Summary:

- Qualcomm’s strong modem technology and integration of modems, RF, and CPUs into single chipsets position it as a leader in smartphones and emerging technologies.

- Expansion into automotive, IoT, and AI PCs, with the Snapdragon Digital Chassis and a significant share of the $1.1 trillion IoT market by 2028.

- Valuation suggests a price target of $363.1 per share, a 116.5% premium over the current price, indicating a strong buying opportunity.

- Risks include potential loss of Apple as a customer, fierce competition, and trade tensions with China, potentially impacting revenue significantly.

Robert Way

Overview

Qualcomm (NASDAQ:QCOM) is a major player in the tech industry, specializing in mobile chipsets and wireless communication solutions. The company’s Snapdragon processors are widely used in top smartphones, and its modem and RF technologies are crucial for fast, reliable mobile connectivity. Qualcomm has expanded into automotive, IoT, and AI-driven PCs, offering solutions for connected cars, smart devices, and advanced computing.

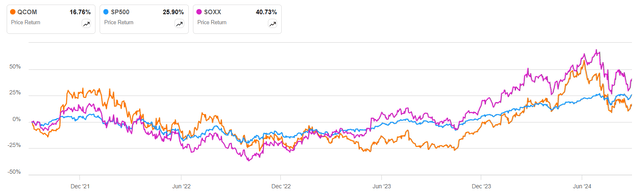

Figure 1: Seeking Alpha

Qualcomm has lagged among the S&P 500 and the Semiconductor industry, has an attractive 2.2% dividend yield, and is pursuing new big markets. The question is whether it will break the trend in Figure 1 and outpace the industry.

Qualcomm has a clear advantage in modem technology

In 2019, Apple (AAPL) acquired Intel’s (INTC) smartphone modem business for $1 billion, a strategic move to reduce its reliance on Qualcomm for modem chips. Apple acquired around 2,200 employees, mostly engineers in modem technology, and access to 17,000 patents for wireless technologies like 5G, 4G, and 3G. This helped Apple to develop its modems and have more control over how hardware and software work together in future iPhones. The decision was also influenced by Apple’s legal disputes with Qualcomm over royalty payments, which had deteriorated the relationship between the two companies.

Intel had difficulty competing with Qualcomm in making 5G modems, losing about $1 billion yearly. So, Intel decided to sell that part of the company to Apple. This means Intel is getting out of the modem business, and Apple can now make its modems. Even though Apple bought this part of Intel, it still uses Qualcomm modems for its 5G phones. Making good modems is hard and takes a long time. People think Apple will start using its modems by 2025, but we can’t be sure.

AI stresses chip design, which only some companies can match

Qualcomm is in a strong position because it’s good at making smartphone modems. Right now, no other company can do it as well as they can. With AI becoming increasingly important in phones, it’s getting harder to ensure the modem, RF, and CPU all work together properly for AI tasks. AI tasks need a lot of power, and the modem and CPU must work extra hard, especially when things need to happen immediately. Putting all these things together in one chip is tough because it has to be efficient with power, have good signal quality, stay cool, and be made specially. For example, the modem and RF circuits always have to be on phones, even when the CPU isn’t doing anything. Ensuring each part gets enough power without making the phone overheat or slowing down is a big challenge. If it’s not done right, the phone could temporarily slow down to stop it from getting too hot.

Qualcomm does a great job of combining different parts into one package. For example, its Snapdragon SoC includes the CPU, GPU, modem, and RF transceivers. This is a big deal because it gives Qualcomm an advantage in making more power-efficient smartphones perform better, especially when running AI apps. This advantage is hard for other companies to copy.

By combining all the parts, we can use fewer chips, which makes the product cheaper and saves space on the circuit board. This could cut manufacturing costs by around 15-20%, which would make the design more affordable, especially for popular smartphones and IoT gadgets.

A report by IEEE Spectrum highlights that integrating modem, RF, and CPU components into a single chip results in significant power efficiency improvements. When these parts work together on the same chip, it helps to manage power-hungry communication processes more efficiently, reducing overall energy consumption by 20-30% compared to using separate components. This is important for mobile devices, where preserving battery life is crucial.

Qualcomm has many growth opportunities on which to capitalize

As I have just described, Qualcomm can grow in other industries besides new AI smartphones and AI PCs.

Qualcomm’s car business is growing fast because it makes money from deals it made 2-3 years ago to supply carmakers with technology. Their Snapdragon Digital Chassis is a big part of this growth and can be used in traditional and electric cars. The focus is on making cars more digital rather than just improving some parts. In Q3 2024, Qualcomm had a good year with ten new vehicle models using its technology, and it also got contracts to design technology for ten more vehicles. This is favorable for Qualcomm because more cars are becoming digital, connected, and using artificial intelligence, so they will likely make more money from this trend.

Qualcomm’s IoT opportunity is substantial, with global IoT spending expected to reach $1.1 trillion by 2023, growing rapidly across other sectors like industrial IoT, healthcare, and automotive. The industrial IoT market is expected to grow from $397 billion in 2023 to over $1.1 trillion by 2028. This reflects the increasing need for connectivity and automation solutions in manufacturing, energy, and logistics areas. By 2028, about 60% of cellular connections will be IoT-based. This shows that Qualcomm has the potential to gain a large market share as companies embrace advanced IoT technologies for operational efficiency and real-time data processing.

