and reward.

The Bottom Line

I see both AT&T and Verizon as attractive choices in order to help you raise the Average Dividend Yield of your investment portfolio. Both companies provide you with an attractive Dividend Yield [FWD] of 5.68% (AT&T) and 6.24% (Verizon). Increasing the Average Dividend Yield of your portfolio helps you to increase the amount of extra income you generate year over year.

However, I consider Verizon to be slightly more attractive at this moment in time. The company provides shareholders with the slightly more attractive Dividend Yield, has shown a higher Dividend Growth Rate [CAGR] over the past 5 years (2.06% compared to -5.69%) and has produced a higher Revenue Growth Rate [CAGR] over the same period (1.74% compared to -0.68%). Furthermore, I consider Verizon to be the lower risk investment. Proof of this is Verizon’s lower 60M Beta of 0.34 when compared to AT&T’s (60M Beta of 0.73).

My opinion to see Verizon as the slightly more attractive pick is further underlined by the results of the HQC Scorecard (Verizon receives 61/100 points while AT&T gets 55/100) as well as the results of the Seeking Alpha Dividend Grades, which indicates that Verizon is the more attractive pick for dividend income and dividend growth investors.

I would be happy to hear your opinion on which company you currently consider to be the more attractive choice! Are you already invested in one of these companies?

Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.