Valuation

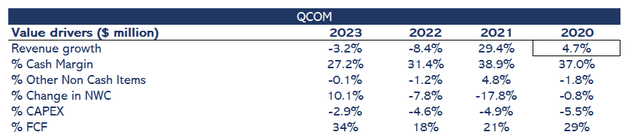

Figure 2 shows Qualcomm’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Figure 2: Author

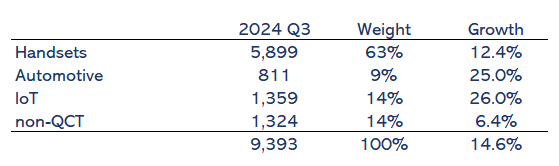

Qualcomm is pursuing several big opportunities simultaneously. I estimate that general revenue growth will be 14.6% over the next ten years. It is hard to be precise, but I am comfortable with this rate. I justify why I get this figure.

Qualcomm has several segments: handsets, Automotive, IoT, and non-QCT. Handsets are Qualcomm’s traditional segment. They have been growing at 6.4%, but this will change with AI smartphones, and Qualcomm will enter the PC market with AI PCs. AI smartphones will grow by 25%, and the AI PC market will increase by 44%. Assuming Qualcomm grows at the market rate and combines with the low-growth traditional market, I estimate this segment will grow 12.4%.

The automotive market will rise 25% per year from 2024 to 2032, at the same pace (26.1%) as the IoT market. Considering those growth rates in Figure 3, I arrive at a general 14.6% rate.

Figure 3: Author

I think margins will improve moderately. The AI PC segment is expected to generate strong margin growth due to Qualcomm’s leadership in ARM-based AI processing. Qualcomm’s high-value processors and connectivity solutions will expand margin in this space as AI-enabled PCs become mainstream. Qualcomm expects margins to grow in the automotive segment as more design wins translate into revenue over the coming years. This is due to the scaling of the Snapdragon Digital Chassis platform, which drives higher average selling prices and economies of scale.

Margins have been under pressure, partly due to component shortages. Even though the company anticipates gradual margin improvement as supply chain conditions stabilize, I foresee cyclical supply chain problems in the industry. I expect the competition will be fierce. So overall, I estimate a four percentage point improvement over the next ten years.

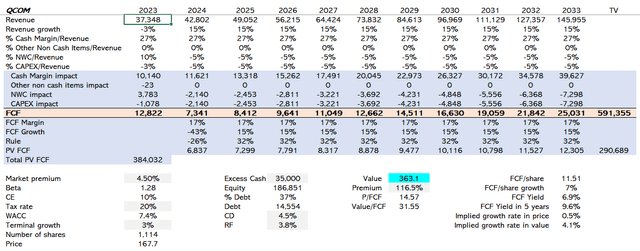

Investment in networking capital will be 4% at a historical value, the same as the CAPEX, which is 4.5%. Cash flows will be discounted at a 7.4% WACC because the beta is 1.28 and risk-free at 3.8%. Given the company’s low leverage of 37% of total capital debt, WACC is weighted towards the cost of equity. The terminal growth rate is set at 3%.

Figure 4: Author

As shown in Figure 4, my value estimate is $363.1 per share, a 116.5% premium over its current stock price. This premium provides a reasonable margin of safety for me to consider it a buying opportunity.

Risks

Qualcomm makes a lot of money from a few big customers, like Apple and Samsung. Apple is considering making its iPhone parts instead of buying them from Qualcomm. If Apple stops buying from Qualcomm, Qualcomm could lose a lot of money—over $1.5 billion every three months. This would have a big impact on Qualcomm’s finances, potentially costing them $5-6 billion yearly.

Qualcomm faces tough competition from companies like MediaTek in mobile chipsets and Nvidia in the AI and automotive sectors. If Qualcomm loses market share, it could see a big drop in revenue from key growth markets like automotive, IoT, and AI-driven PCs. For example, the automotive revenue is expected to hit $4 billion by 2026, and IoT is already bringing in $1.4 billion annually. If competitors take away 10-15% of Qualcomm’s market share, it could mean a $1-1.5 billion loss in annual revenue, affecting free cash flows by up to $500 million a year.

Trade tensions between the U.S. and China, along with restrictions on selling advanced technology to China, could be a big problem for Qualcomm. Qualcomm makes a lot of money from selling its products in China, and if it’s not allowed to sell as much there, it could lose a lot of money—maybe $2-3 billion a year.

Conclusion

Qualcomm’s clear advantage in modem technology and its ability to integrate complex components like modems, RF, and CPUs into a single chipset position it as a leader in smartphones and emerging technologies. Despite Apple’s acquisition of Intel’s modem business in 2019, Apple still relies on Qualcomm’s superior 5G modems, with plans to develop its own by 2025. Beyond smartphones, Qualcomm is expanding into high-growth areas like automotive, IoT, and AI PCs. The Snapdragon Digital Chassis is driving automotive digitization, while the company is well-positioned to capture a significant share of the $1.1 trillion IoT market by 2028. Qualcomm’s ability to leverage its expertise across multiple sectors ensures strong growth potential in the coming years.

I strongly support buying the company with a price target of $363.1 per share, a considerable premium over its current price. Risks are significant, but the main one, losing Apple as a customer, would not materialize until 2026.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in QCOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.